The last year has been a strain, not only on global economies but also on the mental health of consumers around the world.

With repeated lockdowns, it is becoming more likely that the consumer behavioral changes we’ve had to adapt to during the pandemic will remain.

One of the first places that saw an easing of restrictions last spring was the outdoors, which — for clear reasons — is a much safer environment for gatherings due to the ease of social distancing and the natural air ventilation.

I also suspect there will be a continuation of hesitancy towards taking vacations that require air travel, going to bars/restaurants, spending time at shopping centers, museums and other indoor venues such as concerts and some sporting events, which may still be without crowds for the foreseeable future.

Consumers looked to the outdoors for ways to spend their time and money last summer, and they will likely do the same again when the current lockdown eases. Luckily, thanks to Theodore Roosevelt’s conservation efforts, there is a vast array of opportunities across the US to enjoy outdoor recreational activities.

A post-coronavirus world: Outdoor retail stocks expected to spike

For many of us, the outdoors has always been a special place to enjoy our time but I expect a surge of newcomers, especially from urban markets that look to get out and explore areas preferably within driving distance of their homes.

It’s worth noting that the shift in consumer behavior, and spending habits, during the pandemic is likely to be a positive revenue driver for many of the companies offering outdoor recreational equipment.

I know personally that I will be upgrading all of my camping, hiking and fishing equipment with the money that had been allocated to vacation plans. But it’s not just the outdoor retail stocks that will benefit. Businesses working in the healthy living and active lifestyle spaces will likely see a boost from the large millennial demographic.

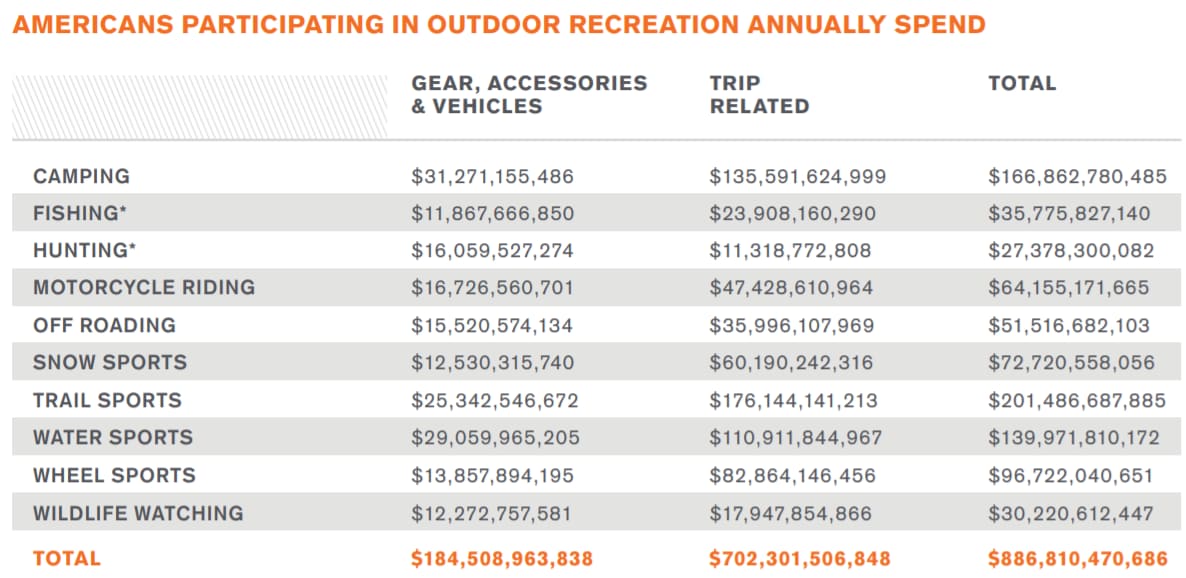

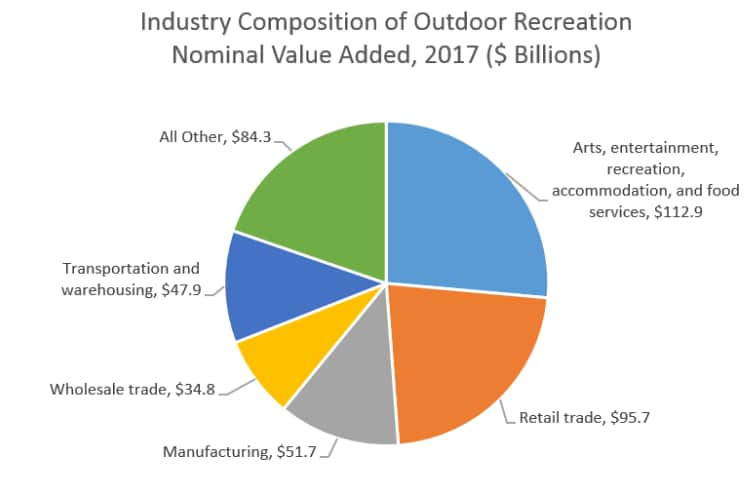

The outdoor recreation market is massive. It is one of the nation’s largest economic sectors with $887bn in annual spending, according to the Outdoor Industry Association.

For comparison’s sake, this is nearly twice the size of the pharmaceuticals industry, and nearly equal the sizes of the financial services and insurance industries.

Some of the largest sub-segments in the market — in order from high annual spending to low — are camping, water sports, cycling, trail sports, off-roading, snow sports, motorcycling, fishing, wildlife viewing and hunting.

The number of people participating in outdoor activities in the US has averaged 49% over the last five years.

Determining the outdoor markets’ pure plays

Before investing in the outdoor market, investors must be mindful of determining how much exposure each company has to the outdoor recreation market, to see if it is enough of a needle mover to offset weakness in other business segments.

During my research, I’ve found that there are not a ton of pure plays for this theme. It surprised me how many of our favorite outdoor brands are owned by much larger notable brands, which makes me think that there could be a push for further acquisitions in the space.

There are a number of interesting small-cap stocks, however, that I will detail below as prime stocks for embracing this opportunity.

After I’ve looked at the spending numbers for each company, the next step is to look at the leading brands in the space and determine the components of those categories.

A few of the products I will look at in this article include backpacks, boating, recreational vehicles, kayaks, coolers and other goods related to beverages, outdoor cooking equipment, sleeping bags, hiking footwear, sportswear/apparel, fishing equipment, GPS devices, optics, and more.

In an effort to determine the best stocks to participate in the coming outdoor recreation boom, I researched the top brands and then reverse-engineered them to find the publicly traded owners of them, while also taking into consideration the travel portion of spending.

I will break down the featured segments of this theme below and look at the stock components, while also highlighting the best in class names.

The outdoor footwear stocks to watch

The footwear space is a clear area of consumer spending for outdoor recreational activities. This group really captures other favourite trends like healthy living and the direct-to-consumer sales mix shift.

While Nike [NKE], for example, is massive and has some exposure to the outdoors, the company also has a lot of exposure to group sports, which is not the kind of name to focus on for this particular theme.

Adidas [ADDYY] also owns a number of outdoor brands but like Nike is not a major needle mover with the offset of sports and other categories.

Wolverine [WWW], on the other hand, is a $1.65bn footwear name that has a number of leading brands under its business that should see an upturn in demand such as Sperry, Saucony and Merrell — the latter of which is the most popular hiking boot brand and Sperry is the number one brand in boating.

The concern is that 85% of its sales in 2019 were via the wholesale channel and just 10% came in from ecommerce, but I expect a positive shift to occur as it pursues direct-to-consumer strategies like many of its peers. At 16.13 times earnings and 4.5% operating margins, its shares seem relatively cheap and attractive.

Deckers Outdoor [DECK] is another favorite outdoor footwear name of mine. The stock had an excellent buying opportunity into the sell-off in March. Despite the stock climbing steadily since, the $9bn company remains relatively attractive with a clean balance sheet, industry-leading margins, and at 25.26 times earnings.

It has a number of leading brands with major consumer momentum including UGG, Teva, Sanuk, Hoka One One and Koolaburra. Deckers has also pursued a strong direct-to-consumer strategy, with 35% of sales stemming from that channel.

The outdoor apparel stocks to watch

There are a number of companies focused on active wear.

Lululemon [LULU], for one, is a high quality brand with a great direct-to-consumer strategy that will continue to be successful. Despite the company likely facing some headwinds from the closing of gyms, its apparel should still be rather popular for many outdoor activities.

Apparel and footwear company VF Corp [VFC] also has a long history of success and, after exiting underperforming businesses like Wrangler and Workwear, is now more focused.

Some of its outdoor businesses like The North Face and Timberland could be seeing a surge in demand now that it's winter. VF Corp also owns some other outdoor brands that are not such big revenue drivers but could benefit from the uptick such as Icebreaker, Smartwool, Reef and Eagle Creek.

The growing demand in direct-to-consumer channels is a focal point for many businesses, particularly Sportsman’s Warehouse [SPWH] and Dick’s Sporting Goods [DKS], as the two wholesale retailers could see a demand uptick.

Columbia Sportswear [COLM] has long been a favorite operator of mine and carries a smaller market cap at $5.95bn, which I have long seen as an eventual acquisition target. Columbia Sportswear trades at a 24.64 forward P/E ratio and 2.34 times sales with a very strong cash-rich balance sheet.

The main brand under Columbia — Mountain Hardware — is a leader in outdoor apparel, it also happens to be a brand I personally like. It also owns SOREL, a footwear brand that has strong growth potential. Another adventure brand it owns in prAna. It has a strong direct-to-consumer presence with over 40% of sales through that channel.

Clarus [CLAR] is a very small company I would highlight as a pure play. The $504.8m business is focused on skiing, climbing and mountain activities under brands such as Black Diamond, Sierra and PEIPS. Clarus trades 18.1 times earnings, 2.4 times sales and has a strong balance sheet. Clarus has a history of acquiring brands and has clear plans to drive further growth and margin expansion.

Fenix Outdoor [FOI-B:SS] and Kathmandu [KMD:NZ] are two potential international plays in this space. Fenix owns brands like Fjall Raven, Primus, and Hanwag, while Kathmandu acquired the popular footwear brand Oboz.

The outdoor stocks in electronics to watch

Garmin [GRMN] is the best play in the outdoor electronics space. The company has seen major momentum in its outdoor and fitness segments, as it moves away from the auto business.

Garmin is facing some headwinds, however, in the aerospace sector but should see a positive offset in its boating business. Its fitness segment saw 35% growth in the third quarter of fiscal 2020, driven by sales in its advanced wearables segment and cycling business.

35%

Growth of Garmin's fitness segment in Q3

The marine segment of Garmin grew 54% during the quarter, driven by chart plotters and advanced sonar. The $23.2bn company has a debt-free balance sheet with a lot of cash, a 2% dividend yield and trades 23.9 times earnings and 5.89 times sales.

*This is part one of a two-part article exploring Joe Kunkle’s outdoor stocks to watch.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy