The JK Innovators Signature Sharebasket — available to trade on CMC Markets — has seen increased volatility in recent weeks. The basket focuses on research and development (R&D) and contains tech-centric stocks.

There have been multiple compression in many of these premium valuation stocks as rising US Treasury yields create a stir.

The companies have continued to deliver stellar numbers despite the current rotation out of tech and into cyclicals. Furthermore, management teams remain optimistic about the long-term opportunities that will create value for shareholders.

Software and semiconductor names have seen the sharpest corrections, the former mainly due to profit-taking and fears of higher rates leading to lower multiples, and the latter because of worries related to chip shortages. The median correction of the twenty-six basket corrections has been approximately 25% off 52-week highs, and most names are now considered extremely oversold.

iRobot [IRBT] has been the strongest performer, with shares up 45% for the year to date. The company sharply beat estimates in its Q4 report and gave FY21 guidance well above the consensus number.

45%

iRobot's gains YTD

HubSpot [HUBS], which helps small and medium-sized businesses with digital marketing campaigns, is a software component that has managed to stay positive YTD after its blowout earnings report.

There are also a few medical technology names in the basket that have held up better than other components. STAAR Surgical [STAA], a smaller cap favourite, is disrupting the vision correction market with its technology.

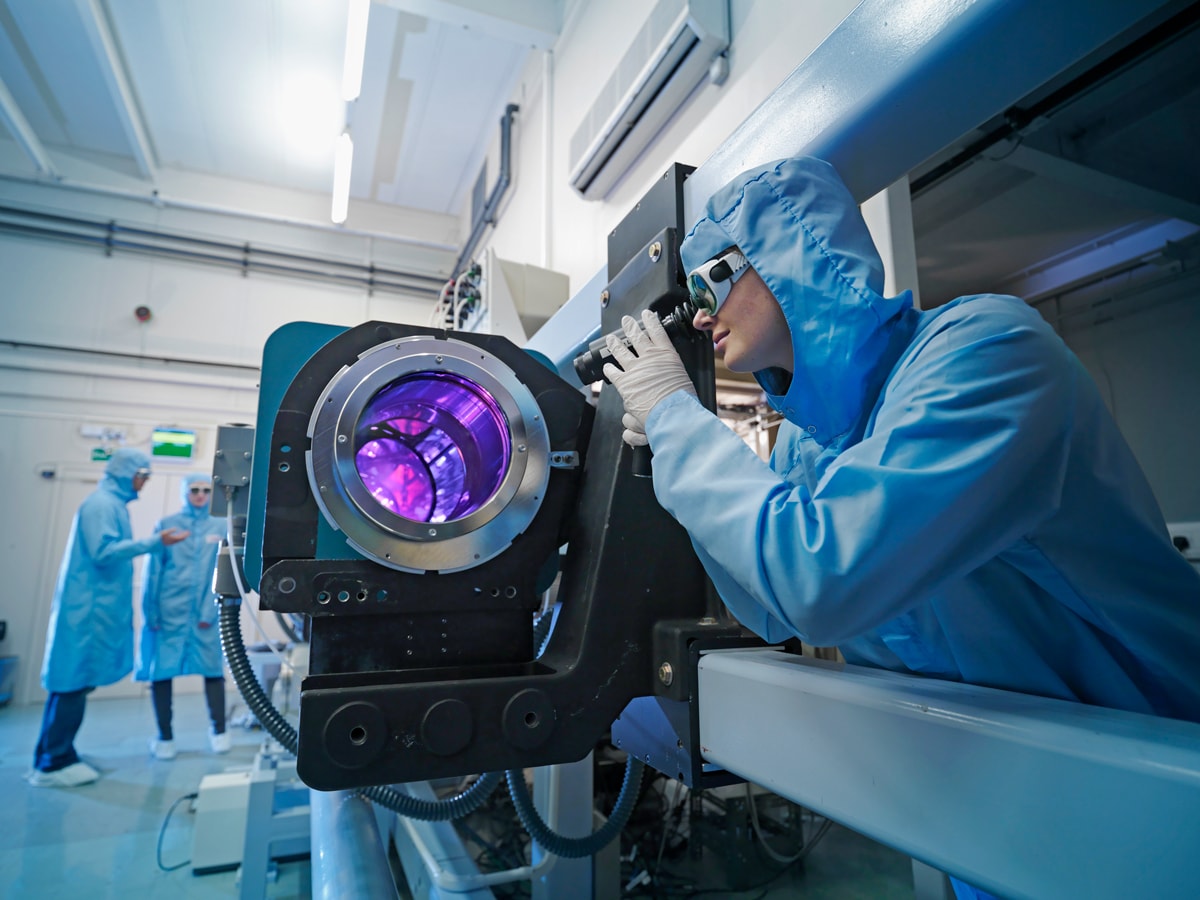

The chip shortages have weighed on components like Cadence [CDNS], Lumentum [LITE] and Monolithic Power [MPWR]. However, all indications suggest the demand trends are as strong as ever. Lumentum also made news this quarter after it pursued Coherent [COHR] in an M&A deal that has turned into a three-way bidding war as companies vie for Coherent’s precision lasers with exposure to OLED ahead of an expected rebound in the industrial laser market.

With circa one hundred stocks fitting the criteria for this basket, there are several options to consider as rebalance nears.

Two of the names bought out at healthy premiums were Real Page [RP], bought by Thoma Bravo in December, and Glu Mobile [GLUU], bought by Electronic Arts [EA] buying in February. Larger cap tech names investing heavily in R&D, such as Twitter [TWTR], Google [GOOG], and Microsoft [MSFT], have outperformed in the first quarter.

For a look at how these companies addressed R&D spend in the latest round of earnings reports:

ACM Research [ACMR]: “In 2020, we spent 12% of sales or about $18m in R&D, up 55% from 2019 levels. That spending enabled us to expand our offering beyond SAPS and TEBO and Tahoe, semi-critical tools, ECP, and most recently, Furnace products … Our strong growth is providing the capability to accelerate our R&D spending in new products,” David Wang, CEO and founder of ACM Research, said during the company’s fourth quarter earnings call.

Autodesk [ADSK] — the largest R&D spender in its peer group — addresses its R&D allocations: “But if you look at programmatically where we're going to be leaning into, platform enhancements that bring design and make in the industries together and create commonality across many of the industries we serve are going to be a particular lever that we're going to be moving with. We just hired a new CTO with a lot of platform strategy chops that we're going to be leveraging to integrate some deeper platform capabilities into the company,” Andrew Anagnost, CEO of Autodesk, said during its fourth quarter earnings call.

“I haven't talked a lot about what we're going to be doing with manufacturing, but here's what I can tell you. We're very interested in the cloud transformation in manufacturing, and I think you'll see us lean deeply into the cloud transformation around manufacturing more. We've invested pretty heavily there. Our investment is large in that whole portfolio, particularly in the Fusion portfolio. I think you'll continue to see us to invest in that area.”

"We're very interested in the clouse transformation in manufacturing" - Andrew Anagnost

Ansys [ANSS]: “If you recall, when we went through the go-to-market transformation that we spoke of a couple of years ago, and when we really started to accelerate in the last couple of years, it was around putting together a traditional customer pyramid where we had enterprise customers at the top of the pyramid. And enterprise customers were deemed to be such, not only because they had significant spending powers and have large and complex problems to solve, and therefore were spending a lot of money on R&D, but also because we had enterprise customers who were being supported by specialised teams,” Ajei Gopal, CEO of Ansys, said during the company’s fourth quarter earnings call.

Universal Display [OLED] on R&D initiatives: “Well, we are doing a number of things, which obviously would include work on blue, which is one of our major efforts. OVJP is another one. But we're continuing to work on new and next-generation materials because as we had stated, we're having more and more customers. Each one of our customers has more and more specific needs. And we are continuing to do everything we can to meet our customers' needs across the board and they are different. So, the more customers we have, the more materials we're going to develop and the more time we're going to spend on R&D to ensure that we support them,” Sidney Rosenblatt, Universal Display’s CFO, said during the company’s fourth quarter earnings call.

In closing, capital allocation is a question asked on nearly every earnings call by analysts and history has proven companies investing in their businesses tend to outperform.

M&A remains an important part of capital allocation, but R&D spend is even more important to find companies generating organic growth. Focusing on these companies is likely to reward investors over the long term, though it also carries some volatility — such as we’ve seen in recent weeks as the growth trade became crowded.

Despite the recent turbulence, I continue to favour companies that have clear paths to well above market average growth opportunities over the coming five to ten years.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy