In the part two of this three part series on cannabis, Andrew Little, research analyst at Global X, considers the legalisation of cannabis across the US. This article was originally released on 20 April 2021.

Part one in this series highlighted and evaluated progress toward legalisation in US states. Part three will discuss the possibility of federal legalisation in the US and abroad.

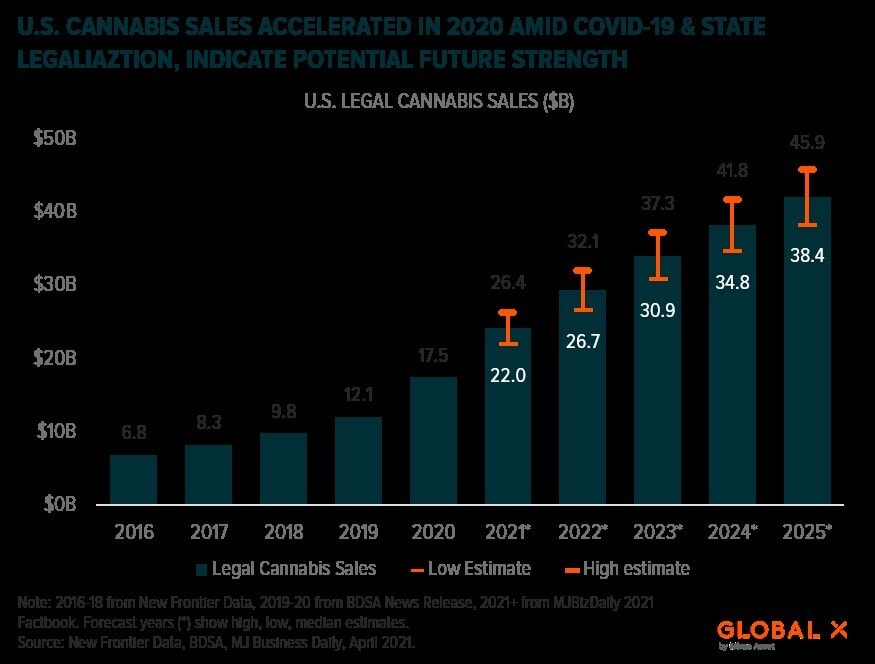

Global cannabis markets are thriving despite the backdrop of COVID-19. 2020’s lockdowns translated to devastating losses for some industries, but Cannabis fared better. Many state and federal governments around the world deemed cannabis businesses as essential, keeping their doors open and catalysing what ended up being a watershed year for the industry. Global legal cannabis sales reached a record $21.3bn in 2020, up an impressive 48% year-over-year (YoY). 2021 is also proving to be a boon with most legal markets showing similar or greater strength thus far.

In the following, we examine legal cannabis markets across the globe, providing updates and outlooks on cannabis sales, as well as delving into the implications of recent market developments.

Key Takeaways:

- US states that recently legalised recreational cannabis sales are experiencing robust growth, propelled by the pandemic and a streamlining of licensing and regulations.

- More established markets in the US like California and Colorado are continuing to enjoy growth years after legalisation as consumers embrace new cannabis products.

- Canada’s nation-wide legalisation efforts initially started off slow, but growing retail distribution and an expansion into derivative products are helping businesses capture market share from illicit sales.

Legal cannabis markets in the US

Legal state markets in the US contributed to over 80% of global sales in 2020, growing to $17.5bn on the back of greater acceptance and supportive stay-at-home trends.

States with recent legalisation make their mark

Illinois

Market Update: Illinois legalised recreational cannabis in June 2019. Legislators were swift to establish retail regulations and in-store sales commenced at the start of 2020.

Despite the prompt rollout, the state’s licensing process limited the number of retailers, inhibiting supply and immediate scale. 2020 sales still reached the milestone $1bn mark but was still held back from its full potential as licensing delays stalled retail growth throughout the year.

These dynamics are still in effect. As of April 2021, only about 110 licensees serve Illinois’ population of approximately 13 million — that’s around 1 licensee to every 120,000 people. For comparison, there is 1 for every 10,000 people in Colorado.

Outlook: Promising legislation is in the works that would help improve supply dynamics in Illinois. House Bill 1443 would provide for more than 110 retail dispensary licenses and will initiate the distribution process for an additional 75 dispensary licenses that were previously earmarked for social equity programs.

Governor JB Pritzker has expressed support for HB 1443 and is expected to sign the bill into law in the near future. Illinois is one of the most undersaturated legal cannabis markets, and we believe that an expansion of licenses in 2021 will go a long way in addressing this. Cannabis sales could total reach $1.7bn in 2021 and $3bn by 2024, assuming the market develops as expected.

Michigan

Market Update: Michigan legalised recreational cannabis in November 2018 and the market has scaled quickly in the three years since. 260 recreational cannabis stores currently serve the state’s population, amounting to about 1 store for every 34,461 people.

But despite greater availability of retail stores, sales weakened towards the end of 2020. Between Q3 and Q4 2020, sales of dry flower fell 16% while total recreational sales declined 9%. Dry flower products became less popular as the pandemic raged, due in part to Michigan’s generous at home cultivation policy. Instead of going to the store, many consumers opted to grow their own plants.

In Michigan, unlicensed adults are allowed to grow up to 12 mature plants within their own residence. In an encouraging sign for the industry, highly profitable derivative products led the way for a sales recovery in early 2021. Cannabis sales surged in Q1 2021, up 163.6% YoY and up 21.4% sequentially from Q4 2020.

Outlook: Michigan’s recreational cannabis market stands to benefit from stable supply dynamics and high volumes of cannabis derivative sales. In April 2021, 43% of total cannabis sales in Michigan were derivatives, the highest rate in the nation.

We expect high-margin derivatives such as edibles, concentrates, and THC-infused beverages to continue to constitute a large percentage of Michigan’s product mix, much to the benefit of retailers and distributors. On the back of derivatives, recreational sales are expected to grow from $990m in 2020 to reach between $1.9bn and $3bn by 2024.

Massachusetts

Market Update: Massachusetts legalised adult use of cannabis in November 2016, but recreational sales only began in November 2018. The Massachusetts market is known for its high prices which are which are often twice the national average.

The state’s seasonal climate is unfavourable for cultivation, forcing producers to rely on expensive climate-controlled facilities. The average facility of this kind costs 82% more per square foot than cultivating cannabis outdoors. Additionally, high excise tax rates, and licensing costs associated with a robust regulatory process add to the costs.

Despite these headwinds, Massachusetts cannabis businesses continue to chip away market share from illicit markets. Recreational sales in the state totalled $700m in 2020, up 56% YoY. Notably, the state achieved this sales growth even though cannabis retailers were not considered essential and were closed state-wide for 60 days in 2020.

Outlook: Massachusetts must find ways to incrementally cut costs if it wants to propel the growth of legal cannabis sales. In January 2021, the Massachusetts Cannabis Control Commission approved new regulations that are more accommodative for both the medical and recreational segments of the industry.

The new regulations reduce annual costs for social equity approved cannabis businesses, permit delivery services for recreational and medicinal cannabis, approve specific branded sponsorships, and increase flexibility for caregivers who utilise medical marijuana.

Upstream cultivators have performed admirably in a low margin environment, and we believe such cost-cutting measures will provide outsized relief to the entire value chain. Total annual sales of cannabis may be able to clear $1bn in 2022 and reach $2.6bn by 2025.

Pandemic year invigorates established state markets

California

Market Update: California just celebrated four years of legal recreational cannabis. Over that time, its legal retail market blossomed into the world’s largest, growing from $1.4bn in 2018 when sales began to $4.4bn in 2020.

Though a complex and strict regulatory framework governs the market, a characteristic that typically hampers supply, licensing is progressing without issue. California’s three licensing authorities have granted more than 10,000 licenses to commercial businesses throughout the state.

The pandemic proved to be a tailwind for the state’s industry with sales surging in the spring and summer. California was the first state to mandate non-essential business closures and it set the tone for the rest of the country when it designated cannabis businesses as essential. Cannabis businesses reaped the rewards of this action, gaining further credibility and generating outsized revenues during the stay-at-home economy portion of the pandemic.

Outlook: We expect momentum from 2020 to continue through 2021 — some estimate that legal sales could reach as much as $5.5bn by the end of the year, a 25% YoY increase.

The state is more than on track to achieve this total. Monthly sales exceeded those of 2020 in each of 2021’s five full months and by 34% on average. Growth prospects beyond 2021 also look promising. According to Marijuana Business Daily’s 2021 Factbook, adult-use sales could total $6.7bn by yearend 2025, representing an 8.8% compound annual growth rate (CAGR).

In our view, high-growth derivative products like edibles and infused beverages, streamlined regulatory processes, and greater acceptance of legal cannabis will play key roles in achieving this.

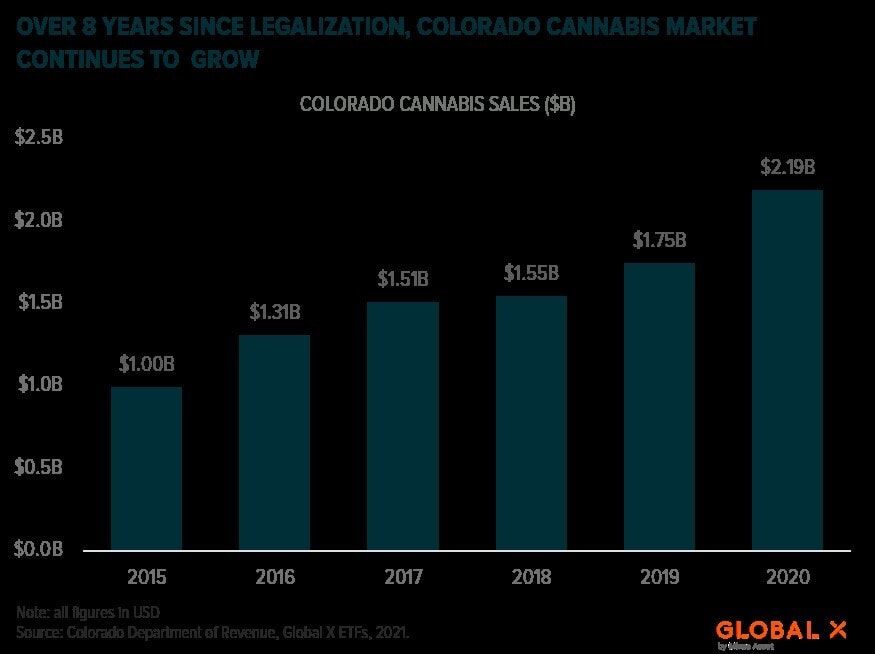

Colorado

Market Update: Colorado became the first US state to legalise recreational cannabis with the passage of Amendment 64 in 2012. Fast forward to today, and the state ranks number one nationwide in legal cannabis sales per-capita, while its legal cannabis market is the second-largest in the world after California.

While Colorado’s legal market is oldest in the country, it is still growing quickly. Legal retailers sold $2.2bn worth of cannabis in 2020, a 25% YoY increase. Speaking to this success, business owners across the state noted cannabis consumption became a recreational activity for consumers during lockdowns and that cannabis derivatives provided a sales boost amid COVID-19 concerns.

Outlook: Adult-use sales are expected to total just under $3bn in 2025, growing at a CAGR of 4.9% with 2020 as the base year. Colorado may lose some of its first to scale advantage in the coming years as other state legalisation efforts succeed.

Tourism has long bolstered the state’s sales, especially when few alternatives existed to purchase legal cannabis. However, we do not feel as though this trend represents an existential threat. Total sales attributed to tourism increased leading up to the pandemic, even as an increasing number of states legalised recreational cannabis.

Revived tourism following the pandemic should also provide a short-term boost. Additionally, we view Colorado’s highly accommodative regulatory environment as a value driver that will give cannabis operators flexibility as the industry matures.

Our take

While cannabis is still federally illegal in the US, the combined size of legal state markets and the widespread designation of cannabis businesses as essential alongside pharmacies and supermarkets are bringing new credibility to the industry.

Incumbent state markets like Colorado and California are demonstrating that properly scaled markets can generate significant revenue and provide a glimpse of what a bona fide legal cannabis industry might look like. For these markets, it is still just the beginning. There is still more illicit market share left to capture and new ways to capture more of existing customers’ wallets.

New state markets are still facing some of the same problems that incumbents did in the past, but now have playbooks to turn to. While sales may start off slow, strong consumer demand and the ability to learn from the legalisation experiences of other early-adopter states means that places like Illinois, Michigan, and Massachusetts should be able to enjoy stronger sales in the coming years.

Beyond that, legal cannabis states that have yet to commence retail sales are poised to capitalised on the lessons learned in 2020 and all the decade leading up to it.

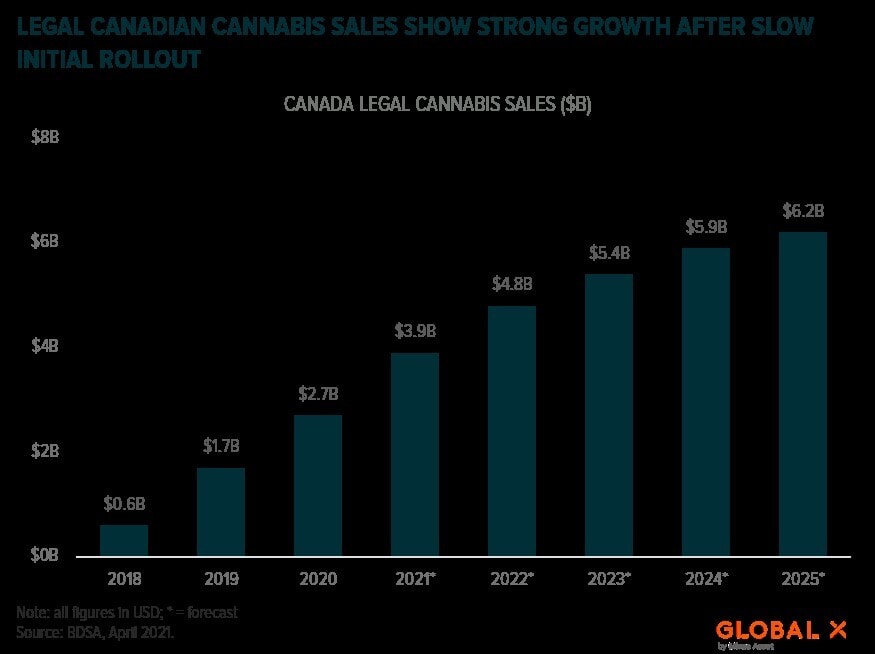

Canada begins to crack the code

Canada’s federally legal market is hitting its stride after an underwhelming inaugural full year in 2019. The retail adult-use market doubled in 2020, serving as a testbed for scaling a successful country-wide market and rolling out cannabis products outside of flower.

Market Update: Cannabis became legal in Canada in late 2018 after the passage of bill C-45, better known as the Cannabis Act. An initially lumbering licensing process capped the market’s short-term potential as only a limited the number of retailers were given the green light.

Ontario, Canada’s most populated province, only had 24 licensed retailers one year into legalisation. Fewer stores meant less supply, which led to higher prices and less consumption by volume — all of which benefitted the existing illicit market.

Things are different today, though, and processes around licensing have markedly improved. Ontario boasts almost 600 stores and an additional 800 stores are scattered throughout Canada’s 12 other provinces and territories.

Greater supply resulted in lower prices and more consumption, driving recreational cannabis sales to a record $2.2bn in 2020. Encouragingly, for the first time ever, household expenditures on legal cannabis exceeded those of illicit product in Q3 2020.

A part of this success was the maturation of Cannabis 2.0, a term used to describe sales attributed to derivative cannabis products like edibles, extracts, and cannabis-infused food and beverages. Cannabis 2.0 products became legal in 2019 and saw some success in 2020 after a poor initial rollout. At the end of the year, derivatives accounted for 36% of legal cannabis sales with 20% attributed to edibles and 16% to extracts

Outlook: The future bodes well for Canada’s legal market as it seeks to capture further illicit market share. Some project that the total legal market could grow an additional 44% to $3.9bn in 2021 and reach as high as $6.2bn in 2025.

We expect Cannabis 2.0 to meaningfully drive a portion of this growth. Some forecast that derivative products could account for as much as 54% of Canada’s recreational cannabis consumption by 2025.

The continued growth of such products will likely prove essential in further capturing illicit sales. In Q1 2021, 55% of recreational cannabis spending occurred in the legal market, representing a 34% YoY increase and the third straight quarter where the legal sales outstripped illicit ones.

We also expect an expanding total addressable market to drive growth. In a 2020 survey, 24% of Canadians aged 25 and over reported using recreational cannabis in the 12 months prior compared to 21% in the year before.

Our take

The slow start of Canada’s legal market underscores the importance of streamlined licensing processes and initial product diversity. Future or soon-to-be legal markets can learn from Canada and implement licensing protocols that optimise initial supply and pricing so as to capture illicit sales at the get-go.

Regulators should also design policy that recognises the importance of derivative cannabis products in maximising the addressable market. The later and faltering rollout of Cannabis 2.0 slowed the legal market’s initial traction and gave operators unsteady footing at launch.

We understand that regulators must be thoughtful of initial policy, but we also believe that legal markets that find a happy medium between regulation and policy that sparks market-capture will be the most successful moving forward. That said, Canada overcame many of its initial difficulties and we expect continued growth in the coming years.

Conclusion

Legal cannabis markets thrived during the pandemic. While lockdowns and stay-at-home orders had devastating impacts for most brick and mortar retailers, many cannabis businesses capitalised on their essential business status.

Consumers across the country embraced recreational cannabis, purchasing more product than ever and enjoying it in their newfound leisure time. Expanded product lines that included cannabis-infused beverages, a wider range of edibles, tinctures, and other derivatives brought optionality to existing consumers and captured more of their wallets.

They also represented an entry point for new consumers, expanding the total addressable market. Flush with new capital, a large consumer base, and positive momentum toward widespread legalisation, global cannabis markets are well-positioned to see growth in the years to come.

This article was originally written and published by Global X. The article, which includes footnotes where readers can find the original source material, can be found here.

Investing involves risk, including the possible loss of principal. The investable universe of companies in which POTX may invest may be limited. The Fund invests in securities of companies engaged in Healthcare and Pharmaceutical sectors. These sectors can be affected by government regulations, expiring patents, rapid product obsolescence, and intense industry competition. International investments may involve risk of capital loss from unfavourable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. POTX is non-diversified.

POTX’s investments are concentrated in the cannabis industry, and the Fund may be susceptible to loss due to adverse occurrences affecting this industry. The cannabis industry is a very young, fast evolving industry with increased exposure to the risks associated with changes in applicable laws (including increased regulation, other rule changes, and related federal and state enforcement activities), as well as market developments, which may cause businesses to contract or close suddenly and negatively impact the value of securities held by the Fund. Cannabis Companies are subject to various laws and regulations that may differ at the state/local, federal and international level. These laws and regulations may significantly affect a Cannabis Company’s ability to secure financing and traditional banking services, impact the market for cannabis business sales and services, and set limitations on cannabis use, production, transportation, export and storage. The possession, use and importation of marijuana remains illegal under U.S. federal law.

Federal law criminalising the use of marijuana remains enforceable notwithstanding state laws that legalise its use for medicinal and recreational purposes. This conflict creates volatility and risk for all Cannabis Companies, and any stepped-up enforcement of marijuana laws by the federal government could adversely affect the value of the Fund’s investments. Given the uncertain nature of the regulation of the cannabis industry in the United States, the Fund’s investment in certain entities could, under unique circumstances, raise issues under one or more of those laws, and any investigation or prosecution related to those investments could result in expense and losses to the Fund.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the Fund’s investment objectives, risks, and charges and expenses before investing. This and other information can be found in the Fund’s summary or full prospectuses which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Solactive AG, nor does Solactive AG make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO, Global X nor Mirae Asset Global Investments are affiliated with Solactive AG.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy