In the wake of landmark AI legislation in the US and a key international summit at Bletchley Park in the UK, the regulatory framework around artificial intelligence is taking shape. Reports from Global X and Goldman Sachs suggest that this could be a positive development for investors.

- Goldman Sachs and Global X connect maturing AI regulation to upswings in M&A and IPO activity.

- Deloitte views public trust in AI systems as crucial to its long-term growth.

- Alphabet and Meta among the “Magnificent Seven” stocks that have seen outsized growth this year.

Regulation has been one of the keywords buzzing around the artificial intelligence (AI) community over the past 12 months.

In May, OpenAI CEO Sam Altman testified to a Senate subcommittee that the increasingly powerful technology was in need of regulation. Then, in late October and early November, governments swung into action. US President Joe Biden’s executive order on AI established a new legal framework for the technology in the US, while UK Prime Minister Rishi Sunak’s Bletchley Park summit laid the foundations for supranational cooperation.

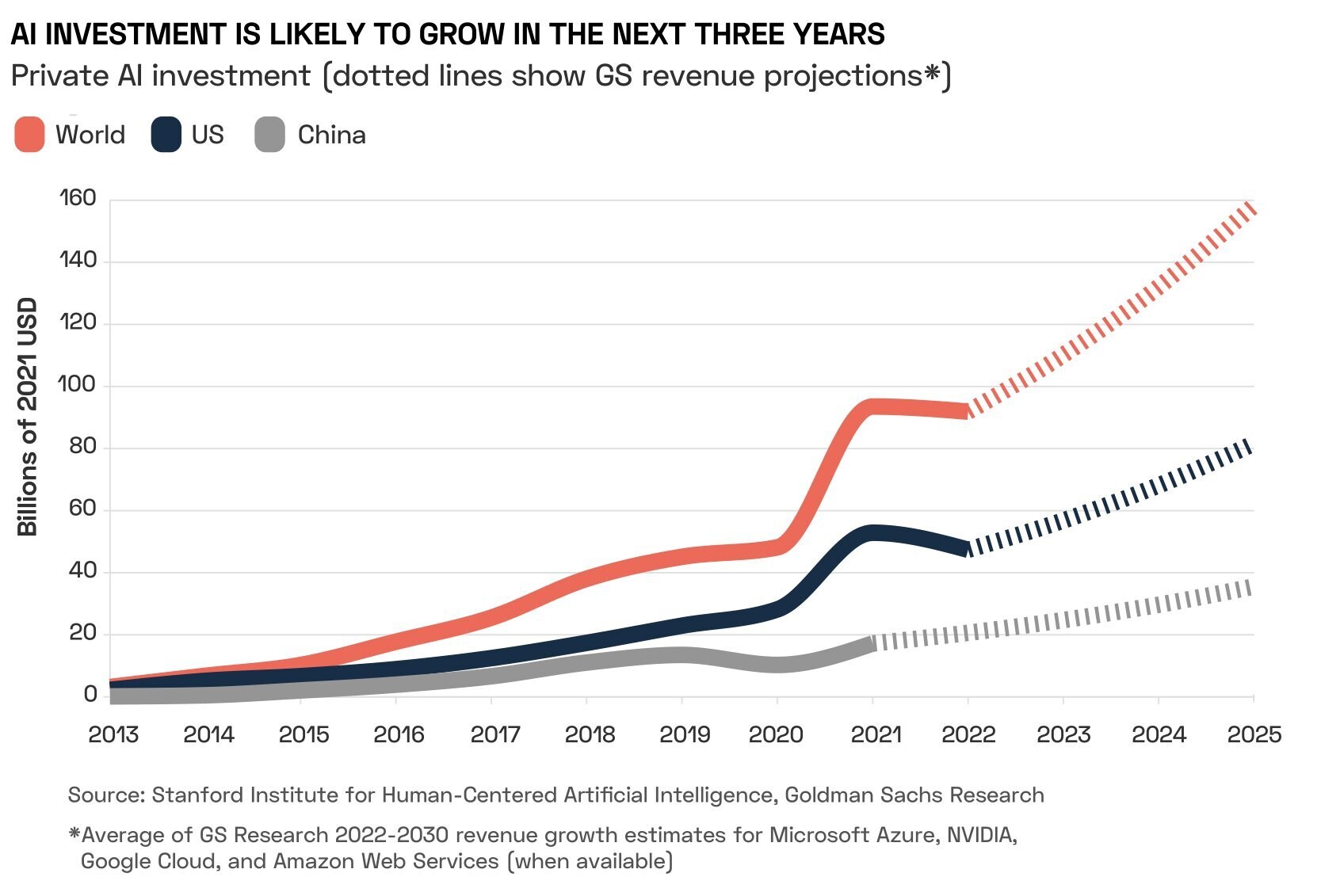

The maturing regulatory framework around AI could, according to research from Goldman Sachs, catalyse a flurry of M&A activity. “As clarity is gained and AI use cases continue to evolve, the M&A landscape will shift”, according to a white paper entitled ‘Navigating the AI Era: How Can Companies Unlock Long-Term Strategic Value?’

The process had already begun in January this year, when large incumbent technology companies began investing in or acquiring AI start-ups — in some instances, purely for the sake of acquiring the skills of their workforce, asserts Goldman Sachs in an October report entitled ‘How to Unlock an AI-driven M&A Supercycle’.

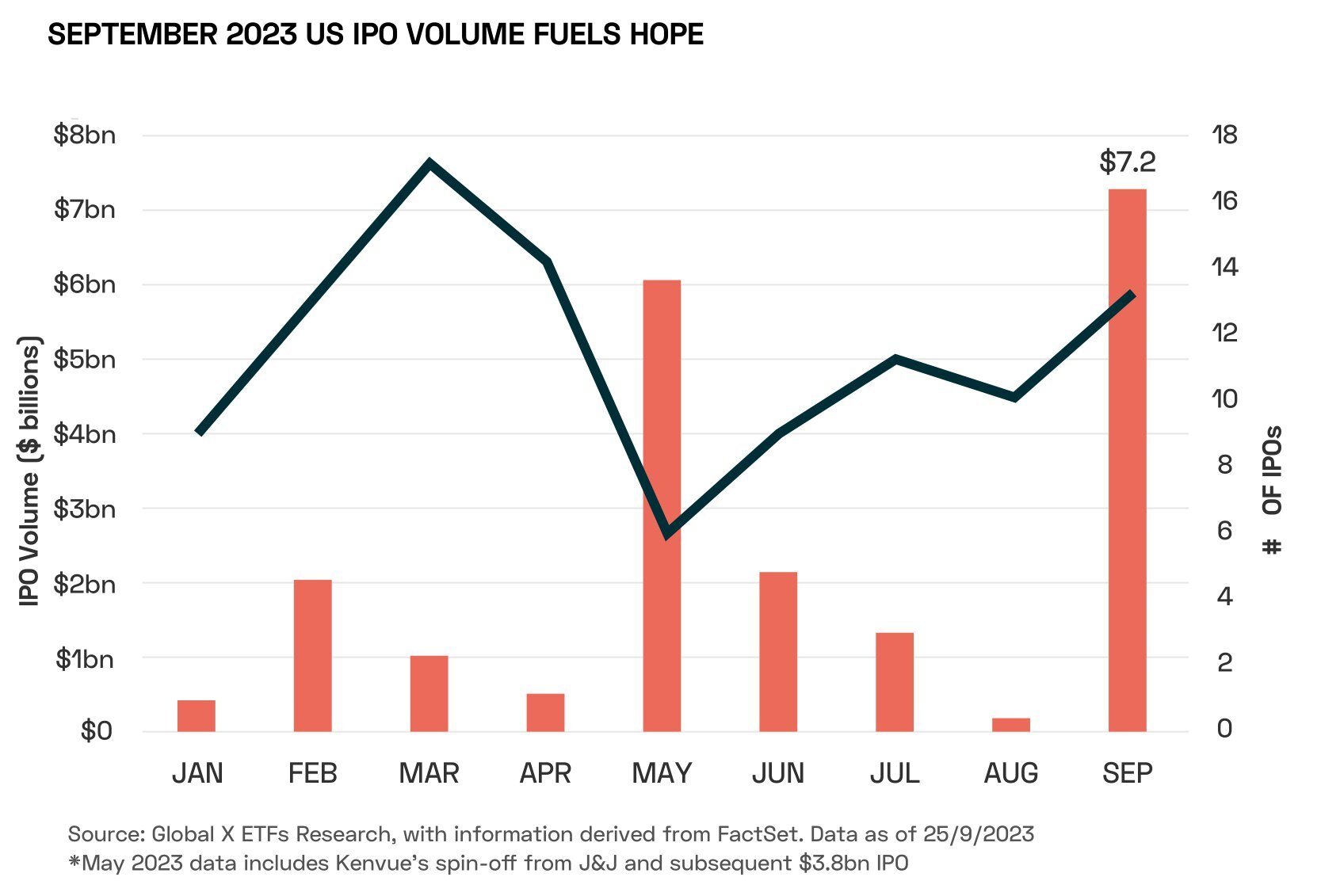

In a similar vein, Global X ETFs published research in October suggesting that AI is having a positive impact on the IPO market. New US listings raised $7.2bn in September, the largest amount in a single month since late 2021.

Arm’s [ARM] September IPO was the flagship event on this front, with a first-day closing valuation of $67.9bn underscoring, in Global X’s view, “the red-hot demand in the AI chip market”.

“A maturing regulatory framework will ensure AI systems are safe, secure, and trustworthy before companies make them public, which should undoubtedly increase investor confidence,” Ido Caspi, Private Markets Analyst at Global X ETFs and author of the report, told OPTO.

Developing Trust

Caspi also believes that bolstering public trust in AI systems will be beneficial for their development. “New regulations can help de-risk investments made by companies in building foundational models from regulatory uncertainty, which could spur further investments in innovative experimentation,” he added.

Caspi’s is far from a lone voice. The Deloitte AI Institute has also published a report entitled ‘Trust in the Era of Generative AI’, which made the case that trust in the technology is crucial to its ongoing success.

“To prepare the enterprise for a bold and successful future with Generative AI, we need to better understand the nature and scale of the risks, as well as the governance tactics that can help mitigate them,” wrote Beena Ammanath, Global & US Technology Trust Ethics Leader at Deloitte and author of the report.

Deloitte maps six domains of trust for AI: fairness and impartiality, transparency, safety and security, accountability, responsibility and privacy. While a maturing regulatory framework will increase the accountability of businesses that develop or use generative AI — by documenting impartiality and modelling transparency, for example — they also present an opportunity for AI companies to build their trust in the public eye.

These moves “should be viewed as a new guidance opportunity to enable secure AI implementation in business endeavours, in addition to spearheading the long-term success of AI,” Ammanath told OPTO.

Embracing Regulation

Recent weeks have seen key milestones in the development of national and supranational efforts to regulate AI.

Biden’s executive order, signed on 30 October, was a landmark piece of legislation in the US. It put into law a requirement for new models to share safety test results with the US government before they are released. On announcing the executive order to the press, Biden said that he was “determined to do everything in my power to promote and demand responsible innovation”, reported Forbes.

Later that week, the UK played host to the world’s first international summit focused on supranational AI governance. Held at Bletchley Park, where Alan Turing’s work during World War II famously marked a major advance in the development of modern computing, the summit saw the governments of the US, UK, EU, China and others agree to collaborate on mitigating the risks that could potentially arise from AI technology.

Some technology leaders — such as Jack Clark, Co-founder and Head of Policy at Anthropic — have been supportive of the recent step change in government efforts to regulate AI. Joe Biden’s executive order “has made meaningful steps towards creating third-party measurement and oversight of AI systems,” Clark told Forbes.

Regulatory Capture?

Not everyone has been so positive. Meta’s [META] Chief AI Scientist Yann LeCun has branded attempts to regulate the research and development of AI as “incredibly counterproductive”. According to the Financial Times, LeCun accused regulation’s proponents of wanting “regulatory capture under the guise of AI safety”.

At the crux of LeCun’s argument was the notion that regulation would suit only the largest technology firms, effectively limiting the development of AI to that small handful of companies.

However, Demis Hassabis, Founder and CEO of Alphabet’s [GOOGL] DeepMind, later responded that he disagreed with LeCun. Hassabis outlined three core areas of concern: near-term risks, such as misinformation and deepfakes; the repurposing of AI systems for malicious, unforeseen purposes by “bad actors”; and long-term risks such as the potential threat that artificial general intelligence may pose to humanity.

How to Invest in AI

Both Meta and Alphabet are among the so-called “Magnificent Seven” stocks that have seen outsized gains this year thanks to the rise of AI.

Alphabet is a particularly interesting prospect for investors focused on the development of regulation, thanks to its considerable stakes in Anthropic, which describes itself as “an AI safety and research company”, and DeepMind, which has played a part in advising the British government on AI regulation, according to CNBC.

Alphabet’s share price is up 49.4% year-to-date, while Meta’s has soared 165.7%.

Alternatively, investors could select an ETF such as the Global X Artificial Intelligence & Technology ETF [AIQ]. Both Alphabet and Meta are among the fund’s top five holdings as of 8 November. As of 31 October, information technology accounts for 63.2% of the fund’s holdings, while communication services (14.1%), consumer discretionary (11.6%), industrials (8.9%), financials (1.3%) and healthcare (1%) account for the rest. AIQ is up 39.5% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy