Introduction

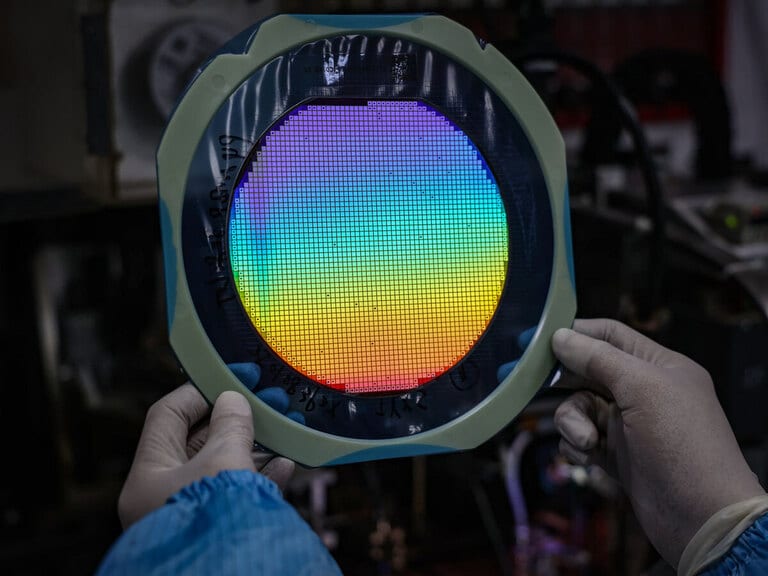

Micron Technology [MU] describes itself as one of the “global leaders in semiconductors” and says it is “leading the future of high-performance memory”.

It is not clear whether investors agree with this assessment.

Despite good Q2 results and an outlook that beat Wall Street expectations, MU stock tumbled following its recent earnings call.

What are investors looking for from the semiconductor manufacturer, and will it be able to meet those expectations?

Latest News from MU

Micron’s latest financial results, announced March 20, saw record revenues from high-bandwidth memory, owing to current demand outstripping supply, and topped consensus estimates by $0.13 with earnings per diluted share of $1.56.

Revenues beat analysts’ expectations, with $8.05bn versus estimates of $7.93bn. The firm’s outlook for both Q3 and FY 2025 are also optimistic, with Chairman, President and CEO Sanjay Mehrota saying “we are on track for record revenue and significantly improved profitability in fiscal 2025”.

While the results were positive relative to Wall Street’s expectations, they represented a notable dip versus Q1, which saw revenues of $8.71bn. CFO Mark Murphy also forecast “sequentially lower” gross margins for Q3.

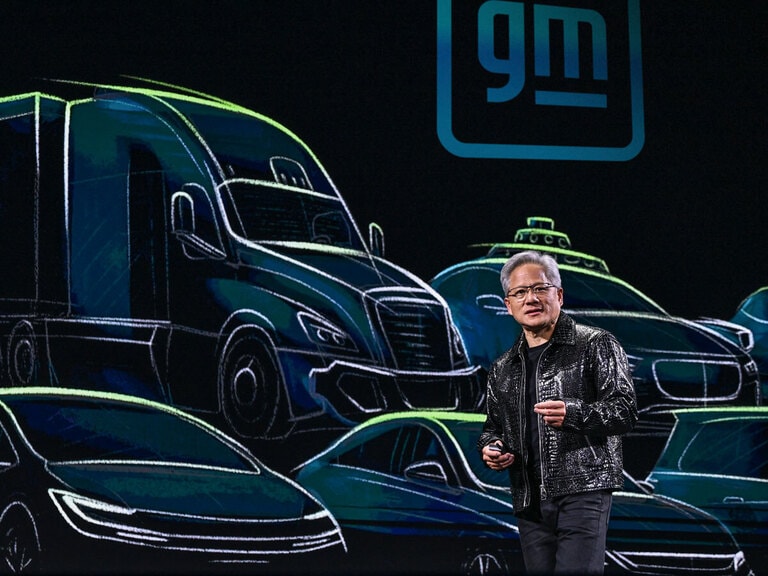

In other news, Micron announced on March 18 that it has started shipping a small outline compression attached memory module (SOCAMM), produced in collaboration with Nvidia [NVDA]. This positions the firm as the only one delivering both HBM3E and SOCAMM products, enabling it to service AI servers more completely.

Earlier this year, the firm announced that Micron Mobile Solutions is integral to Samsung’s [005930:KS] flagship Galaxy S25 range, providing memory and storage pioneer multimodal AI experiences.

MU’s Recent Movements

It has undoubtedly been a difficult 12 months for MU, with a 43.38% drop between June 18 and August 7, 2024. Analysts largely pinned this on the wider AI sector sell-off, although it is worth noting MU’s downfall lasted longer than peer stocks. It is also noteworthy that the drop followed a relatively positive Q3 2024 update, with optimistic targets for future quarters.

Eight notable peaks and troughs have followed, although the stock has not reached more than 30.8% higher than its August 7, 2024 low. As of the March 24, 2025 close, it was just 11.95% higher than this level.

Following the recent Q2 2025 earnings call, things were looking uncertain once again for MU, with an 8.04% drop in the 24 hours following the announcement on March 20. The stock has since fallen another 5.88% to the close on March 24.

Investors will no doubt be keen to see whether this appears to be a new trend, or if the stock can recover as this week progresses.

How Are the Competition Faring?

Investors who largely base their judgements on growth potential can see below that MU is leading the market in terms of growth predictions for the next 12 months, something that is particularly appealing when paired with a P/S ratio of just 3.41.

However, growth is not always a sign of results, and it will be imperative to monitor how the firm manages its financing going forward.

Analog Devices [ADI] and NXP Semiconductors [NXPI] both received green lights from Christopher Danely and his team at Citi Research on March 19, who have stated they are bullish on the analog sector because they believe inventory to be low.

Metric | MU | NXPI | ADI |

Market Cap | $105.86bn | $50.89bn | $101.38bn |

P/S Ratio | 3.41 | 4.10 | 10.92 |

Projected revenue growth (2025) | 40.97% | -4.55% | 9.59% |

Source: Yahoo Finance

Do the Bulls Win Out for MU?

There are many reasons to be optimistic when considering MU, especially if investors can identify a promising entry point while the stock dips. However, any exposure to MU will come with risks, particularly if the sector does not rebound as hoped.

The Bull Case for MU

Could the current state of play represent an entry point?

Dominance in High Bandwidth Memory for AI

As a self-professed market leader, MU’s high-capacity bandwidth and power efficiency may become more essential as the use of generative AI continues to expand.

If Micron can maintain — and perhaps even increase — its lead in the market, there could be large profit margins awaiting the firm.

Anticipated Recovery of the Memory Market

The memory chip industry is cyclical, with periods of oversupply and undersupply all but baked in. As mentioned above, reduced inventory and booming demand could bode well for Micron.

With its strategic supply adjustments, the firm may be well-placed to capitalize on the wider market’s upswing.

Headwinds for MU

However, wider economic circumstances and increased technological risks could present reasons for caution when considering an investment in MU stock.

Macroeconomic Sticking Points

With global inflation, rising interest rates and geopolitical tensions impacting almost every sector at the moment, the memory chip market faces significant risks of reduced spending from both consumers and commercial customers.

Consumer electronics, PCs and data center hardware could be purchased in reduced numbers due to this wider downturn, leaving demand for Micron’s products at risk.

Technological Risks

As with the macroeconomic risks, the constant danger of technological innovation going awry, or a competitor releasing a much more advanced product and stealing market share, looms large for MU.

Maintaining an edge in the tech space necessitates significant investment in R&D, with no guarantee of a payout at the end. If MU fails to keep up, it could incur noteworthy losses.

Conclusion

MU finds itself in an interesting position. While earnings look positive and it maintains market share, there is potential for further dips ahead owing to the macroeconomic landscape and the competitive nature of the semiconductor sector.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy