In this article, Howard Penney and Daniel Biolsi, managing directors of the consumables research team at Hedgeye Risk Management, recently considered the investment case for Oatly ahead of its market debut.

[Oatly [OTLY] went public on Thursday last week. Launching at the top end of its $15-$17 range, its market capitalisation was close to $10bn when it opened. By Friday, shares were trading hands at $21.]

The valuation may seem steep, but Oatly could be the next great global consumer products company, reminiscent of the greatest consumer growth stories we’ve seen IPO in recent decades (for example, Chipotle Mexican Grill [CMG], Lululemon [LULU], Under Armour [UA]).

Oatly is already a proven global consumer products company as a Swedish-based brand with a significant presence in the more progressive European and UK markets as well as a market leader in the US. In addition to global growth prospects, the company is positioned to benefit from strong secular tailwinds as consumers shift to plant-based milks.

Oatly has several large growth opportunities. The company is driving consumer awareness of oat milk, which is still in the early innings of adoption.

Oatly's demand drivers have been so effective that it has outstripped supply for the last few years and is projected to continue to do so in the future.

It is growing geographically — the penetration in its home market of Sweden is much higher than the markets it has entered recently, like the US. It is rare for a consumer brand to be growing in two continents this early in its expansion, but Oatly has already entered its third continent.

Oatly is also growing with new products, adding yogurt, spreads, butter, cheese, etc. Only two countries even have the full product assortment.

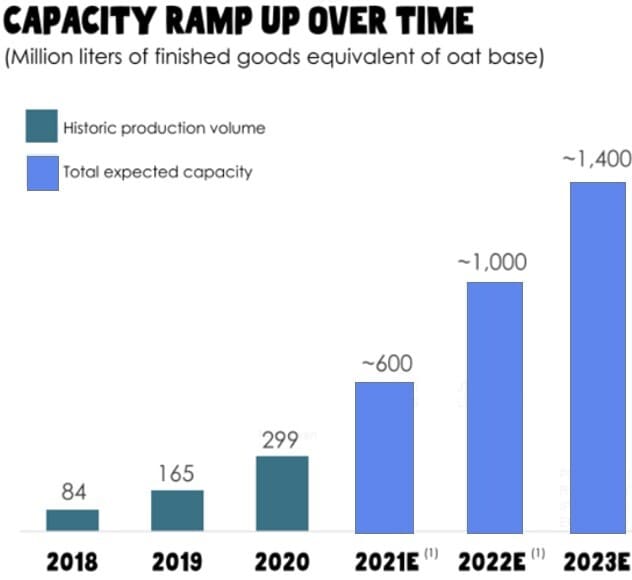

Oatly is challenged to expand its manufacturing capacity to keep up with demand. The IPO is raising funds for future growth. The company has announced new plant construction in three continents ahead of the IPO.

In the US, we have documented Oatly products being frequently out of stock in outlets. Perhaps the company's biggest near-term challenge is to build enough supply to keep up with demand (see tweet below).

As the authors suggest in the graphic above, Oatly has the potential to be “the next big global consumer brand”. It is arguably the most recognisable player in the nascent milk alternative market, which is causing disruption across Asia, EMEA and the US. However, demand for its beverages is outstripping supply and aggressive expansion efforts are weighing on the company, which it is not yet profitable.

This article is an excerpt from a complimentary research note written and published by Hedgeye. The original article and the full report, can be found here.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy