Notwithstanding growing demand for EVs, the battery sector has struggled as raw material costs continue to rise. QuantumScape reported a narrow beat for Q4, and has seen stock gains this year after 2022’s carnage, but is yet to turn a profit. Elsewhere, the UK’s beleaguered Britishvolt is to be taken over by Australian firm Recharge.

- QuantumScape sees share price fall in trading following earnings.

- EV sales projected to grow, but high raw material costs remain a barrier.

- Direxion Daily Electric and Autonomous Vehicles Bull 2X ETF offers exposure to QS stock.

Leaders in the global field of electric vehicle (EV) batteries have rallied on markets so far in 2023, among them California-based QuantumScape [QS], Texas-based Microvast [MVST] and Japan’s Panasonic [6752.T].

QuantumScape’s share price is up 108.8% year-to-date, while Microvast is up 1.6% and Panasonic has rallied 8.6%.

Elsewhere, the assets of collapsed startup Britishvolt will be taken over by Australian company Recharge Industries, after the company outbid three others in early February.

Britishvolt went under due to “insufficient equity investment”, according to administrators at EY-Parthenon. The company announced on 18 January that 300 workers at its Northumberland base would become redundant. Recharge has outlined ambitious plans to build a £3.8bn “giga-factory” at the site.

Material costs climb

QuantumScape announced its fourth quarter (Q4) 2022 earnings after the bell on Wednesday, reporting losses of $0.25 per share, shy of a Refinitiv consensus estimate of a $0.21 loss per share.

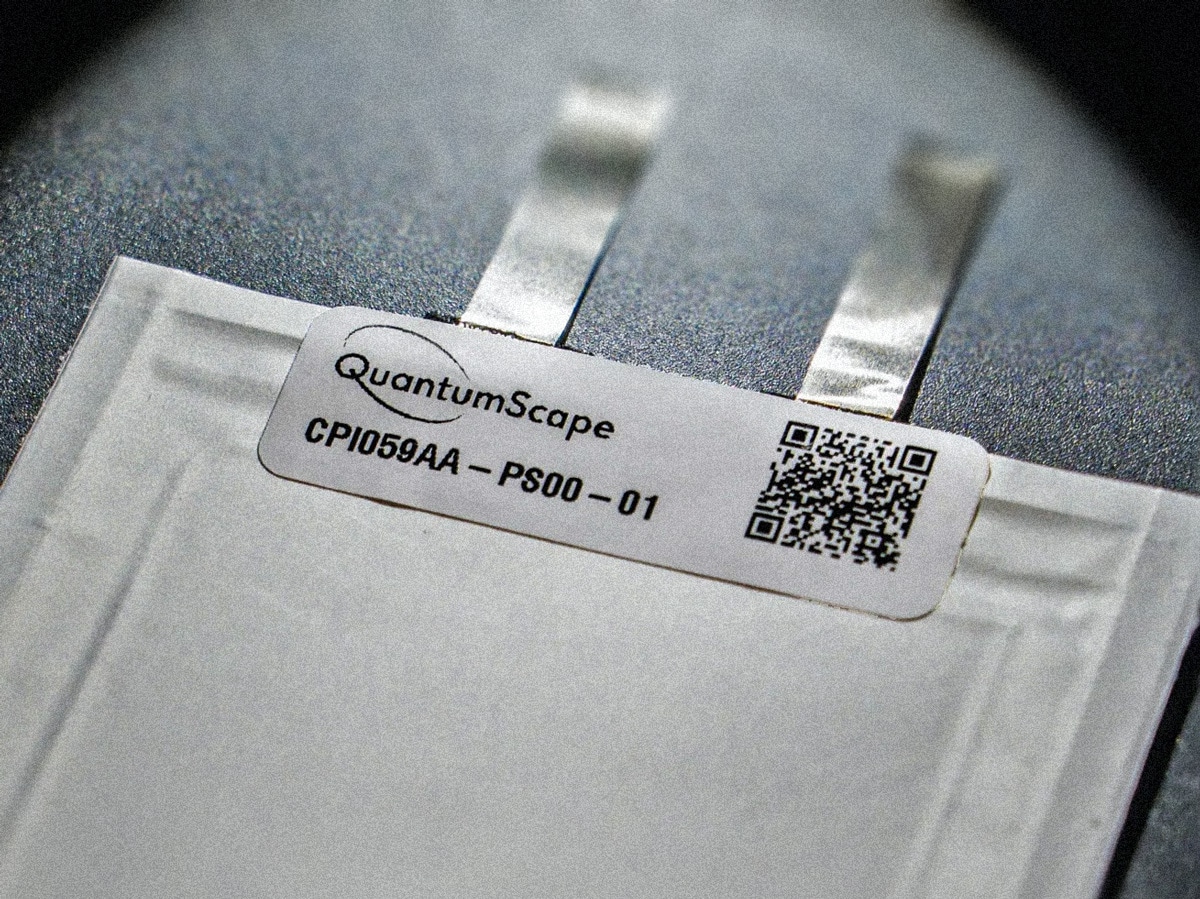

The company specialises in developing solid-state lithium-metal batteries, and in December announced it was to test its first prototype cells for wider usage. In a shareholder letter posted on its website for Q4, it said “much work remains to be done” but that it was on course to meet its commercial goals.

QuantumScape said capital expenditures for Q4 and full-year 2022 came in at $37.8m and $158.8m respectively. For full-year 2023, it projected a figure of between $100m and $150m.

Japanese firm Panasonic, meanwhile, has a high-profile partnership with Tesla [TSLA], and last year said it is building a new $4bn battery plant in Kansas. The facility will focus on producing lithium-ion batteries for Tesla’s Models Y and 3.

However, Panasonic recently cut its forecast for 2023 operating profits, despite posting a 16% increase in profits for Q3, blaming higher raw materials costs.

Microvast is known for cutting-edge, fast-charging batteries. Most recently, REE Automotive [REE] announced it will use the firm to supply its vehicles. Microvast posted year-over-year revenue growth of 4.7% in its Q3 earnings last November, but the company has yet to turn a profit.

This week, Nissan [NSANY] warned manufacturing costs need to fall in the UK to make new EVs more profitable. The firm’s chief operating officer Ashwani Gupta said high production costs left the country at a competitive disadvantage. Nissan began making batteries at its £10m Sunderland factory last September.

However, David Collard, founder and CEO of Recharge’s New York-based owner Scale Facilitation, remained upbeat about the UK’s prospects. “I strongly believe any premium we may end up paying is reflective of our bullish view on the untapped opportunity the UK market provides us”, he told the Guardian.

Sales up but challenges remain

Last year, the US Department of Energy awarded a $200m grant to Microvast and General Motors [GM] to create a plant for manufacturing separators, a thin film that is a vital component of lithium-ion batteries.

Shane Smith, chief operating officer at Microvast, said the company was excited to enhance its “vertical integration strategy by expanding our domestic footprint and production capabilities to include battery components”. He said the company expected to source raw materials and equipment directly from the US and “its allies”.

However, the EV battery sector has plenty of challenges, not least the fact that raw materials are so expensive.

In June 2022, AlixPartners reported that the raw material costs involved in producing EVs had more than doubled during the pandemic. The price of materials such as lithium, nickel and cobalt all rose sharply.

Last year, Carlos Tavares, CEO of Stellantis [STLA], predicted the world will see a global battery shortage for EVs in 2024-25 for similar reasons, which could slow down the adoption of EVs going forward.

Funds in focus: Direxion Daily Electric and Autonomous Vehicles Bull 2X ETF

Funds that offer exposure to QuantumScape stock include the Direxion Daily Electric and Autonomous Vehicles Bull 2X Shares ETF [EVAV]. As of 16 February, QuantumScape stock has a 6.18% weighting within the fund’s portfolio. Microvast shares have more limited exposure, with 1.50% of the portfolio, while Tesla accounts for 10.88% of assets under management (AUM).

The fund is up 52.4% year-to-date, but down 62.8% over the past 12 months.

QuantumScape is the top holding in the WisdomTree Battery Solutions UCITS ETF [VOLT.L], with a 5.44% weighting in the portfolio as of 15 February. Tesla accounts for 0.65% of AUM, while Panasonic has 0.25%.

The fund is up 15.4% year-to-date, and down 9.6% over the past 12 months.

Panasonic stock is the third-biggest holding in the Global X Lithium & Battery Tech ETF [LIT] and has a 5.69% weighting as of 15 February. The fund has risen by 17.6% year-to-date, but is down 11.7% over the past year.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy