The future of work theme is being driven by increased mobility and the ability to now work remotely from just about anywhere on the planet as companies undergo significant digital transformations.

One of the stronger sub-themes within this is digital documents, which includes the journey from preparation, signature, payments, and management.

We live in the information age, with exponential growth in data, yet are moving away from physical documents, resulting in a massive growth opportunity for digitalisation of documentation.

Leading the way

One of the leaders in this space, DocuSign [DOCU], refers to this as the agreement cloud. It held an Analyst Day in March in which it outlined the market opportunity, as follows:

Adobe [ADBE] addressed the topic on its earnings call in March, saying:

“What's happening with the future of work and remote work and the limitations of what you can do with in-person interaction … will lead to more automation of digital documents and … every business in the planet is going to focus on engaging digitally with their customers, so massive opportunity. “

We are in the early innings of this theme and continue to see expanding use cases and it expanding across multiple verticals. From personal experience, I have recently been investing in alternative investment platforms. The process allows digital signing of agreements within seconds to finish transactions, very convenient and efficient.

I’ve signed several subscription agreements over the past year for various services via electronic signature. The entire document workflow theme is one that will see further growth as integrations expand to make the process more automated across a range of industries.

During its earnings call in March, Box [BOX] noted: “When we surveyed hundreds of our customers in 2020, esignature was the most requested new Box capability. There are an incredible number of use cases that Box Sign will address for our customers.

“For example, legal teams will be able to create and finalise contracts within Box, from drafting and co-editing to signing and retaining the agreement with Box Governance. HR teams will be able to initiate and complete offer letters using Box Relay together with Box Sign. Sales teams can initiate digital customer contracts for signature right from Salesforce. And compliance teams will be able to retain and protect executed agreements while securing sensitive content with Box Shield.”

Dropbox [DBX] is another player in this space. In February, it said: “We're really excited about HelloSign. It's the fastest-growing product in the company. We saw strong growth in revenue in paid seats and signature requests last year. And I think the pandemic really accelerated the adoption of esignature as a category. So we see it's pretty early innings, both for HelloSign, specifically in the category in particular, and there's a number of natural adjacencies around esignature and just document workflow and better handling the document life cycle in general.”

In March, Dropbox announced a $165m deal for DocSend and noted: “Dropbox, DocSend and HelloSign will be able to offer a full suite of self-serve products to help our millions of customers manage the entire critical document workflows and give more control over all aspects of that.”

Another top name, but one that gets less attention, is Open Text [OTEX]. The company held an Analyst Day in March when it said: “Ready for modern work with leadership in document management, record management, archive capabilities, intelligent capture and with many more innovations coming around the esignature and collaboration in the public cloud.”

The back-office, where a lot of paperwork is prepared and processed, is one of the ripest for disruption by digitalisation, and three key players are Bill.com [BILL], Workiva [WK] and SmartSheet [SMAR]. There is a massive opportunity where automation and digitalisation remains underpenetrated across the many businesses both in the US and abroad.

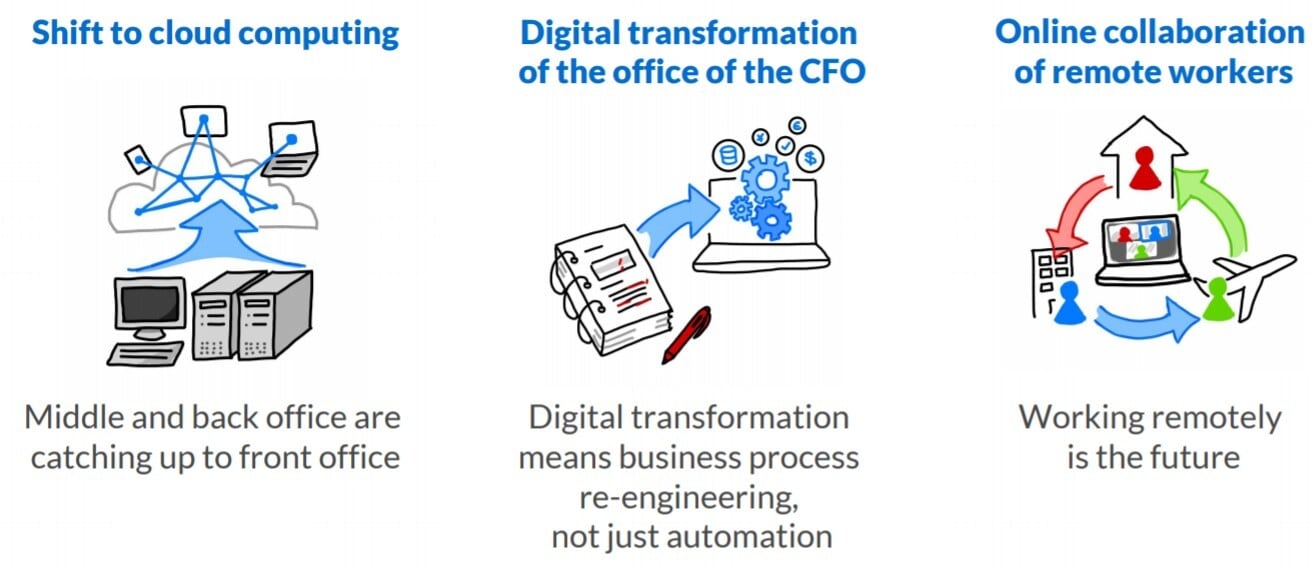

Workiva outlined key secular trends at its recent investor presentation:

Iron Mountain [IRM], a company with a long history of physical document storage, has shifted to a more modern & digital approach as it sees the future opportunity, and in doing so, has expanded its total addressable market of $10bn in 2015 to $80bn in 2020.

Transformational technology

Transforming document-centric business workflows is a key component of any digital transformation strategy. According to research from IDC, taking this step reduces the time spent on document-related tasks by 17% each week, increases employee productivity by 41%, decreases errors by 52% and lowers costs by 35%.

The beauty of the digital documentation trend is that it lies at the crossroads of multiple mega-trends — a world moving digital, an age of information and exponential data growth, and an environment of larger and more frequent transactions requiring documentation. The benefits are multiple as consumers enjoy convenience and businesses see high efficiency and lower costs.

It is for these reasons I continue to favour this theme. My highlights include Adobe as a large cap growth name at the center of everything related to documents, DocuSign as a leader in thriving markets that should be able to triple revenues in coming years, Dropbox for its complete suite of document workflow solutions, and Bill.com for its leadership position in a massive opportunity that is severely underpenetrated.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy