Over the last 26 years, NVIDIA [NVDA] has produced some of the best and most popular graphics processing units (GPUs) used in the gaming industry. What many people may not be aware of, however, is that high-end video cards are also used in the mining of cryptocurrencies like Bitcoin.

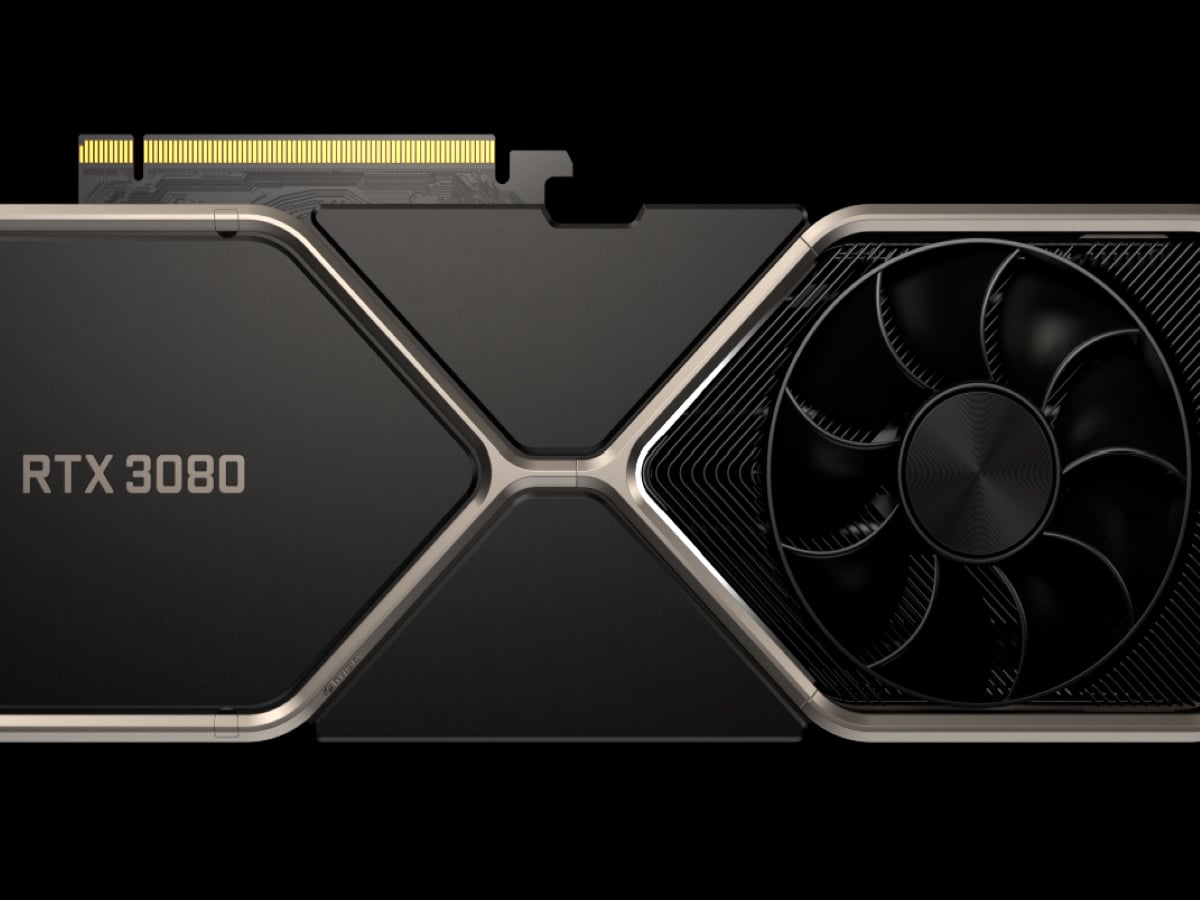

This explains why cryptominers have been eagerly awaiting the release of NVIDIA’s new GeForce RTX 30 series cards. This ultra fast GPU series includes the GeForce RTX 3070, 3080 and 3090 cards that have customers lining up to buy them and scalpers flipping them for hundreds of dollars over their list price.

While Bitcoin may currently be prohibitively expensive to mine, other digital currencies can still be profitably mined using NVIDIA GPUs even though they have not gained as much as Bitcoin in its latest spike upwards. Also, lower mining requirements for altcoins compared to Bitcoin helps explain why NVIDIA GPUs are still so much in demand among cryptominers.

GPUs and Crypto Mining

Mining cryptocurrencies was originally performed on central processing units (CPUs). CPU based mining eventually became obsolete due to the limited processing speeds and high power requirements.

Happily for NVIDIA, a GPU’s design for rendering graphics turned out to be much better suited for crypto mining. A standard graphics card can execute 3,200 32-bit instructions per clock versus just 4 32-bit instructions per clock on a CPU.

Another factor that makes GPUs preferable to CPUs consists of the increased number of Arithmetic Logic Units (ALUs) that perform the mathematical calculations needed for mining cryptocurrencies. While GPUs offer better results than CPUs, two other pieces of hardware can be used to mine cryptos: application-specific integrated circuits (ASICs) and field-programmable gate arrays.

Best NVIDIA GPUs for Crypto Mining

NVIDIA’s GPUs allow anyone with the proper equipment to mine cryptocurrencies. The most popular GPUs offered by NVIDIA are currently the aforementioned GeForce RTX 30 Series. This includes the 3070, 3080 and 3090 models that were released on 17 September. These GPU cards can generate up to $58.30, $86.55 and $99.44 respectively per month in mining income as of November 2020, according to BetterHash.

The company still makes several graphics cards that were popular for mining cryptocurrencies and are now cheaper than the pricey new 30 series models, including:

1. NVIDIA GeForce RTX 1080 Ti - Still a decent graphics card, the 1080 Ti can currently generate up to $33.94 in monthly mining income.

2. NVIDIA GeForce RTX 2070 Super - This supercharged version of the RTX 270 model performs considerably better than the regular version. It can currently generate up to $35.40 in monthly crypto mining income.

3. NVIDIA GeForce RTX 2080 Ti - This graphics card was considered the best NVIDIA graphics card for mining performance before the 30 series arrived. It can currently generate up to $48.81 in monthly mining income.

NVIDIA Stock’s Performance during the Crypto Rally

PayPal, one of the largest electronic payment platforms with 346 million active users worldwide, announced on 21 October that it would allow U.S. customers to hold Bitcoin, Ethereum, Bitcoin Cash and Litecoin in accounts. It also said those cryptocurrencies would become “a funding source to pay at PayPal's 26 million merchants around the globe” in early 2021.

This announcement sparked a sharp rally in cryptocurrencies that also eventually boosted NVIDIA’s stock price and its volatility. NVIDIA stock had begun to rise several months earlier in 2020, however, on expectations that the COVID-19 shutdown would result in an online gaming boom. That news, combined with the PayPal announcement, boosted the stock from its $196.40 close on 16 March to close at $582.48 on 6 November.

After its sharp pullback to $505.13 on November 10th, the stock has since risen. The near term technical picture currently suggests further significant upside is likely for the stock beyond its recent September 2nd and November 9th highs at the $589.07 and $587.66 levels to at least the $598 level just below the psychological $600 mark. A significant downside correction could then set in that may drop the stock back into the $468.17 to $589.07 region.

So, time to buy NVIDIA's share price?

From a fundamental perspective, the company’s forward earnings of $9.05 per share, its price/earnings ratio of 60, its yearly dividend of $0.64 and its dividend yield of only 0.12% suggest the stock is becoming overvalued. Even after the recent correction to its current level of $531.88, the stock has gained over 120% year to date versus a rise of just 11% in the S&P 500.

Furthermore, according to MarketBeat, NVIDIA stock is a buy according to 29 analysts, a hold by 4 analysts and a sell by 4 analysts. Analyst price targets for NVIDIA stock range from $285 on the downside to $519 on the upside, which is 2.32% lower than the stock’s current price of $531.88. This means even the most favorable analyst targets for the stock have already been met, so its price may be approaching a medium term top.

As gaming and virtual reality platforms continue to evolve and grow in popularity and cryptocurrencies become more accepted for payments, demand for NVIDIA GPUs will likely remain strong and continue to grow. This makes the stock worthy of consideration as a long term investment.

| Market cap | $331.22bn |

| EPS (TTM) | 5.44 |

| PE ratio (TTM) | 98.49 |

| Quarterly revenue growth (YoY) | 49.9% |

Nvidia's share price vitals, Yahoo Finance, 17 November 2020

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy