This article was written by the team at Benzinga.com. Benzinga's mission is to connect the world with news, data and educational resources that help readers manage their financial strategies.

Special purpose acquisition companies or SPACs — also known as “blank cheque companies” — have gained considerable ground as an alternative way for companies to go public and for investors to fund them.

Virgin Galactic Holdings Inc. [SPCE] and sports betting firm DraftKings [DKNG] went public via SPACs in 2019 and 2020 respectively. Since then, over 300 SPACs with a war chest of $90bn are now actively seeking deals.

California-based photo sharing company Shutterfly is a recent entry into the SPAC arena after being taken private by Apollo Global Management [APO] in June 2019. The Apollo deal had an enterprise value of $2.7bn, and its $51 per share cash price represented a 31% premium over Shutterfly’s closing price of $38.91 on 23 April 2019.

Shutterfly first went public on the NASDAQ exchange under the SFLY symbol at $15 per share in an initial public offering in September 2006. The company sold 23.6 million shares at that price, thereby giving the company an initial market capitalisation of over $350m.

Shutterfly in talks with Altimar Acquisition Corp.

According to anonymous sources familiar with the matter quoted in the Wall Street Journal, Shutterfly has been discussing a potential deal with a SPAC known as Altimar Acquisition Corp. II [ATMRU], which began publicly trading on 5 February 2021.

In a previous deal consummated on 23 December 2020, Altimar Acquisition Corp I [ATAC], a SPAC with $275m, combined with Owl Rock Capital and Dyal Capital Partners division of Neuberger Berman Group LLC to form Blue Owl Capital in a $12.5bn deal. The merged company specialies in alternative asset management with over $45bn in assets under management.

Altimar Acquisition Corp. is a subsidiary of privately held HPS Investment Partners, LLC, and consists of a collection of SPACs with the mission to act as a strategic partner for company founders, shareholders, management teams and other important shareholders of companies that want to pursue a public listing.

Altimar Acquisition focuses on these key industrial sectors: technology, media and telecom (TMT), financial services and fintech, consumer industries and healthcare. Altimar’s goal is to pursue the acquisition of companies with efficient business models that are poised for strong growth and cash flow generation.

How SPACs work

SPACs or blank cheque companies can be extremely lucrative to early investors. Furthermore, their popularity as an investment vehicle has blossomed recently, raising more money in 2020 than in the entire previous decade. SPACs also offer a more convenient, faster and cheaper path for a company to go public than a normal IPO.

The SPAC model involves initially raising capital in an IPO and then taking as long as 2 years to find a private company to merge with. The SPAC then takes the merged company public.

Shares can typically be redeemed at the time a merger is proposed if investors do not approve of the proposed merger. In addition to getting back their full investment, SPAC investors who redeem their shares can also receive a high return.

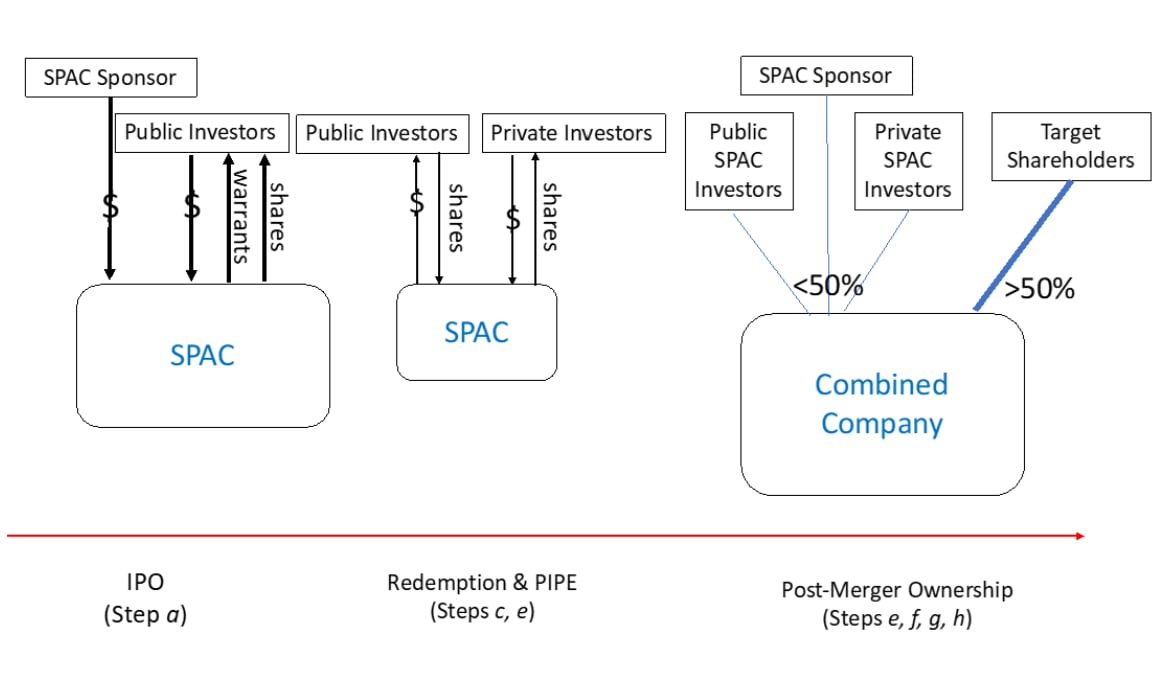

The SPAC process usually consists of these four key steps:

- Share issuance: The SPAC issues units of redeemable shares and warrants to the public in an IPO while the sponsor simultaneously invests to cover the costs incurred by the SPAC during the time between the IPO and the merger.

- Target company identified: The SPAC finds a privately held company to merge with within 2 years and proposes a merger for the company to go public.

- Redemption offered: At this point, typically 75% of SPAC shares are redeemed. The SPAC then issues new shares to parties in private placement (PIPEs) and to the sponsors to replenish some of the cash paid out in redemptions.

- Merger consummated: The merger takes place with the remaining sponsors, public shareholders and PIPE investors owning a piece of the company’s post-merger equity.

The process of SPAC mergers. Source: Harvard Law School.

While hedge funds and investors with deep pockets can gain considerably from a SPAC merger, a number of sources of dilution are inherent in the overall structure of a SPAC that may not benefit long-term shareholders. These typically include:

- SPAC sponsor payoff: The first arises from the fact that 25% of IPO funds typically go to SPAC sponsors from the original IPO proceeds or 20% from post IPO proceeds to compensate the original sponsors of the deal.

- Share redemptions: This results from the premium price paid for any shares redeemed at the time of the public merger. Shareholders who ask for their money back generally get a handsome return on the money the SPAC held for 2 years.

- Additional share issuance: This occurs when the SPAC needs to replenish the cash lost from redemptions by issuing more shares.

To check out more investing and finance content from the team at Benzinga, you can visit their site here.

Where next for the potential Shutterfly Altimar deal?

Shutterfly saw its valuation increase to circa $4bn after Apollo took the firm private. Despite a recent merger with competitor Snapfish in 2020, Shutterfly’s management is increasingly concerned about its growing overheads, its competitors’ pricing and the many alternatives now available in its field.

A large cash infusion would give Shutterfly the chance to offer more sophisticated design capabilities and improve their customer base as a result. While a Shutterfly SPAC deal could happen at any time, and would likely value the company between $4bn and $5bn, no guarantee exists that any such deal will actually go through.

Even if the Shutterfly SPAC deal does occur, the pricing and returns may be less than stellar. According to the NASDAQ, a total of 387 SPACs are currently seeking targets, with SPACs having raised a total of $73bn so far in 2021 compared to $83 billion for the entire year of 2020.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy