The global economy has entered a “new regime”, characterised by greater macroeconomic and market volatility resulting from a range of supply constraints, according to BlackRock’s midyear outlook report. However, periods of volatility bring their own set of opportunities. BlackRock and JP Morgan suggest that investors may need to adopt a different strategy, targeting themes set to benefit from these structural trends.

- Deglobalisation and geopolitical shifts could create investment booms in technology, clean energy, infrastructure, and defence, BlackRock predicts.

- Ageing populations are increasing, and potential beneficiary themes are healthcare and real estate, and companies offering products and services for the elderly.

- Addressing low-carbon energy scarcity leads to materials scarcity, and the demand for specific metals is set to skyrocket with the push to electric vehicles, JP Morgan anticipates.

Economic relationships investors have traditionally relied upon could break down in the new regime.

Factors contributing to this shift include climate change, ageing populations, geopolitical risks, and lasting changes to supply chains and labour markets due to the pandemic. In a global move away from resource abundance, JP Morgan sees scarcity as an opportunity for investment.

Amid a volatile macroeconomic environment, opportunities can be found by getting granular within asset classes and doubling down on mega-forces and structural shifts, says BlackRock.

Below, we have extracted six key thematic investment opportunities arising from these structural shifts, based on the midyear outlooks from BlackRock Investment Institute and JP Morgan Asset Management.

1. Digital disruption

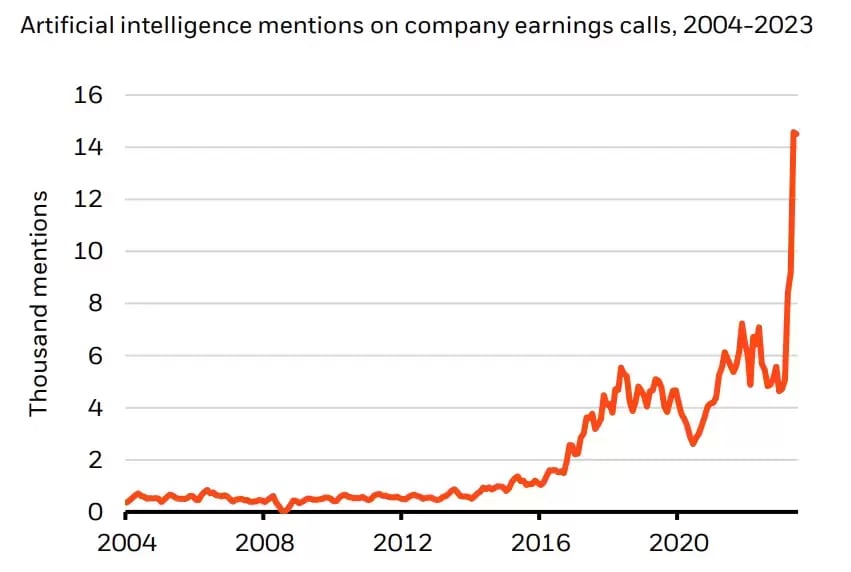

BlackRock’s midyear outlook report highlights the increasing prevalence of digital disruption and artificial intelligence (AI) in mainstream sectors, driven by a surge in computational power and data. Advances in machine learning have introduced innovative AI tools, which can undertake tasks traditionally performed by humans and analyse vast data sets. This capability not only has profound implications for productivity and economies, but has also generated strong market enthusiasm, as demonstrated below. [1]

AI-driven productivity enhancements are anticipated to augment profit margins, particularly for businesses with high staffing costs or those with a significant proportion of automatable tasks. Alongside these benefits, the rise in digitalisation escalates cybersecurity risks. Businesses are demonstrating a growing emphasis on AI, thereby intensifying the demand for experts in machine learning and AI.

Investors are encouraged to assess the impacts of digital disruption on various sectors and companies, seeking opportunities to capitalise on these shifts for potential returns. Moreover, as digital disruption reshapes established sectors and economies, strategies to adapt and achieve investment objectives are of paramount importance.

2. Geopolitics & deglobalisation

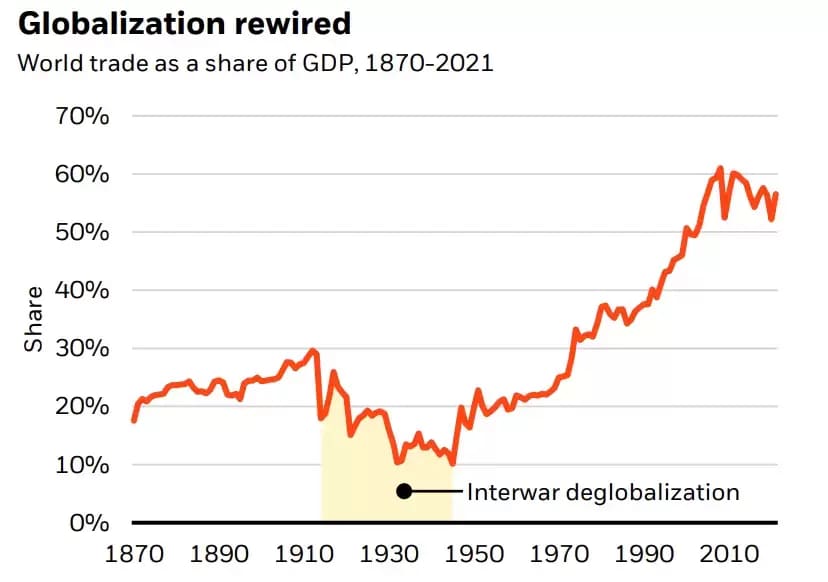

According to BlackRock, the escalating strategic competition between the US and China is poised to redefine global supply chains. Governments are increasingly reshoring operations to better align production and trade with allies, signalling a potentially seismic shift away from decades of globalisation, as shown below [2].

The global landscape is evolving into distinct defence and economic blocs, a stark contrast to the post-Cold War era's embrace of globalisation and geopolitical moderation. Factors like the Ukraine conflict and tense US-China relations have catalysed this move towards global fragmentation. The report highlights that such fragmentation, coupled with industrial and protectionist policies, might stimulate investment in infrastructure and robotics. As these competing blocs solidify, nations seeking alliances—such as the Gulf oil states, India, Brazil, Vietnam, and Mexico—will see their power and influence amplify due to their strategic resources and roles in supply chains. These countries will likely make alignment decisions based on national interests, further altering supply chain dynamics and industrial policies.

This evolving geopolitical scene may heighten the risk of confrontations on terrestrial fronts or even in space and cyberspace, potentially spurring growth in the defence, aerospace, and cybersecurity sectors. While this shift could usher in investment booms in technology, clean energy, infrastructure, and defence, it may also inflate economic costs in the long run, especially for emerging markets. The report underscores that economic growth will become more erratic and susceptible to external shocks. Consequently, investors must tread carefully, pinpointing themes poised to capitalise on these emerging trends.

3. Low-carbon transition

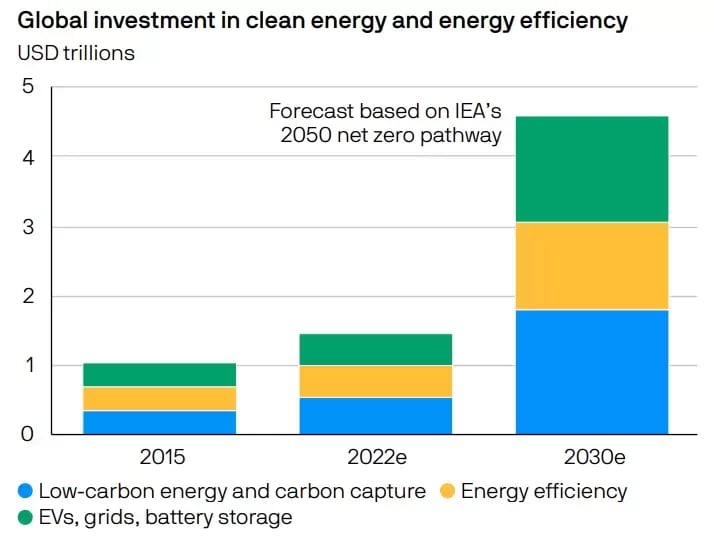

The transition towards a low-carbon economy signifies a substantial surge in investment and a massive reallocation of capital as energy infrastructures are redefined [3]. This shift is propelled by a blend of economic catalysts and obstacles, influenced by policy, technological advancements, and the preferences of consumers and investors. Critical junctures, or tipping points, are anticipated when low-carbon technologies become more cost-effective than existing solutions and when adoption barriers diminish.

Such tipping points will manifest variably across regions and industries, leading to an asymmetrical and staggered transition, as BlackRock's report elaborates. The move to a low-carbon paradigm is poised to exert economic and investment repercussions, with potential short-term inflationary pressures from rising energy prices coupled with escalated capital expenditure. Yet, these pressures may wane as the costs of low-carbon technologies reduce.

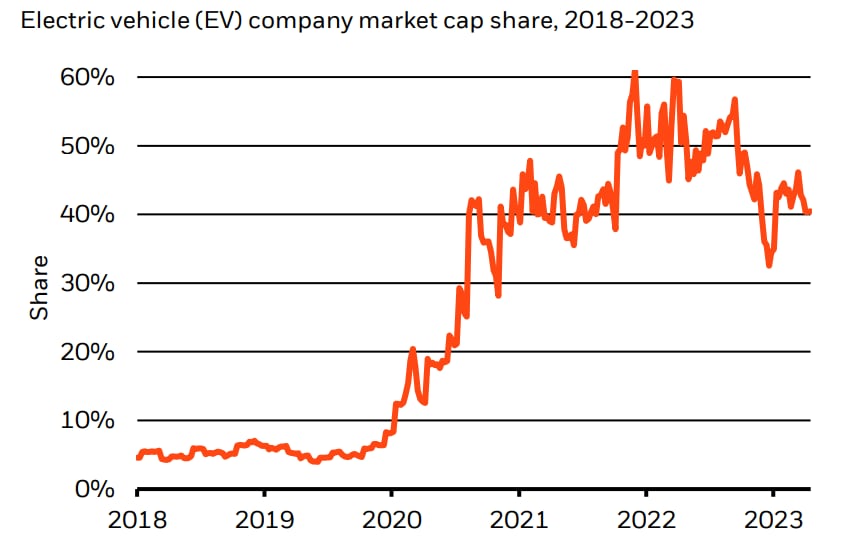

Moreover, the predominant growth impact during this transition stems from tangible climate adversities. Thus, fortifying climate resilience against these challenges emerges as a prime investment theme. The rapid rise in market capitalisation of electric vehicles (EVs) in recent times exemplifies the financial market pricing in these structural shifts. According to IEA estimates, EV company valuations surged before declining in the past year. However, their share of total automobile sales continues to rise. [4]

4. Ageing populations

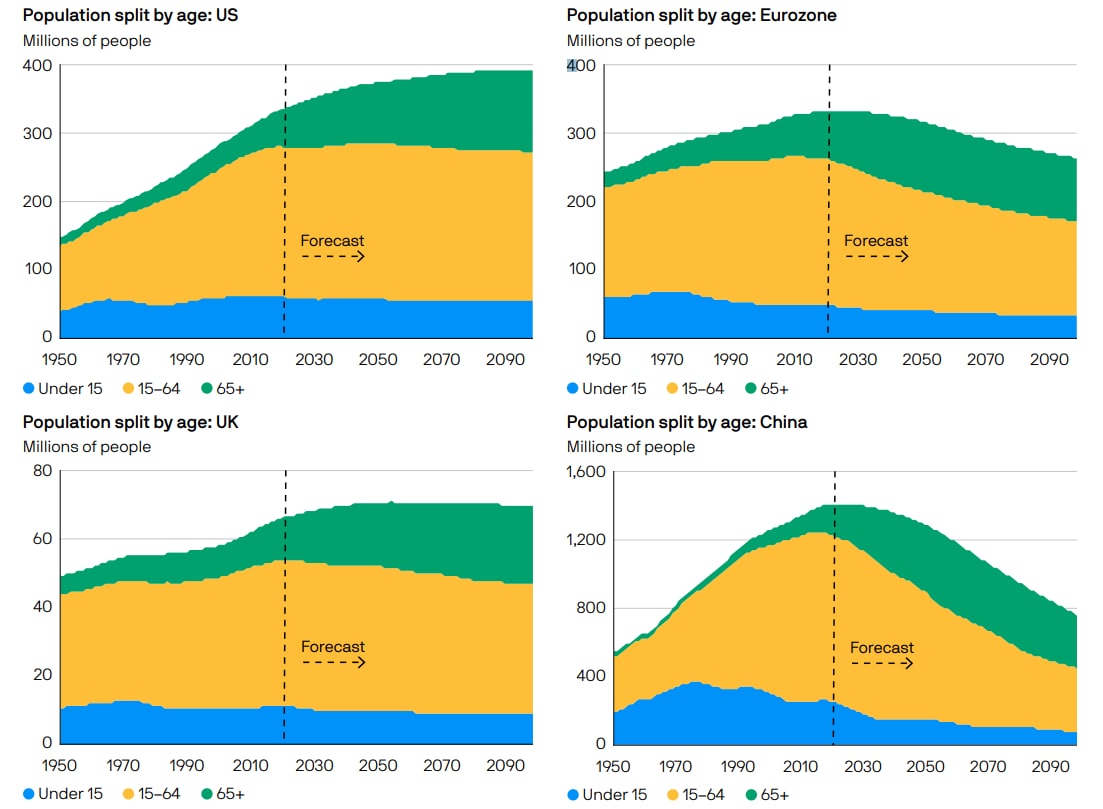

Populations in many of the world’s major economies are ageing. [5]

According to BlackRock’s report, ageing populations typically generate lower income, which has repercussions on consumer spending and public finances. Many developed markets, such as the euro area and China, are anticipated to see a decline in their working-age population in the coming years.

This demographic trend may constrain an economy's potential to produce and grow, leaving a smaller workforce to cater to a rising non-working demographic. A constricted labour supply can influence government finances; there's likely to be a drop in per capita revenue from income tax coupled with increased spending on retirement-related benefits like pensions and healthcare. This financial strain might prompt increased government borrowing, especially during periods of rising interest rates that already compound debt levels.

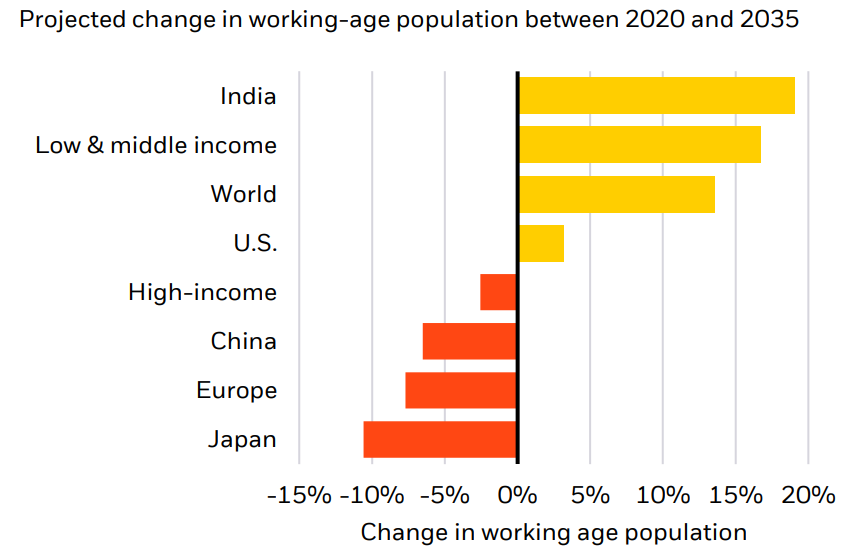

A growing ageing population is predominantly a DM occurrence, both BlackRock and JP Morgan affirm through the charts below [6]. While the working-age populace in high-income economies is predicted to decline, it's set to surge in low-income regions.

Despite global population growth, JPMorgan sees this demographic shift as a trend in labour scarcity. Several potential opportunities could arise, including growing investment in physical capital to compensate for the lack, such as automation and AI. This theme is further expanded below.

Investors may thus evaluate how different nations and businesses are navigating the challenges of an ageing demographic, BlackRock notes. Potential sectors to watch are healthcare and real estate, as well as enterprises offering tailored products and services for the elderly, such as in the leisure industry.

5. Future of finance

The finance landscape is experiencing transformative shifts driven by mega forces such as ageing populations, technological advancements, and escalating interest rates. These shifts are notably influencing the roles and functions of banks and other credit providers. Technological innovation, in particular, not only underpins these forces but also interconnects them, enabling rapid adoption that can reshape entire economies.

Moreover, these influences span across public and private markets, various asset classes, and different regions. As the financial system evolves to cater to these changing dynamics, investors should assess how these transformations impact the broader financial ecosystem and strategize to optimise returns.

In this changing scenario, traditional banks are confronted with heightened competition in financial services, with non-bank lenders emerging as formidable contenders. The advent of digital payments has revolutionised fund transfers, enabling instantaneous cash movement. Moreover, shifts in financial infrastructures mean that funds no longer necessarily revert to deposits as they once did.

BlackRock sees this evolving landscape heralding several notable outcomes: a trend towards consolidation among smaller banking institutions, banks becoming more conservative in their lending practices, and a growing appetite for non-bank lending and private credit solutions. In the long run, it believes incumbent banks face potential risks.

Factors such as regulatory changes, increased market concentration, intensified competition for deposits, and the disintermediation of payments can all significantly reconfigure the future of banking and finance.

6. Scarcity

The global economy's transition from abundance to scarcity paves the way for significant investment opportunities, JP Morgan believes. This transition is influenced by factors like climate change, geopolitical challenges, and enduring alterations to supply chains and labour markets resulting from the pandemic.

JP Morgan sees investment opportunities in leaning into physical capital and diversifying into alternative asset classes, such as infrastructure, to bolster equity portfolio resilience.

The asset manager also highlights the growing significance of automation and AI to address looming labour shortages, noting that the scarcity in low-carbon energy sources presents lucrative prospects for companies involved in renewable energy, efficiency, electrification, and carbon capture. In essence, while scarcity introduces challenges, it also creates new opportunities for forward-looking investors.

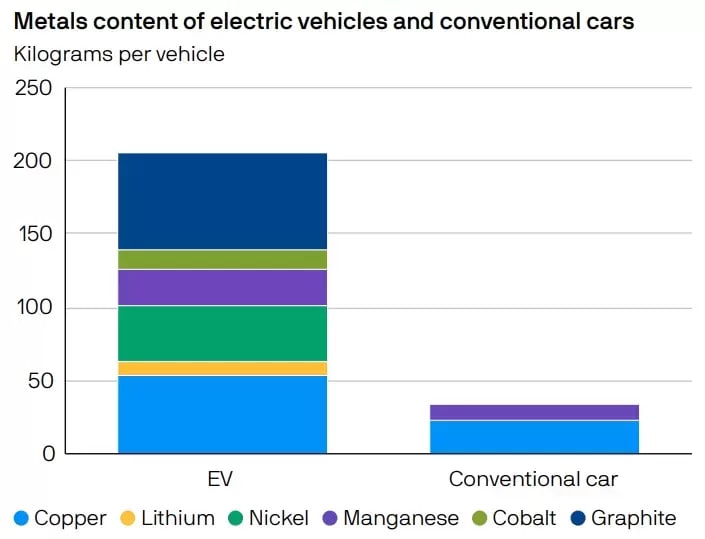

Addressing energy scarcity inadvertently leads to another challenge/opportunity: materials scarcity. As the energy landscape transforms, the demand for specific metals like lithium, copper, and silicon is set to skyrocket. For instance, solar energy generation demands over four times the materials compared to gas-fired plants. The push towards utility-scale electricity storage, a response to the fluctuating nature of wind and solar energy, will further drive up metal demand.

Additionally, the transition to EVs, which require six times more minerals than conventional combustion engines, will exacerbate this demand. [7] Given these dynamics, JP Morgan advises that investors brace their portfolios for not only elevated average inflation in the mid-term but also periodic spikes in inflation volatility.

[1] Sources: BlackRock Investment Institute, with data from Bloomberg, June 2023. Notes: The chart shows the three-month rolling sum of mentions of the phrase “artificial intelligence” in publicly listed company earnings releases or earnings calls with analysts.

[2] Source: BlackRock Investment Institute, Klasing and Milionis (2014), Penn World tables, World Bank, June 2023. Notes: The chart shows the sum of world exports plus imports, divided by world GDP. The yellow shaded area highlights the period between the first and second world wars when trade integration fell material.

[3] Source: IEA, J.P. Morgan Asset Management. Data is from the IEA’s "World Energy Investment 2022" report. 2030e is based on the IEA’s net zero by 2050 scenario. Data as of 15 June 2023.

[4] This information is not intended as a recommendation to invest in any particular asset class or strategy. Source: BlackRock Investment Institute, with data from Refinitiv Datastream, MSCI and IEA, July 2023. Notes: The chart shows the combined market-cap weight of pure-play EV companies – or companies that only produce EVs - within the MSCI All-Country World Automobiles Index.

[5] Source: (All charts) United Nations, J.P. Morgan Asset Management. Forecast is from the United Nations. Data as of 15 June 2023.

[6] Sources: BlackRock Investment Institute, with data from United Nations, June 2023. Notes: The chart shows the percentage change in population aged 20-64 for selected countries and regions between 2035 and 2050 based on UN data covering 237 countries or areas. Low, middle and high income groupings are based on the World Bank classification which use gross national income. Forward-looking estimates may not come to pass.

[7] Source: IEA, J.P. Morgan Asset Management. Data is from the IEA’s "The Role of Critical Minerals in Clean Energy Transitions" report. Data as of 15 June 2023.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy