In part three of this three part series, Rob Arnott, the founder and chairman of Research Affiliates, and colleagues Vitali Kalesnik, a partner and head of research in Europe, and Lillian Wu, vice president of the firm’s European business strategy, highlight how value strategies are trading across financial markets.

Value around the globe

UK equities are not the only segment of the market that performed poorly in recent years. US value stocks have lagged growth stocks for nearly 14 years, perhaps ending their drawdown in September 2020.

The magnitude and length of the drawdown depends on which valuation measure we use to define value. If we use price to sales, the drawdown began in 2017, if we use price to earnings, it began in 2014, and if we use price to book (using the Fama –French methodology), it started in 2007.

In other regions, value stocks also experienced long and deep underperformance relative to growth. The UK equity market’s underperformance means it is now trading at relatively attractive valuation multiples.

What about value?

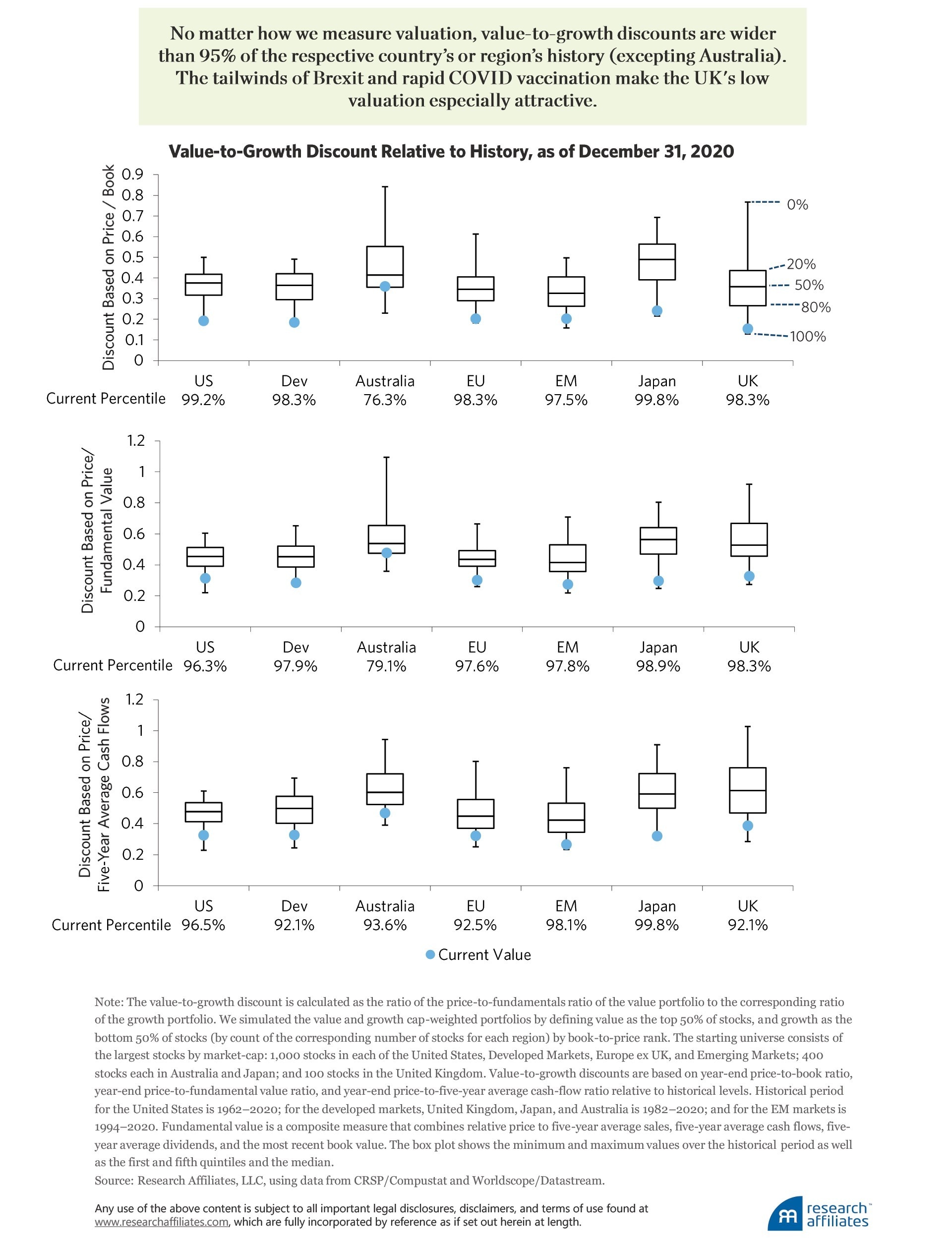

Today, around the globe, value is trading at extremely deep discounts relative to growth. Except in Australia, value-to-growth discounts are wider than 95% of the respective country’s or region’s history, in some cases falling into the cheapest percentile of all available history.

The discounts are wide no matter how we measure valuation: price to book or price to fundamental value (a composite measure that combines relative price to five-year average sales, five-year average cash flows, five-year average dividends, and the most recent book value).

Why are value stocks trading at such deep discounts?

Value stocks represent more cyclical sectors and are much more prone to economic shocks. Perhaps the deep discounts reflect the market’s expectations for large declines in future profits and soaring bankruptcy risk for value companies. For the current discounts to be “fair” discounted cash-flow assumptions, however, it is necessary to assume that roughly half of all value companies will go out of business over the course of the current recession. Obviously, this assumption is implausible.

Over the last decade, retail participation in the equity market jumped markedly. The volume of retail trading rose from 10% in 2010 to about 15% in 2019 and soared to an average of 20% in 2020 (Osipovich, 2020). Many of these new retail investors entered the market only in the last decade and have never experienced the end of a long-lived bubble, such as the tech bubble’s bursting 20 years ago.

The 2020 pandemic-related lockdowns contributed to the tremendous rise in retail participation, as workers suddenly found extra time in their day due to furloughs, layoffs, or simply not having to commute because they worked from home.

Further feeding the frenzy of market trading was checking and savings account growth from stimulus payments and lower spending. Many of the new market participants are not investing, but seeking speculative gains and simply gambling, as places such as Las Vegas and Monte Carlo, not to mention sports betting, have largely shut down.

Value stocks are much less shiny and glamourous compared to market darlings like Tesla [TSLA]. In the current COVID-driven environment, the contrarian positioning of value stocks feels especially risky and scary.

"Value stocks are much less shiny and glamorous compared to market darlings like Tesla"

Extreme under-pricing of value stocks relative to their fundamentals, combined with much greater retail participation in momentum trading, has sharpened the contrast between value and growth stocks.

This heightened divergence is likely a more reasonable explanation for the current deep discount rates than is the expectation of the lower profitability of value companies. Going forward, undervalued value stocks should offer an attractive long-run source of return.

Conclusion

The long-running saga of Brexit and the more-recent drama of the COVID-19 lockdown crisis have combined to generate unique investment opportunities. In particular, UK equities are now trading at valuation levels comparable to EM equity markets.

A major difference, however, is that the United Kingdom is a developed market with a sophisticated economy. The recently finalised Brexit deal means that UK businesses can operate with much less uncertainty. The Brexit deal also opens additional markets to UK firms.

An additional positive is that the United Kingdom is among the world’s champions in leading the COVID-19 vaccination charge. The current low valuations of UK stocks, combined with the tailwinds of the Brexit deal and tremendous progress in vaccination, imply that UK stocks should be especially attractive going forward.

Further compounding the investment opportunity of UK value stocks is that value investing in general has suffered significantly over the last nearly 14 years, trading today at bargain-basement multiples. Both UK and emerging market value stocks may prove to be the trades of the decade.

This article was originally published on the Research Affiliates website.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy