In this article, US-based investment manager Direxion explores the bear and bull cases for the precious metal.

For the past few months, many headlines and talking points have been dominated by the presence of cryptocurrency’s massive bull and bear runs across coins and exchanges.

With the latest volatility in cryptocurrency values additionally heating things up, a large number of eyes are locked onto the crypto market. However, with the combination of the signs of the rise of inflation in the US and the Chinese ban on financial institutions and payment companies from providing services related to cryptocurrency transactions, traders might be looking again to the classic store of value — gold.

Gold has been a hedge against inflation for a long time due to its standing as a long-term store of real value. It might be in a good position to be even more valuable if China and other countries take a hard-lined stance against cryptocurrencies, which have been described as possibly becoming “digital gold”.

The bull side

The price of gold per ounce has been climbing back up in the past several months, due to a variety of factors including COVID-19, central banking activities, and increased demand. Starting in early April, gold per ounce rose from its 2020 tumble and has continued the positive trend.

Looking ahead, bulls may be looking for key economic and governmental indicators that could point to a continued upward trend for gold, which can include inflation and low Treasury bond yields. If inflation increases and the US Federal Reserve does not react, the value of gold compared to the dollar should go up.

The bear side

On the other hand, employment numbers and the overall economic outlook for the US and other countries around the globe appears to be getting better. Combining this with the possibility of central banks cutting down on inflation could lower the price of gold moving forward. Additionally, the price of gold has not gone up as much as some other commodities, which could point to less investment enthusiasm in the short term.

Leverage your miners trade, at your own risk

An example for an approach other than simply trading gold as a commodity could be trading the stock of gold and other precious metal mining companies.

In a similar vein to trading oil companies based on the price of oil, mining companies’ stock values often will fluctuate and move in trends based on the underlying price of gold and other valuable precious metals. Additionally, while mining companies’ value will often trend upward when gold moves up, these are companies that when run well may still be able to generate continual value in a lower-priced gold market.

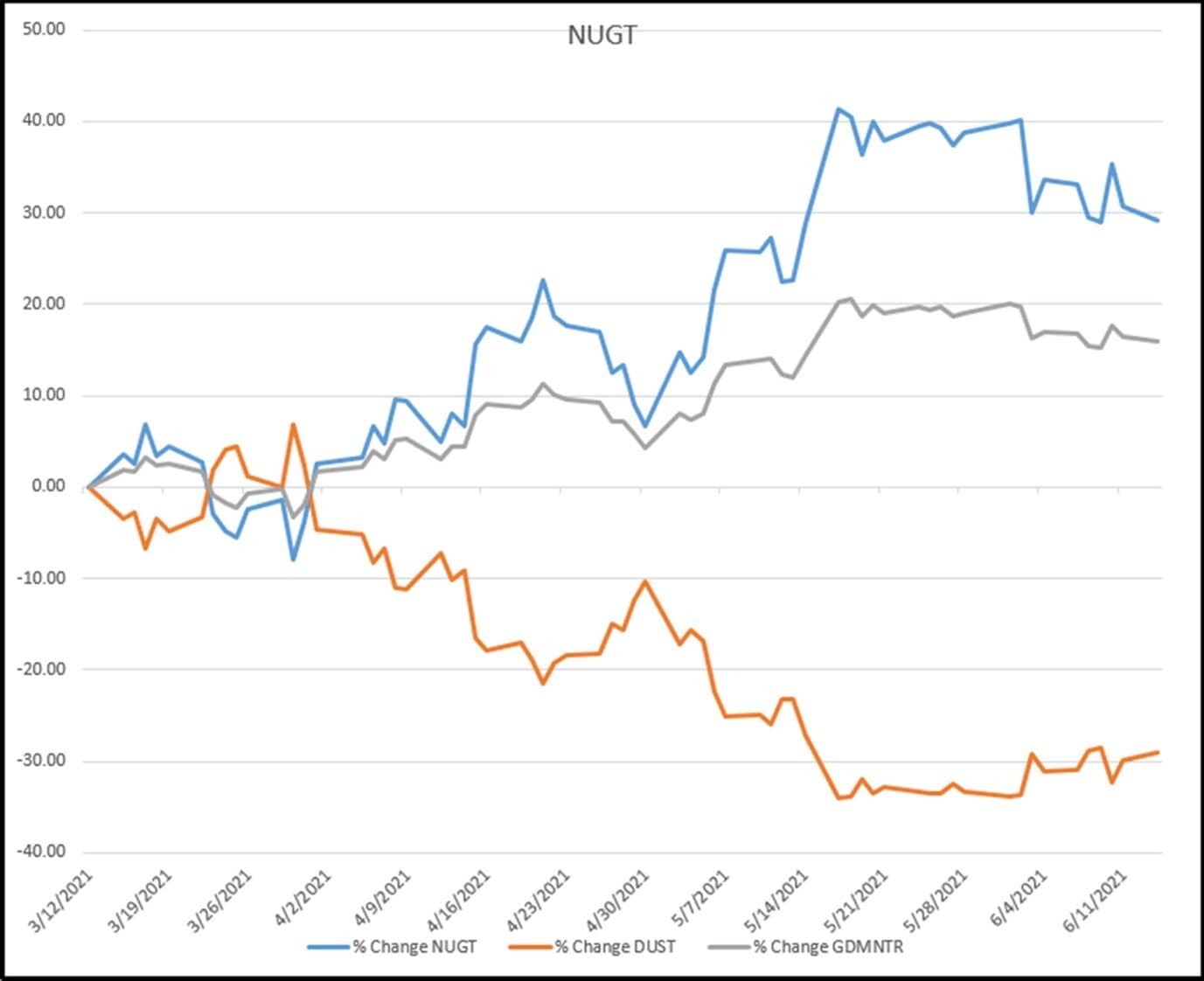

Cumulative Returns. Source: Bloomberg. Data represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For standardised and month-end click here.

With gold prices reaching back to higher levels over the past few months, more optimism from bulls and scepticism from bears has been seen, and traders may want to look into various methods of capitalising on the gold sector. Heading into the summer, concerns about inflation, cryptocurrencies and global governments might continue to bring more uncertainty and opportunity into the market.

This article was originally published by Direxion on 15 June 2021.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy