Robots are transforming many industries, from improving the precision of healthcare to making logistics more efficient. Here is a collection of robotics stocks to consider picking for your portfolio.

- Procept BioRobotics’ surgical robot could be used in the treatment of enlarged prostates.

- Symbotics’ warehouse automation system is being adopted by the largest wine and spirits distributor in the US.

- Doosan Robotics is developing a collaborative robot baggage handling system for Amsterdam’s Schiphol Airport.

Rainbow Robotics

The Dual-Armed Robot Stock

Rainbow Robotics [277810:KQ] announced in February that it had signed a memorandum of understanding with the Korea Electronics Technology Institute and German manufacturer Schaeffler [SHA:DE] to build AI-powered mobile dual-arm robots. The Rainbow Robotics share price popped 16% earlier that month on rumours that the robot specialist’s major shareholder Samsung Electronics [005930:KS] might exercise call option rights twice this year, taking its stake from approximately 15% to above 50%.

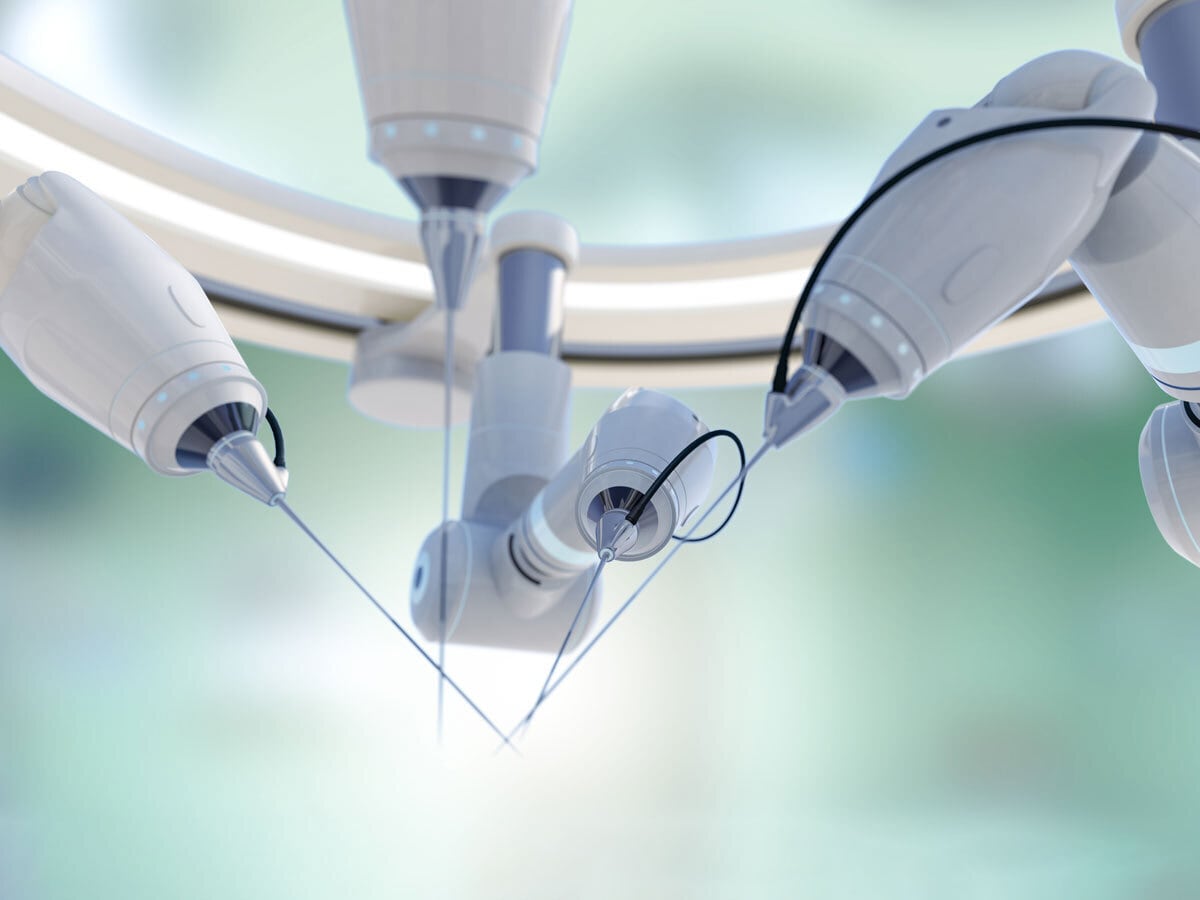

Procept BioRobotics

The Prostate Therapy Robot Stock

Procept BioRobotics [PRCT] has developed a treatment for lower urinary tract symptoms among men with localised prostate cancer. The robotic therapy uses real-time ultrasound imaging to provide surgeons with a multi-dimensional view of the prostate. Once they’ve pinpointed the problem areas, the robotic arm can remove the necessary prostate tissue with precision. The therapy received FDA investigational device exemption last September. “Our aim is to bolster the clinical evidence through this study and collaborate with some of the nation’s foremost cancer physicians,” said Procept CEO Reza Zadno in a statement.

Symbotic

The Warehouse Automation Stock

Symbotic’s [SYM] warehouse automation system, which features robotic case picking capabilities, is to be adopted by Southern Glazer’s, a distributor for hundreds of wine and spirits suppliers across the US and Canada. “This agreement reinforces Southern Glazer’s position as a leader in beverage alcohol logistics,” said Symbotic CEO Rick Cohen in a press release back in November, adding that it will transform its distribution operations. The first system should be implemented by 2025.

Doosan Robotics

The Baggage Handling Robot Stock

Doosan Robotics [454910:KS] announced a partnership with Amsterdam’s Schiphol Airport and the Danish firm Cobot Lift in December, with the aim of developing and deploying a collaborative robot baggage handling system. “This supply of the baggage handling system opens new doors, not just in Dutch airports but also in other European regions,” said Doosan Robotics CEO Park In-won, as reported by the Korea Economic Daily. Since its IPO last October, the Doosan Robotics share price is up 253.8% through 15 March.

FBR

The Bricklaying Robot Stock

FBR’s [FBR:AX] bricklaying robot Hadrian X completed work on a 16-townhouse development earlier this month, reportedly the largest project undertaken by any automated robotic system. Hadrian X can lay 500 bricks an hour and is equipped with a telescopic boom arm that can stretch up to 32 metres. The Australian company announced a capital raise of A$12.6m in January as it aims to break into the US construction market.

Another Way to Invest in Robotics

The Global X Robotics & Artificial Intelligence ETF

The Global X Robotics & Artificial Intelligence ETF [BOTZ] holds Doosan, Rainbow Robotics, Symbotic and Procept BioRobotics as of 13 March. As of 29 February, information technology and industrials account for 51.1% and 32.4% of the portfolio, respectively; healthcare has a 14.5% allocation, while financials, consumer discretionary and energy have weightings under 1%. The fund is up 35.6% in the past year through 14 March and up 24.4% in the past six months.

The iShares Robotics and Artificial Intelligence Multisector ETF [IRBO] holds Rainbow Robotics and Symbotic. As of 12 March, information technology accounts for 56.9% of the portfolio, while communications and industrials have allocations of 17.7% and 15.7% respectively; consumer discretionary, financials and healthcare have single-digit weightings. The fund is up 20.5% in the past year and up 11.1% in the past six months.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy