Artificial intelligence (AI) is here. While the spotlight so far has been on the tech firms developing it, financial institutions are poised to benefit, as Jens Nordvig, CEO and Co-founder of market analytics firm MarketReader, told OPTO Sessions this week.

AI in Finance

“Nvidia [NVDA] is the stock everybody knows about,” he noted. “Semiconductors is the sector everybody knows about. The last two quarters have been focused on suppliers to those companies. Energy companies also had a big run-up, because they think there’s going to be a demand boost.”

But now there is a wider opportunity, said Nordvig, as AI technologies are embedded in existing businesses, including big banks and retail; in other words, “all the companies that have very big human resource pools”.

The impact could be huge, as companies scramble to reduce costs. “I think it’s going to be in the so-called white-collar jobs that don’t require the most expert training,” he said. “Lots of jobs still involve repetitive things. And they’re going to be replaced.”

He predicts that banks and companies with large customer service needs will lead the way. “They have the ability to cut costs dramatically and move away from traditional branch models. I think there are going to be massive efficiency gains.

“It’s an area where I think very quickly we will see a lot of processes get fully automated.”

From an investment perspective, new companies — and sectors — could attract market attention. “The focus is going to shift from the people who produce the technology to the people who are implementing the more incremental productivity gains from using it.”

The New Wave of Finance Chatbots

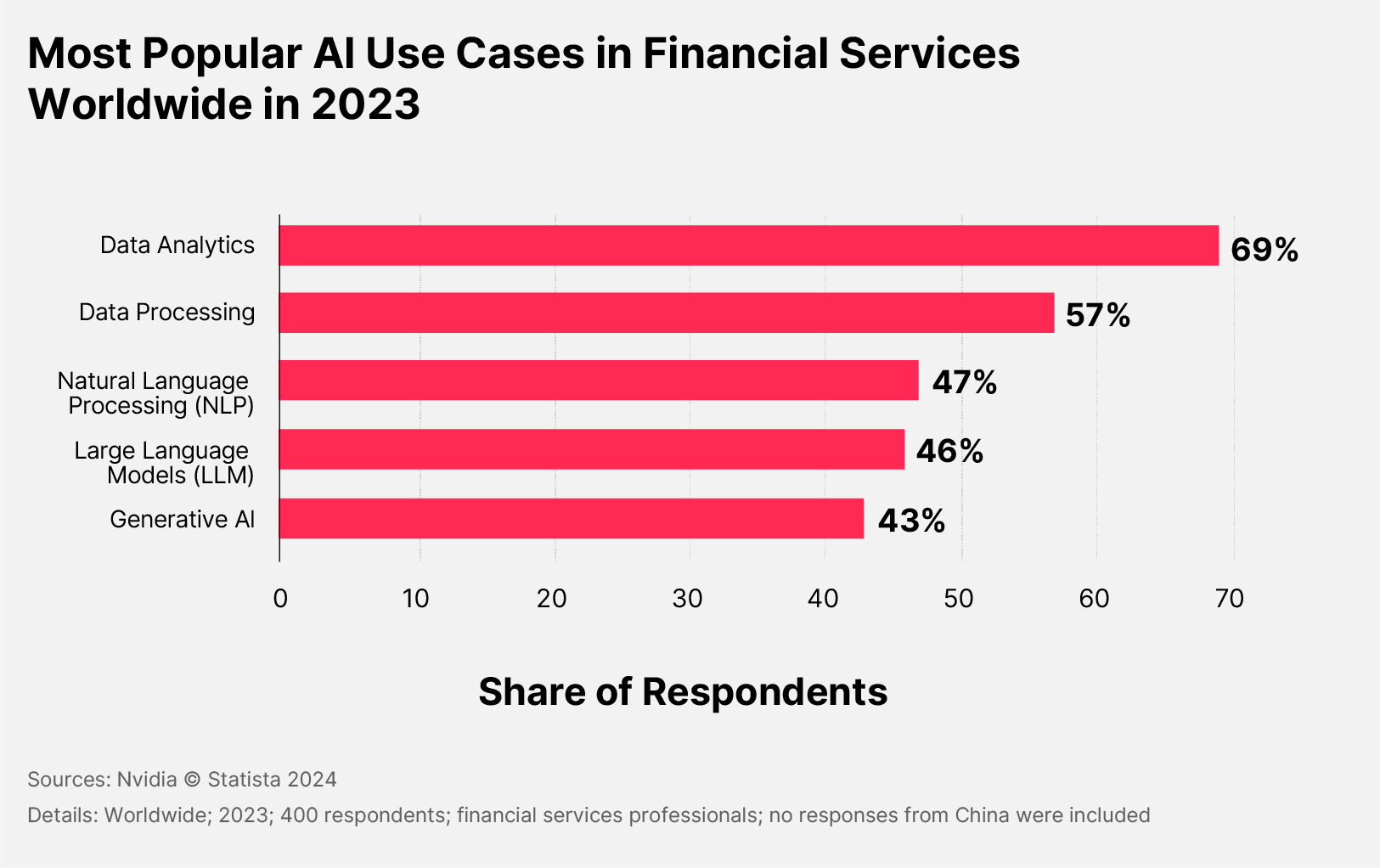

The financial sector already has a track record of going through big reorganisations, says Nordvig, so it is well placed for the gearshift towards AI. “The financial sector is typically the most aggressive in terms of adopting new technology,” he added. “That’s what we’re seeing right now.”

That’s not to say the revolution will happen overnight, “but there’s going to be a lot of change over the next five years, as this gets rolled out properly, because, apart from the people who are creating chips or offering data-centre services, we haven’t seen a huge use case for AI yet.”

One area where there is already visible change is the use of chatbots. “A lot of financial market companies are building chatbots that can answer questions on behalf of customers. Who wants to sit in the waiting line to speak to a person if they can just ask a chatbot?”

“I think we can build robot avatars, chatbots and so forth, that can do a lot of repetitive work, collecting information quicker than humans can, more accurately, without any mistakes,” he underlined.

Homo sapiens won’t be completely redundant: “There are going to be a few humans who handle very special questions.”

What Tomorrow’s Investors Should Know

What about using AI from an investment perspective?

Nordvig is already deploying new AI at MarketReader to help guide clients, and thus witnesses a variety of reactions to the technology. “I see a lot of scepticism that our AI can improve portfolio performance. It is worth thinking very carefully about how we're going to squeeze the value out of AI.’”

At present, Nordvig leverages software at MarketReader to understand what’s going on in the market in real-time, and he’s a big fan. “We have used large language model technology, AI technology, to produce those insights — to make sure the language of those insights is something everybody can understand. That’s a capability we didn’t have two, three years ago. That’s pretty amazing.

“Every morning, our system not only explains all the different stocks that are moving, but it also gives an overview of what’s going on in the world. It’s almost like having a research assistant.”

What’s worth thinking about now, he said, are the exact ways AI could be employed. “How are we going to squeeze the value out of AI? Is it from doing something humans have never done before? Or AI investing in a new way, investing better? Or from doing something repetitive and boring, that humans would like not to do?

Ultimately, he believes that’s where the real efficiency gains lie ahead — a kind of computer-generated production line, “as opposed to the new frontier of something we’ve never seen before”.

Whatever happens next, AI is here to stay, and financial institutions will likely benefit. “There’s a massive amount of low-hanging fruit in that space that will be visible to a lot of people over the next couple of years.”

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy