The 3D printing theme has recently seen a boost, with the Ark 3D Printing ETF up 8% in one week. Historically unpredictable, the sector is nonetheless set to grow, with the fund's top three holdings announcing positive Q3 earnings.

- Ark 3D Printing ETF is down year-to-date, but was boosted by the share growth of its top holdings

- The 3D printing industry is set to climb to $43.5bn value by 2026

- Bico, Faro and Ansys stocks slated for moderate growth in the next 12 months

The Ark 3D Printing ETF [PRNT] performed well last week, jumping 7.8% in the seven days to 14 December, on the back of an upturn in third quarter (Q3) earnings for its top holdings. However, it is still down 39.1% year-to-date, suggesting there's some way to go before the 3D printing industry recovers from losses earlier in 2022.

The Ark 3D Printing ETF offers investors exposure to companies in the Total 3D-Printing Index, covering businesses concerned with 3D printing hardware, computer-aided design (CAD) and simulation software, 3D printing centres, scanning and measurement, and 3D printing materials. It currently has net assets worth $181.1m.

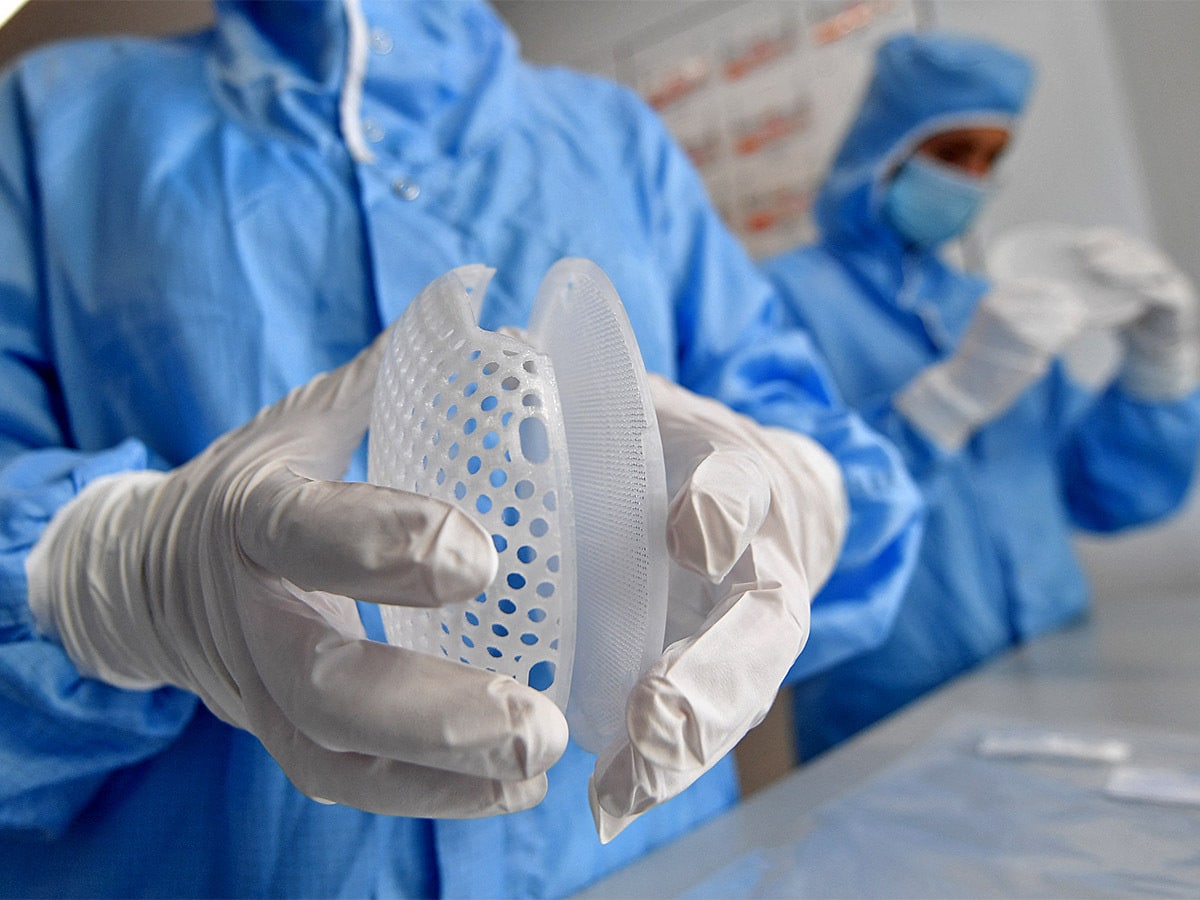

3D printing is regarded as a growth area, as more and more sectors, including healthcare, rely on the technology. However, Ark's ETF has suffered in 2022 amid a generally challenging macroeconomic backdrop.

In September, it was announced that Cathie Wood, the high-profile CEO of Ark Invest, would no longer be the portfolio manager for the company's PRNT fund. William Scherer, Ark's trading manager since 2014, has replaced her.

Positive earnings drive share price recovery

The Ark 3D Printing ETF currently has 54 holdings.

The company with the largest weighting is Bico Group [BICO], which has a substantial 10.26% weighting in the fund as of 19 December. Second is Ansys Inc [ANSS], with a 4.16% weighting, and third is Faro Technologies [FARO], which has 4.09% of the fund's portfolio.

Swedish company Bico specialises in bioprinting, supporting the production of vital tissues and organs for the healthcare industry. In November, it reported upbeat Q3 earnings, with revenue of kr623.2m, a leap of 79% year-over-year, while its net income increased to kr66.4m from a loss of kr104.2m in the equivalent quarter in 2021.

The Bico share price has plummeted 58.2% year-to-date to close at kr116 on 16 December but has recovered significantly from lows of kr26 in September this year. Factors, including the abrupt resignation of CFO Gusten Danielsson earlier in the year, played a part in its collapse.

The share price for Ansys, which makes 3D printing software, has fallen by 39.5% this year but has also recovered in recent weeks, rising by over 20% since its low close of $200.33 on 11 October. Ansys beat analyst estimates in its Q3 earnings report when it delivered earnings of $1.77 per share, exceeding the Zacks consensus estimate by 9.26% and representing an increase of 11.3% year-over-year. Meanwhile, its non-GAAP revenues of $473.7m beat the Zacks forecast by 1.44%.

Faro, which specialises in "4D digital reality solutions," has also suffered on markets this year, with its share price dropping a hefty 58.2% year-to-date, but also recovered substantially from October lows. Its Q3 earnings beat expectations, rising 7.8% year-over-year to $85.3m, though its earnings per share slumped to a loss of $0.34 per share.

Theme outlook

The 3D printing industry began life as a way to print novelty items and toys. Still, it is increasingly being routinely used on production lines for high-tech items, ranging from medical supplies to jet engine parts. However, 3D printing companies have often struggled to deliver reliable gains for investors. The question is whether this will change as the technology becomes more widely adopted.

According to GlobalData, the 3D printing industry is set to grow from a value of $15.8bn in 2021 to $43.5bn in 2026 while rising at a compound annual growth rate of 22.4%. The PRNT ETF could, therefore, be seen as a good longer-term bet for investors hoping to cash in on this overall trend.

At the Financial Times, a consensus of three analysts gave Bico stock a 12-month price target of kr135.00, a rise of 16.4% from the stock's last close. Meanwhile, 16 analysts who gave Ansys stock a 12-month forecast offered a median $262.50 price target, up 8.1% from the previous close. Lastly, four analysts gave Faro a median outlook of $31.00, up 6% from the last close.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy