Goldman Sachs expects non-US equities to outperform due to China's reopening. Morgan Stanley anticipates slowing global GDP growth. JPMorgan says a recession is likely and foresees a volatile year with potential higher inflation and geopolitical uncertainties. Allianz predicts short-term equity market gains but warns of potential volatility. BlackRock sees opportunities despite volatility, through structural changes in the global landscape. What else lies ahead?

- Allianz and JPMorgan anticipate a likely recession in the US and Europe this year.

- Morgan Stanley sees global GDP growth slowing due to high interest rates, but believes the US is heading for a moderate economic slowdown rather than a full-blown recession.

- Goldman Sachs says the economy is becoming more resilient to restrictive conditions relative to previous cycles.

- BlackRock expects “full employment recessions" due to structural global shifts such as ageing populations and digital disruption.

Overall outlook for the rest of 2023

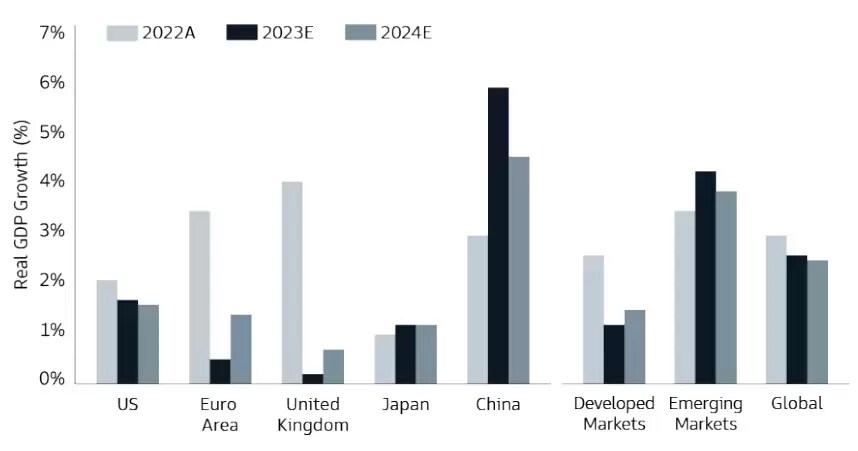

Goldman Sachs Asset Management forecasts flat US returns for the remainder of 2023 due to complete valuations and persistent margin pressures, suggesting that non-US equities may outperform given their higher cyclical beta, income, and sensitivity to China's reopening. Contrarily, Morgan Stanley anticipates global GDP growth to slow, projecting a 2.9% growth in 2023 and 2.8% in 2024, but notes a continued recovery in China and strong nominal growth in Japan.

JPMorgan Asset Management, however, paints a more volatile picture, indicating that 2023 is shaping up to be a better year for economies than expected, but a recession is still more likely. They believe that elevated valuations now make it challenging for markets to be appropriately priced for the forecasted slowdown, with potential risks including higher inflation and interest rates, geopolitical uncertainties, and the ongoing pandemic.

On a similar note, Allianz Global Investors offers a near-term positive outlook for equity markets, expecting gains in 2023 and balanced multi-asset portfolios performing positively in absolute terms. Still, they warn of the potential for renewed volatility, specifically if new Bank of Japan (BOJ) governor Kazuo Ueda revises the current controls on government bond yields, and sensitivity to signs of fresh stress in the banking sector.

Interest rates

The interest rate outlook from major asset managers varies, with broad consensus about a higher interest rate environment being sustained. BlackRock Investment Institute anticipates that rates will stay higher for longer due to shrinking worker supply in major economies, creating a potentially challenging landscape for developed market (DM) equities. Similarly, Allianz expects short-term rate increases, particularly as central banks reassess their paths, with further hikes in the US and more aggressive moves than currently priced by the European Central Bank (ECB).

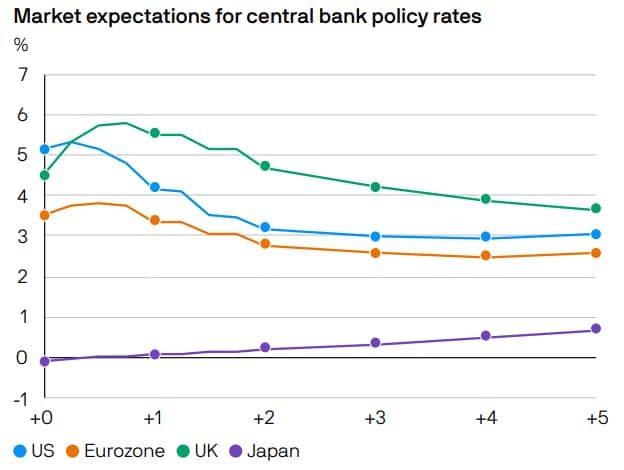

JPMorgan forecasts the Federal Reserve will pause its hiking cycle with rates below 5.5% as its base case scenario, and suggests that rate cuts would indicate a recession, further noting that investors should brace for higher medium-term inflation. The chart below shows how markets are pricing in interest rate cuts from several major banks. [1]

Goldman Sachs, however, suggests the monetary policy shift has become a marathon, with each central bank guided by domestic inflation. It sees potential for more tightening by the ECB and Bank of England (BoE), while predicting persistent easy policy in Japan. The firm also notes that investors can benefit from tighter global monetary policy and higher rates. In contrast, Morgan Stanley warns of a slowing global GDP growth amidst high interest rates and unusual occurrences, such as record-low US unemployment and rapid rate hikes by the Fed and ECB. They forecast the Fed will maintain a policy rate of 5.1% before initiating quarterly cuts in 2024.

Inflation

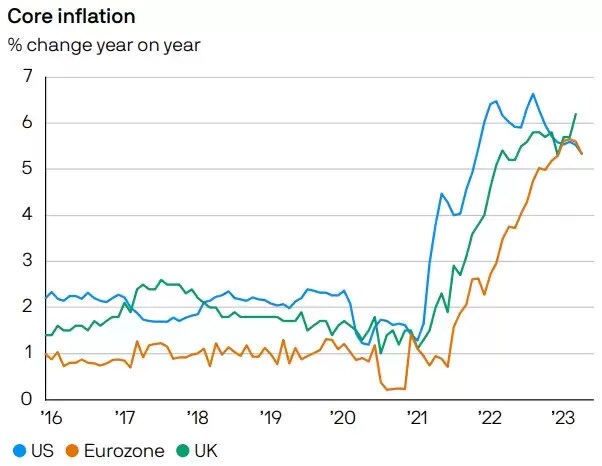

Core inflation remains obstinately high, as seen below. [2]

Persistent inflation pressure necessitates tighter long-term monetary policies, according to BlackRock, due to various factors like digital disruption, low-carbon transition, and ageing populations. The asset manager believes central banks have a difficult task in balancing growth and inflation in this new economic regime, leading to significant interest rate hikes.

Meanwhile, JPMorgan believes that inflation is set to fade rapidly, permitting central banks to focus on growth support. However, they warn that higher medium-term inflation is probable, requiring preparedness for inflation volatility in portfolios.

Contrarily, Goldman Sachs envisions a shift from a 'synchronised sprint' of monetary response to a marathon where each central bank adjusts according to its domestic inflation. Further ECB and BoE tightening might be needed, while Japan continues with an easier policy until 2% inflation is sustained. On the other hand, Allianz notes stubborn high inflation at 4-5%, causing extended high-inflation regimes and necessitating further rate hikes by central banks.

Morgan Stanley predicts global GDP growth to slow to 2.9% in 2023 as central banks tackle inflation. Although wages are accelerating, the firm warns it might take until the end of 2024 to reach the ECB's target of 2% inflation, implying a prolonged period of monetary policy tightening.

Economic growth or recession

BlackRock warns of "full employment recessions" due to forces such as ageing populations and digital disruption reshaping the global economic landscape. JPMorgan foresees a robust service sector counterbalancing higher costs and interest rates, but suggests a recession is more likely, with slowing growth in the US, Eurozone, and the UK.

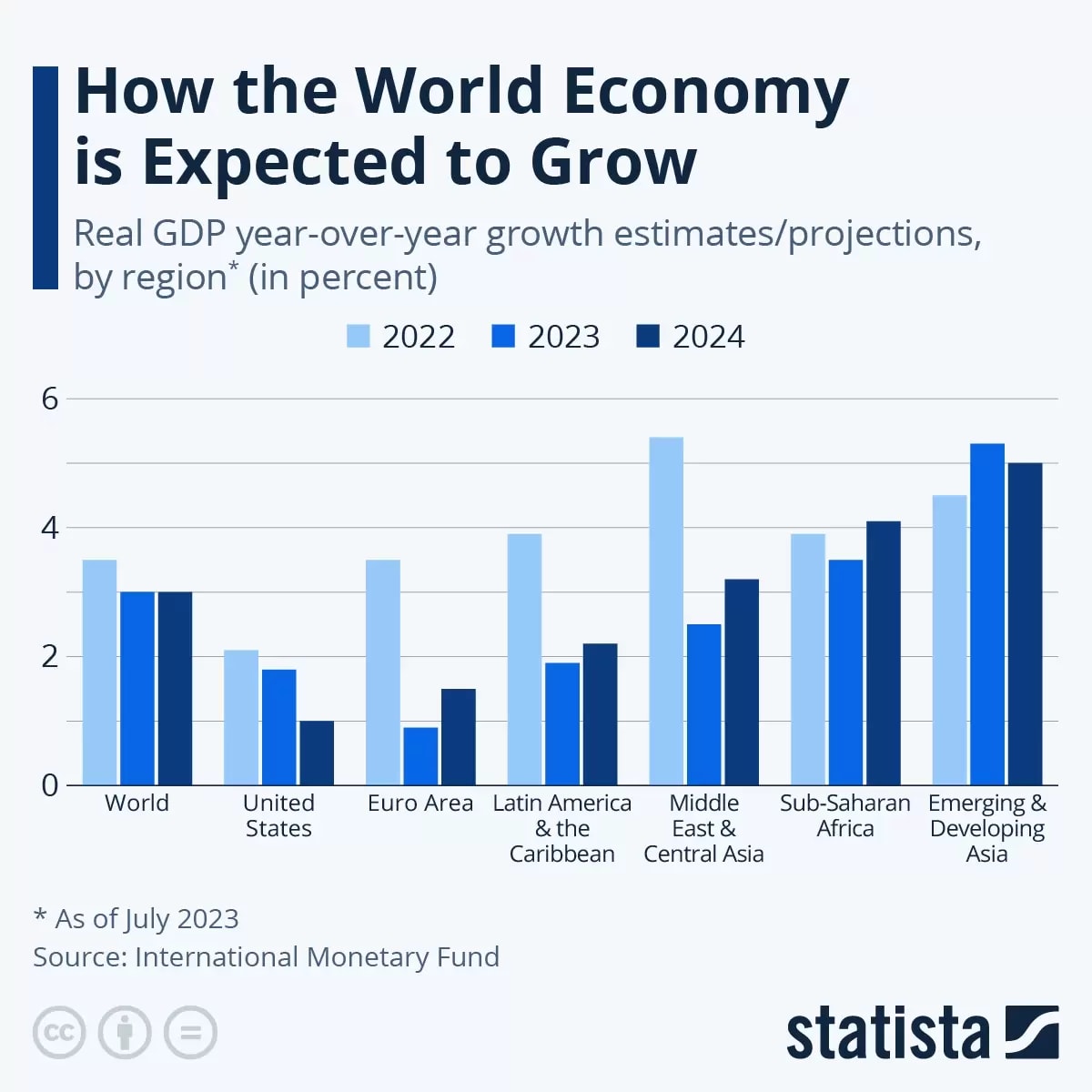

Goldman Sachs presents a contrasting picture, acknowledging localised economic challenges but not predicting a recession, citing high global tolerance for restrictive conditions. Allianz, however, predicts a recession in the US and Europe, with indicators like yield curve inversions and contractions in money supply. Morgan Stanley forecasts a global GDP slowdown in 2023, but expects emerging markets (EMs), especially in Asia, to outperform, making no mention of a global recession.

Both the International Monetary Fund (IMF) and Goldman Sachs [3] expect global real GDP growth to decline in 2023, and see growth in EMs accelerating.

Equities

Morgan Stanley predicts that US and European equities may lag as earnings fall short of expectations in the second half of this year, though a rebound is expected in 2024. They view the US dollar as attractive due to its negative correlation to equities.

In contrast, Allianz provides a positive outlook for equities, citing gains in 2023 and boosted US tech stocks, but they anticipate potential volatility from potential BoJ policy changes and fresh banking sector stress. Goldman Sachs also projects a flat performance for US equities due to full valuations and ongoing margin pressures, with non-US equities poised to outperform. They suggest a highly idiosyncratic approach to investing in this lower return environment.

BlackRock holds a mixed outlook, being overweight on EMs due to growth trends and appealing valuations, but underweight on DMs, expecting earnings to not reflect anticipated macro damage.

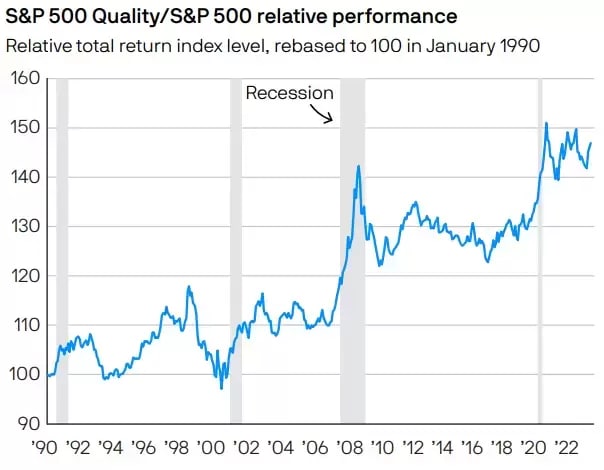

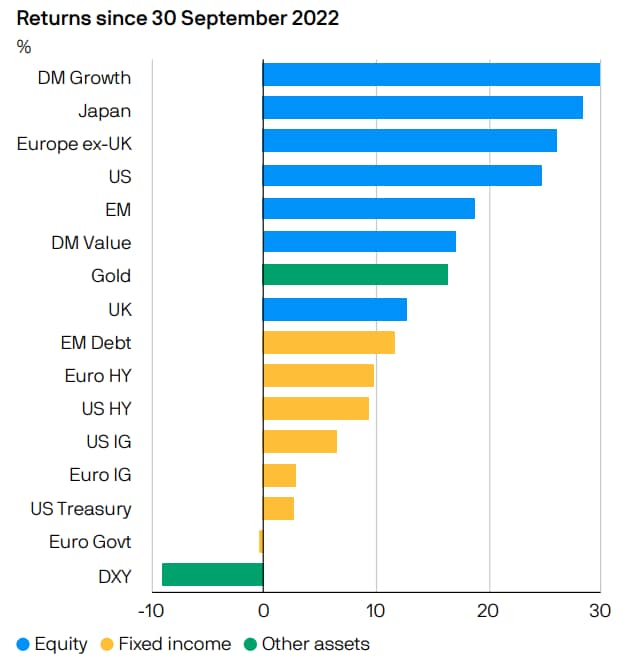

JPMorgan notes the rollercoaster performance of the global equity market, attributing current high valuations to an abundance of good news, but warns of potential volatility from factors such as higher inflation and interest rates, and geopolitical risks. The charts below show how quality stocks have historically outperformed in periods of economic stress [4], and how global equities have made strong returns since 30 September 2022 [5].

Emerging markets

Goldman Sachs predicts that a bifurcated earnings recovery will drive EM equity performance, bolstered by Chinese consumers' excess savings. While acknowledging risks such as US-China tensions, they see reopening in China and a weaker US dollar supporting EM earnings growth.

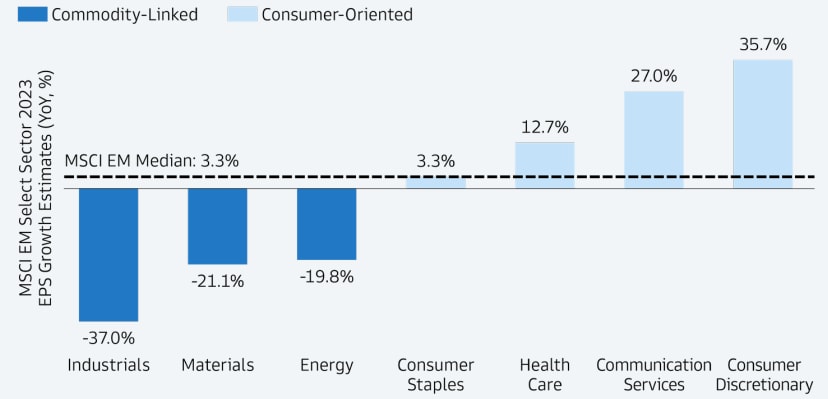

They anticipate strong consumer-oriented sectors to gain, with analyst consensus expecting 2023 earnings to grow by 22.7% on average. Commodity-linked sectors, however, are forecast to drop by an average of 19.9%. [6]

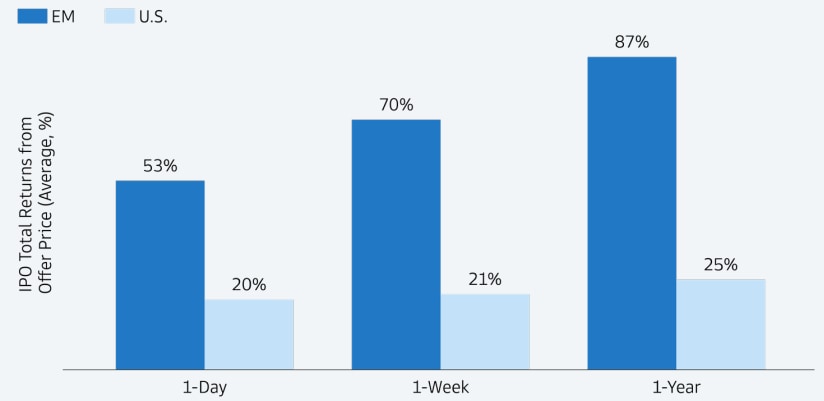

Goldman also sees significant growth upside potential in EM IPOs, as shown below [7], noting that EM companies that went public between 2016 and 2022 brought in an average 53% return from offer price to first close.

Similarly, Morgan Stanley finds Japan and EM equities attractive due to stronger growth, lower inflation, and easier policy. They foresee China's reopening and recovery doubling its GDP growth, and note trends such as digitalization supporting India's economy. Morgan Stanley is optimistic about GDP growth in certain EMs, particularly India and Brazil, maintaining a forecast higher than the consensus estimates for 2023 and 2024.

“Overall, we continue to forecast outperformance in emerging markets, particularly in Asia,” says Seth Carpenter, Morgan Stanley’s Global Chief Economist.

BlackRock echoes these positive sentiments on EMs, citing slowing growth and sticky inflation in major economies, brighter growth trends in EMs, and attractive valuations. However, JPMorgan highlights that although EM stocks already trade at a discount to developed markets and may benefit from potential rate cuts, a global economic slowdown may impact them adversely. Allianz positions EMs as a preferred pick in their multi-asset portfolios, supported by attractive valuations and a weaker US dollar, and they expect China's reopening to boost broader EM sentiment.

Investment opportunities

Morgan Stanley anticipates a divergent global economy due to persistent inflation and tight monetary policy in the second half of 2023, prompting a shift in investment strategies based on region, with a focus on offence in Asia and defence in the US and Europe.

Similarly, Allianz suggests potential opportunities in equities, high-yield bonds, and commodities, emphasising investments in quality companies with reasonable valuations and those benefiting from long-term structural trends such as AI and climate solutions.

In contrast, JPMorgan advises diversified investments, noting opportunities in Europe given cheaper multiples and stronger dividends. They identify low-carbon energy as a sector potentially poised for growth due to governmental incentives and scarcity. Additionally, they propose that a possible recession might create investment opportunities in "growth-ier" clean energy firms.

Meanwhile, BlackRock sees investment opportunities in granular asset classes and structural shifts, such as AI and globalisation rewiring, though acknowledging the current economic environment as not conducive for broad asset class returns.

Goldman Sachs suggests global equities and broader fixed income as viable alternatives to constrained US equity beta, with potential yield levels capitalization due to tighter global monetary policy and higher interest rates. They propose that core fixed income could offer a reasonable alternative to equities moving forward.

The second part of this report will focus on the thematic opportunities these macroeconomic trends are expected to bring.

[1] Source: Bloomberg, J.P. Morgan Asset Management. Expectations are calculated using OIS forwards. Data as of 15 June 2023.

[2] Source: BLS, Eurostat, ONS, Refinitiv Datastream, J.P. Morgan Asset Management. Core inflation excludes food and energy in the US, and food, energy, alcohol and tobacco in the eurozone and the UK. Eurozone and UK use HICP and CPIH measures respectively to better reflect housing costs. Data as of 15 June 2023.

[3] Source: Goldman Sachs Global Investment Research and Goldman Sachs Asset Management. As of June 13, 2023. “Real GDP” refers to Gross Domestic Product adjusted for inflation, year-over-year.

[4] Source: J.P. Morgan Asset Management Quantitative Beta Solutions, S&P Global, J.P Morgan Asset Management. S&P 500 Quality index is the top quartile of quality stocks in the S&P 500 determined by JPMAM Quantitative Beta Strategies based on measures of profitability, financial risk and earnings quality. Past performance is not a reliable indicator of current and future results. Data as of 31 May 2023.

[5] Source: Bloomberg, ICE BofA, J.P. Morgan Economic Research, MSCI, Refinitiv Datastream, S&P Global, J.P. Morgan Asset Management. MSCI indices are used for EM, Europe ex-UK, DM Growth, DM Value, Japan and UK. S&P 500 is used for the US. Equity returns are total returns and are shown in local currency, with the exception of EM which is in US dollars. Bloomberg Barclays Aggregates used for US Treasury, Euro Govt, US IG and Euro IG. Euro HY: ICE BofA Euro Developed Markets Non-Financial High Yield Constrained; US HY: ICE BofA US High Yield Constrained; EM Debt: JPM EMBI Global Diversified. Past performance is not a reliable indicator of current and future results. Data as of 15 June 2023.

[6] Source: Bloomberg and Goldman Sachs Asset Management. As of May 31, 2023. Chart shows 2023 YoY EPS growth estimates for all sectors in the index excluding Utilities, Financials, Real Estate, and Information Technology.

[7] Source: Bloomberg and Goldman Sachs Asset Management. As of May 1, 2023. Disclaimer: there can be no assurance that the forecasts will be achieved.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy