Christian Magoon, CEO of Amplify ETFs, explains the tailwinds behind the cannabis industry, as lawmakers in the US and around the world appear set to relax legislation. He outlines cannabis’ two key use cases and explains the disruptive impact he feels legalisation could have on markets.

“Cannabis has been one of the top-performing themes of 2024”, Christian Magoon, CEO of Amplify ETFs, tells OPTO Sessions.

According to OPTO’s thematic screener, cannabis has gained 12.1% year-to-date as of 29 February, making it the second-highest performing theme of 2024. Individual ETFs have outperformed this average; the Amplify US Alternative Harvest [MJUS], for example, gained 22.3% in the year to 29 February.

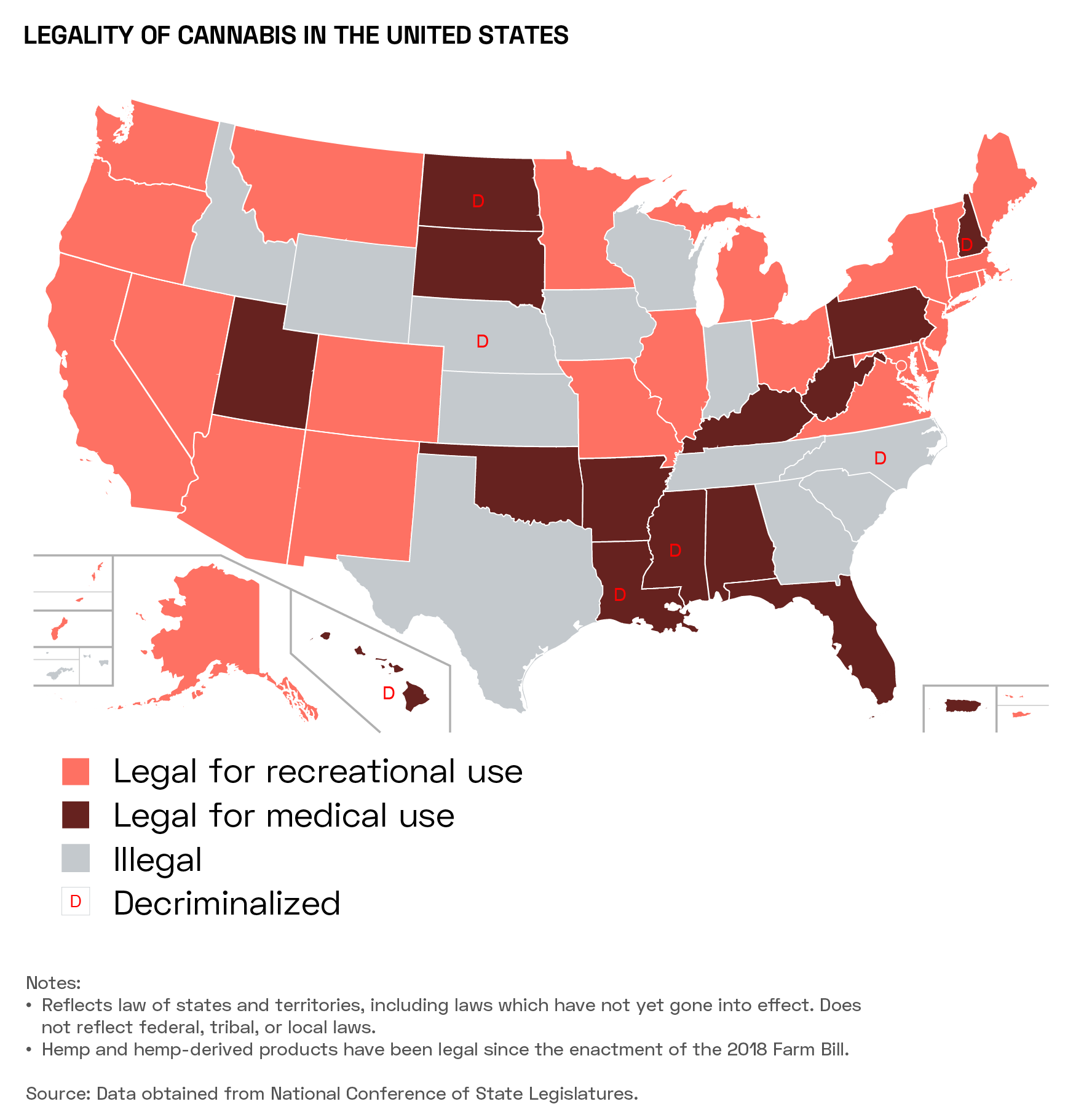

Magoon attributes this outperformance to increased optimism regarding regulation. “Over 70% of Americans think that cannabis should be legalised,” says Magoon, and the drug is widely legalised at the state level for healthcare and, increasingly, recreational uses throughout the US.

Despite this, the federal government remains “a little bit behind”.

Cannabis is still a Schedule I drug at the federal level, alongside heroin and methaqualone. The designation suggests cannabis has “no currently accepted medical use and a high potential for abuse”, according to the US Drug Enforcement Administration (DEA).

This reduces cannabis companies’ access to capital and banking services, as well as weighing on their profitability, by preventing them from deducting business expenses from their taxable incomes.

However, some policymakers are moving to reschedule cannabis.

In August 2023 the US Department of Health and Human Services (HHS) recommended that cannabis be rescheduled from Schedule I to Schedule III.

Then, in January, 12 Democrat senators cited the HHS’ position in a letter to the DEA and the Biden administration. The senators went even further and argued that cannabis should be removed from the list of controlled substances altogether.

Reforms in the US are mirrored by developments in the EU. Germany’s Parliament passed a law in February that decriminalises the possession of up to 25g of cannabis in public, and 50g in private homes.

While he believes that the US will remain the largest market, Magoon is confident that cannabis legalisation is “a global story”.

How Legalisation Could Impact Markets

Magoon anticipates that cannabis legalisation could lead to a spate of M&A activity, especially with traditional consumer goods companies.

“Whether that’s tobacco companies, or the Johnson and Johnsons [JNJ] of the world that do a variety of different types of health-oriented products, we think that many of these mainstream brands are going to go out and acquire different cannabis companies, to become units within their overall businesses.”

Should this happen, cannabis companies would be able to leverage these businesses’ expertise on how to distribute similar products — whether health treatments or adult-use products such as alcohol and tobacco — enabling them to scale.

“This is one of the reasons we think this space is really going to be exciting,” says Magoon. “I think it will play out over the next 10–15 years as a consumer packaged goods story.”

The two use cases of cannabis — medicinal and recreational (or ‘adult use’) — both have intriguing investment cases, says Magoon.

“You cannot deny the adult use side,” says Magoon. He points out that in some states where recreational use is legal, cannabis has caught up with or replaced alcohol as the leading adult-use substance.

However, he is personally more intrigued by its potential medicinal market. CBD products are one of the fastest-growing categories in US pharmacies, and, according to Magoon, are most popular among senior citizens and retirees. As such, Amplify sees “a lot of potential for the wellness side”.

New Uses

It is here, especially, that the abundance of research and innovation being carried out has the greatest potential.

“There’s a lot of money going into researching what cannabis is: everything from what THC does, to CBD and some of the nearly 30 other compounds, and how those can be used in different ways to more effectively treat issues that the human body experiences.”

The range of conditions that cannabis could help treat is considerable. Magoon mentions inflammation, anxiety and insomnia, and certain emerging cases such as seizure and nausea.

Further adding to the disruptive potential of cannabis is artificial intelligence. This, Magoon says, is accelerating the speed at which compounds and their effects can be researched.

“I think we’ll know, in the next few years, a variety of new use cases,” he says.

Magoon even anticipates that medicinal cannabis innovation could lead to demand for targeted ETFs catering for the medicinal and adult use verticals separately.

LINKS TO THE INTERVIEW:

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy