The iShares Robotics and Artificial Intelligence ETF is weighted towards high-growth tech stocks like iQIYI and Kingsoft Cloud Holdings, which have struggled on the back of rising interest rates. New advances in the AI industry, however, could help to turn around the fund’s performance.

- The iShares Robotics and Artificial Intelligence ETF dropped 32% in 2022 as tech and growth stocks fell out of favour with investors

- Chinese video streaming giant iQIYI is the fund’s top holding and has helped deliver strong returns

- New advances in generative AI may stimulate rapid growth within the sector

The iShares Robotics and Artificial Intelligence ETF [IRBO] has dropped in value by 31.7% in the last year. The fund, which has a large exposure in tech and emerging market companies, has been at a disadvantage this year as investors favour the stability of larger asset-heavy shares. Rising interest rates have also impacted the discounted valuations of the high-growth shares held within the fund.

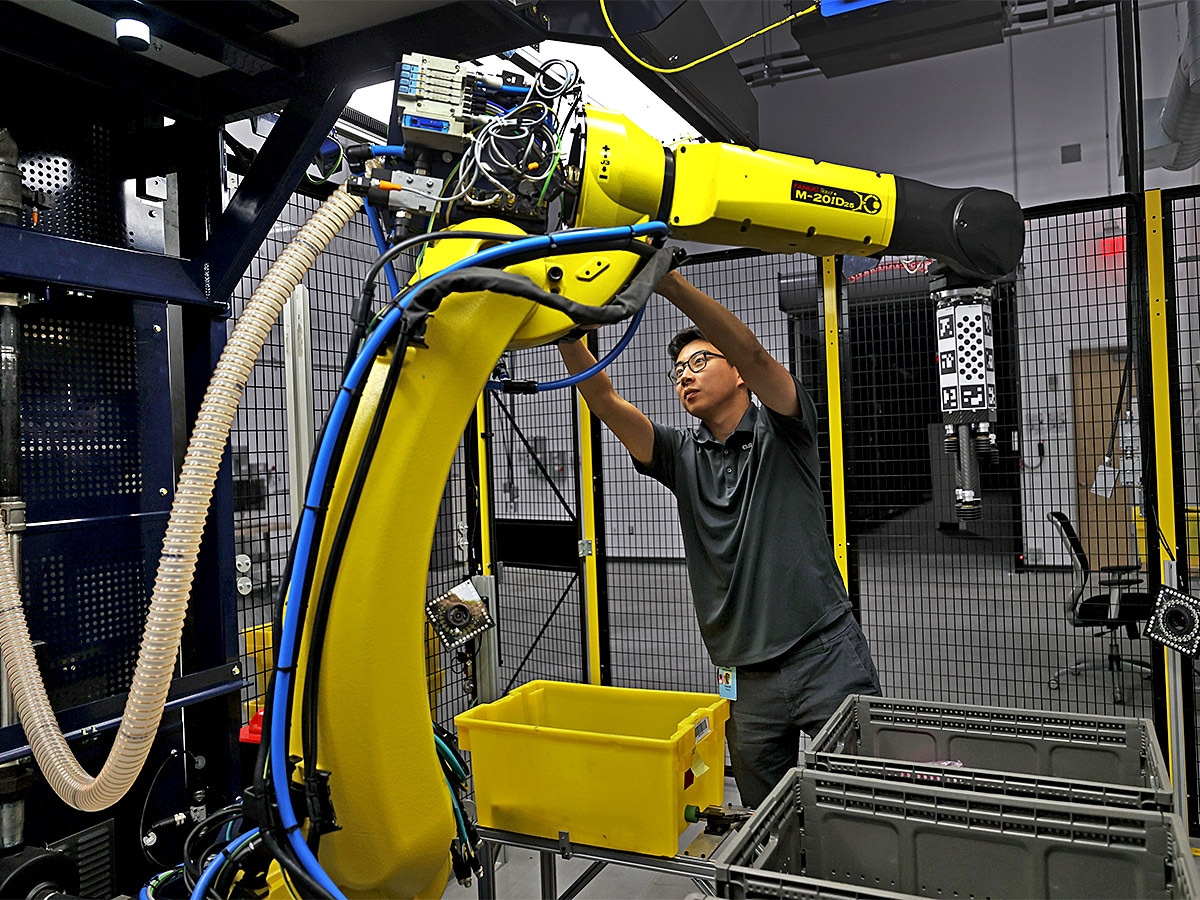

The ETF aims to invest in companies that are at the forefront of the shift towards robotic and artificially intelligent business solutions. In the 12-month period ending 31 July, 2022, the fund had a considerable position in the information technology (IT) sector, which made up 57.4% of the total fund. Companies within the communication sector accounted for another 18.2% of the fund.

As of 6 January, the fund holds 120 different companies within the robotics, AI and technology sectors. Chinese streaming service iQIYI [IQ] is the fund’s largest holding, yet makes up only 1.52% of the total fund value. The large number of holdings within the fund means there is not an unhealthy dependence on only a few companies.

Chinese video streaming and cloud services dominate the fund’s top holdings

IQIYI performed impressively in the final weeks of an otherwise uninspiring 2022.

The shares exploded 146.4% in the last two months, taking the return over the last year up to 31.8%. Last September, the company’s subscribers rose on the back of renewed marketing efforts in August, and a rise in exclusive content. Last week, more there was more good news as the company announced it had secured $500m in debt funding from investment firm PAG. The funding will allow the company to expand its current operations and develop new original content.

Kingsoft Cloud Holdings [KC] is the fund’s third largest holding and makes up 1.31% of the fund’s assets under management. The Chinese-based cloud company's share price has dwindled 62.8% over the last year, helping to bring down the total value of the iShares Robotics and Artificial Intelligence ETF. In the company’s third quarter trading update, chairman Jun Lei noted that the company aimed to improve on its current products and further pursue artificial intelligence initiatives.

New tech developments sweeten the AI market outlook

While tech stocks, to which the fund is highly exposed, dramatically underperformed in 2022, there is an exciting outlook for the artificial intelligence industry going into 2023. OpenAI, the developer behind artificial intelligence bot ChatGPT, is currently in talks to raise new capital with a current valuation of almost $30bn.

ChatGPT can composes original responses to complex questions and prompts using AI deep learning. Its recent beta release in late November took the industry and the world by storm, highlighting the opportunities that lie in the artificial intelligence sector.

Within five days of its November launch, users surpassed 1 million and ChatGPT is continuing to see usage above its previous expectations.

The technology remains in early-stage development and there are still concerns over the accuracy of the information that generative AI produces, as well as the political or social biases it might exhibit. Nevertheless, ChatGPT has publicly demonstrated how transformative AI could be in improving productivity.

OpenAI is reportedly in talks to sell shares on the market, and is looking to value the company at $29m.

Future outlook

According to Pitchbook, investors gave at least $1.37bn to generative AI start-ups in 2022, with many suggesting that 2023 could be a breakthrough year for the sector.

As more and more funding enters the sector and the technology continues to mature, artificial intelligence will begin to find increasingly commercial and profitable use. For the iShares Robotics and Artificial Intelligence ETF, which holds companies that have direct and indirect links within the artificial intelligence sector, the growth of the technology could help future performance.

As for the performance of holdings in the fund, analysts remain mixed. Out of 23 analysts providing 12-month price targets for iQIYI shares to CNN Business, the median was $4.85, a 16.7% downside on the stock’s recent close of $5.84.

Out of 11 analysts providing 12-month price targets for the Financial Times, the median was $4.02, a 19.8% downside on the recent closing price of $5.02.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy