Christian Magoon, CEO of Amplify ETFs, joins Opto Sessions to discuss the prospects for the fintech industry in emerging markets (EMs). Here, he dives into the reasons he thinks that payment and investment platforms will spearhead growth in the theme.

Amplify’s Emerging Markets FinTech ETF [EMFQ] seeks to capitalise on what Christian Magoon views as a tremendous growth opportunity for the fintech industry in the world’s EMs.

The stocks included in the fund are spread across eight sub-sectors within the fintech theme: payments (51% of fund holdings), banking (11%), lending and credit (11%), investment and trading (11%), fintech software (6%), digital assets/wallets (5%), insurance (4%) and real estate (1%), as of 30 June.

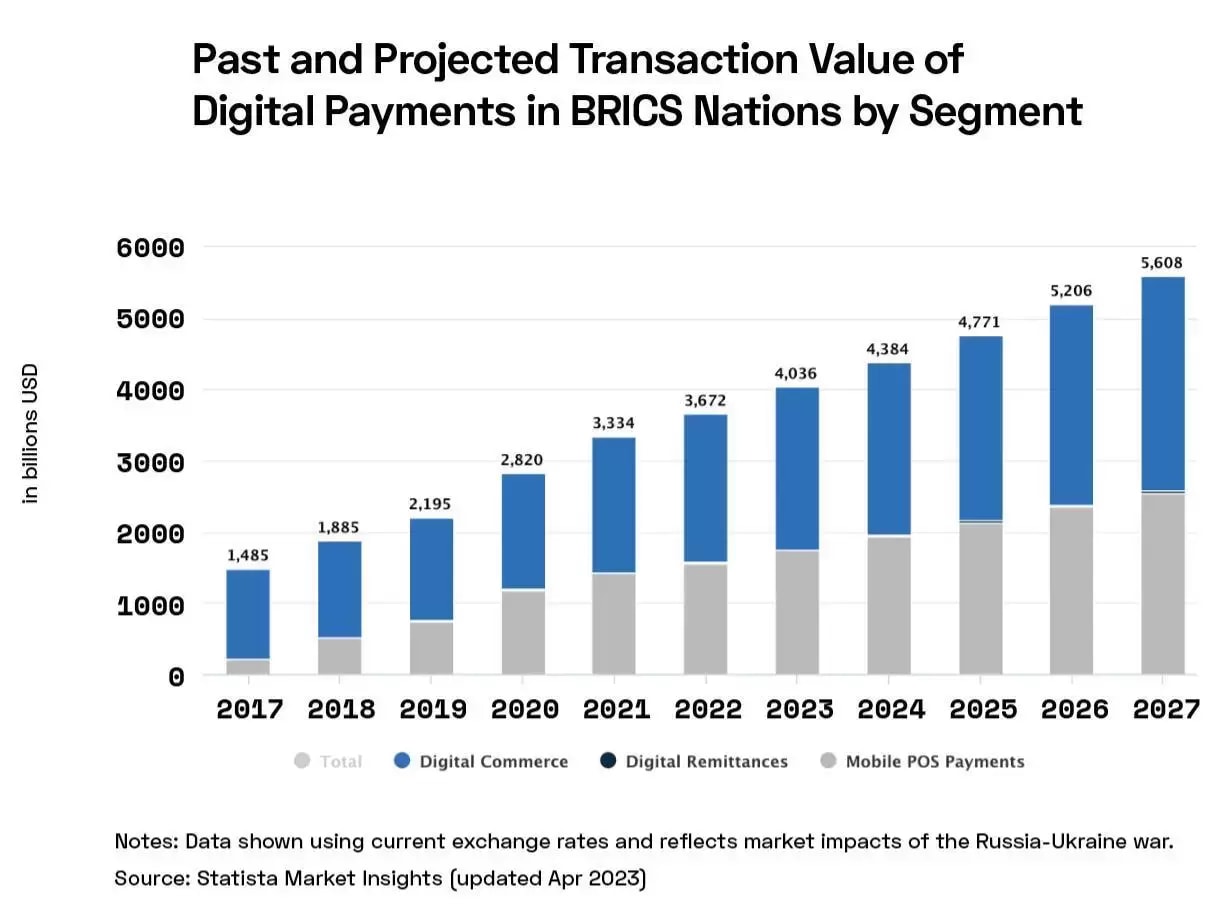

Of these, payments are the key pillar. Magoon says that this vertical is the one that will see “fintech becoming more of a utility like we would think of water and electricity”.

This sector “is going to grow and grow”, albeit at a relatively slow rate. Magoon believes that a continued shift away from cash transactions in EMs will be the primary driver for this vertical.

“China, India and Mexico, who have traditionally been very cash-focused, from a government standpoint, are pushing to be less and less so.”

This drive is motivated in part by a desire to eradicate some of the negative aspects of cash-based societies, such as corruption, although Magoon acknowledges that there are potential downsides to a cashless society, too.

“Depending on what the government’s political standpoint is, it can be used to monitor and control people.”

However, he says, “transforming unbanked people into being banked, and their being able to pay through their phones… is a big change in quality of life and efficiency”.

Magoon says that payments will be “the foundation” of the EM fintech theme, thanks to continued adoption and wider penetration within EMs.

“Transforming unbanked people into being banked, and their being able to pay through their phones… is a big change in quality of life and efficiency.”

Investing for upside

However, he believes that the main driver of upside will be investment and trading platforms, and potentially digital assets (such as cryptocurrencies and non-fungible tokens), thanks to the increasing wealth of EM populations.

“We all know what access to capital markets does for us as individuals in terms of trying to pursue our financial goals. And we know that when we have additional income that goes beyond what we need to pay for food and housing, and we're looking long term, a lot of that income ends up going into investments to grow for the future. And because of the increased overall standard of living of consumers in these countries, I just think the flows are going to be enormous.”

The effect will be amplified by a generational transfer of wealth over the next 10 to 20 years, says Magoon. While older generations may be more conservative with their savings and lack the technological savvy to invest it via fintech platforms, increasingly wealthy younger generations across EMs will leverage access to investing platforms and institutions, even those based outside their own country.

“Because of the increased overall standard of living of consumers in these countries, I just think the flows are going to be enormous.”

New technological developments, such as artificial intelligence (AI), will add impetus to these trends.

“It’s intimidating if you’ve never been on an investment app or you’ve never done this before… but what if there’s an AI assistant coming alongside you, asking you ‘what is your risk tolerance and your time horizon? What are your goals?’ And then recommending investments. That’s what is really going to propel that investment and trading side into the next sphere.”

EMFQ’s Fintech Picks

Magoon outlines some of EFMQ’s holdings that he believes show the strongest prospects.

For example, XP [XP] creates investment and trading applications for the market in Brazil, which Magoon calls “an important country on the payment side”. As of 17 August, the fund has a 2.89% weighting in XP.

Network International [NETW.L] “deals with loans, micro loans, credit applications and also has some payment capabilities”, with its focus geographies being the Middle East and Africa. Network International comprises 3.13% of the fund.

One of Magoon’s top picks is Mercado Libre [MELI], which has “one of the largest payment companies in Latin America. A lot of Latin Americans use Mercado Libre in their various payment applications to process things online and not have to worry about producing cash,” explains Magoon. Mercado Libre shares comprise 3.35% of the fund’s holdings.

Finally, he discusses Alibaba [9988.HK], which has a 1.69% weighting in the fund and offers the payments platform Alipay, and Chinese insurance giant Ping An [2318.HK], “which has really pressed forward on doing more and more insurance through the digital side”.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy