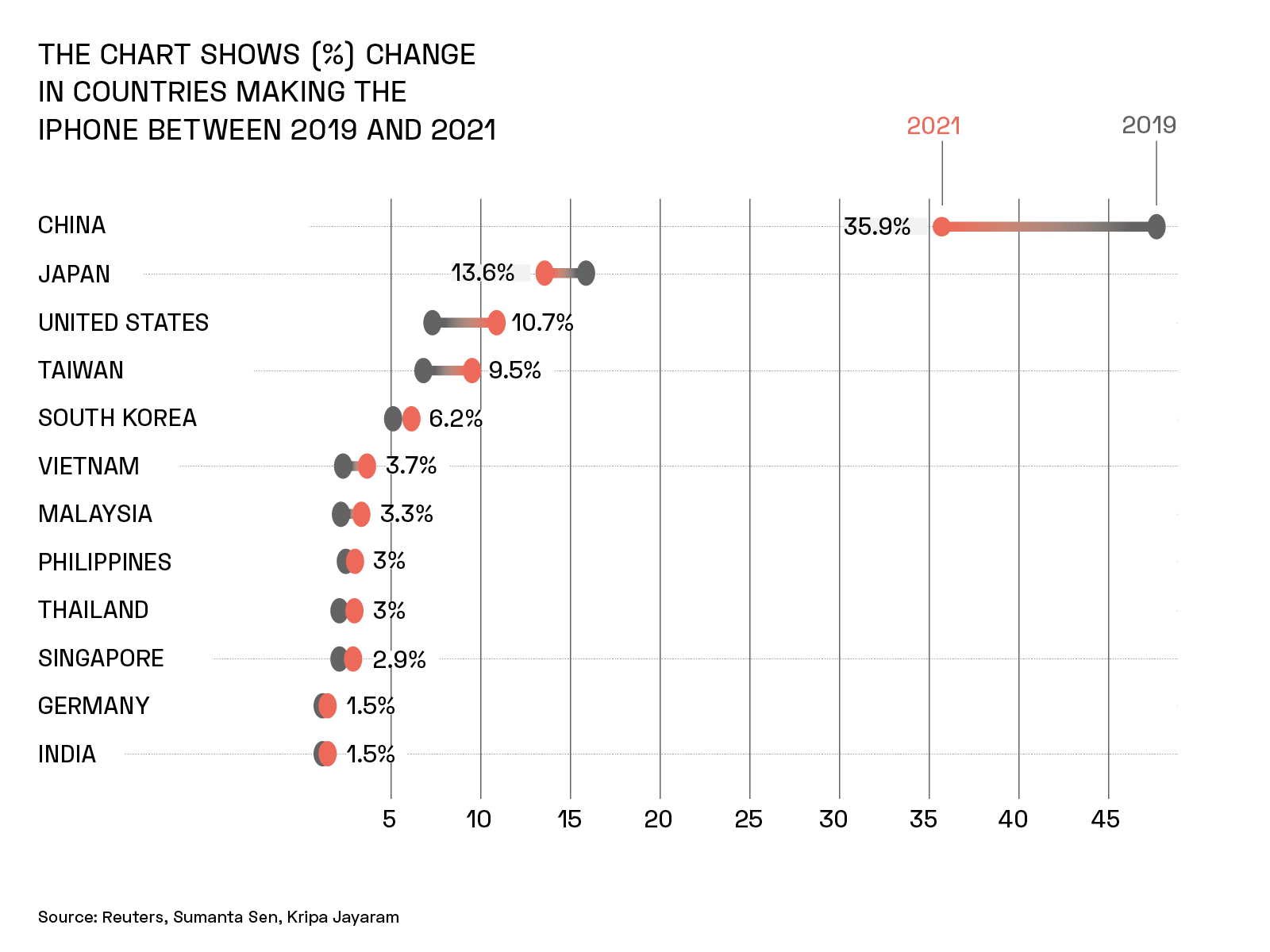

Like so many electronic items in the modern world, most iPhones have been made and assembled in China. But that’s all beginning to change.

Geopolitical tensions, problems maintaining production volumes at its iPhone-making hub in China, and the country’s strict zero-Covid policies encouraged Apple [AAPL] to think beyond China. Throughout 2022, Apple’s stock fell 26.4%.

Apple is making strides in diversifying its supply chain. Most notably, it’s ramped up production in India, the world’s second-largest smartphone manufacturer. In September, JPMorgan predicted that one in four iPhones will be made in India by 2025.

Apple also plans to move production of its laptops to Vietnam by mid-year; it already makes AirPods, iPads and watches there.

The company has announced it will purchase chips from the $40bn megaplant that Taiwan Semiconductor Manufacturing Company (TSMC) [TSM] began building last year in Phoenix, Arizona.

According to Lucy Chen, vice president of Isaiah Research, the Arizona facility could create a US-based supply chain. “The surrounding area may form a small cluster where more people settle, more stores open [and] infrastructure, schools and real estate markets flourish,” she says.

Last year, TSMC’s share price slid 36.7% amid the wider tech selloff, but climbed 13.7% in the first four months of 2023.

Shifting to India

Eddie Han, senior analyst at Isaiah Research, sees India becoming a fixture for supply chains going forward. “Because of competitive labour costs, India appears to be a desirable location, and the proportion [of Apple devices] produced in India may increase from 5% to 10% in 2022 to 18-23% in 2024.”

Tata Group already provides Apple with parts and is close to clinching a deal to be the country’s first homegrown iPhone maker. Meanwhile, India’s biggest Apple distributor Redington [REDI.NS] saw its stock rise 25% last year.

Apple is not the first consumer electronics company to ‘decouple’ from China. Samsung [005930.KS] has been distancing itself since 2014, when it moved its smartphone production operations to Argentina and Vietnam. Last summer, the South Korean electronics giant launched the world’s biggest phone factory in Noida, India, and closed its last mobile plant in China. Amazon [AMZN] already makes Fire devices in Chennai, India, through Foxconn subsidiary Cloud Network Technology.

Now that Apple has got the ball rolling, things could progress swiftly, says Chen. “Based on our checks, Apple has sped up [its] production plan outside China and we believe this may be irreversible even if China’s economy has been reopening.”

Last October, an American Chamber of Commerce survey showed 19% of companies polled were reducing their investment in China, up from 10% the previous year. The group said “confidence has been shaken” by pandemic restrictions and supply chain issues.

Andy Burwell, international director of the Confederation for British Industry (CBI), says shifts in supply chain tactics are inevitable. “With China so heavily integrated into international supply chains, it’s only natural to take stock of how those existing links are performing and seek greater diversification where required.” The process of decoupling from established supply networks won’t be easy. As one business executive told the Harvard Business Review in 2021: “We spent 13 years getting into China. It’s impossible for us to just pull out.”

There are already signs that Apple’s withdrawal won’t be easy. In February, the Financial Times reported around half of the iPhone casings produced at India’s Tata facility were rejected on quality grounds.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy