Introduction

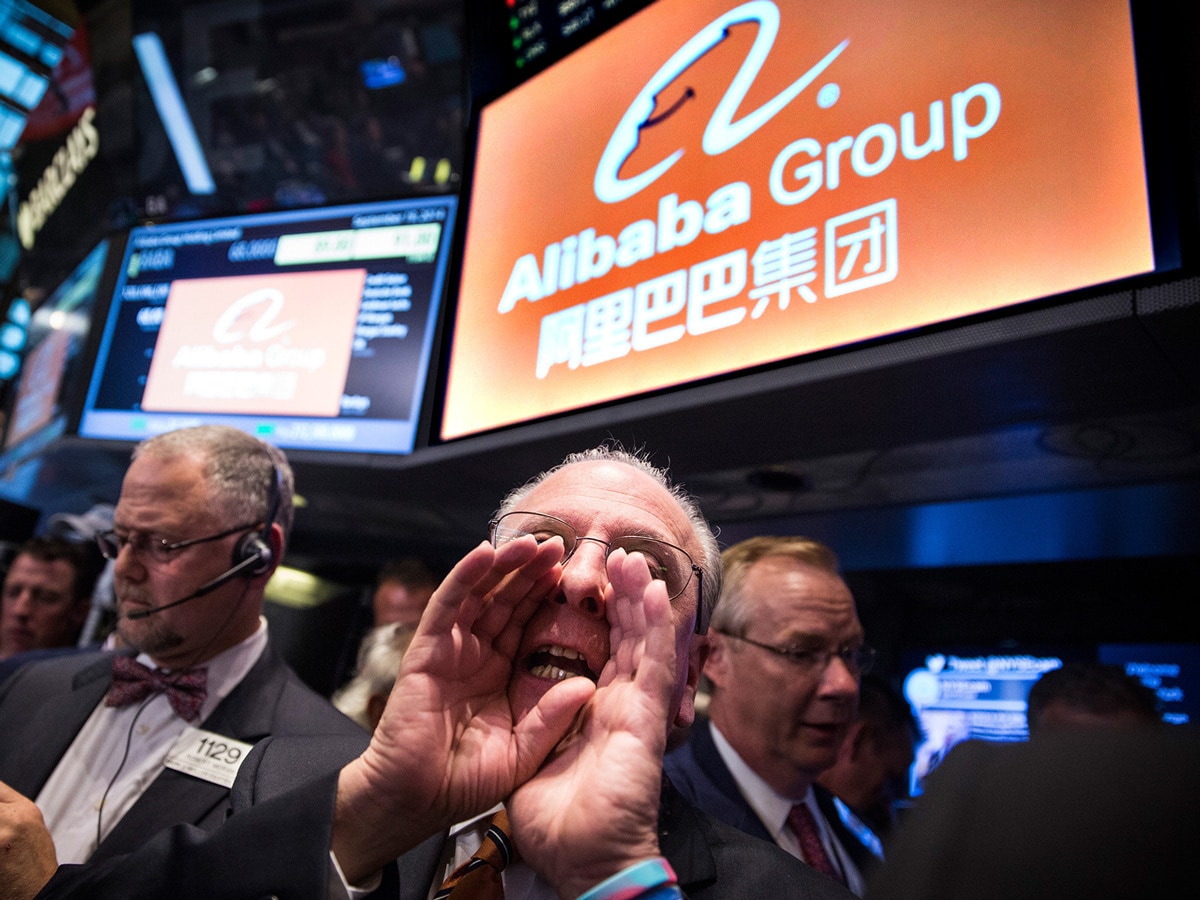

Alibaba [BABA] and JD.com [JD] are two of China’s tech giants. In 2023, they were the two biggest e-commerce platforms in the country by gross merchandise volume, with 46% and 27.2% market share, respectively.

However, these giants have seen their share prices slide this year amid concerns about China’s sluggish economy. Additionally, the two companies have been coming under pressure from younger rivals offering cheaper products to cost-conscious consumers.

This stock spotlight will look at how the two companies are softening their rivalry and sharing logistics expertise and services to try to navigate the impact of China’s economic woes. It will also discuss how Beijing’s stimulus decisions have been impacting the two stocks and what investors can expect from their earnings reports this week.

Alibaba and JD.com Partner Up

The two have long been at war. In December 2023, for instance, JD.com won an anti-monopoly lawsuit against its rival, which was fined RMB1bn.

However, with China’s economy in a slump, Alibaba and JD.com announced last month that they would slightly lower the barriers each has put up against the other.

Alibaba-owned marketplaces Tmall and Taobao have agreed to offer its merchants JD.com’s logistics services, including warehousing and shipping. Meanwhile, JD.com is adding Alibaba’s digital payments service Alipay as a checkout option on its e-commerce platform, according to the South China Morning Post.

The Highs and Lows of BABA Stock and JD Stock

Both BABA stock and JD stock set 52-week highs on October 7 as investors were buoyed by news of Beijing’s plans to pump extra liquidity into the market with the launch of a swap tool designed to “promote the healthy development of the capital markets”.

However, the very next day, Chinese equities suffered their worst day since the Covid-19 pandemic. Fresh stimulus announced on November 8 also disappointed investors.

BABA stock and JD stock have fallen 12.69% and 9.72%, respectively, in the past month through November 11. They are up 25.78% and 38.96% since the start of 2024.

Alibaba’s Net Income Falls, JD.com’s Rises

JD.com and Alibaba both report earnings this week — the former on November 14 and the latter on November 15. Taken together, their reports should give an indication as to whether there is still softness in consumer demand.

Alibaba saw its fiscal Q1 2024 revenue grow just 4% to RMB243.23bn, mainly due to a 1% drop in Taobao and Tmall revenue to RMB113.37bn. Net income for the April–June quarter declined 27% year-over-year to RMB24.02bn. The company repurchased RMB42.70bn worth of ordinary shares in the quarter in a bid to boost investor confidence.

JD.com exceeded profit expectations in Q2 2024 thanks to a price-cut strategy designed to attract cost-conscious consumers to its e-commerce platform. The average order value in the three months to June 30 declined year-over-year due to “soft consumer spending”. Net income attributable to shareholders jumped 69% from the year-ago quarter.

In contrast, e-commerce competitor and Temu parent PDD Holdings [PDD] reported an 86% year-over-year jump in revenue for the April–June quarter, as net income soared 144% from Q2 2023.

Neither Alibaba nor JD.com issued guidance for the July–September quarter.

Here is how BABA stock and JD stock’s fundamentals stack up against each other and those of PDD.

| BABA | JD | PDD |

Market Cap | $231.64bn | $59.71bn | $162.69bn |

P/S Ratio | 1.81 | 0.40 | 3.62 |

Estimated Sales Growth (Current Fiscal Year) | 7.90% | 3.90% | 63.50% |

Estimated Sales Growth (Next Fiscal Year) | 8.20% | 5.60% | 28.00% |

Source: Yahoo Finance

Given the recent sell-off of Chinese equities in reaction to disappointing stimulus, it could be argued that both BABA stock and JD stock are oversold and undervalued, especially when you factor in their low P/S ratios.

BABA Stock and JD Stock: The Investment Case

The Bull Case for Alibaba and JD.com

Despite China’s economic challenges impacting near-term consumer demand, and concerns about stimulus weighing on BABA stock and JD stock, the country’s e-commerce market could still have some potential.

Alex Yao, Co-Head of Asia Technology, Media and Telecommunications Research at J.P. Morgan, told the South China Morning Post in May 2024 that he was optimistic about e-commerce growth over the next few years.

“There is ample room for [e-commerce platform operators] to take market share if they are able to continuously improve their value proposition to stakeholders, particularly consumers,” said Yao.

Cross-border e-commerce could be a “big structural growth opportunity” for the likes of Alibaba and JD.com as they come under more pressure from alternative platforms like PDD and ByteDance-owned Douyin.

The Bear Case for Alibaba and JD.com

One problem is that, in order to keep up with the competition offering cheaper products, the two companies have had to offer big subsidies and discounts. Alibaba has also introduced a 0.6% software service charge.

This may not have had a material impact on profit yet, but if this price war were to continue, then it potentially could. Even if it does not, there is no guarantee that lowering prices will help Alibaba and JD.com to fend off PDD and Douyin from growing their share of China’s e-commerce market.

Conclusion

Their earnings reports this week should give investors a clearer picture of near-term consumer demand for cheaper products. Regardless, BABA stock and JD stock may stand to be boosted by China’s e-commerce growth in the longer term.

-

OPTO’s proprietary theme relevance system maps the world’s biggest investing megatrends. For in-depth analyses of stocks with high growth potential, subscribe to OPTO Foresight.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy