Arelis Agosto, Senior Healthcare Analyst at Global X ETFs, recently joined OPTO Sessions to discuss how the healthcare sector needs to scale up its cybersecurity to protect and anonymise patient information, including genomic data — and how AI can play a valuable part in doing so. She also explains how this could provide investors with a new niche to target in their portfolios.

Cyberattacks on healthcare organisations are on the rise.

Last week, the US government signed an order to limit China’s access to US citizens’ health data in an attempt to prevent blackmail. In late January, it also revealed its worries that China could use genomic data to make targeted bioweapons.

However, there appears to be an upside for investors: there is “significant opportunity for cybersecurity or overall technology in the healthcare space”, Arelis Agosto, Senior Healthcare Analyst at Global X ETFs, recently told OPTO Sessions.

According to the World Economic Forum, data breaches in the healthcare sector cost an average of $10.9m each, more than they did in any other sector in 2023. With everything from patient records to gene sequencing stored online, there is growing urgency around keeping sensitive data safe.

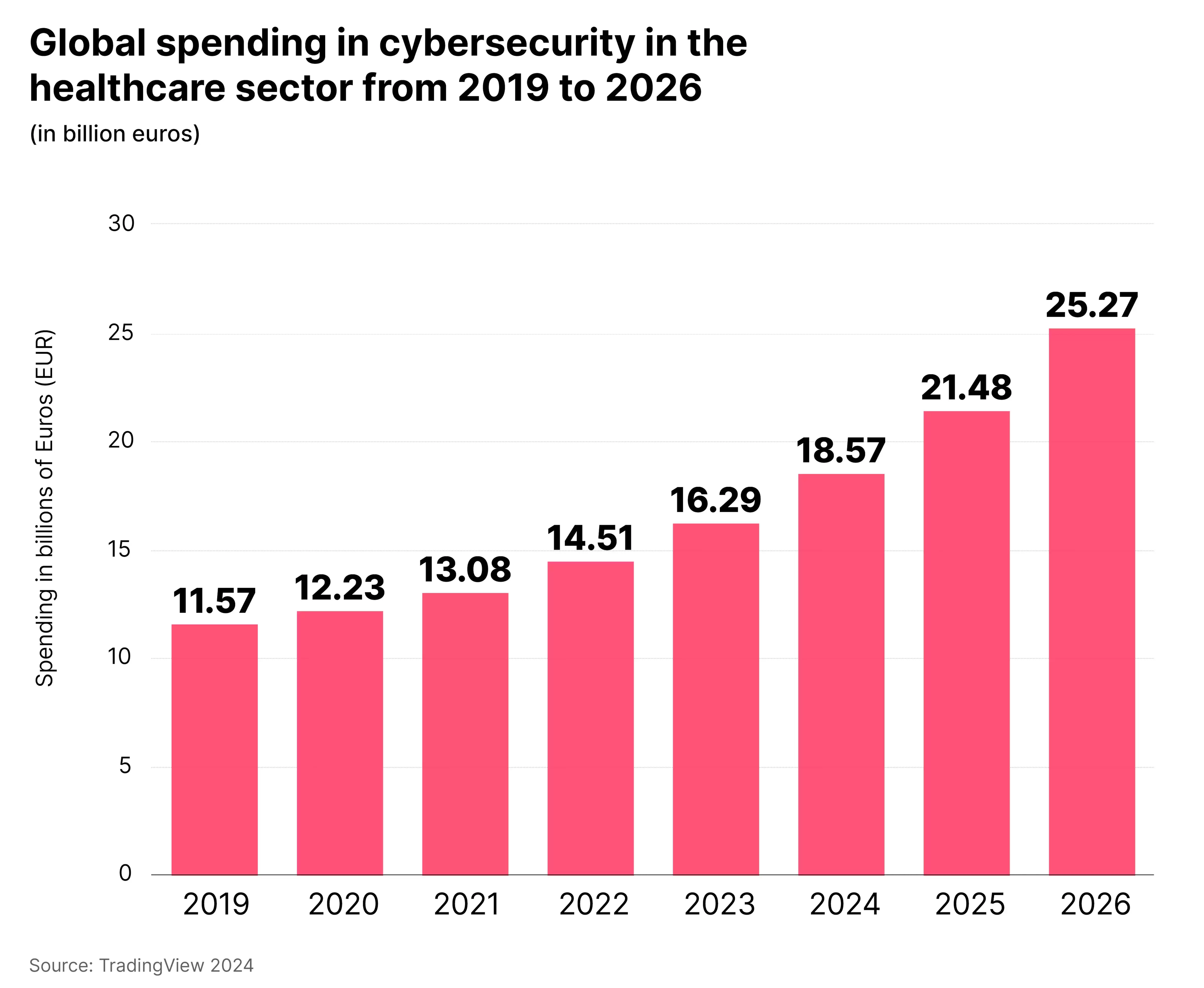

Global spending on cybersecurity in healthcare is projected to reach €25.3bn by 2026, up from €16.3bn last year, according to data from the European Commission and European Investment Fund.

The need to protect patient’s health information is an “ever-evolving” issue and area of priority for regulatory bodies, Agosto says. “The FDA in the US has made significant strides to ensure information is going through significantly rigorous processes to ensure cybersecurity, whether it be [for] wearable devices, electronic medical records or genomic sequencing.”

In particular, Agosto believes the healthcare industry must improve care of patients’ medical data when it is shared and needs to be anonymised. Here artificial intelligence (AI) could play a major role. “To allow physicians, for example, to learn about cases on the other side of the country or world, anonymised data is really important,” she says.

“Perhaps there is an opportunity for AI to not only help anonymise information, but ensure that we’re doing it in a way that can help the industry scale, grow and improve overall care.”

Genomic Security Market Set to Expand

Cybersecurity geared to protect sensitive genomic data is one area ripe for future expansion. “Genomic sequencing is essentially sequencing the DNA of a patient, and understanding where potential mutations might lie,” explains Agosto.

This can give valuable insights into disease risk and potential treatments. “It’s giving us the understanding to see this is the particular portion of DNA that needs to be altered or fixed to cure a patient,” as well as “seeing how the DNA is performing over time, whether through environmental impacts, lifestyle, choices, age or other factors”.

However, information could be used to ill effect in the wrong hands. Concern around China’s access to genomic data has led to the US Congress seeking to block China's largest genomics firm, BGI, from operating within the US.

At present, only an estimated 0.07% of the world's population has had their genome sequenced, but this could change fast. In the past, it cost millions to sequence one patient’s genomic data, but the price has already dropped to $400–500, says Agosto.

“The industry overall has agreed the $100 mark will allow for an inflection point in the industry for greater adoption.”

Once this happens, there will be greater penetration — meaning more sensitive data stored globally, driving future demand for investment in cybersecurity.

That’s not to say all information gleaned will be useful.

“Nvidia [NVDA] has mentioned that the current ability to sequence DNA has far outpaced the ability to actually decipher the information it contains,” points out Agosto.

“Nvidia [NVDA] has mentioned that the current ability to sequence DNA has far outpaced the ability to actually decipher the information it contains.”

Global X Products

For now, investors may wish to look at existing funds focused on cybersecurity and healthcare technology.

Global X offers exposure to cybersecurity-focused interests via its Cybersecurity ETF [BUG]. The fund has an “unconstrained approach”, according to its website, as the need for digital security expands “far beyond personal computers, reaching an ever-multiplying number of devices and applications”.

As of 8 March, the fund had increased 32.1% in the last 12 months and 3.4% year-to-date.

Global X also offers exposure to the digital health space via its Telemedicine & Digital Health ETF [EDOC] fund and to genomics with its Genomics & Biotechnology ETF [GNOM]. Genomic medicine is a growing industry, with the market forecast to be worth $50bn by 2028, according to Global X research.

EDOC has slumped 17.5% in the past 12 months and is down 5.2% year-to-date. GNOM is down 5.2% and up 3.1% over the equivalent periods.

Agosto reckons that, going forward, there will be an opportunity for companies across all of the above themes to work together. “I think we’re going to start to see more unconventional partnerships. We’re already seeing a third partner or category in terms of partnership, which is AI.”

She says pharma and diagnostic companies will seek to utilise anonymised sets of patient data to inform decisions going forward.

“We do think that there’s a lot of opportunity for collaboration across the board.”

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy