The ARK Fintech Innovation ETF is up 14.5% in the past month, as rallies for its two largest holdings, Coinbase and Shopify, continue apace. But analyst projections suggest a slowdown may be in the pipeline.

- Following huge rallies and BlackRock bitcoin ETF custodian hopes, top holding Coinbase cools 8.5%, between 19 July and 21 July.

- ARKF grows 14.5% in the last four weeks.

- Analysts’ outlook flat for Coinbase and ARKF’s second-largest holding Shopify.

The ARK Fintech Innovation ETF [ARKF] has climbed this year as it benefits from the soaring value of cryptocurrency exchange Coinbase [COIN], ARKF’s largest holding. Despite ongoing regulatory pressures, crypto has had a strong 2023.

In the year to 21 July, ARKF is up 61.7%, while in the last month it rose 14.5%.

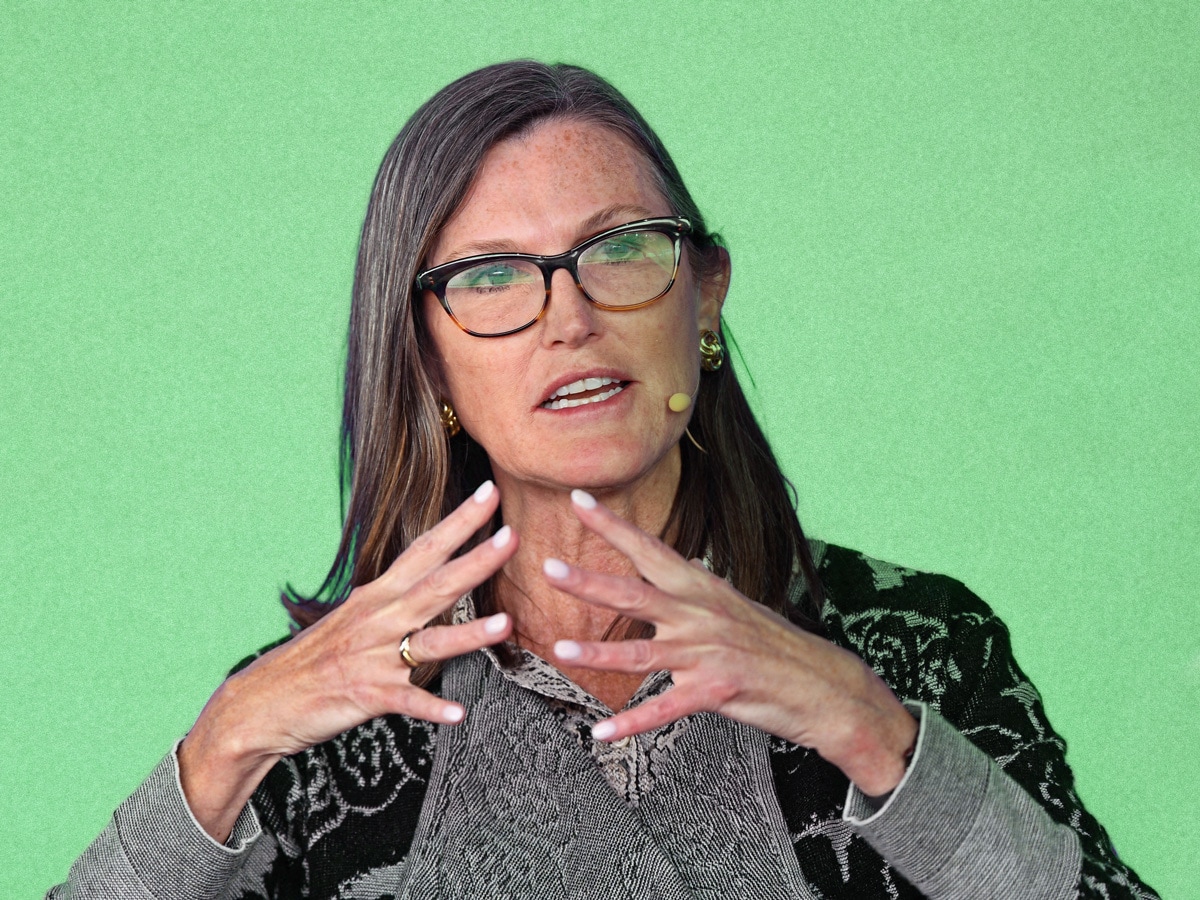

Cathie Wood’s ARKF is an actively managed ETF tracking companies that are active in the fintech sector, including blockchain technology providers and digital payment platforms. In the past year ARKF has leaped 28.7%, although across the last three years it has fallen by 34.2%.

As well as Coinbase, high-profile names in the ARKF fund include ecommerce company Shopify [SHOP] and payment platform firm Block [SQ].

In terms of geographical allocation, 75.8% is concentrated on companies based in North America, while South and Central America accounts for 9.01%, Africa and the Middle East 8.16% and Western Europe 4.02%, with Asia and Central Europe holding smaller shares.

67.39% of the fund’s holdings are large-cap companies worth $10–100bn; medium-cap companies worth $2–10bn have a 27.5% weighting and mega-cap firms worth over $100bn comprise 5%.

Coinbase rockets despite SEC problems

Coinbase is ARKF’s largest holding with 11.47% as of 24 July. The digital exchange has hit headlines this year as Coinbase’s stock dramatically rallied, following the theme’s crash in 2022 amid the infamous collapse of crypto exchange FTX. Year to date, Coinbase shares have rocketed 184.9%. Coinbase stock is reportedly benefiting since being named as custodian for a new spot bitcoin ETF proposed by BlackRock. Recent rises come despite the SEC announcing in June that it is suing Coinbase for “operating as an unregistered broker”, as reported by The Guardian.

The second-largest holding in ARKF is Shopify, with a 10.11% weighting. The Shopify share price has also soared, climbing 88.9% in the year to date to 21 July, though it is down 6.82% between 13 July and 21 July.

In May this year, Shopify posted first-quarter results that beat analysts’ expectations, announcing revenues of $1.51bn, up 25% year over year and well above Refinitiv analysts’ forecasts of $1.43bn. Earnings of $0.01 per share also beat forecasts of a $0.04 loss.

Shopify also announced it will cut its workforce by 20% and offload subsidiary 6 River Systems, which produces robotics for warehouses. Of staff cuts, CEO Tobi Lütke said he “did not make this decision lightly.” Shopify is set to announce its second quarter 2023 results on 2 August.

Analyst outlook muted for ARKF stocks

Wood’s ARK Invest is known for backing companies invested in disruptive technology. While ARKF is up this year, net outflows of -$3.7m suggest investors are less willing to direct their money into the fund than previously. ARKF is outperforming the market in 2023 following a difficult 2022, but some analysts believe it underperforms relative to the ETF market.

Despite huge gains this year, the Coinbase share price recently cooled, sliding 8.5% between 19 July and 21 July. If falls persist, this could affect the performance of ARKF. However, Wood recently said she remained “very positive” on the outlook of crypto exchanges.

According to a consensus of 23 analysts at CNN, the COIN share price is overheated, with the median price target of $65 — a 35.5% fall from its last close.

Coinbase’s next quarterly earnings release is due 3 August. Zacks Equity Research forecast losses of -$0.78 per share, or a rise of 84.24% year over year, with projected revenues of $648.9m representing a 19.72% fall from a year ago.

Some analysts believe the Shopify share price is similarly overheated, again potentially weighing on ARKF’s outlook. Tech analyst Mark Mahaney of Evercore last week downgraded Shopify stock to ‘in-line’ from ‘outperform,’ though retained a 12-month price target of $69. Mahaney said he believed Shopify’s recent rallies dent its investment appeal.

The median 12-month price target of $65 among 38 analysts polled at CNN represents a 0.9% fall. The consensus among 47 analysts is to ‘hold’ SHOP stock.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy