Colin Canfield, Investor Relations Manager at Rocket Lab, speaks to OPTO Sessions about Rocket Lab’s significant step towards vertical integration, and how its acquisition strategy and capital deployment have worked to support this. He also discusses how Rocket Lab distinguishes itself by focusing on small launch services, with its Electron leading the market, while also venturing into the medium launch domain with Neutron.

In a pivotal step towards vertical integration, in November Rocket Lab [RKLB] leased a 113,000-square-foot factory from Lockheed Martin [LMT] in Middle River, Maryland. The facility will become a new Space Structures Complex, and is set to play a pivotal role as Rocket Lab scales up to meet rising demand, Colin Canfield, Investor Relations Manager at Rocket Lab, told OPTO Sessions.

Rocket Lab’s acquisition strategy, and the capital it raised in 2021 and deployed through 2022, was focused on securing the best heritage and businesses in the sub-component domain. These feed into the company’s vertically integrated businesses, with the acquisition of companies that handle raw materials on one end, and those that produce space components on the other.

“We’re really proud of how these assets have rolled into our portfolio, what they’ve enabled from a cash perspective in terms of providing cash stability as well as technological differentiation,” says Canfield.

The businesses not only contributed to financial robustness, but also brought in cutting-edge technology such as reaction wheels, which enable the repositioning of space vehicles, and star trackers, which measure the position of stars using photocells.

The use of technologies such as 3D printers and carbon composites — the latter of which protect against extreme environments during re-entry — also facilitates vertical integration, allowing the company to engage in comprehensive satellite manufacturing.

“The Middle River facility is a great example, where we can take more affordable locations, integrate our technology and scale within the umbrella of the available talent community,” Canfield says.

Looking ahead, the Middle River facility, complemented by Rocket Lab’s takeover of the former Virgin Orbit facility in October and its headquarters in Long Beach, California, will play a pivotal role as the company scales up.

Space as a Service

This move is a shift away from the traditional organisational structure for space companies, towards what Peter Beck, CEO of Rocket Lab, has called “Space as a Service” — the new SaaS. This would grant the company direct-to-customer capabilities, as it is able to construct its own rockets, satellites and components.

“The process begins by deciding on the application we want to pursue, keeping in mind that we benefit a lot from a second-mover dynamic,” Canfield told OPTO Sessions. The company’s experience in launch services has provided it with insight into capital efficiency in that domain, shaping the Neutron’s development process.

“In the longer term that’s definitely the vision,” Canfield says, referring to Beck’s version of SaaS. “But internally, the company is going to continue focusing on learning from both our competitors and our partners as we crystallise what we can achieve over the next decade.”

Standing Out

The space industry as a whole encompasses a variety of key technologies that underpin daily life, such as mobility, communications and intelligence. These advancements are made possible through the deployment of satellite technologies in space, including, but not limited to, GPS and weather monitoring satellites.

“Communication is increasingly important in terms of the architecture of future economic growth. A lot of growth and jobs will probably come from digital services and the like. Connectivity is paramount for that,” he says.

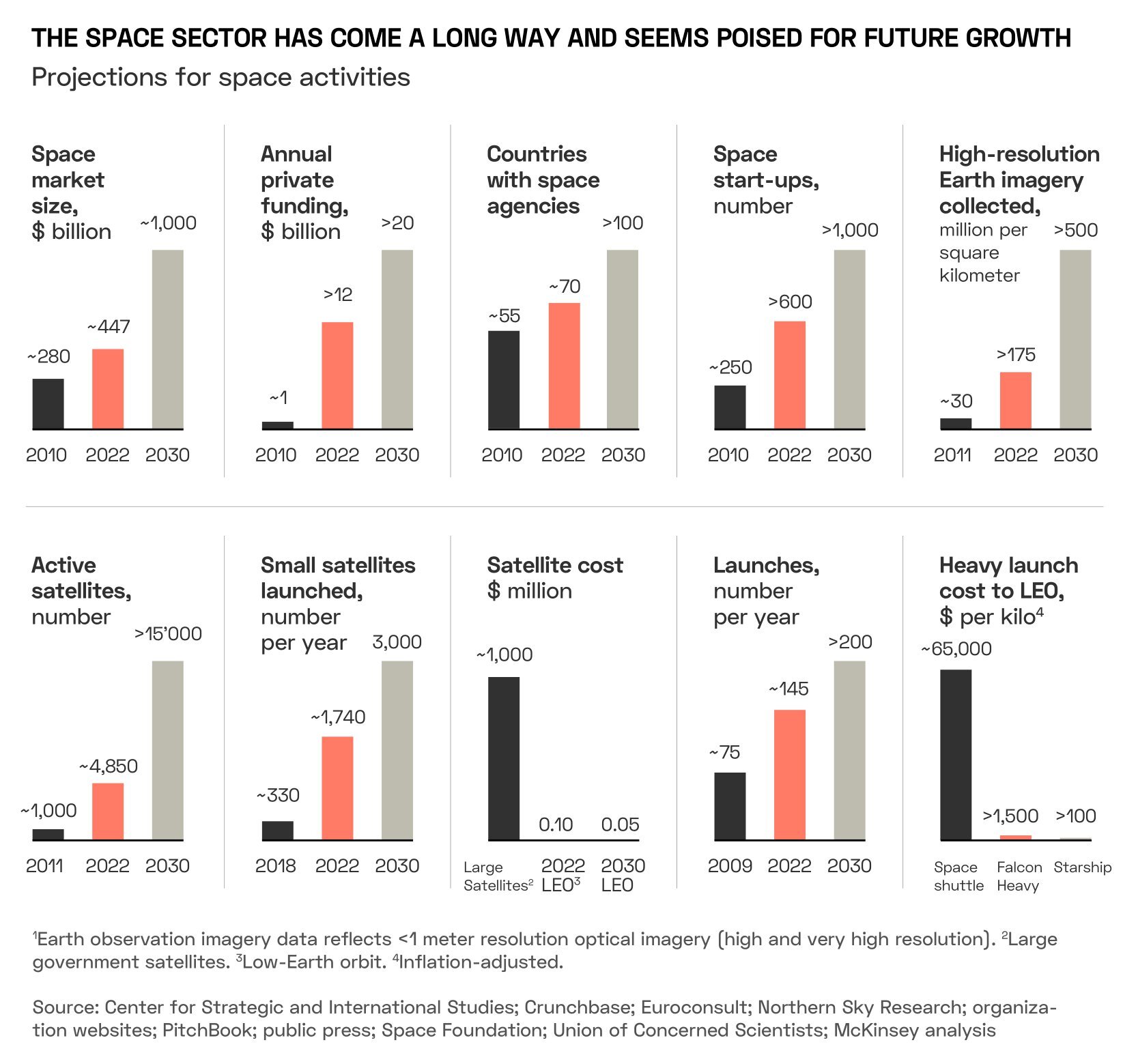

This is reflected in recent and projected expansion in the industry: the number of annual launches rose from 75 in 2009 to 145 in 2022, and are set to top 200 in 2030, according to McKinsey research. Meanwhile, private funding is also expected to increase, from approximately $1bn in 2010 to $12bn in 2022, and an estimated $20bn by 2030.

While SpaceX may be more well known, Rocket Lab has sought to set itself apart in the competitive industry by focusing on manufacturing satellites and subsystems for customer satellites, rather than putting its own assets into space. “We focus typically on small launch services. The Electron is definitely the leader in that market.”

Looking to the future, however, the company is focused on the medium launch domain, through Neutron. “SpaceX pushes higher up the curve into the super heavy domain, afforded by their capital supply, fundraising environment and how their model works. We’re a little more bootstrapped. Once Neutron comes to market, we believe it’ll be a really competitive vehicle class, just based on the pricing, the capacity and its reusability for the future.”

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy