Michael Gayed, author of The Lead-Lag Report, joins OPTO Sessions to discuss the recent rally for the Russell 2000 Index. Is it simply the consequence of tactical repositioning by institutional investors, or could it signal an end to fears of a US recession?

Michael Gayed is Portfolio Manager at Tide Financial Group and author of The Lead-Lag Report, an award-winning Substack newsletter.

On 17 July, The Lead-Lag Report published an article entitled ‘Is the Small-Cap Rally A Trap?’

The question pertains to the shift towards small-cap stocks outpacing large-cap stocks — a shift that coincides with June’s monthly CPI report, which shows a cooling of inflation in the US.

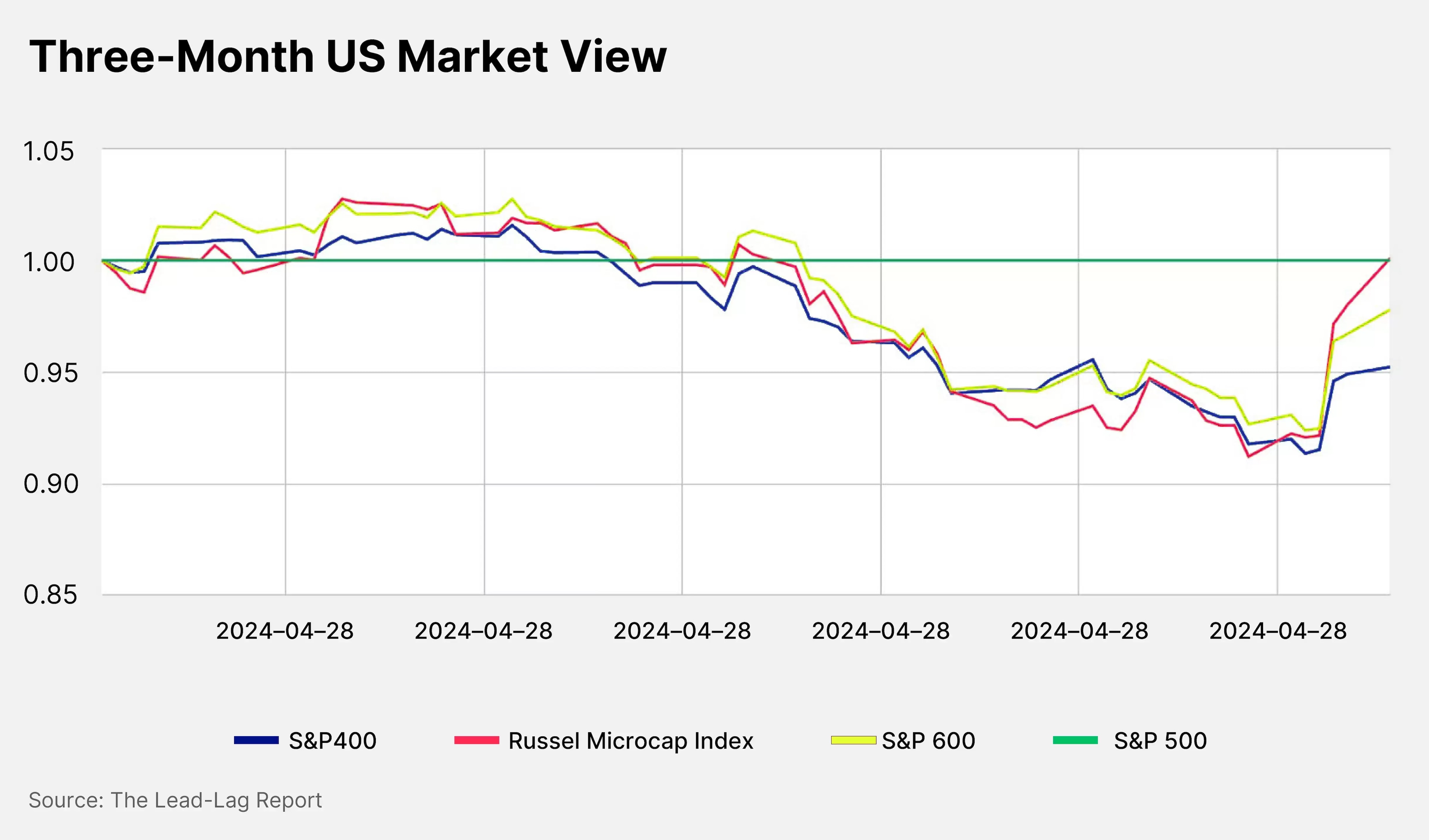

In the week between 10 July and 17 July, the Russell 2000 index gained 9.2%. Over the same period, the S&P 500 fell 0.8%, narrowing the stark divergence that has existed between the two over recent months.

This is traditionally a bullish signal for markets; a move towards historically riskier small caps, especially when (as is the case now) there is no accompanying movement towards treasuries, has often coincided with a market bottom and the start of a new bull market.

However, Gayed explains to OPTO Sessions, “by the same token, generally when you’re at the start of a cutting cycle, the market starts going down”.

Offside Spread Dynamics

There could be a much more short-term, tactical explanation for the sudden outperformance of small-cap stocks.

“Was the disinflation news the spark for a bigger trend? Or was it the spark for offside spread trading, margin call dynamics which are taking place? I think it’s more of the latter, but we’ll see”

“This smells to me like some major hedge fund or institutional player that’s blowing up,” says Gayed. He explains that the strategies these kinds of firms pursue to generate non-market like returns often lead to them shorting a particular segment of the market, such as small caps, whilst piling cash into the parts of the market — such as mega-cap tech stocks — that are outperforming.

When the macro environment starts indicating that market dynamics could shift, any firms holding this type of position could suffer major losses.

“There’s a panic covering on the short side of that spread trade. At the same time, there’s a panic selling on the long side of the large-cap tech play.”

In other words, says Gayed, the rapid, short-term gains of small caps compared to mega caps may not be indicative of a systemic, long-term market shift towards small caps; it may simply be a shorter-term move that reflects institutional investors’ repositioning.

That said, Gayed believes that “there’s a longer-term case for small caps outperforming large caps, because the market is so beyond stretched. There is a cycle and there’s a real argument to be made that small caps should lead. The question is the speed of this move.

“Was the disinflation news the spark for a bigger trend? Or was it the spark for offside spread trading, margin call dynamics which are taking place? I think it’s more of the latter, but we’ll see.”

Does This Mean There Won’t Be a Recession?

The disinflationary trend evidenced in June’s CPI report could indicate one of two things. Either the Fed has been successful in its goal of hiking interest rates enough to tame inflation, but not so aggressively as to cause a recession; or, it has over-hiked, and a recession is on the horizon.

Gayed says that the bond market (as well as utilities, “the bond-like sector of the stock market”) and credit spreads (the differential between AAA and junk bonds) will be the key indicators of whether the market has bottomed or not.

Assuming the Fed’s strategy has been successful, bond yields would be expected to fall — Gayed mentions that this is already observable “at the periphery” — and credit spreads to remain tight. That could be positive for the stock market, as it could trigger a cycle of rate cuts.

However, should disinflation continue alongside a widening of credit spreads, this would be “more consistent with what you see in a recession, and a bigger drawdown for equities”.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy