General Motors’ [GM] share price has enjoyed a reasonable amount of growth over the past 12 months, outpacing the S&P 500 to the close on March 21.

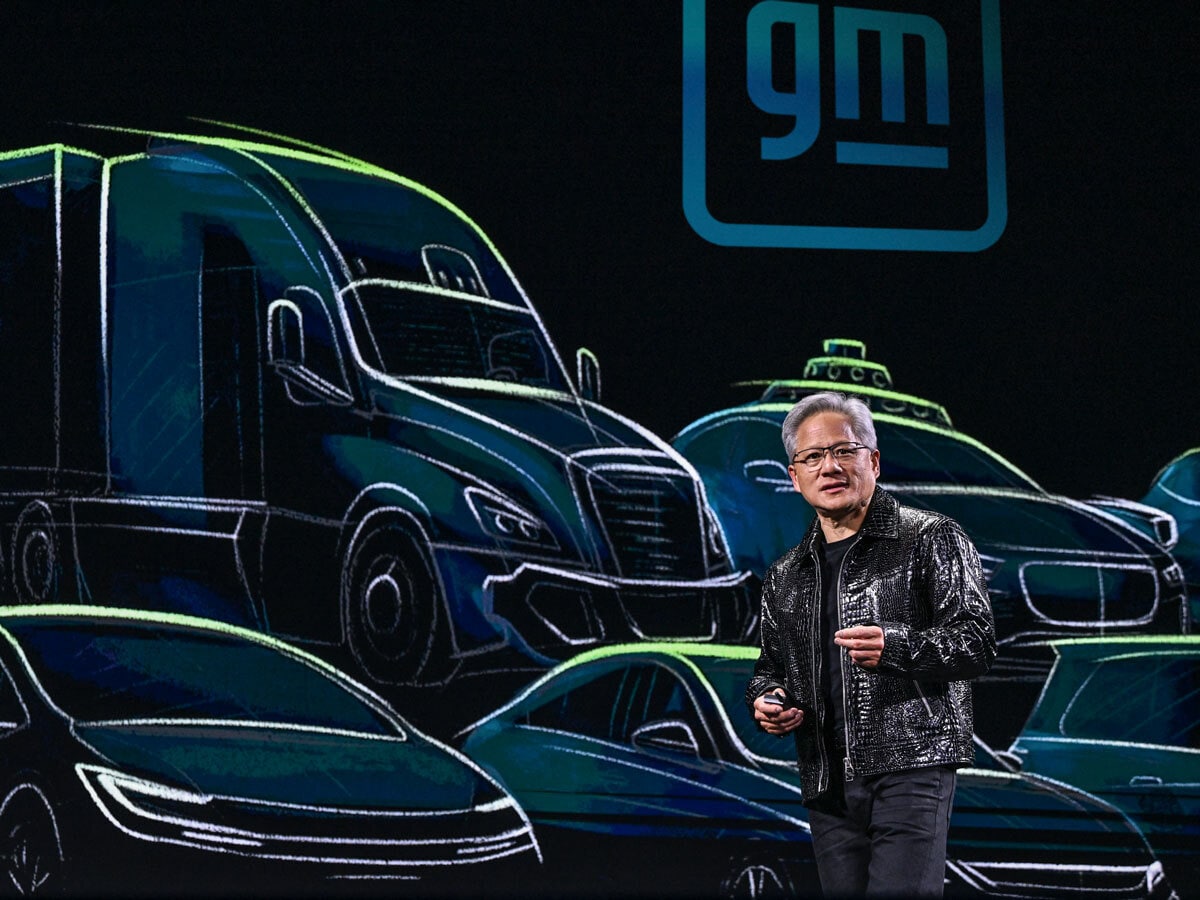

The US automaker’s partnership with tech firm Nvidia [NVDA] is likely to be one cause of this positive performance, but can an old hand like GM really reinvent itself as a leading tech player?

What’s New with GM?

These days, any stock news worth reading seems to involve artificial intelligence (AI) — and GM’s recent activity is no exception.

On March 18, the firm announced an expanded collaboration with existing partner Nvidia, highlighting the joint goal of developing next-generation vehicles, factories and robotics. This will bring AI into plant design and operations, as well as implement Nvidia’s Drive AGX in-vehicle hardware, priming for the use of AI-assisted in-cabin software in the future.

GM and Nvidia saw a modest increase of 2.30% and 1.81%, respectively, in the 24 hours following the announcement.

GM’s Q4 results seemed to spell progress for the firm, with FY EBIT-adjusted net income beating Wall Street estimates to come in at $14.9bn, at the very upper end of the guidance of between $14-15bn. FY25 guidance looked similar at $13.7-15.7bn.

How Has GM Stock Reacted?

GM’s 15.84% growth for the 12 months to March 21 has outpaced the wider S&P 500’s 7.81% rise in the same period by a significant margin. That said, it is worth noting that the S&P’s performance has on the whole been less volatile than GM’s.

Despite the positive news in Q4 earnings, GM’s share price plunged 8.89% on January 28. Broader discomfort in the sector married with $5bn allocated in special charges — mostly associated with various Chinese joint ventures and the removal of funding for the Cruise unit’s robotaxi — may have caused investor hesitancy.

GM’s investors will no doubt be hoping that the Nvidia link continues to drive the stock upwards, but the longevity of this boost remains to be seen.

Will More Automotive Players Enter the Tech Space?

While GM’s growth outlook may appear lackluster in comparison to Tesla’s [TSLA], the image problems currently facing Tesla could hamper its performance.

The firm, famously owned by controversial figure Elon Musk, has seen its market cap plummet from $1.30trn as of December 31, 2024, to $799.87bn. Current growth estimates may prove optimistic if Musk continues to make negative headlines.

Tesla has always led with technology integration, featuring advanced in-cabin support systems from inception, and the brand is also a leading contender in driverless vehicle development.

Hyundai Motor Company [005380.KS], the biggest player considered here by some margin, has also focused on technology advancement alongside vehicle production, as well as pursuing other innovations GM might learn from.

One example is the announcement, made on January 7, that Hyundai vehicles are now available to add to cart on Amazon’s [AMZN] eponymous e-commerce site.

Metric | GM | Tesla | Hyundai |

Market Cap | $49.55bn | $799.98bn | $50.28trn |

P/S Ratio | 0.30 | 8.91 | 0.31 |

Projected revenue growth (2025) | -2.86% | 12.48% | 4.50% |

Source: Yahoo Finance

Can GM Stock Push Higher?

GM is clearly angling to position itself alongside tech players through its Nvidia partnership. Will this be enough to carry GM’s share price higher, or are its year-to-date losses signs of worse to come?

GM Bulls Are Optimistic

The bull case for GM is booming, with much of the optimism rooted in very strong fundamentals.

GM’s earnings for Q4 2024 and FY 2024 may have proved a pleasant surprise for investors, at least based on the EBIT-adjusted figures.

The earnings release indicated the firm is continuing to steal market share from competitors and to grow at an impressive rate despite unfavorable market conditions more broadly.

Wedbush analyst Dan Ives noted that the firm’s strong guidance came as “GM looks to ramp the delivery of its new models while stabilizing the bottom line through continued EV profitability improvements”.

Analysts are also identifying the current low trading price as a potential entry point, with a forward price-to-sales ratio sitting 69.40% below the sector average, and forward price-to-cash flow an impressive 73.61% below the average.

Of 29 analysts who have issued ratings in the last 90 days, according to Seeking Alpha, 12 rate GM a ‘strong buy’, six rate it a ‘buy’, nine have issued ‘hold’ ratings, and just one each suggest the stock is a ‘sell’ or ‘strong sell’.

What Could Hold GM Back?

As with many consumer-dependent companies in the current climate, there is potential cause for concern regarding the firm’s commercial performance in the foreseeable future.

Geopolitical tensions — not least the application and removal of tariffs from the US to key markets around the world — may combine with a general economic downturn that sees consumers shy away from new vehicle purchases.

Environmental concerns and legislation regarding vehicle emissions could also affect GM’s bottom line.

Lastly, GM has backed out of a project that investors might have been interested in as a future innovation play, namely its Cruise unit.

If GM wishes to reposition itself in the tech market, it will need to prove it can carry exploratory tech projects through to completion in order to gain investor confidence.

Conclusion

GM appears to be positioned well for future growth as things stand. However, investors will be interested to see whether the firm can continue to prove its value in the tech space, through partnerships as well as its own innovation, while also balancing its bottom line.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy