In this article, US-based investment manager Direxion — which launched the Direxion Moonshot Innovators ETF [MOON] — suggests a method for investors to measure a company’s innovation and expected disruption to an industry.

What’s the next big thing?

Despite being separated by decades, John F. Kennedy and r/wallstreetbets, the popular stock traders community on Reddit, are linked by one common word: “Moon”. For the 35th President, it was the impossible challenge of putting a man on the moon. For the r/wallstreetbets crowd, it’s to see their investment in Bitcoin or Tesla [TSLA] rocket to the proverbial moon.

Whether it is the actual moon, or a proverbial one, getting there may not be easy. As JFK framed directly, it is a true test.

In spite of sharp economic contraction and earnings decline, a handful of US mega-cap stocks have recently made it close to moon status. There have been several small cap stocks that have joined the large cap ranks seemingly overnight. Even Bitcoin has made an unbelievable comeback this year, hitting new all-time highs, but with considerable volatility.

While everyone wants the next moonshot in their portfolio, finding one is easier said than done.

We created the Direxion Moonshot Innovators ETF [MOON] in an effort to offer exposure to the 50 most innovative US companies at the forefront of changing our lives not just today, but tomorrow, by identifying the companies both pursuing innovation, and having the potential to disrupt existing technologies and/or industries.

While each moonshot is unique, one common theme of any moonshot is the focus on innovation, whether at the product or company level. But how does one measure innovation? How does one try to systematically capture moonshot potential?

We, and our partners at S&P Kensho, believe in two ways — allocation to innovation and innovation sentiment, defined as the following.

Allocation to Innovation Score | Innovation Sentiment Score |

Rank companies based on the ratio of R&D expenses to revenue | Review of company’s regulatory filings over the previous 12 months |

Score the ratio relative to other companies in the same industry | Scan to find companies utilizing a greater than average variety of innovation related terms |

Source: Direxion, S&P Kensho.

These two measures help to find companies with corporate cultures focused on breaking new ground, supporting the path towards creating the future in their respective sectors and industries, along with actually spending toward it.

The companies selected for inclusion are deemed to have the highest “early-stage composite innovation scores”. Within the broader moonshot themes sit subsectors and technologies that are poised to solve some of the most difficult, and interesting, problems in the world.

From the final frontiers of space and drones, to the future of communication and security, these radical pursuits are shaping the future today. They span themes and emerging sectors such as smart transportation, clean power, and the human evolution.

The result of the selection process is just that: the Direxion Moonshot Innovators ETF is able to capture 50 companies that are spending the most significant portion of their time, and cash, on developing technologies, building infrastructure, and delivering products and services in the industries of tomorrow.

The Direxion Moonshot Innovators ETF offers exposure to 18 cutting-edge sub-themes

Sub-Theme | Weight |

Genetic Engineering | 19.16% |

Cyber Security | 17.02% |

Clean Technology | 9.83% |

Digital Communities | 8.04% |

Wearables | 5.88% |

Drones | 5.88% |

Autonomous Vehicles | 4.65% |

3D Printing | 4.23% |

Virtual Reality | 3.98% |

Enterprise Collaboration | 3.92% |

Distributed Ledger | 3.23% |

Robotics | 3.18% |

Software & Services | 2.50% |

Smart Buildings | 2.05% |

Advanced Transport Systems | 2.01% |

Internet Services & Infrastructure | 1.96% |

Space | 1.44% |

Smart Grids | 1.04% |

Source: Bloomberg Finance, as of 8 January 2021. Sub-themes identified by S&P Kensho Indices.

For investors and their portfolios, this means high impact relative to the broader market coming from individual security selection, with innovation in mind. The Direxion Moonshot ETF is able to provide exposure to companies many are likely not aware of, which lean smaller cap in nature, and span traditional Global Industry Classification Standard (GICS) industries such as consumer electronics and industrial machinery, and biotechnology and communications equipment.

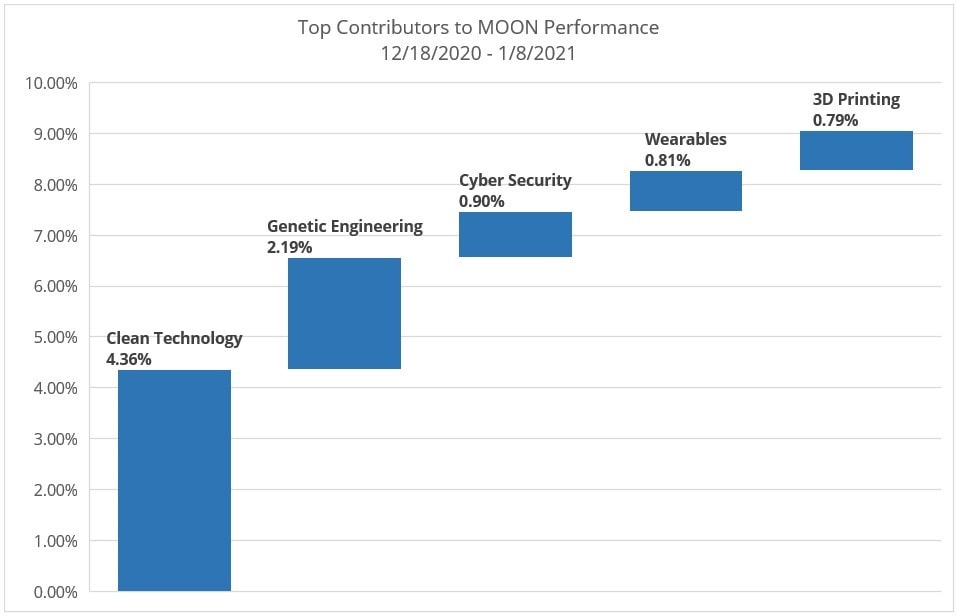

Since the most recent rebalance on December 18, 2020, [as of 20 January 2021] the Direxion Moonshot ETF has gained 11.7% (between 18 December 2020 to 8 January 2021), relative to 3.2% for the S&P 500 and 6.2% for the Russell 2000, respectively. From a factor and style perspective, the fund has also outpaced widely followed factors such as momentum and growth.

Clear technology and genetic engineering have driven notable outperformance

Source: Bloomberg Finance.

Since 18 December 2020, we have seen positive portfolio contributions from 15 of the 18 sub-themes. While lighter in weight, sub-themes such as the distributed ledger and wearables have also seen notable performance, where Oneconnect Financial [OCFT] is creating infrastructure around digital finance, and Vuzix Corporation [VUZI] is bringing advanced eyewear technology to the medical and manufacturing fields.

Landing on the moon is hard, but radical solutions and products come from disruptive approaches and technologies. Having a systematic approach to single security selection that stresses innovation can be a great approach. As President John F. Kennedy said in 1962: “We choose to go to the moon… and do the other things…”

This article was originally published in Direxion’s Spotlight newsletter on 20 January. For more information about Direxion’s thematic ETF range, visit their site.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy