It’s been a busy week for AI, as Alphabet-owned Google offers wider access to Bard, its ChatGPT rival, and major player Nvidia launched the Google Cloud-run L4 Platform. The Nvidia share price has soared 80% in 2023 as its AI capabilities grow, while Alphabet’s is up almost 20%.

- Alphabet stock sees a modest rise of nearly 4% after offering early access to Google AI chatbot Bard, while Nvidia stock soars in 2023.

- Bill Gates terms AI as the most important tech development in decades.

- Global X Robotics & Artificial Intelligence ETF gives exposure to Nvidia.

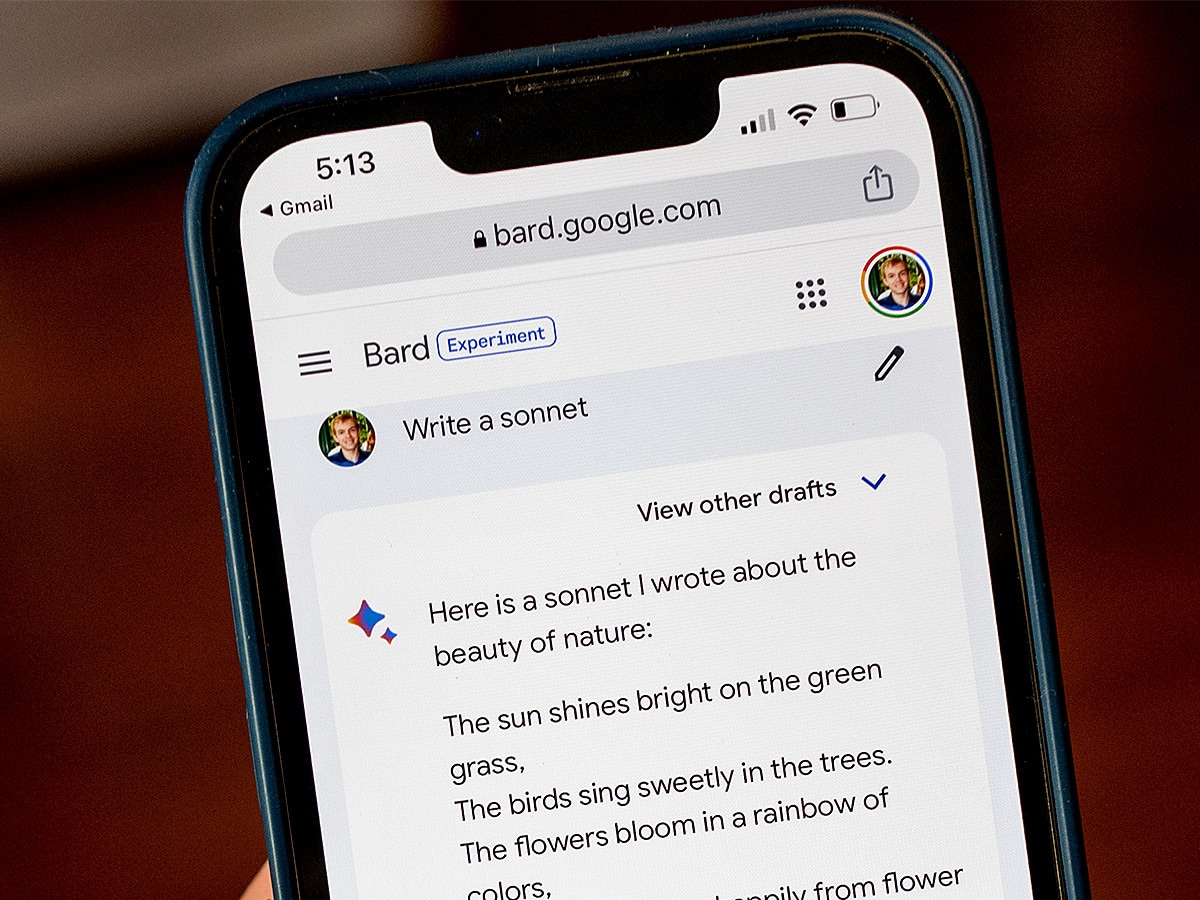

Last week Alphabet’s [GOOGL] Google widened user access to Bard, its generative artificial intelligence (AI) rival to much-hyped chatbot ChatGPT. Investors will hope the move strengthens its share price, which suffered last year.

As yet, the Bard chatbot is only open to UK and US users and not directly integrated into Google’s search engine. However, the software will incorporate connected query boxes so users can check the accuracy of the information and sources used.

In what proved a busy week for AI, Nvidia [NVDA] also launched its cloud hardware platform L4, which will be integrated with Google Cloud, and is optimised for video apps.

The Alphabet share price closed up 3.8% on the day of the Bard news on 21 March. The stock fluctuated in 2023 but climbed 18.2% in the year to date to 24 March after plummeting 38.8% in 2022.

Meanwhile, chipmaker Nvidia’s stock has rocketed in 2023 as the company focuses on AI, soaring 83% year to date to 24 March, after tumbling 50% in 2022.

Nvidia stock soars off AI gains

All eyes will be on Bard’s performance going forward, and in particular on how it compares to Microsoft-backed [MSFT] ChatGPT. In February, Alphabet saw its share price dive and $100bn wiped off its market value when Bard shared misleading information in a video.

However, last week investment advisors Ruane, Cunniff and Goldfarb, which manage the Sequoia Fund, said in its fourth quarter (Q4) 2022 letter that, despite Alphabet’s share price crash last year, the future looked good. They expect Alphabet revenues to rise 10% in 2023, with EPS down 16%. Compared to pre-pandemic levels, this represents a CAGR of 21–24%.

Jensen Huang, CEO of Nvidia, called its deal with Google a “very big event” that will help the company develop its own AI products.

Nvidia’s shares closed up during its annual AI GTC conference on 21 March, with suggestions the stock is heading for its strongest quarter since 2003. At the conference, Nvidia noted it planned to rent out ‘supercomputers’ that allow access to the AI cloud.

In February, Nvidia saw Q4 revenues fall 21% on the previous year, to $6.05bn. However, this beat Wall Street predictions, with data centre revenues, which include AI semiconductors, jumping 11% to $3.6bn.

The AI wars have barely begun

AI is increasingly seen as a crucial area for big tech going forward, with competition heating up between the biggest players.

Last week Microsoft [MSFT] founder Bill Gates said he believed AI was the most important technological advance for decades. Google’s Bard generates conversational, human-like text responses to requests using a Large Language Model, as doesOpenAI’s ChatGPT, which is backed by Microsoft to the tune of $10bn.

There are signs AI will be increasingly used by financial services. Last week investment bank Goldman Sachs [GS] announced it is testing AI tools to help it write code internally.

Writing for Forbes, Alex Kreger, founder of financial design agency UXDA, says banks could use AI for tasks like password resets or balance enquiries, freeing up “human” staff to focus on more complex requests.

According to a UBS report, just two months after its November launch, ChatGPT had monthly active users totalling 100 million, making it the fastest-ever growing application.

Amin Vahdat, vice president of Systems & Services Infrastructure at Google Cloud, said the latest generative AI programmes heralded a “new era of computing”.

At its AI conference, Nvidia previewed CUDA Quantum, a platform allowing developers to create quantum algorithms.

According to Allied Market Research, the global generative AI market is set to reach a value of $126.5bn by 2031.

Fund in focus: Global X Robotics & Artificial Intelligence ETF

The Global X Robotics & Artificial Intelligence ETF [BOTZ] offers exposure to companies in the field of AI. Nvidia is currently the largest holding as of 23 March, with an 8.99% weighting in the portfolio. The BOTZ fund is up by 18.5% year to date.

Alphabet and Nvidia are both held in the ROBO Global Artificial Intelligence ETF [THNQ], in second and third place, respectively, with weightings of 2% and 2.02% as of 23 March. In the year up to 24 March, THNQ is up 17%.

Following Nvidia’s AI conference, analyst Vivek Arya of Bank of America gave Nvidia a ‘buy’ rating and raised the price target to $310, as Nvidia’s growing AI capabilities widen its addressable market, alongside partnerships including Google and Amazon [AMZN].

Toshiya Hari of Goldman Sachs also issued a ‘buy’ rating, identifying the chipmaker as a “key enabler of AI.”

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy