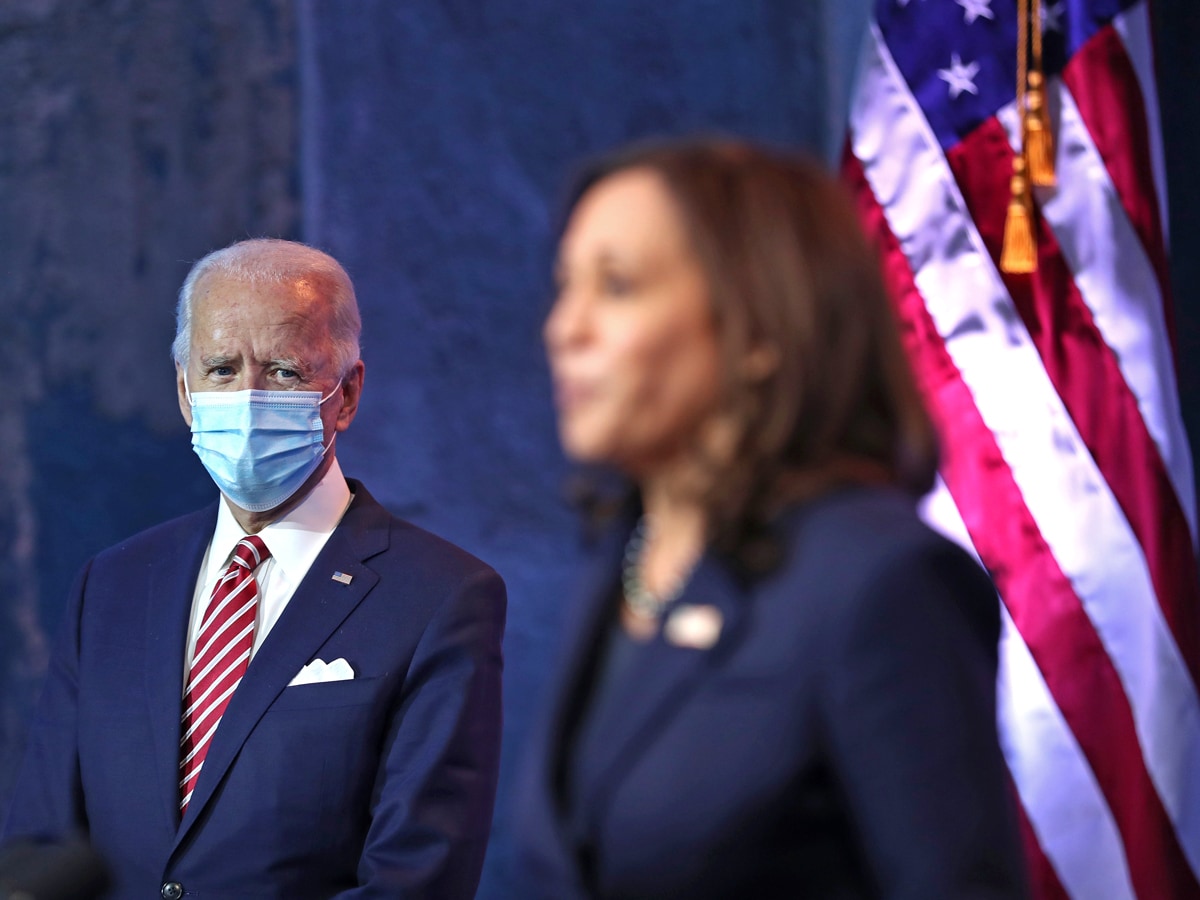

If pre-US election opinion polls had proved correct, investors in US stocks would have had a much smoother ride. With a reported 10 percentage point lead, Joe Biden would have cruised into the White House and, although US president Donald Trump was always expected to contest the result, the predicted clear-cut Democrat victory would have ensured a relatively serene few days for the markets either side of the vote.

Of course, it didn’t happen like that. Trump, as in 2016, confounded pollsters by turning not only election night, but most of the following week, into a nail-biting rollercoaster. Swing states produced surprise results and the president claimed an unlikely victory that was never his. At times, though, it looked like it could have been.

And it’s not over yet. Trump’s raft of legal challenges seem unlikely to keep him in power, but the accompanying race for majority over the US Congress is uncomfortably tight. The public — and, crucially, investors — won’t know until the New Year whether the Democrats will enjoy control of the presidency, the House of Representatives and the Senate.

Whether Biden will be free to pursue policies and reforms unhindered remains an open question. If the Republicans take the Senate, they would wield sufficient power to slow him down.

Wall Street sizes up the US election

Ahead of the election, many investors steered away from US government bonds, wagering that a comfortable Democrat clean sweep would mean a large fiscal spending spree, boosting economic growth and inflation. However, when it became obvious that Trump performed much better than expected — particularly when holding Florida gave him a real chance — they recovered.

As Trump made his extraordinary claim of victory and began a tirade of unsubstantiated voter fraud claims, futures dived once more as investors reacted to the possibility of a worst-case scenario involving months of uncertainty.

In the week before the election, the S&P 500, Nasdaq and the Dow Jones all shed circa 4%, but as the race went down to just six swing states and Biden’s postal votes began to gobble up Trump’s walk-in leads, equities gathered momentum. In the four days between polls closing and Pennsylvania flipping blue to confirm the Democrat’s victory, all three indices rose between 5% and 6%.

Biden’s blue wave

Trump and Biden offered such polarising visions of the United States that there was some spectacular post-poll share price movement in US stocks. Biden’s immediate declaration that the country would rejoin the Paris climate agreement boosted many renewables stocks.

RBS analyst Brad Heffern’s understated prediction that a Biden win would “favour” biofuels specialist Valero Energy Corporation [VLO] proved immediately true. At 4pm on Friday 6 November, its shares stood at $38.17. By 10am Monday 9 November, following confirmation of Biden’s victory, Valero Energy’s share price had leapt nearly 18% to $44.91.

18%

Valero Energy's share price rise after Biden's victory

Biden’s green credentials meant that of 22 CNN analysts, 16 gave the stock a Buy rating, three gave Outperform, two had Hold and just one had a Sell rating, forecasting a median 22.4% increase from a price of $55 over the next 12 months.

It was a bumpier ride for other clean energy stocks, however.

Biden’s victory brings a mixed outlook for Tesla [TSLA]. He may be championing electric vehicle tax credit, but his determination to strengthen unions (which currently have no representation in Tesla’s US sites) and protect workers’ rights was reflected in an uncertain share price performance. Tesla’s share price leapt 6% on Election Day and a further 3.3% in the following 48 hours, but as Biden’s win became more apparent it fell away. On 10 November, a week after the vote, it stood at $410.36 — 3.2% below its election day closing price. In the week since then, however, Tesla’s share price has surged again, closing up 7.6% at $441.6 on 17 November, after its entry into the S&P 500 was finally confirmed.

First Solar [FSLR], another US stock predicted to win following the Biden victory, had a similarly bumpy election week, plunging 8.6% on 4 November to then bounce back 8.9% in the next 24 hours. It has continued to fluctuate since, with no sign of a sustained rally yet.

The red mirage mutes markets

Unsurprisingly, US stocks that would have more obviously benefited from a Trump victory — including defence firms and companies which would have implemented his loudly touted roadbuilding and infrastructure programme — have been more muted since polling day.

Vulcan Materials [VMC], America’s largest producer of asphalt and ready-mixed concrete, plunged 10% in the week after the election, but investors remain confident as they wait to hear Biden’s own infrastructure plans.

10%

Vulcan Materials' share price drop after election

Meanwhile, aerospace firm Lockheed Martin [LMT], expected to be a winner under Trump, ended election week at $361.27, just two cents down from polling day. Analysts predict it will also benefit under Biden — a CNN consensus of 12 analysts out of 23 rated it Buy, with two rating it Outperform and nine Hold.

Markets still gripped by Senate run off

More widely, all investors will be watching the outcome of the US Senate run-off elections in Georgia on 5 January. The Democrats need to win both available seats in order to gain a 50-50 tie. This would give vice president-elect Kamala Harris the casting vote and the resulting clean sweep for blue would potentially result in large fiscal stimulus and boost US stocks such as banks and the automotive industry.

That said, if the Republicans win one of the two remaining seats, they retain control of the Senate and, under Trump acolyte Mitch McConnell, this would likely mean a continuance of the outgoing president’s corporate tax cuts. The Senate would also be able to dilute Biden’s promised plans for heavy regulation across several industries, including fossil fuels and technology.

Arguably the best overall outcome for investors could be a Republican Senate.

Historically, a Democrat president and a split US Congress has been the most lucrative combination for the stock markets, offering an average 14% return per presidential term since 1945.

14%

Average stock market return per presidential term with Democrat president and split US Congress

Despite all of this, in the uncertain, unprecedented times of the coronavirus crisis, it may ultimately be that over the next few months, the greatest impact on the markets will not come immediately from who controls what.

If recent news of an imminent COVID-19 vaccine proves true, that would bring a greater shot to investors than anything else.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy