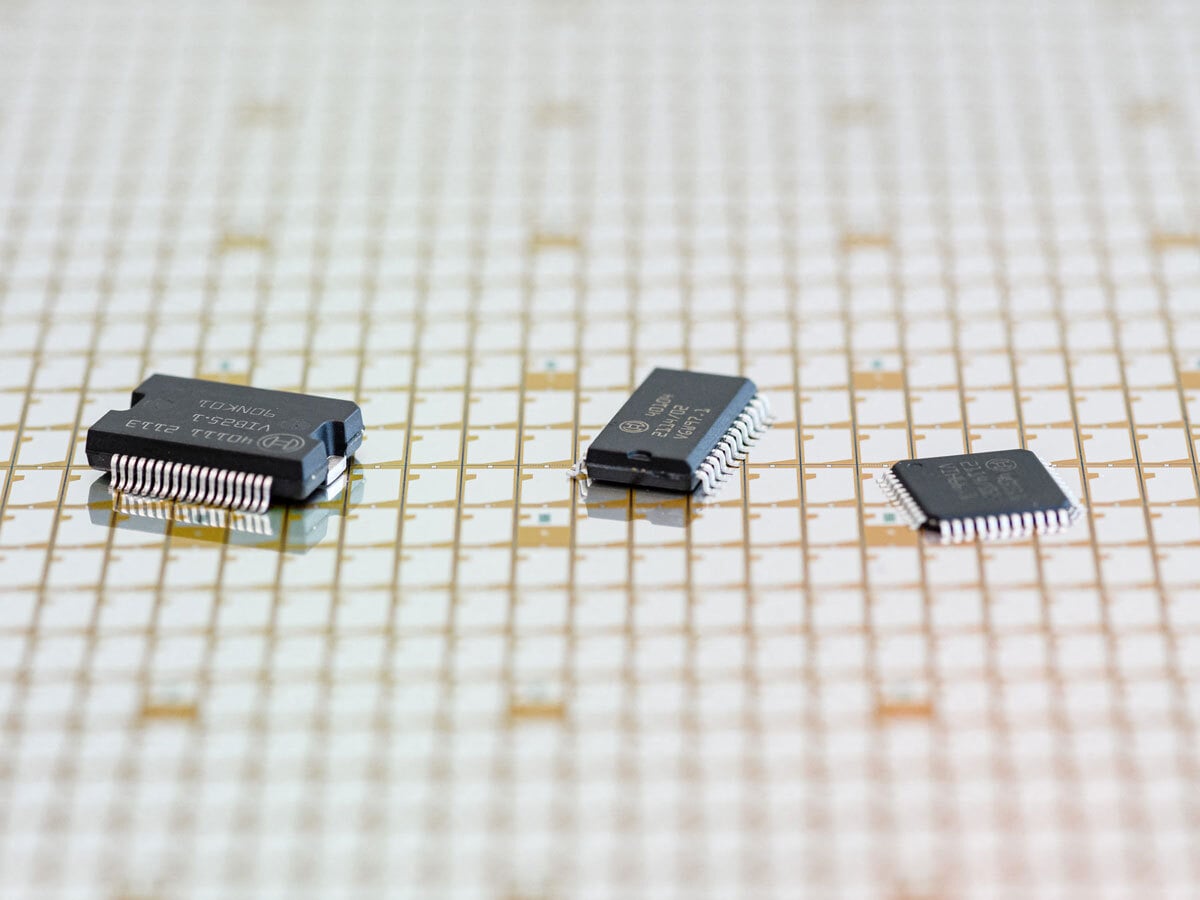

The global semiconductor shortage is putting a squeeze on new car deliveries. But how long will the shortage last, and what does it mean for the share prices of Tesla [TSLA], Ford [F] and Volkswagen [VOW.DE]?

In August, 68,000 new cars were delivered in Britain, down 21,000 from the same month last year. The Society of Motor Manufacturers and Traders said it was the worst month for deliveries since 2013.

This isn’t exactly breaking news. During earnings season, many manufacturers warned that the supply of semiconductors – or lack of – would likely hurt deliveries in upcoming quarters.

However, the figures also showed that demand was increasing for electric vehicles. New deliveries for hybrid cars jumped 72% year-on-year, indicating that the recent dips could be a good time to buy into automobile stocks as the industry transitions to electric vehicles.

How have Tesla, Ford and Volkswagen’s share prices been performing?

The Tesla share price has seen a roaring 20% gain over the past month, accelerating from $617 on 14 June to $736.27 on 10 September. Ford’s share price, however, has dropped off a cliff, falling by more than 18% in the same period, while Volkswagen’s share price has had a similarly disastrous 15% decline.

Ford had reported that its June sales had dropped 27% compared to the same period the year before and would have to curtail production, while Volkswagen warned that the chip shortage would continue to worsen as it posted strong first-half sales in Europe.

27%

Ford's YoY drop in sales in June

In comparison, the S&P 500 is up just over 5% over the past three months, while the First Trust NASDAQ Global Auto Index Fund [CARZ], which tracks global auto manufacturing firms, is down around 5%.

How has the automobile industry responded to the shortage?

Tesla could be well placed to withstand the semiconductor shortage. The electric vehicle manufacturer has said it will pivot to microcontrollers and write new firmware to navigate the issue.

“Our team has demonstrated an unparalleled ability to react quickly and mitigate disruptions to manufacturing caused by semiconductor shortages. Our electrical and firmware engineering teams remain hard at work designing, developing, and validating 19 new variants of controllers in response to ongoing semiconductor shortages,” Tesla said in its second quarter earnings letter.

“Our team has demonstrated an unparalleled ability to react quickly and mitigate disruptions to manufacturing caused by semiconductor shortages. Our electrical and firmware engineering teams remain hard at work designing, developing, and validating 19 new variants of controllers in response to ongoing semiconductor shortages” - Tesla's Q2 earnings letter

Ford has shifted the focus of its supply chain on built-to-order vehicles. The car manufacturer will allocate chips to its more profitable vehicles and orders. This will result in fewer vehicles being built but give Ford better visibility on demand. Still, the semiconductor shortage is a problem. In August, Ford was forced to stop production on Fiestas at its Cologne factory for five days due to supply issues from a chipmaker in Malaysia. The same month saw Ford stop production of its bestselling F150 pickup.

Volkswagen, whose brands include VW, Seat, Audi, and other household names, managed to mitigate the impact of the shortage by prioritizing supplies for its more profitable models.

When is the semiconductor crunch likely to turn around?

Ford said that it expects the semiconductor shortage to last until early 2022. Volkswagen has said the shortage is likely to lead to a slowdown in production over the autumn, and won’t rule out any further changes to production, according to Reuters. The German manufacturer said the situation should improve by the end of the year and would hopefully be able to make up for any shortfall. IBM and Intel both recently said that the shortage could last a couple of years still.

In the meantime, Tesla, Ford and Volkswagen’s share prices are likely to be affected by how much the shortage affects next quarter’s earnings.

“We will see worsening figures in quarter three, and then recovery in Q4,” Volkswagen’s CEO Herbert Diess told CNBC’s Squawk Box Europe in July.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy