Every day, we handpick the 5 Top Stories stock market investors need to know. In 5 minutes, you’ll learn the stocks, CEOs, and money managers moving markets.

Huang on the Future of AI

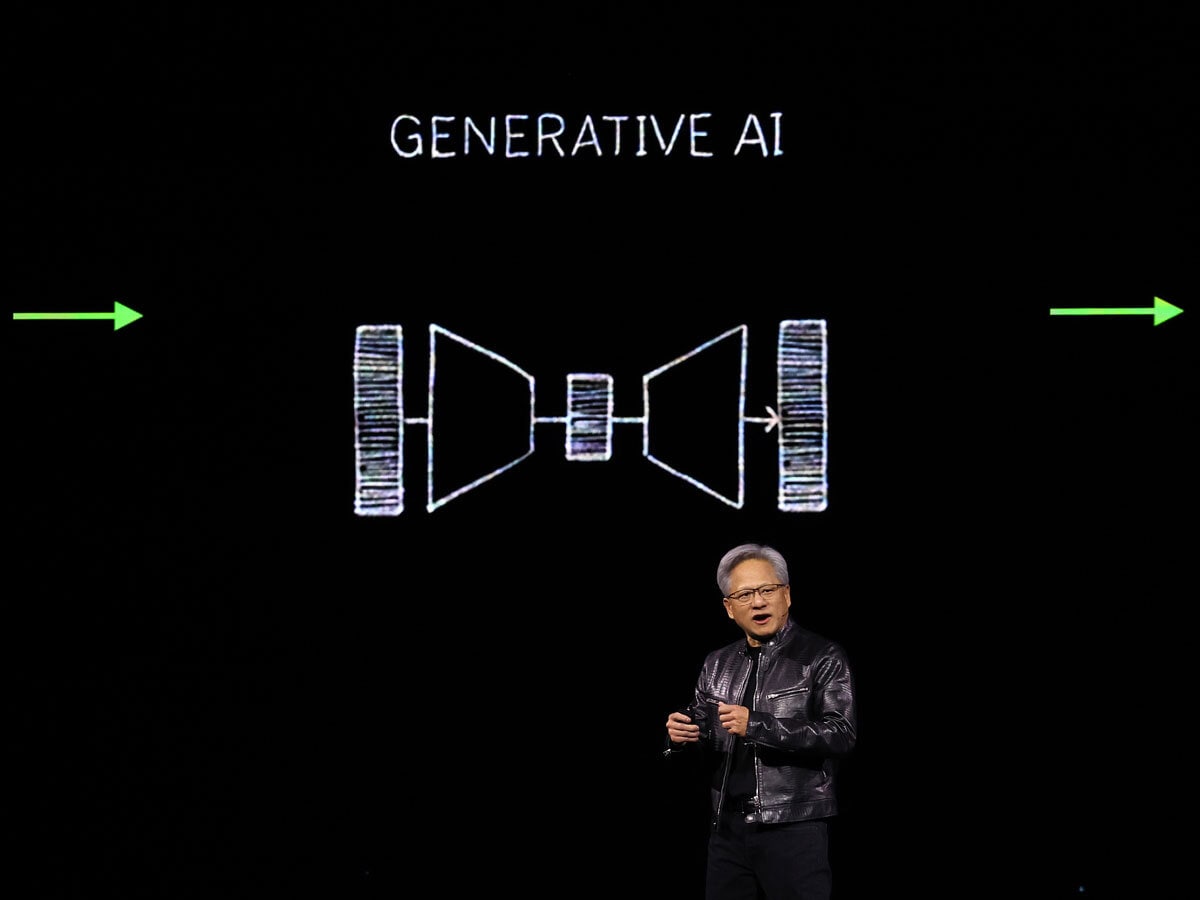

Speaking at the Goldman Sachs Communacopia and Technology Conference on Wednesday, Nvidia [NVDA] CEO Jensen Huang made a number of predictions about the imminent future of artificial intelligence (AI), including that it will expand into the world of skills, from assembly lines to call centers, and that trillions of dollars’ worth of data centers will be adapted to suit the needs of generative AI. Elsewhere, the US government is weighing whether to let Nvidia export chips to Saudi Arabia, according to Seeking Alpha.

OpenAI Looks to Double Valuation

Microsoft-backed [MSFT] OpenAI is looking to raise at least $5bn at a $150bn valuation, nearly doubling its valuation from earlier this year, according to the Financial Times. The funding round is led by Thrive Capital, which is set to invest $1bn; it aims to support OpenAI’s plans to develop AI models surpassing human intelligence. Potential investors include Apple [AAPL], Nvidia and Microsoft. The raise could ultimately exceed $6.5bn, giving OpenAI a significant edge over competitors in the AI space.

Test Flaw Exposé: Roche Stock Drops

Shares of Roche [RHHBY] fell 5% on Wednesday after Reuters reported that the promising July data for its obesity drug candidate CT-996 was based on only six participants. Roche had previously announced a 6.1% placebo-adjusted average weightloss in a Phase 1 study. However, new slides revealed that of the 25 enrolled patients, only six were part of the key group, with the second-best group of seven showing 4.6% weightloss. Meanwhile, shares of rivals Novo Nordisk [NVO] and Eli Lilly [LLY] rose in reaction to the news.

Can HPE Secure Funds to Buy Juniper?

Hewlett Packard Enterprise [HPE] talked with potential investors on Wednesday, Bloomberg reported, regarding a $9.5bn debt package to support its acquisition of Juniper Networks [JNPR]. The package includes $6.5bn in unsecured bonds with maturities ranging from five to 30 years and a $3bn term loan. JPMorgan Chase is managing the logistics, and a bond offering may follow the discussions. Additionally, HPE priced $1.35bn in preferred stock on Tuesday.

Lithium Miners Spike on CATL Suspension

Lithium miner shares were rallying Wednesday after a report that China’s CATL [300750.SZ], the world’s largest electric vehicle battery maker, may suspend some lithium mining and production activities: in a note seen by Seeking Alpha, Citi analyst Jack Shang mentioned that CATL is considering halting its lepidolite mine and one of its three lithium carbonate production lines, potentially cutting 6,000 metric tons of supply per month. Albemarle [ALB] led the S&P 500 gainers, surging 10.7%

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy