In the first part of this three part series on cannabis, Andrew Little, research analyst at Global X, considers the legalisation of cannabis across the US. This article was originally released on 20 April 2021.

Today is 20 April, a date of cultural significance in the long history of cannabis. There are many guesses as to why this is this the case, but in the context of the budding global cannabis industry, today is a day when many take stock of legalisation efforts and prune their predictions for the future.

The following is part one in three-part blog series that will take the pulse of the global cannabis industry in 2021. This part highlights and evaluates progress toward legalisation in US states. Part two will look back at how existing markets performed over the past year. Part three will discuss the possibility of federal legalisation in the US and abroad.

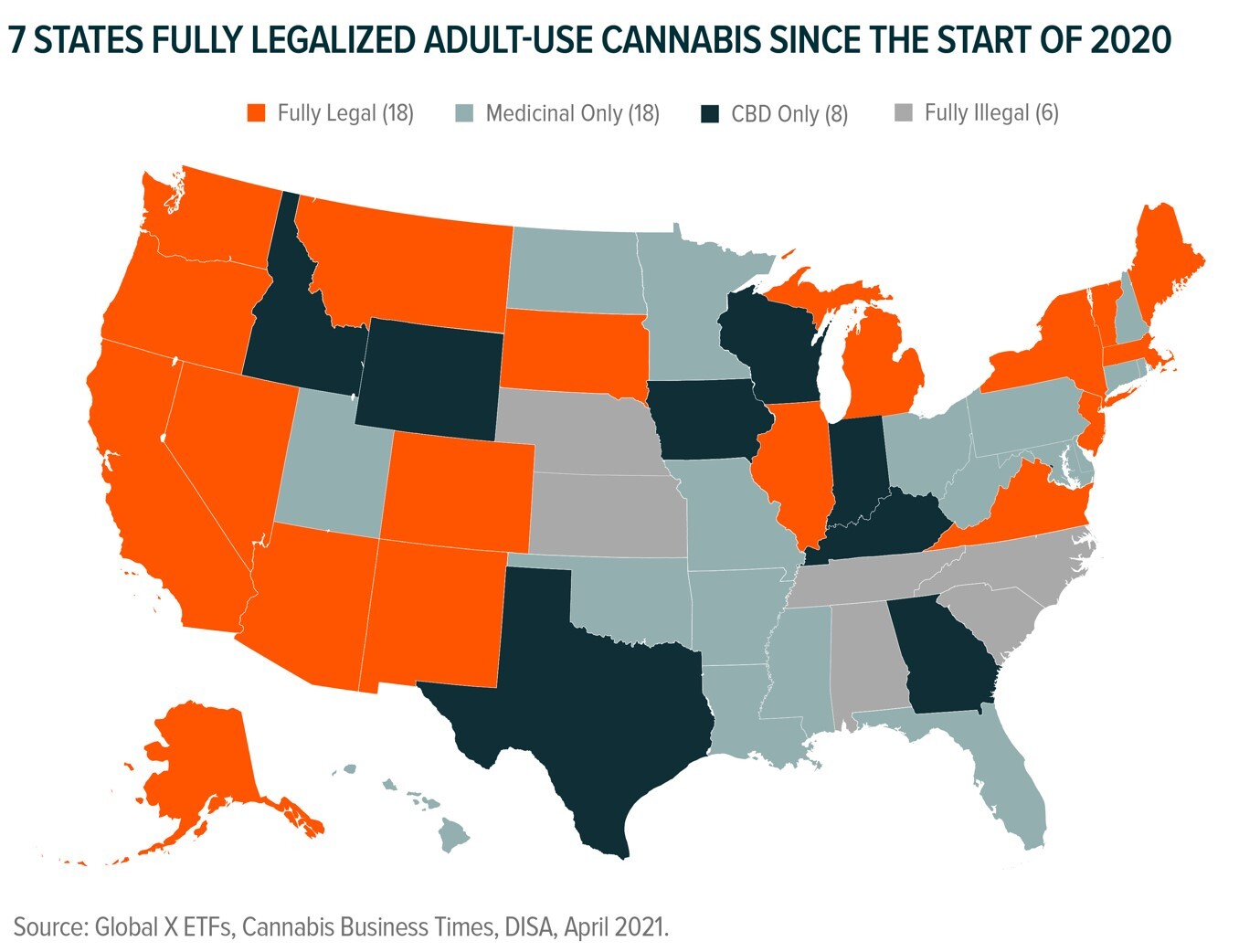

2020 was a landmark year for the state-level cannabis industry in the US and 2021 is shaping up to be one as well. Americans purchased $18.3bn of cannabis products in 2020 — 71% more than in the year prior — amid COVID-19 lockdowns and social distancing.1 And since last November, seven states have legalised recreational, or adult-use, cannabis, bringing the total to 18 plus Washington, DC, though it remains federally illegal.

We believe that the US cannabis market is at an inflection point where continued state legalisation will further accelerate sales and help cannabis companies get their footing in advance of potential federal legalisation. In the following, we will explore 2021 state-level legalisation efforts and their implications, and also provide an update on state legalisation that came from the 2020 election.

State-level legalisation efforts are accelerating in 2021

Thus far in 2021, 18 million Americans have gained access to adult-use cannabis through state-initiated legalisation in New York, Virginia, and New Mexico. Adult-use sales could roughly total more than $7bn across these states as their respective markets mature (approximation of below forecasts, see sources).

18 million

Americans with access to adult-use cannabis

New York

What happened? On 31 March 2021, New York became the fifteenth state to legalise adult-use cannabis. This comes almost seven years after the state legalised cannabis for medical use and two years after non-medical possession was decriminalised.

Some components of the legislation became active immediately, making legal: the consumption of cannabis products by individuals aged 21 and older, the possession of up to 3oz of flower or 24 grams of concentrate, and public smoking wherever tobacco use is permitted. Additionally, the bill’s signing marked the start of the state expunging non-violent cannabis-related criminal convictions.2

Other aspects will go into effect in the coming year as policymakers formulate and implement a regulatory framework. Within months, New Yorkers over 21 will be permitted to grow plants in their homes, a state regulatory body will be established, and the state’s medicinal cannabis program will expand.3 But cannabis consumers will have to wait until 2022 to purchase adult-use products in dispensaries, have products delivered to their homes, and to visit cannabis lounges.4

Projections: New York could very quickly become one of largest legal cannabis markets in the United States. Some estimate that legal and illicit cannabis sales in the state could reach $4.6bn by the end of 2023 and $5.8bn by the end of 2027.5 While regulatory clarity is still needed for proper assessment, the legal market’s share of sales could grow from 26% to 72% over this four year period, assuming New York’s rollout follows a similar path as other states’.6

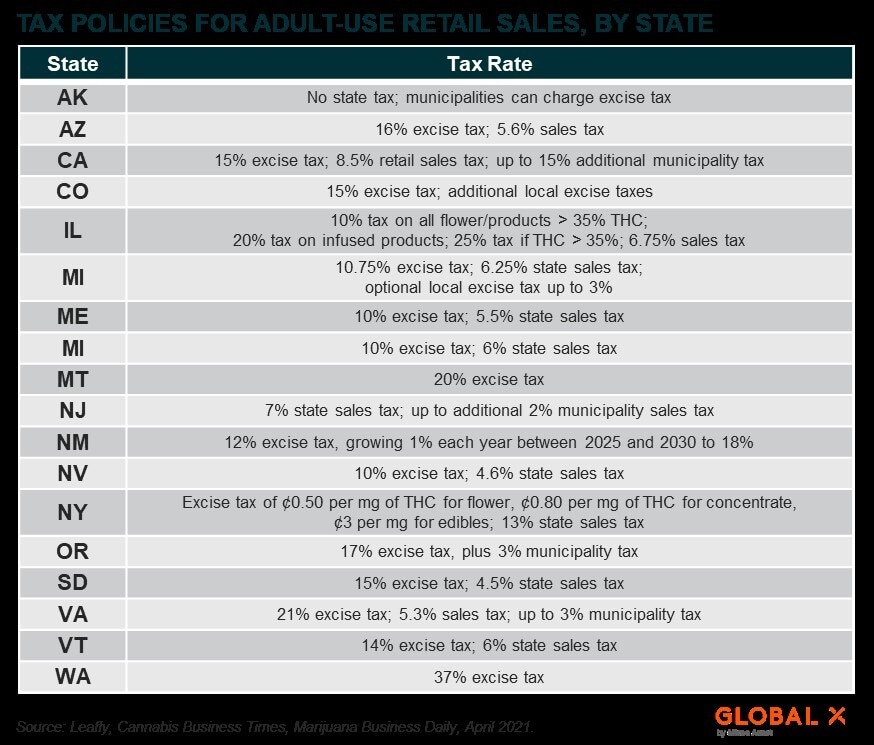

State and local revenues from sales and excise taxes could reach $350m annually based on the rates set in the legislation. Additionally, the state expects that the industry will create 30,000 to 60,000 new jobs.7

Our Take: New York’s adult-use cannabis industry will likely become a critical determinant of market dynamics in other adult-use states, and possibly at the national and global levels if supportive federal cannabis reform materialises. New York is the fourth most populous state and it ranks third in state-level GDP. This bodes well for the state purely from a consumption dollars standpoint, but more importantly, New York City is debatably the global epicentre of finance, commerce, and communication.

Proximity to these services could have a dramatic positive impact on the industry’s trajectory. For one, expanded resources could benefit companies with business in multiple states, or multi-state operators (MSOs), across all their involved markets. Non-MSOs could similarly take advantage, using these resources to scale their operations. And though federal law limits how financial services companies can work with the industry, a burgeoning New York cannabis market could push institutions to back the SAFE Banking Act legislation which could ease restrictions.

In our view, the state’s ten existing operators with medicinal licenses will see an outsized degree of success compared to MSOs and other operators who have yet to establish a presence in New York. The legislation grants existing medical licensees two licenses for adult-use stores, removing several initial barriers to entry. It also allows them to remain vertically integrated and recognise revenues from retail and wholesale channels, while new entrants must declare themselves as either retail or wholesale.8

Virginia

What happened? In April 2021, Virginia lawmakers voted to legalise adult-use cannabis by this July, making Virginia the first southern state to do so. This comes less than two years after the legislature approved a formal medicinal industry and decriminalised possession of the plant in small amounts.

Under the law, Virginians aged 21 and older will be allowed to consume cannabis products, possess up to an ounce, and grow up to four plants in their homes. Additionally, those with sentences from marijuana convictions can petition to suspend or modify them.9 Retail adult-use sales are further out — the approved legislation is targeting the first day of 2024. When this commences, the state will collect revenues from a 21% tax on adult use sales.

Projections: A November 2020 state-led impact report found that a mature adult-use market in Virginia could be worth $628m to $1.2bn annually, generating up to $274m in tax revenues per year.10 Further analysis shows that the industry could also create up to 18,000 jobs.11

Our Take: Assuming implementation follows the path paved by April’s legislation, we think it is reasonable to expect that adult-use sales and respective state revenues align with mature-market projections by 2030. Federal cannabis reform could accelerate the market’s maturation, though it is uncertain how this would materialise and what the implications of it could be.

Most significant is that Virginia is the first southern state to legalise adult-use cannabis. We expect additional southern states to follow suit, with many of them likely to first legalise medicinal cannabis.

Just last fall, Mississippi voted to legalise medicinal use cannabis, and as of April 2021 Alabama, North Carolina, Texas, Florida, and South Carolina have cannabis-related bills pending with their respective state legislatures. Obstacles to legalisation certainly exist in the region, but we think that support from constituents and interstate competition will eventually lead to positive outcomes for the cannabis industry.

New Mexico: On 12 April 2021, Michelle Grisham, governor of New Mexico, signed the Cannabis Regulation Act into law, making New Mexico the eighteenth state to legalise adult-use cannabis.

The Act legalises the purchase and possession of up to two ounces of flower, 16 grams of concentrate, and 800mg of THC-infused edibles for adults aged 21 years and older. Retail sales will likely have to wait until 2022, but in the meantime New Mexicans can grow up to six plants in their homes (12 per household).12 According to the Office of the Governor, adult-use first year sales could reach $318m, generating $20m in revenues for the state. The industry could create over 11,000 jobs as it matures.13

Notable Pending Efforts (as of 18 April 2021)

- Minnesota: House committees are currently assessing a bill to legalise the use and possession of up to 1.5 ounces of recreational cannabis. The bill has advanced through seven committees and the house could vote on it in May.14 Tim Walz, governor of Minnesota, is in favour of the plan.

- Rhode Island: The state’s senate is evaluating multiple proposals to legalise adult-use cannabis.15 Legalisation is seen as a top priority for many leading Rhode Island legislators and Dan McKee, governor of Rhode Island.

- Connecticut: A Bill to legalise and regulate adult-use cannabis passed through the state’s judiciary committee on 6 April and is likely heading the senate.16

- Delaware: The state’s House Health and Human Development Committee approved a bill to legalise and regulate adult-use cannabis on 24 March. It is currently with the House Appropriations Committee.

The 2020 state elections moved the needle on cannabis reform

Cannabis policy reform was a defining theme of the 2020 state elections.

Varying degrees of legalisation appeared on five state election ballots, with voters approving measures in each case. Arizona, New Jersey, and Montana voted to legalise cannabis for recreational use; South Dakota approved it for both recreational and medical use; and Mississippi legalised it for medical use.

New Jersey

What happened? In November 2020, New Jersey voters approved an amendment to the state constitution that legalises the use and possession of recreational cannabis for adults over age 21, as well as the cultivation, processing, and sale of retail cannabis.17

Three months later, in February 2021, Phil Murphy, governor of New Jersey, signed three cannabis reform bills into law, legalising a regulated adult-use industry and decriminalising the use and possession of up to six ounces of unregulated product.18 Sales likely won’t begin until 2022 as the state formulates a regulatory framework for retail cannabis sales.

Projections: New Jersey’s adult-use market could capture as much as $773m of sales from its existing illicit market by the end of 2022. This could grow to $1.8bn by 2025, creating 22,000 jobs in the process.19,20 The state expects to collect $126m annually from related taxes.21

Arizona

What happened? 10 years after voting to legalise medical cannabis, Arizona voters approved legislation to legalise an adult-use market. Proposition 207 permits recreational cannabis use and possession of up to one ounce of cannabis flower for adults over age 21.22The law also allows Arizonans to cultivate up to six cannabis plants in their homes.

Unlike other states, Arizona moved to implement all aspects of the law almost immediately. Retail sales began only two months later on 22 January, with sales reaching $2.9m within 10 days.23 At that point the state had granted adult-use licenses to 73 of its existing medical operators adult-use licenses.24 As of 15 March 2021, all 130 existing medical establishments were permitted to sell recreational product.25

Projections: Arizona adult-use sales could reach $300m by the end of 2021, on the back of a speedy rollout and existing infrastructure. Some projections show that this could reach between $1.3bn and $1.5bn by 2025, but much is dependent on the ability to grant new licenses.26 The law limits the number of licenses granted to adult-use only establishments to one per every 10 registered pharmacies. Based on current licensing, this would cap the number of adult-use establishments at 165-170.27

South Dakota

What happened? In November, 69% of South Dakotans voted for Measure 26, which legalises medical marijuana, and 54% approved of Amendment A, a proposal to legalise recreational cannabis in the state.28

Measure 26 calls for the Department of Health to begin reviewing applications for medical marijuana cards as well as licenses for growers and sellers by January 2021. Measure 26 is expected to activate on schedule.29 Amendment A’s future is uncertain, however. In February 2021, South Dakota’s Sixth Judicial Circuit Court ruled that it should not be ratified. This ruling is expected to be appealed to South Dakota’s Supreme Court.30

Obstacles & Implications: Amendment A is imperilled by the fact that the measure passed with a tighter margin of approval than any of the other initiatives discussed in this piece. Likewise, opponents of the legalisation efforts have not been successful in halting activation of Measure 26, the relatively more popular initiative.

In March 2021, the proposal by Kristi Noem, governor of South Dakota, to scale back Measure 26 died in the state Senate, with state senators citing the high rates of approval rates among voters as a reason not to postpone the program.31

With nearly 70% approval, Measure 26 appears politically unassailable. The legal opposition to Amendment A targets technicalities in the construction of the amendment as well as how the measure was presented to voters. Such strategies mirror past efforts to repeal voter approved legalisation efforts.

Montana: On 1 January 2021, almost two months after Montana voters approved ballot initiatives to legalise adult-use cannabis, the relevant legislation was signed into law.

Dual initiatives 190 and 118 legalise the possession, production, and commercial sale of recreational cannabis in the state of Montana. The state is currently on track to begin accepting license applications in October 2021, while recreational legal sales should commence in January 2022.32 Montana’s cannabis market is expected to generate $175m in sales and create 1,300+ new jobs by 2025.33

Mississippi: 74% of Mississippians voted to amend the state’s constitution to establish a medical marijuana program.34 As proposed, the program would be overseen by the state’s Department of Health and would allow Mississippians with one of 22 medical conditions to purchase cannabis beginning August 2021.35

However, Initiative 65 has experienced legal challenges as legislators have questioned whether the initiative unfairly favours the cannabis industry. On 14 April 2021, the Mississippi Supreme Court heard a challenge regarding the constitutionality of Initiative 65.36

A decision is expected to be delivered in May 2021. Regardless of this legal outcome, it is unlikely that Mississippi’s cannabis program will begin by the proposed August 2021 deadline.

Conclusion

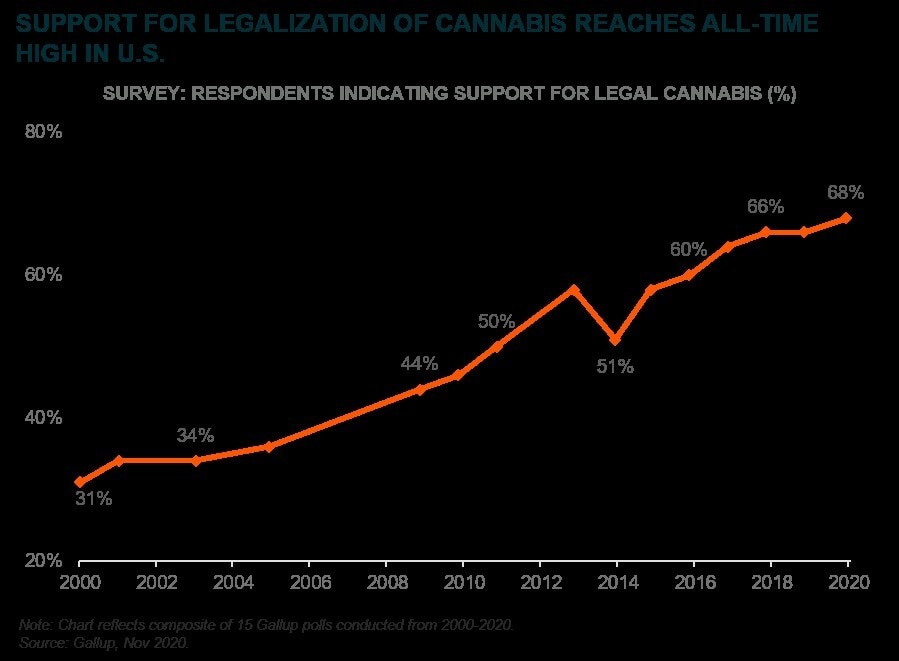

While cannabis is still illegal on the federal level, more than two thirds of the US population lives in a state where a form of legal cannabis is available for purchase and almost 70% of Americans support full legalisation.37

We believe that recent legalisation efforts are indicative of more widespread state legalisation that could accelerate the timeline for potential federal legalisation. The continued growth of existing cannabis markets and introduction of new ones should give existing cannabis companies the opportunity to scale and optimise their operations, priming the industry to benefit from any further progress.

This article was originally written and published by Global X. The article, which includes footnotes where readers can find the original source material, can be found here.

SEI Investments Distribution Co. (1 Freedom Valley Drive, Oaks, PA, 19456) is the distributor for the Global X Funds.

Check the background of SIDCO and Global X’s Registered Representatives on FINRA’s BrokerCheck

Investing involves risk, including the possible loss of principal. The investable universe of companies in which POTX may invest may be limited. The Fund invests in securities of companies engaged in Healthcare and Pharmaceutical sectors. These sectors can be affected by government regulations, expiring patents, rapid product obsolescence, and intense industry competition. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. POTX is non-diversified.

POTX’s investments are concentrated in the cannabis industry, and the Fund may be susceptible to loss due to adverse occurrences affecting this industry. The cannabis industry is a very young, fast evolving industry with increased exposure to the risks associated with changes in applicable laws (including increased regulation, other rule changes, and related federal and state enforcement activities), as well as market developments, which may cause businesses to contract or close suddenly and negatively impact the value of securities held by the Fund. Cannabis Companies are subject to various laws and regulations that may differ at the state/local, federal and international level. These laws and regulations may significantly affect a Cannabis Company’s ability to secure financing and traditional banking services, impact the market for cannabis business sales and services, and set limitations on cannabis use, production, transportation, export and storage. The possession, use and importation of marijuana remains illegal under U.S. federal law. Federal law criminalizing the use of marijuana remains enforceable notwithstanding state laws that legalize its use for medicinal and recreational purposes. This conflict creates volatility and risk for all Cannabis Companies, and any stepped-up enforcement of marijuana laws by the federal government could adversely affect the value of the Fund’s investments. Given the uncertain nature of the regulation of the cannabis industry in the United States, the Fund’s investment in certain entities could, under unique circumstances, raise issues under one or more of those laws, and any investigation or prosecution related to those investments could result in expense and losses to the Fund.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the Fund’s investment objectives, risks, and charges and expenses before investing. This and other information can be found in the Fund’s summary or full prospectuses which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Solactive AG, nor does Solactive AG make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO, Global X nor Mirae Asset Global Investments are affiliated with Solactive AG.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy