Weak consumer confidence is weighing on China’s e-commerce stocks. This major player is seeking to invest in its supply chain and logistics even as price competition hinders sales growth.Despite this, the stock could be considered heavily underpriced compared to its rivals.

JD.com [JD] is a Chinese e-commerce and tech giant headquartered in Beijing.

It was the second-largest Chinese e-commerce retailer by gross merchandise value (GMV) in 2023. Its 27.2% share of total GMV was surpassed only by Alibaba’s [BABA] 46%, according to Statista.

This stock spotlight will highlight the broader challenges e-commerce retailers in China have been experiencing as cost-conscious consumers rein in their spending. It will also discuss why JD.com’s commitment to its low-price strategy — which it first introduced at the end of 2022 —could be critical to growth, as well as the company’s investment to scale its procurement and logistics.

JD.com Considers Buyout of UK Delivery Firm for European Expansion

Reports emerged in July that JD.com is in talks about buying UK delivery firm Evri, formerly known as Hermes, which has put itself up for sale. Rival Alibaba is another potential bidder, according to Reuters.

JD.com has not commented, but a bid for Evri would not be too surprising. The two parties announced a strategic alliance at the start of the year that will enable European businesses to enter the Chinese e-commerce market. Customers in China will be able to access European brands through Evri’s pickup and warehousing in Europe.

“By integrating Evri’s extensive delivery network with our cutting-edge e-commerce and logistics solutions, JD.com is enhancing our service capabilities in Europe,” said Qun Xue, JD.com Vice President and Head of JD Logistics International.

JD.com’s Share Price

JD.com’s American depository receipt (ADR) shares are down 3.8% since the start of 2024 through August 21 and down 16.1% in the past year.

For comparison, Alibaba’s ADR shares are up 10.1% and down 1.7% in the respective periods. PDD Holdings’ [PDD] shares are down 0.3% and up 89.6%.

Want to invest in JD.com? Download the OPTO app today.

JD.com and Alibaba Report Slight Revenue Declines for Q2

JD stock has been dragged down in recent months by concerns about weak consumption in China. However, JD.com’s second quarter (Q2) earnings, reported on August 15, could help to allay investors’ fears, even if temporarily.

Revenue rose marginally, up 1.2% to RMB286.77bn for the three months to the end of June. However, operating margin rose from 2.9% to 3.6%, while net income jumped 92% to RMB12.6bn. JD.com CEO Sandy Ran Xu attributed the growth to "growing economies of scale and procurement efficiencies”.

Chief Financial Officer Ian Su Shan added that the company had “continued to enhance price competitiveness during the promotional season through our supply chain and disciplined approach, as opposed to reliance on subsidies”.

Alibaba, which also reported on August 15, saw revenue for its China commerce retail business fall 1% to RMB113.37bn, although it did report double-digit growth in the gross merchandise value for its Taobao and Tmall platforms. PDD, parent of the discount marketplace Temu as well as Chinese ecommerce platform Pinduoduo, reports Q2 earnings later in August, but revenue surged 131% in Q1.

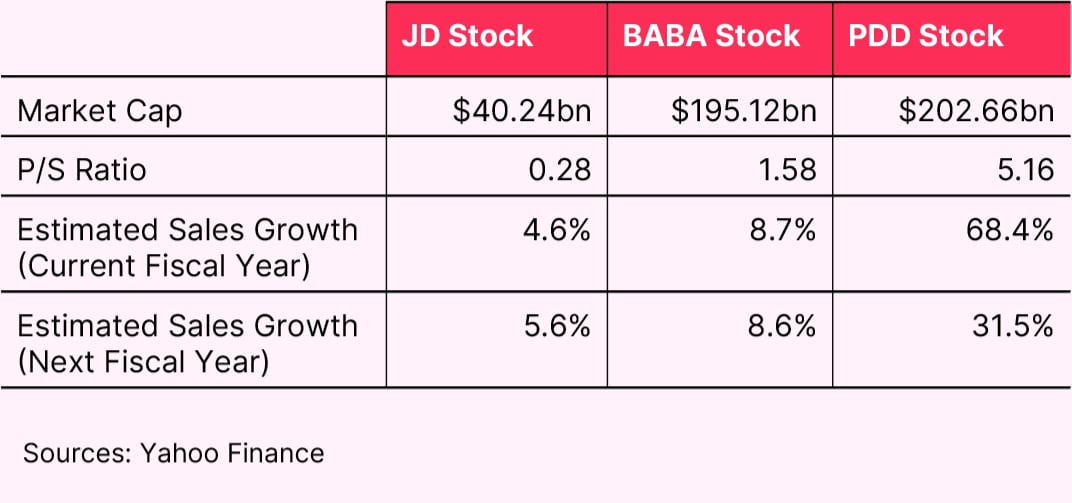

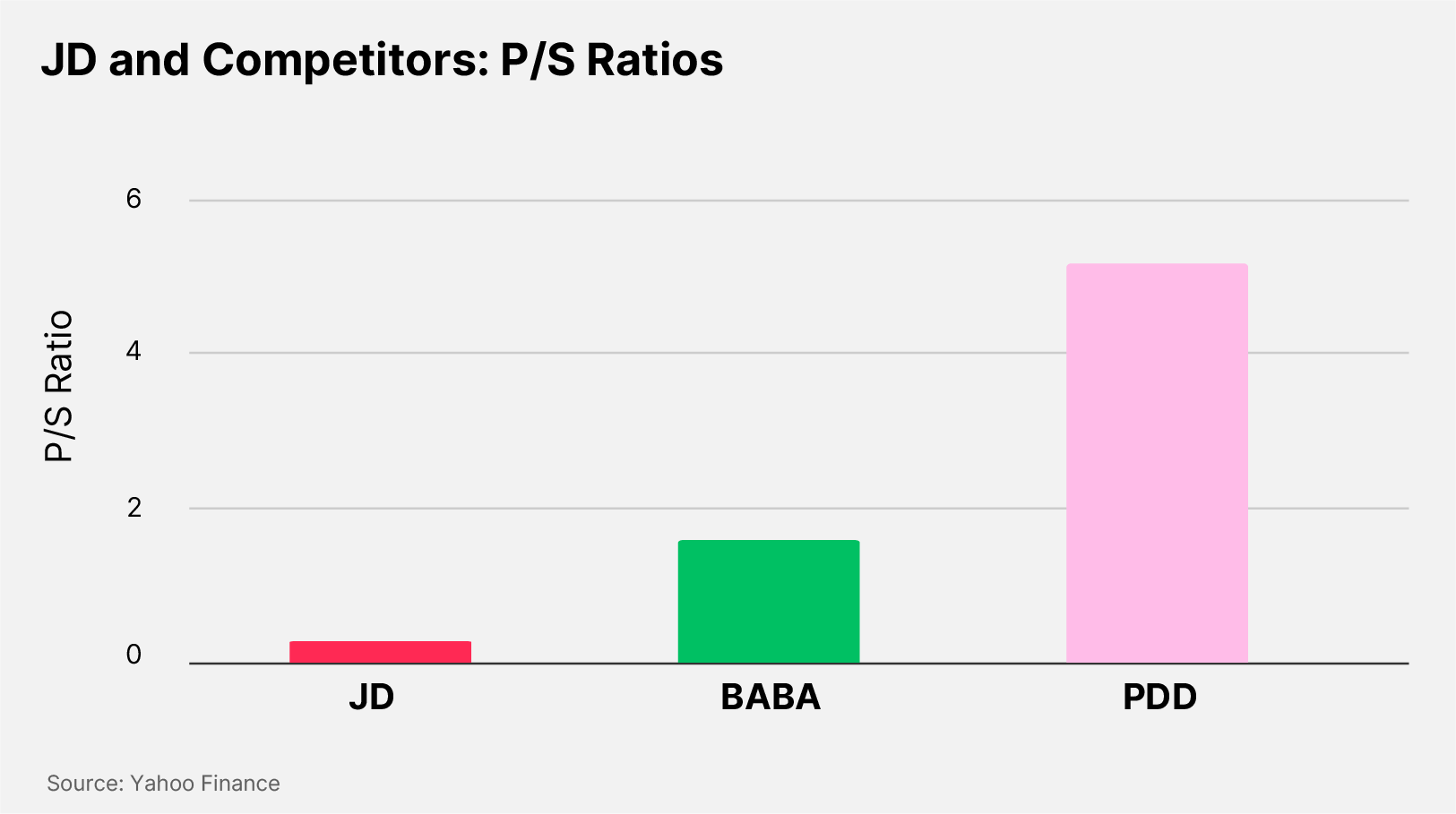

JD.com stock may have the lowest projected revenue growth of the three companies, but the outlook for the next fiscal year could potentially change if consumer confidence were to rise.

Even if it does not, JD.com stock could still be considered undervalued given how low its price-to-sales ratio is compared to its competitors.

JD.com Stock: The Investment Case

The Bull Case for JD.com

In a bid to drive growth, JD.com has been phasing out low-margin products from businesses that sell to consumers directly. Instead, third-party merchants are selling these products through their platforms.

The company has also invested in its supply chain and logistics. JD.com noted on its Q2 earnings call that it has made “solid progress on programs including free shipping, free doorstep pickup for return, cashback for delayed shipping.”

“We will continue to invest in user experience as we believe it will translate to stronger user mindshare and user engagement, which are fundamental to drive sustainable growth,” said Xu.

The Bear Case for JD.com

Discounted products and price cuts have become an increasingly important sales tactic for JD.com as shoppers in China have reined in their spending. "Low price is a result of our core capabilities … This will continue to distinguish us in the e-commerce industry,” said Xu on the Q2 earnings call.

However, as e-commerce competition in China grows, one of the key battlegrounds is expected to be budget consumers. According to the South China Morning Post, JD.com is overhauling its budget shopping platform Jingxi to capture more of the low-budget market.

It remains to be seen whether JD.com would be able to successfully challenge PDD. A focus on cheap, unbranded products has seen Pinduoduo become the third-most popular e-commerce platform in China, behind Taobao and ByteDance’s Douyin, while JD.com is fifth.

Conclusion

Despite weak consumer confidence in China, JD.com’s investment in its supply chain and logistics could help it to lure more customers and maintain growth.

Plans to double down on its low-price strategy could help it gain market share from Pinduoduo, but competition will be fierce.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy