“It’s probably going to be a negative year,” Michael Gayed, Founder of the Lead-Lag Report, told OPTO Sessions recently.

“I think probably the forward-looking returns for the US markets are not going to be that phenomenal.”

He adds: “I’m pretty sure the January barometer — how the market behaves in the first five trading days, which is a fairly good predictor of year-end returns — would suggest that.”

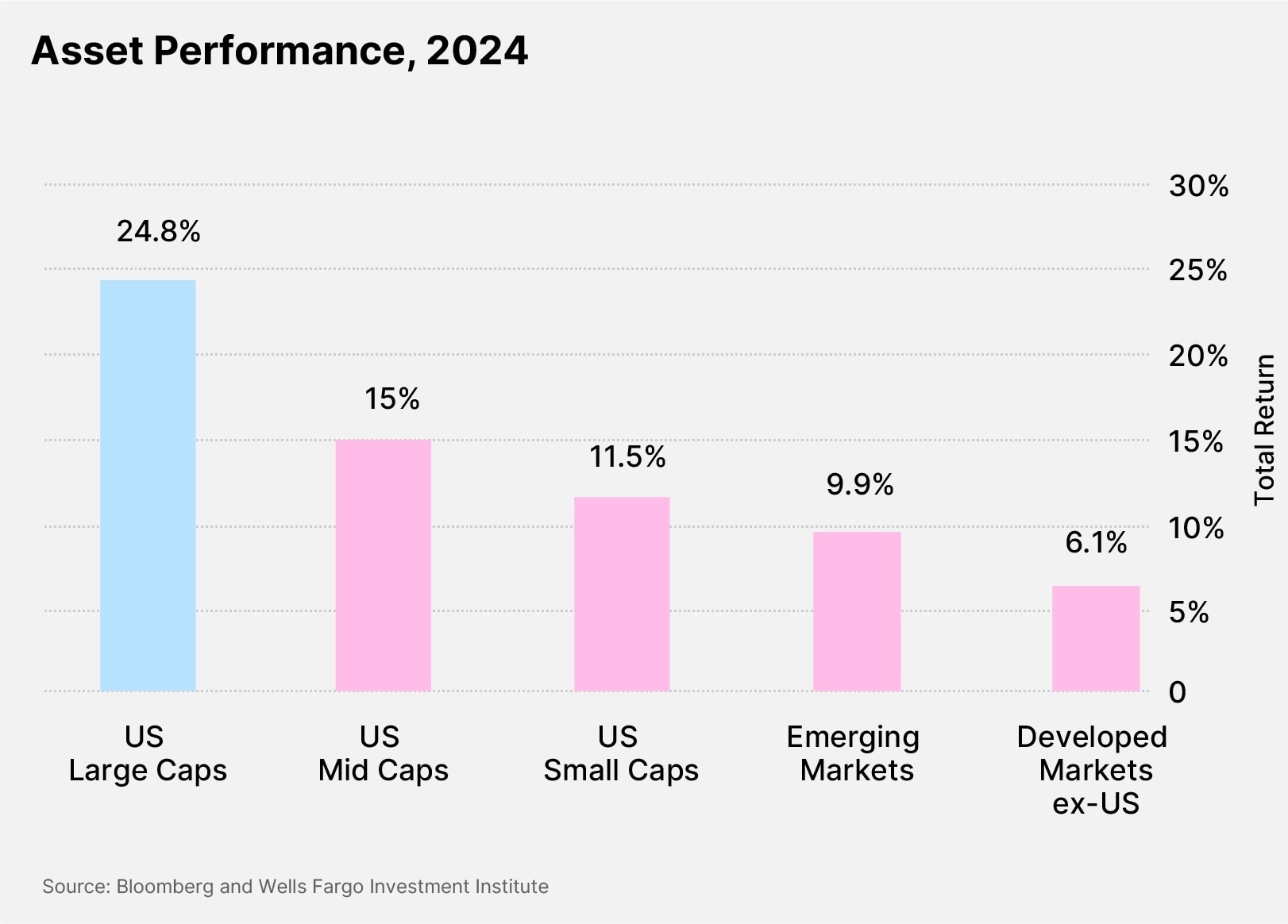

When it comes to his predictions, “I would bet that, probably this year, small caps do outperform large caps.”

And his hot take on the current picture? “The artificial intelligence (AI) mania, in hindsight, will mark the blow-off top of large-cap tech dominance.”

From then on in, Gayed believes we will see a correction to the investment landscape.

“Tech has been dominating since 2011. Large caps have been outperforming small caps. The US has been outperforming internationally since 2008, but a large part of that is because the US has tech, and international does not. Growth has been outperforming value because growth has tech, value does not.”

He says: “I think we are probably due for that to finally change.”

Gayed offers an extra caveat regarding small caps.

“Notice I’m using the term ‘outperform’, not ‘go up’. Small caps, for example, historically more often than not outperform, not by being up more than the S&P, but by being down less.”

A Trump Recession?

There’s been a wave of market optimism related to Trump-onomics. As well as widely discussed trade tariffs and de-regulation, tax cuts and reducing government spending could be on the president’s agenda. Will this be positive or negative for markets over the next 12 months?

“I think it’s positive. I just don’t know if it’s as positive as the market narrative would have you believe,” cautions Gayed. “Clearly, under the first Trump administration the markets did well. But that was also one race.”

“It’s not a function of me thinking Trump would disappoint. I just think the magnitude is either largely priced in and the likelihood of disappointment is probably a lot higher than people think.”

People have short memories, says Gayed: “They have suddenly forgotten there are lags in terms of when the recession typically hits following an un-inversion of the yield curve. It’s like nobody wants to believe you can have a recession in 2025 … For all we know, it could be the case we do have a recession finally, even under Trump.”

However, “it would probably be a good thing for Trump if markets were to break down heavily early in his term, or relative to when the midterms are, because ‘recency bias’ is what causes people to vote.”

Volatile Times Ahead

What about inflation and the Federal Reserve’s rate-cutting strategy, as it repeatedly tries to dodge a downturn — how might this play out? Even they do not seem to know what’s going on, according to Gayed.

“It seems weird to me because they went from being reactive to now proactive. They would typically respond to a crisis after the crisis already started.

“Now they are trying to be proactive by saying, we allude to the idea that Trump’s policies are going to be inflationary and they’d have to raise rates because of that. Since when are they trying to actually anticipate the future?”

So what can we really bet on going forward?

“I know it’s a cliche to say it’s going to be volatile, but I think that probably is the most accurate statement. But volatility will bring with it opportunities.”

That said, a new generation of investors could be disappointed. “You’ve had so many newer traders come into markets post-Covid, and it’s a younger generation… they feel like they’re entitled to 20% annualized returns. Newsflash: you’re not entitled to anything.”

Things could shake up in global markets, too. “I have gone on record saying — which is a very unpopular opinion — that I would bet in the next four years, China’s stock market outperforms the US stock market,” says Gayed.

“It’s like the ultimate contrarian trade under a Trump administration: China’s stock market outperforms the US. You can’t write a better contrarian trade than that.”

Listen on Apple Podcast, Spotify, or watch on Youtube.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy