Rapidly adopted digital payments infrastructure has transformed India’s economy over the past decade. Kevin T. Carter, Founder and Chief Investment Officer of EMQQ Global, discusses with OPTO Sessions the companies and technological innovations that are driving this change.

One of the main factors driving India’s digital growth is its population.

Since April, the country has had the world’s largest population, comparable only to China’s in scale. However, its proportion of young, digitally native consumers is unmatched: more than half of its population is below the age of 30.

Unlike its population, India’s technology sector is old — “older than me”, says Carter. He mentions that companies such as Infosys [INFY], Tata [TCS:NS] and Wipro [WIT] have been publicly listed for decades.

The country’s digital public infrastructure — the “India stack”, as it’s known — is the icing on the cake for Carter. The stack is, he says, “a series of programmes that work together and serve as a digital platform for the whole country”.

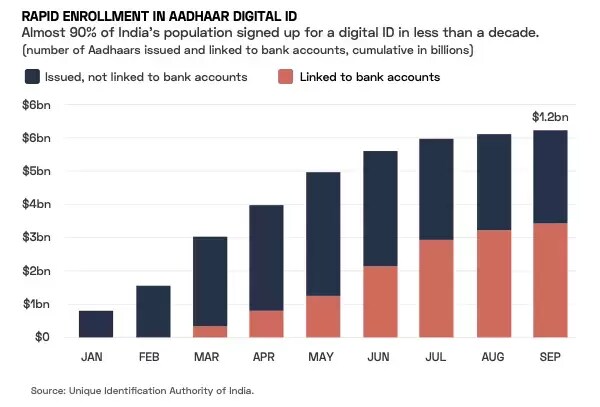

At the base of the system is Aadhaar, a biometric ID database that saw 1.2 billion Indians — almost 90% of the adult population — sign up (voluntarily) for a digital ID in less than a decade.

Approximately half of these linked their ID to a digital bank account; at the scheme’s outset, just one in three Indian adults had a bank account, according to the IMF.

The next layer on top of this is the Unified Payments Interface (UPI), which allows unlimited free transfers between any two Aadhaar bank accounts.

The other “big bang moment” for India’s digital infrastructure came in 2016, when Reliance Industries [RELIANCE:NS] invested over $25bn in rolling out India’s first 4G infrastructure network via its subsidiary, Jio Global.

Aiming to sign up 100 million users in the first year, Jio sped up the process of customer verification by layering their in-store system over Aadhaar. “When you walked into a Jio store, you could get a new phone in five minutes just by putting your fingers down and looking into the camera.” According to Carter, the 100 million target was achieved in just four months.

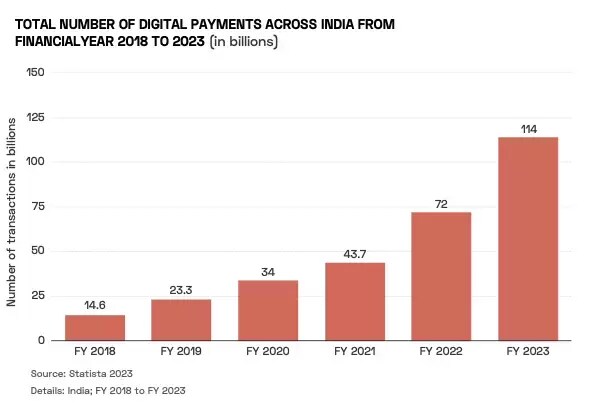

The impact has been extraordinary. As of September, over 10 billion transfers per month take place on the UPI.

This has seen India’s economy go from being predominantly cash-based and largely unbanked to majority digital in less than a decade.

Hyper-Pure Plays

Besides large companies like Reliance, Carter highlights Zomato [ZOMATO:NS], which he calls “the DoorDash [DASH] of India”.

Compared to the US, India’s restaurant sector is relatively immature. Because of this, “Zomato has a chance to basically help develop the entire industry,” says Carter. One of the opportunities that this presents to Zomato is to partner with the providers of food ingredients to restaurants, adding a B2B layer to its business. In Zomato’s most recent earnings report, its B2B segment Hyperpure increased revenue 126% year-over-year.

Carter is also positive about Info Edge [NAUKRI:NS]. “In addition to serving as a classifieds online marketplace — similar to Craigslist but with a focus on jobs — it’s also an investor in Zomato and in PolicyBazaar [POLICYBZR:NS]”, an online insurance marketplace — “the Geico of India”.

He also discusses online payments platform Paytm [PAYTM:NS], which he had shown in presentations to investors for years before its IPO, as an example of potential Indian unicorns. However, the development of the UPI had made him doubt Paytm’s prospects: how would it make money if online transactions were free?

“Well, they’ve become the banker to the 13 million Kirana store owners.”

Kirana stores are small, independent shops selling everyday items and groceries across India. “When you go around India, you’ll see that Paytm QR codes are everywhere… Now, they’re making loans and providing working capital loans to the store owner.”

Creditable Growth Prospects

According to Carter, estimates put India’s annual growth in the coming decades in the 6–6.5% range.

“But I am of the belief that India’s economic growth could actually be faster than the current predictions,” he says. “A lot of that has to do with the value of this digital public infrastructure, especially when we start talking about the introduction of a consumer credit market that's widespread and that will rely on the Aadhaar and the stack.

“I've seen economists projecting that robust consumer credit growth could add two or three full percentage points to the GDP growth — I wouldn’t be surprised if India grew at 6–8%.”

According to S&P Global, India reported GDP growth of 7.8% for the second quarter of this year.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy