Michael Kantrowitz, chief investment strategist at Piper Sandler, saw it coming. Just over a year since the Fed started hiking interest rates, real estate is beginning to feel the impacts. With $1.5trn of debt maturing by 2026, the sector could face a liquidity crisis that could in turn spark further turmoil in regional banks.

LISTEN TO THE INTERVIEW:

- Commercial real estate faces $1.5trn debt maturing before 2026.

- Property values are falling, while interest rates are rising, making refinancing difficult.

- Regional banks currently provide 27% of sector financing, stoking concerns that a crisis is developing.

There is “anywhere between a 15-month and a two-year lag” between central banks raising interest rates and their impacts becoming visible in housing markets, explained Michael Kantrowitz, chief investment strategist at Piper Sandler, on last week’s episode of Opto Sessions.

In the episode, he walked through his firm’s HOPE framework, which lays out a sequence of waypoints — housing, orders, profits, and employment — through which the economy is impacted by cycles of tightening and loosening.

Just over a year since the Fed first started to raise interest rates, the effects of these are beginning to be felt. However, given the persistent increase in remote working in the post-Covid era, the biggest risk may lie in commercial real estate (CRE), as opposed to the housing market.

The shift has already impacted commercial property values, and could continue to do so. A report by Cushman & Wakefield predicts office vacancies will increase by 55% to a total of 18% by 2030. Meanwhile, analysts at Morgan Stanley [MS] believe that commercial property prices could fall as much as 40%, while $1.5trn of real estate debt comes due before the end of 2025.

A reckoning on the horizon

With property prices slumping, who will finance the sector, especially at a time when its biggest lenders face their own challenges from elevated interest rates?

“Our goal is not to find the next default,” said Kantrowitz. However, “there’s plenty of data that’s suggesting CRE is going to get hit.”

The rapid increase in interest rates over the past year is making default more likely. Commercial property investors refinancing this year will be forced to do so at rates that were, in all likelihood, not expected when they first took out their loans.

The HOPE framework isn’t geared towards identifying systemic risks of the type that CRE currently faces, as it reads residential, as opposed to commercial, market indicators.

However, the strains facing CRE are directly related to the Fed’s cycle of economic tightening: high interest rates have caused the challenges that real estate borrowers will soon face in refinancing, with concurrent tension in the regional banking sector exacerbating it.

Regional banks’ CRE exposure

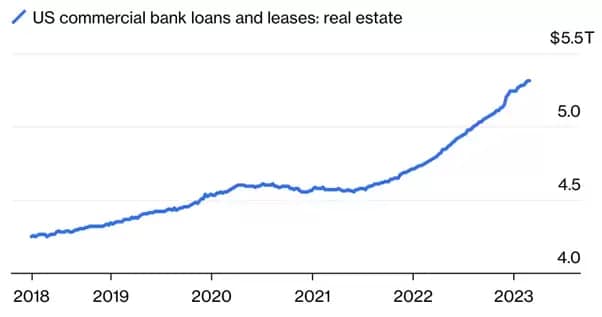

Since the onset of the pandemic, banks have ramped up their exposure to CRE sector debt.

The 11.2% increase in banks’ exposure to real estate in 2022 equalled the combined increase over the past four years, and was the largest amount in a single year since 2006, according to Bloomberg.

Regional banks’ share of financing into the CRE sector rose from 17% in 2017 to 27% in 2022, making it the largest source of funding for the sector.

As Tracy Alloway told Bloomberg’s Odd Lots podcast, this prompts two interlinked concerns. The first is that the regional banks may find themselves lumbered with bad debt in the event that their real estate debtors default. The second is that the sector is starved of capital, as regional banks, already under stress, are unable to keep lending into it.

Furthermore, as played out directly with Silicon Valley Bank, increased rates will require regional banks to write down the value of many of the assets on their balance sheets. “In a rising interest rate environment,” Jim Costello, chief economist of real assets at MSCI, told Odd Lots, “the asset value [of mortgage-backed securities] needs to be written down.”

The problem is not confined to the US. Europe’s CRE market is backed by €1.5trn of debt, with approximately €310bn of new or replacement borrowing issued each year to keep the market moving. Cracks are already beginning to appear. For example, IGIS Asset Management, the South Korean owners of Trianon, a 45-storey skyscraper in Frankfurt, have recently hired advisors to help restructure €375m of debt secured against the property.

The HOPE framework and employment

The HOPE framework implies that worse may yet be to come. While real estate markets are just starting to feel the impact of higher rates, it could take longer for them to impact employment figures.

US unemployment rates have so far stayed stubbornly low, reducing the chance of the Fed reversing its trajectory in the near future. The fall in employment figures that Powell and his colleagues are waiting for will, however, amplify the problems in CRE, according to Kantrowitz.

“When employment starts to deteriorate,” he said, “for obvious reasons, consumers lose their ability to consume.” This will exacerbate the challenges that are beginning to appear for the CRE sector: “as people lose jobs, that creates an even bigger problem for those buildings” — in particular, the businesses renting them and their ability to pay landlords and creditors.

Property owners will have three options if faced with default, according to Costello. Cash-in refinancing, where they put more of their own capital on the table; bringing in extra equity from new investors; or, most worryingly, strategically defaulting on the property.

For more ways to listen:

Listen to the full interview and explore our past episodes on Opto Sessions. You can also check out all our episodes via our YouTube Channel.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy