For Qualcomm [QCOM] shareholders, the past three weeks might have felt like it’s 1999 again. Following the resolution of a long-running legal feud with Apple, news on 16 April that the chipmaker had won a cash payout and a multi-year supply and licensing agreement from the tech firm sent Qualcomm’s stock up 38% in a matter of hours, from $58 late last Tuesday afternoon to over $80 at Friday open.

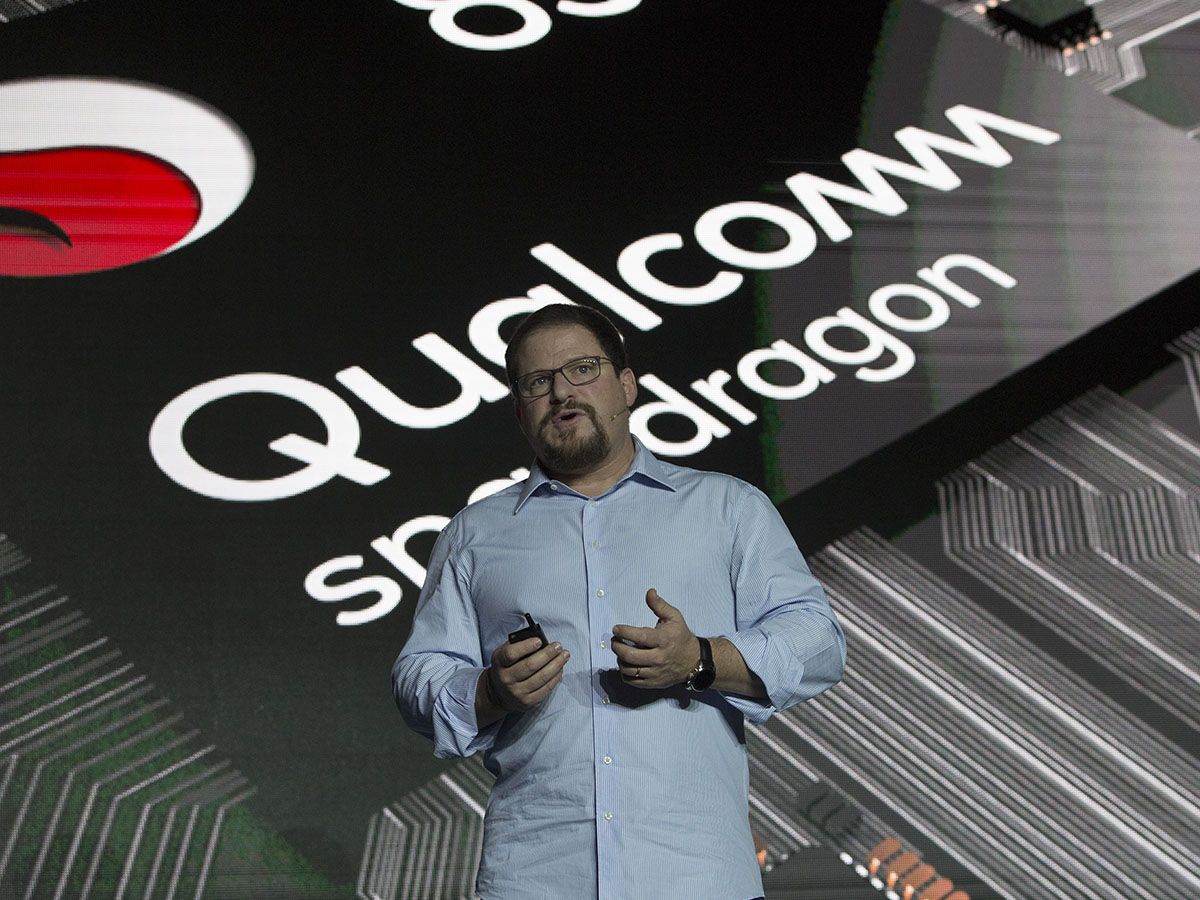

Shares have kept growing ever since, and on release of the company’s Q2 earnings on 1 May, Qualcomm chief executive Steve Mollenkopf revealed the one-off payment from Apple would be a whopping $4.5bn-$4.7bn. The cash injection compensated for a year-on-year decrease in revenues and earnings, and was enough to push QCOM to above $89, a height it had not reached since the dot-com bubble.

The Apple breakthrough heralds a new era for Qualcomm, whose stock, according to Bernstein analysts, had hitherto “broadly been viewed as virtually uninvestible” due to the legal overhang on its royalty-heavy business model. Now that the Apple dispute has been resolved – sending a message to plaintiffs in similar litigations with the chipmaker, including Huawei – Mollenkopf and colleagues see an opportunity not just to grow market share in the supply chain for Apple’s iPhone, but also to take advantage of the 5G emerging market – both among phone makers and beyond.

Apple pipelines

Mollenkopf specified during last week’s earnings call that the $4.5bn payment would be recorded as a special item in Q3, and consequently expunged from adjusted figures, which form the baseline for quarterly comparisons. Asked by analysts what the capital could be used for, the CEO didn’t give any specifics, but said the share buyback programme – which still holds $7.8bn – had “been a strong programme for us”.

The board’s attention was focused on the supply and licensing agreement with Apple. Those two elements alone will increase EPS by around $2, according to the company; to compare, diluted EPS was $0.77 during the last quarter.

| Market cap | $103.58bn |

| PE ratio (TTM) | 44.98 |

| EPS (TTM) | 1.89 |

| Operating Margin (TTM) | 23.68% |

Qualcomm stock vitals, Yahoo finance, 08 May 2019

There is also a less immediately tangible opportunity at Apple: to grow Qualcomm’s role beyond a modem supplier for iPhones. “There’s a lot of tension removed out of the system as a result of these settlements,” said Mollenkopf. “I really like the opportunity to have the two teams [Apple’s and Qualcomm’s] just working together on products in the future, [in] much more natural relationships.”

“I really like the opportunity to have the two teams [Apple’s and Qualcomm’s] just working together on products in the future, [in] much more natural relationships.” - Chief executive Steve Mollenkopf

The Apple win also has the potential to breathe new life into sales volumes at Qualcomm, which have recently been poor due to weak demand in China. The company has cut forecast by 50m units for the full year.

Opportunities of 5G

Beyond Apple, 5G is where Qualcomm’s big bet lies. The company said it had won 75 design contracts for 5G chips – more than double the number announced in January. President Cristiano Ramon expects all “developed economies” to have a 5G launch this year, adding that the advent of the new standard for mobile data “will be a very material event in [Qualcomm’s] fiscal 2020”.

While the focus of analysts’ and management’s attention remains on phones, Qualcomm has been creating hype for what it calls “adjacencies” – markets other than smartphones. Much like rival Intel [INTL], Qualcomm wants to use 5G as its route into the industrial internet of things (IoT) and connected cars.

“We see 5G as an opportunity … to really leverage some of the R&D scale that we have in mobile,” said Mollenkopf. That could be an understatement: Stifel called the company “the clear leader” in 5G, while Morgan Stanley’s James Faucette wrote recently: “Qualcomm enjoys a range of underappreciated options outside handsets that have the potential, in the long run, to make Qualcomm perhaps the largest semiconductor company in the world.”

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy