Besides greening-up and diversifying its North American operations, Anglo-Australian miner Rio Tinto has had a corporate fracas with minority shareholders in an Australian subsidiary that has seen it hold firm in respecting indigenous rights.

The Anglo-Australian multinational mining company Rio Tinto [RIO.L] released its third quarter results on 11 October, reporting a 1% drop in iron ore shipments for the quarter. It attributed the drop to global inflation weighing on demand, as well as a sluggish realty market in China, where it sends the majority of its metals.

While the Rio Tinto share price dropped 1.5% on the day it released the results, it has up marginally up in the year so far. The share price of the mining giant has climbed 2.4% in 2022 to 4,748p, outperforming the FTSE 100 index, which has dropped 6.1% over the same period.

As the second-largest metal and mining establishment in the world, investors will have confidence in its ability to withstand current headwinds. The company is also taking steps to reduce its carbon output and diversify its portfolio, providing hope that the company can develop its immunity to any recession risks that may lay ahead.

Green investments

Earlier this month, Rio Tinto entered into an agreement with the Canadian government to invest C$737m over the next eight years in an effort to reduce carbon output at its Rio Tinto Fer et Titane (RTFT) site by up to 70%, while diversifying Rio Tinto’s portfolio into critical materials for electric vehicles (EVs), 3D printing and aerospace.

A plant is currently under construction at RTFT and is slated to begin operating in the first half of 2023. The demonstration plant will have a capacity of 40,000 tonnes per year of ilmenite ore and could reduce RTFT’s carbon output by 670,000 tCO2e per year.

The moves form part of a trend away from an over-reliance on Chinese production in global supply chains, where Rio Tinto currently earns over half its revenue, and towards a revival of what Canada’s Minister of Innovation François-Philippe Champagne has called “a revival of manufacturing in North America.”

Meanwhile, Rio Tinto recently entered an agreement with Scania to pursue joint R&D towards more agile autonomous haul trucks for its Channar mine in Pilbara, Western Australia. Building on an existing long-term collaboration, the partnership hopes to unlock “environmental and productivity benefits” and support Rio Tinto’s long-term move towards electric-powered haulage vehicles.

Energy Resources Australia dispute

Elsewhere in Australia, however, Rio Tinto has been embroiled in a dispute with minority shareholders in Energy Resources Australia (ERA), the owner of the Jabiluka and Ranger uranium deposits at Kakadu in Northern Territory.

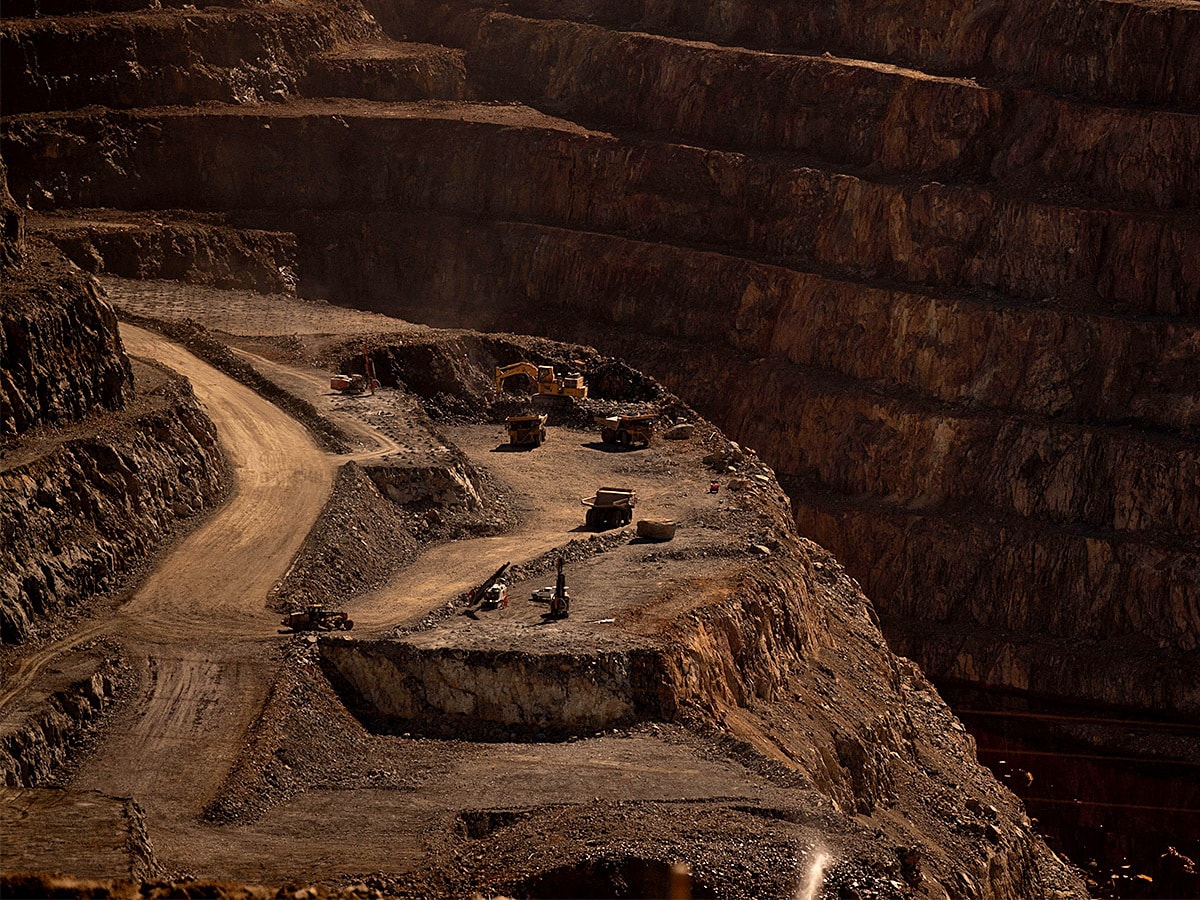

Rio Tinto owns 86% of ERA and is seeking to raise $2.2bn for a long-overdue cleanup and rehabilitation of the Ranger open-cut mine. Despite Rio Tinto being the majority shareholder, ERA is run by an independent board committee (IBC), chaired by Peter Mansell.

On 3 October, Rio Tinto called for Mansell to resign “to allow for board renewal and introduce new perspectives to address the material cost and schedule overruns” of the cleanup.

The Mirrar people, on whose lands the site lies, are vehemently opposed to any continuation of mining at the site, and Rio Tinto has previously indicated it will respect their wishes.

However, resistance from the board of the ERA led Rio Tinto to call for Mansell’s resignation, which will take place once an interim funding solution for the company has been established. The Rio Tino share price gained 0.9% on 3 October following news of the dispute.

Analysts rate stock a ‘hold’

Analysts are split on Rio Tinto. Among the 25 polled by the Financial Times, four rate the stock a ‘buy’, five say it will ‘outperform’, 12 call it a ‘hold’, three an ‘underperform’ while one advises to ‘sell’.

The 22 analysts offering 12-month price targets yielded a median target of 5,616.59p, an upside of 18.3% on its recent close of 4,748p. The high target of 9,275.60p would see its share price rising by 95.4% over the coming year, while the low target of 3,851.58p would be a drop of 18.9% for the stock, indicating a wide range of views about Rio Tinto’s future prospects.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy