The crypto business is in the spotlight as Sam Bankman-Fried’s fraud trial gets under way in the US.

This time last year, the FTX founder was thriving, running the world’s second-largest cryptocurrency exchange and networking with high-profile Wall Street bankers.

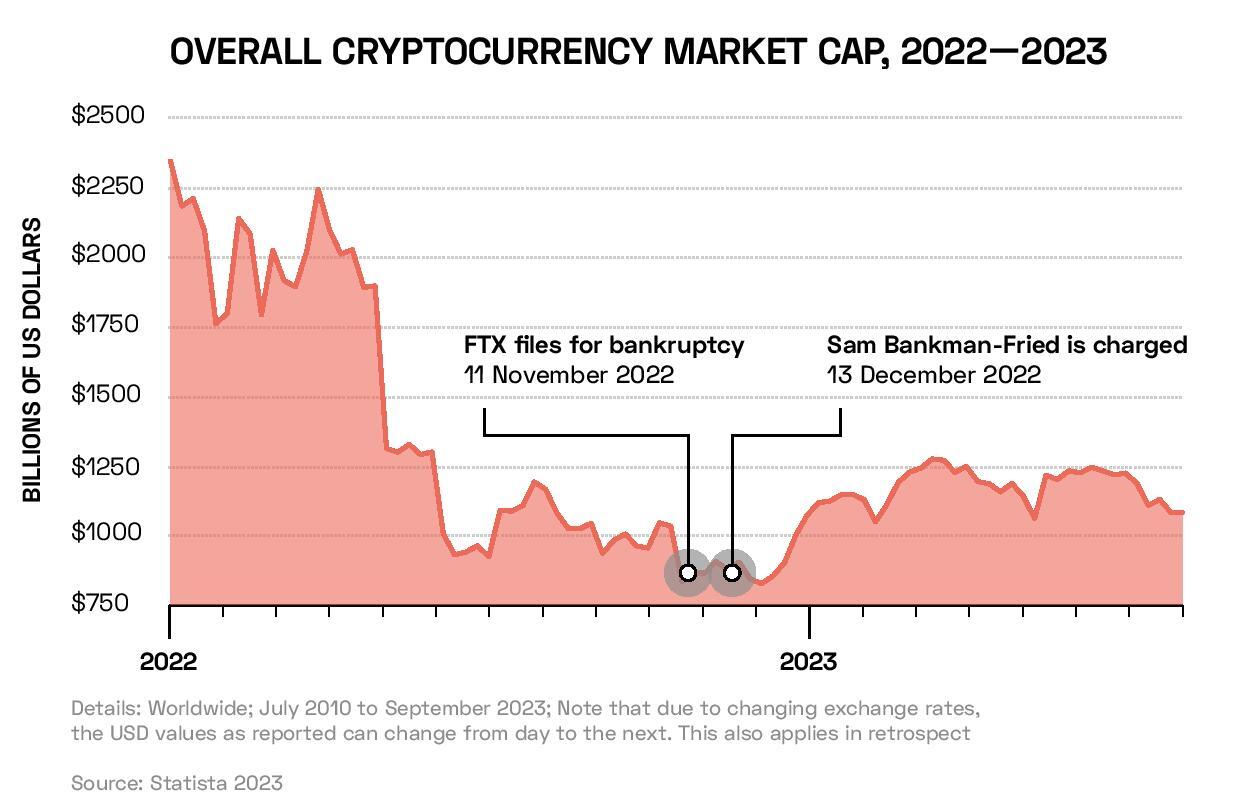

Just a month later, however, FTX collapsed, wiping off 94% of Bankman-Fried’s net worth in the process. Meanwhile, investors scrambled to recover over $1bn in funds that had seemingly gone missing.

One of those caught up in the controversy was Anthony Scaramucci, the founder of hedge fund Skybridge Capital and one-time communications director for former president Donald Trump.

“Sam broke my heart,” Scaramucci tells us on this week’s episode of Opto Sessions. “I thought he was the Mark Zuckerberg of crypto, the revolutionary. It is very sad.”

Entrepreneurial Ties

Scaramucci’s relationship with Sam Bankman-Fried dates back to 2021, when the entrepreneurs purchased stakes in each other’s firms.

According to Bloomberg, Scaramucci’s hedge fund purchased equity in FTX over a number of transactions, with the last taking place in August 2022. Bankman-Fried, meanwhile, paid $45m for a 30% stake in SkyBridge in September 2022, with the stipulation that the majority of this money be put towards crypto investments.

According to Bloomberg, November 2022 — the month that FTX declared bankruptcy — was the worst of the year for SkyBridge. Over the course of 2022 the firm lost 39% in its biggest fund. Following FTX’s collapse, SkyBridge has limited the amount that clients can withdraw from its funds.

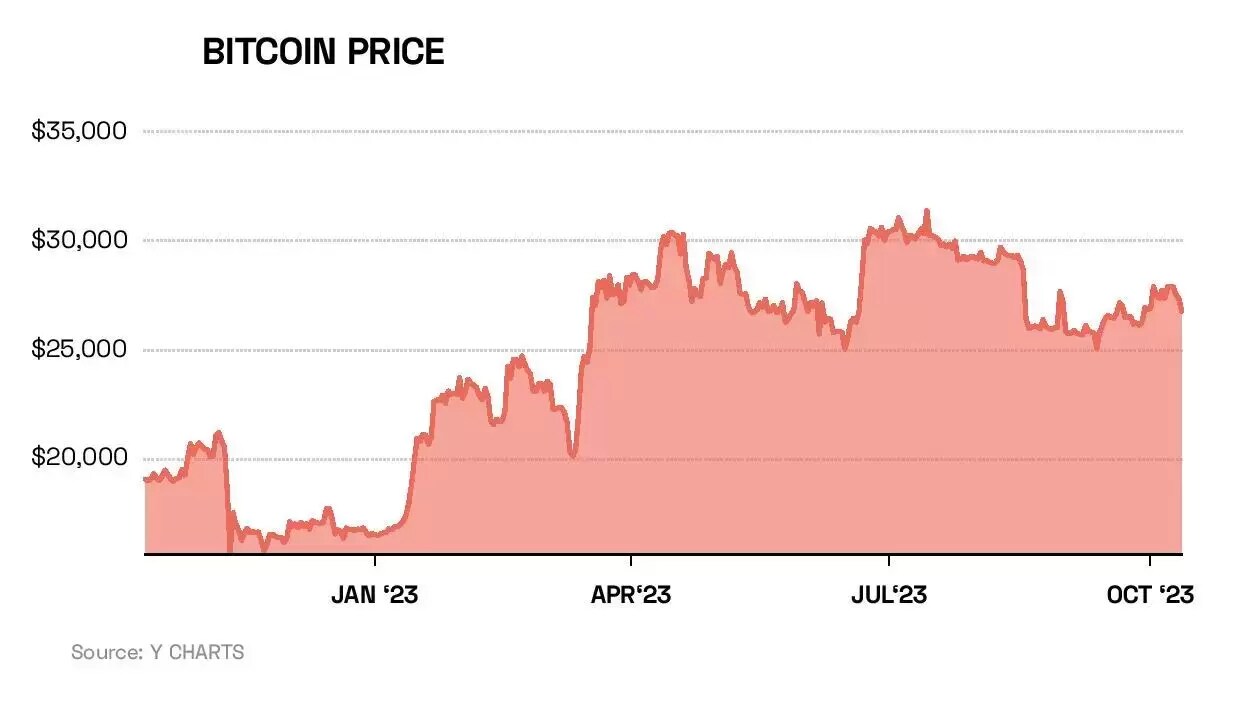

The wider crypto ecosystem also took a hit in 2022, with Ethereum and Bitcoin having their worst annual performance since 2018. However, the cryptocurrencies’ prices have improved in 2023, rising 40.2% and 63.3% in the year to 2 October, respectively.

On Opto Sessions, Scaramucci confirms that around $600m of SkyBridge’s total $1.8bn assets under management is in digital asset-related investments.

SBF’s Trial Picks up Pace

Bankman-Fried’s New York trial will determine whether the FTX founder knowingly committed fraud when allowing the exchange’s funds to be tapped by its sister company, hedge fund Alameda Research.

Bankman-Fried pled not guilty to seven charges, including wire fraud, securities and commodities fraud, and money laundering. Two of his close colleagues — Caroline Ellison and Gary Wang — pled guilty to fraud charges and are now cooperating with the prosecution.

Bankman-Fried faces decades in prison if found guilty. Scaramucci’s opinion is that it will be difficult for Bankman-Fried to convince jurors that he was oblivious to the alleged crimes at FTX.

“I see Sam as a tragic figure and I see what happened to his parents as a great tragedy,” Scaramucci says. “I trusted Sam. I enjoyed his company. It does not reflect well on me, but it is important for me to tell you what actually happened.”

Witnesses who have testified in the trial so far include Wang and Ellison, as well as investors who lost large sums through FTX. First to take the stand was a London commodities trader who spent 50 minutes detailing his experience with FTX, which saw him lose $100,000 in crypto and cash.

Can Scaramucci Trust Crypto Again?

While Scaramucci says he has no plans to up SkyBridge’s $600m stake in the cryptocurrency space, he does believe in the potential for digital assets to be a critical component of future investing portfolios. “Will it become the universal standard of money? I do not think it will. But could it become a store of value for people, that in many ways is more valuable than gold? I believe that is coming.”

He says that Bitcoin could rise from a $522bn market capitalisation as of 11 Oct to “easily a $15trn asset” over time.

An improved regulatory environment will be needed to help the industry fulfil its potential. The UK and UAE are leading the way in this regard, in Scaramucci’s opinion, while the US struggles with politicians who are “completely out of touch” with what digital assets are.

“When I listen to Secretary Yellen talk about bitcoin, I almost feel sorry for her,” he says, while also describing Senator Elizabeth Warren and Gary Gensler, Chairman of the Securities and Exchange Commission, as the “Batman and Robin of the anti-crypto movements, driving around in the anti-crypto mobile wreaking havoc on everybody”.

With Americans entering the polling booths again in around a year’s time, Scaramucci’s hope is that the elections bring in politicians with more progressive ideas around crypto.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy