Smart cities are an intriguing investment proposition, in part because they bring together various technological and sociological trends. A Deutsche Bank report underscores the extent to which smart cities rely on a combination of private and public funding. Stocks that provide smart cities’ underlying technologies, such as 5G or IoT, can be one means of tapping into the theme’s growth potential.

- Deutsche Bank research shows 41% of investment into smart cities is from combined public and private sources.

- Modern approaches to smart city development put citizen wellbeing at the heart of technological advances.

- Technology providers such as Siemens or Qualcomm offer investors exposure to the theme.

In its October report ‘Smart Cities: Investing in the Urban Future’, Deutsche Bank notes that defining a ‘smart city’ is difficult because the term reflects “an interplay of diverse dimensions and components”.

By a similar token, the theme represents a broad investment space that can be accessed from multiple angles. For example, there are companies that develop and install the technical infrastructure, such as 5G connectivity, which underpins the sector. Meanwhile, businesses that produce IoT data-gathering systems to monitor traffic flow or carbon emissions provide another investment case.

Modern smart cities, says Deutsche Bank, do share some general characteristics. Among these are City 5.0 (an urban planning paradigm that puts citizens and their quality of life at the centre of design decisions), the gathering of data via apps, 5G connectivity, and the use of artificial intelligence (AI) and chatbots.

Applications used in smart cities can include those for mobility and logistics analytics, energy and environmental management, digitalised governance and community initiatives, safety and security, smart buildings (such as automatic doors or ventilation systems), and digital health solutions.

The report makes clear that the core concept of a smart city involves numerous data points being collected in a single system, usually cloud-hosted, then analysed, increasingly with sophisticated AI and machine learning algorithms.

The report gives the example of Siemens [SIEGY] as a company offering comprehensive infrastructure and software packages as smart city solutions. Since 2017, Siemens has supported the city-state of Singapore’s digitalisation efforts.

At present, the majority of smart city projects are funded jointly by public and private investors.

“A private-public partnership is needed to design and construct a ‘Secure Smart City,’” Chuck Brooks, President of Brooks Consulting International, recently wrote in Forbes. “While the public sector is in charge, the private sector owns the majority of the vital urban infrastructure,” he added.

Private and Public Decisions

The technologically driven properties of smart cities could influence infrastructure-related decisions over coming years.

A 2021 Deloitte survey of 600 global public officials and infrastructure executives found that AI, cloud, cybersecurity and IoT technologies were most often cited as being likely to shape infrastructure technology in the future.

According to the survey’s respondents, this technological revolution will go hand-in-hand with social developments in urban environments. Of those surveyed, 60% expected increases in investment in urban public spaces for walking, cycling, socialising and eating.

The report also echoes Deutsche Bank’s conclusion that investment in the space depends on collaboration between private and public sources, with privatisation of assets and government funding being the two most frequent sources of funding for smart cities.

Deutsche Bank cites research from Next Move Strategy Consulting, which found the global smart cities market was worth $392.9bn in 2019 and forecast a 12.1% CAGR between 2020 and 2030. Within this, smart infrastructure is the largest segment, accounting for 55% of the market. According to Deutsche Bank, however, other segments, such as smart buildings and environmental solutions, could grow faster in upcoming years.

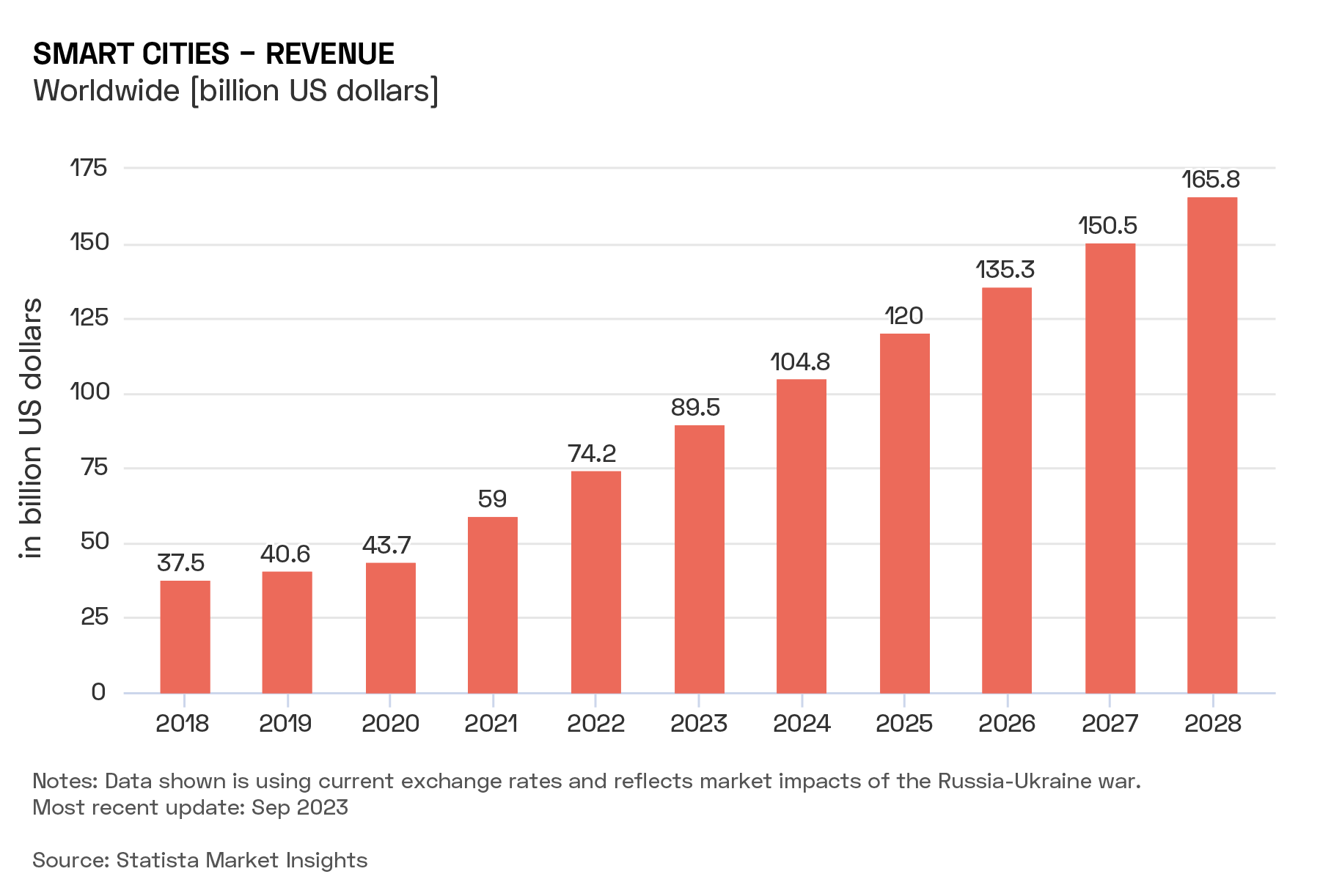

An October report by Statista looking at the global smart cities industry considers it as a subset of the IoT industry; as such, its total numbers are lower than those cited by Next Move Strategy Consulting. Even so, it projects $89.5bn revenue during 2023, and expects this to grow at a CAGR of 13.13% to 2028, bringing the market’s value to $165.8bn by that time.

Expanding 5G Infrastructure

The connectivity of smart city infrastructure depends on 5G technology. Earlier in November, Qualcomm [QCOM] announced it is working with 10 leading telecoms operators to develop use cases for devices with its Snapdragon X35 5G Modem-RF System, underpinned by the 5G RedCap low-power, low-complexity wireless standard. According to Computer Weekly, this standard is regarded by industry experts as the ideal technology for medium-speed use cases.

In an effort to boost the adoption of 5G infrastructure across the country, the UK government granted 10 regions a share of £36m as part of its Wireless Infrastructure Strategy last week.

One of the regions to receive funding was Sunderland City Council, which will get £3.8m to support its aim of making it one of the country’s leading smart cities, according to the Sunderland Echo. The funds will go towards using 5G technology to improve port efficiency and safety, as well as improving the region’s transport efficiency with a connected transport intelligence system.

Smarter, Happier

Another feature of modern approaches to smart cities is the centrality of their inhabitants to planning and decision-making processes. In Japan, this concept is moving towards its next logical step: assessing cities, particularly smart cities, by how much they increase the happiness of their citizens.

Cities Today reports that the Japanese government has been using an evaluation protocol titled the Liveable Wellbeing City Indicators (LWCI) as an essential component of applications for its Digital Garden City Initiative Promotion Subsidy. The LWCI is a framework consisting of 24 subjective and 24 objective indicators to assess the happiness and wellbeing of cities’ inhabitants.

However, while the initiative was launched by the Smart City Institute Japan (SCI Japan), it is perhaps a misnomer. Takehiko Nagumo, Executive Managing Director of SCI Japan, told Cities Today: “We regret that we started off this activity under the name of smart cities. Sometimes I get criticised by my friends who say I named the Institute wrong,” indicating that technological advancement was not the ultimate aim of his research.

“Autonomous cars everywhere, drones overhead — that alone cannot make you happy. We have to step back and ask what does make people happy.”

How to Invest in Smart Cities

Unlike other investment themes, there are few stocks that are specifically dedicated to smart cities in their own right. Because the theme brings together various technological and social developments, however, there are multiple ways to gain exposure.

Companies like Siemens or Amazon [AMZN] offer solutions tailored for smart cities as part of their broader offerings. Siemens’ share price has gained 23.8% in the last year, while Amazon’s is up 59.1%.

Equally, providers of underlying technological infrastructure such as Qualcomm offer exposure. Qualcomm’s share price is up 9.8% over the last year.

Alternatively, an ETF such as the iShares Smart City Infrastructure ETF [CITY:MI] can provide diversified exposure to the theme. CITY holds Qualcomm with a 1.2% weighting as of 27 November. In the last year, the fund is up 1.6%.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy