There’s no doubt that Musk’s eccentric style, as well as never-before-seen products like the Cybertruck, have helped to make Tesla the most recognizable electric carmaker in the industry. Outside of the United States, however, there are many companies that are quietly setting themselves up to compete with, and perhaps even to surpass, the quirky entrepreneur at his own game.

This article was originally published on MyWallSt — Investing Is for Everyone. We Show You How to Succeed.

Tesla’s Competitors

1. Nio

“Tesla” and “China” have been big buzzwords for years, associated as they both are with potentially world-changing innovation and growth. So when a Shanghai-based automotive startup comes along amid whispers of being “China’s Tesla”, you know it’s worth your attention.

Founded back in 2014, NIO (NYSE: NIO) manufactures premium electric vehicles for the international market. While its products have generally been met with critical acclaim, the company has also developed a reputation for being risky and unpredictable. Some commentators fear that its valuation is based on a vague notion of “potential”, rather than its current financial performance — although perhaps a similar charge could be made against Tesla itself.

NIO delivered 36,000 cars in 2020 so far, representing a 111% sales surge, while it saw its share price climb over 1,000% year to date. It’s rapidly growing delivery numbers and improving financial metrics have provided investors who seek a Tesla alternative a viable option. Whether this growth can be maintained and investor demand remains at these astronomical levels is another question. NIO is definitely a high-risk bet, but the company’s commitment to pushing boundaries, combined with its exceptionally low price, make it simply too hard to write off.

2. BYD Company

Based out of the economic powerhouse of Shenzhen, BYD Company (SHE: 002594) is one of the world’s fastest-growing auto firms, and now may be the perfect time to get familiar with it. From the unusual name (an acronym for “Build Your Dreams”) to its unique headquarters (a 670-acre campus complete with schools, hotels, and a monorail system), the company exudes the sort of confidence associated with the early days of Silicon Valley.

Little-known internationally, BYD is already a giant in China, its huge array of products touching on almost every high-tech sector from consumer electronics to energy storage. In fact, the company is already the world’s largest producer of battery-powered vehicles.

Though the company has made little impact outside of China and has yet to show any real global ambition, this doesn’t mean there isn’t still room for phenomenal growth. Electric cars only account for 2% of total car sales in China, partly because the country is poorly equipped with electric charging points. Even if it never ventures beyond its own borders, the future looks exciting for BYD.

3. Volkswagen

When Elon Musk opened Tesla’s European Gigafactory on the outskirts of Berlin, all attention turned to the German auto industry, and its relative failure to produce anything as exciting as its American counterpart.

One of the industry giants that has long been promising to change this is The Volkswagen Group (ETR: VOW3). This time last year, the company made good on its word by starting production of a new electric vehicle dubbed the “ID.3.” Volkswagen has recently committed to spending €73 billion on digital and electric vehicle technologies over the next 5 years and aims to produce 1.5 million electric vehicles by 2025, in anticipation of the EU’s new emission targets.

One of the world’s largest companies, the 82-year-old Volkswagen has survived countless cycles of boom-and-bust — not to mention dictatorship, war, and the division and reunification of its host country — making it particularly adept to achieving long-term aims such as this one.

Does Tesla Have a Competitive Advantage?

As all of these competitors begin to pour into the electric vehicle market, we must examine if Tesla has a competitive advantage and whether it can retain its dominance in the industry:

- First-mover advantage: Tesla has been around the EV industry a lot longer than its competitors. It enjoys brand recognition, word-of-mouth advertising, and a much more expansive charging network thanks to its time in the market.

- Autonomous Driving: It’s estimated that Tesla has amassed roughly 2 billion miles of data through its Autopilot driver-assist feature, each and every inch of which has strengthened its self-driving algorithm through machine learning. The data from which Tesla can avail of is streets ahead of Alphabet’s (NASDAQ:GOOG) Waymo and General Motor’s (NYSE:GM) Cruise.

- Battery Power: The main reason why Tesla made up almost 60% of electric vehicles sold in the U.S. for the first three quarters of 2019 is simple: its cars go further. Tesla’s Model S has a range of 380 miles. Its closest competitor? The Model 3, followed in third by the Model X. Many people call Tesla a battery company that sells cars, with this type of dominance it’s easy to see why.

- Brand Evangelicals: Slightly less tangible than its other competitive advantages, but no less important, is the almost cult-like following Tesla garners. Fans of the company and the stock truly think Tesla is on the brink of changing the world for the better, and they’re putting their money where their mouth is as deliveries and the stock continues to soar.

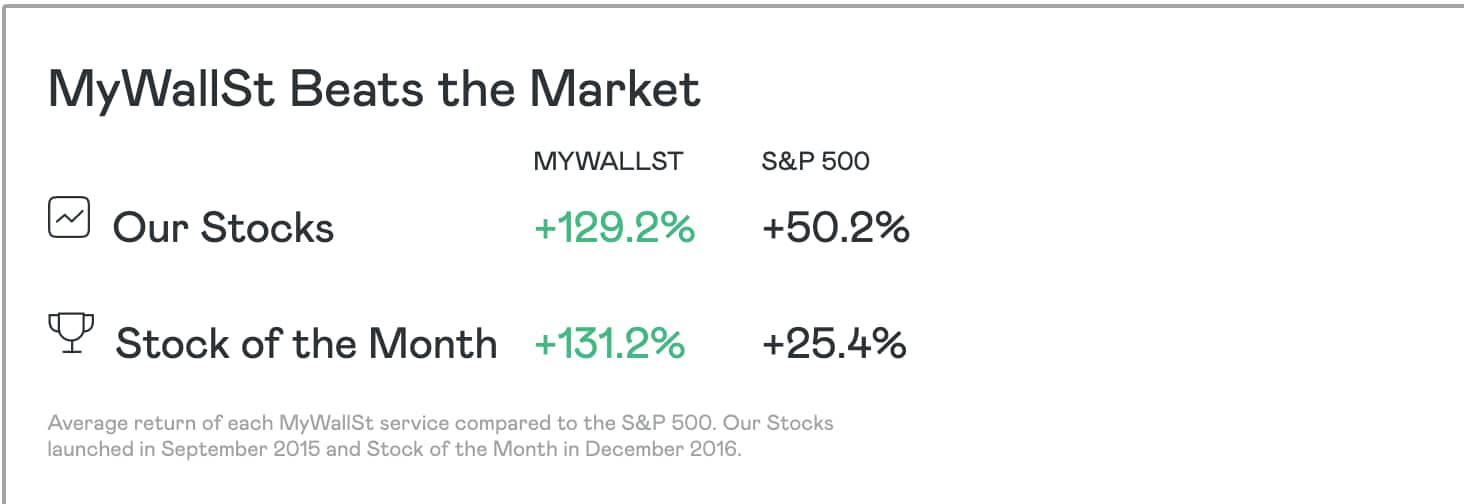

MyWallSt makes it easy for you to pick winning stocks. Start your free trial with us today— it's the best investment you'll ever make.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy