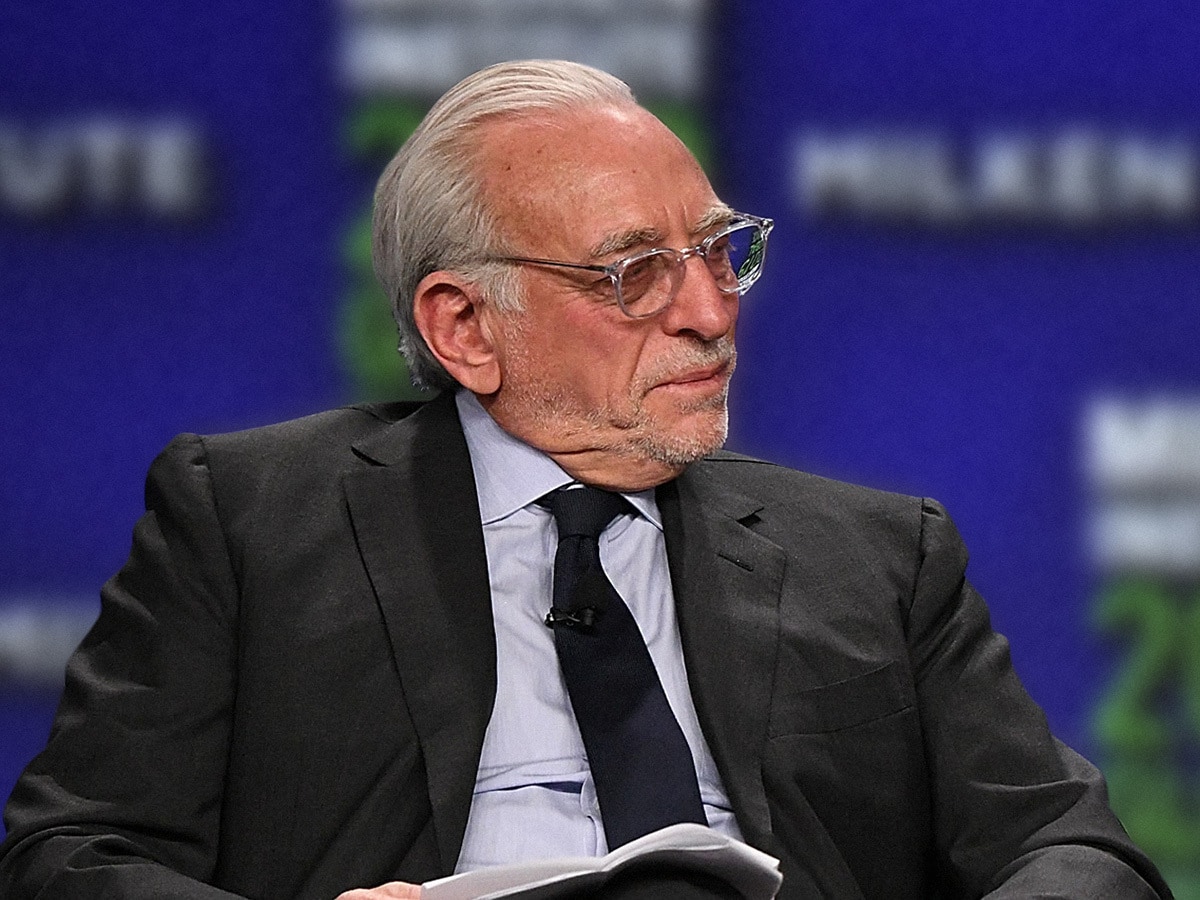

Investors cheered the announcement that hedge fund billionaire Nelson Peltz (pictured) had joined Unilever’s board last week. What might this mean for the multinational consumer goods company?

The Unilever [ULVR.L] share price saw a significant spike following the announcement that Nelson Peltz, the largest shareholder of burger chain Wendy’s [WEN], had been appointed non-executive director of the company. The stock was up by as much as 7.5% in intraday trading on 31 May before closing the day up 9.4%.

A filing with the London Stock Exchange revealed that Peltz’s Trian Partners had amassed in the region of 37.4 million Unilever shares, meaning the investment firm’s stake stands at roughly 1.5%.

“We look forward to working collaboratively with management and the board to help drive Unilever's strategy, operations, sustainability, and shareholder value for the benefit of all stakeholders,” Peltz said in a statement.

Unilever’s London-listed shares closed the trading week, shortened due to the UK public holiday, 6.6% higher. However, the stock is down 4.3% since the start of the year as of 1 June.

Peltz leans on his P&G experience

Peltz has previously sat on the boards of Heinz [KHC] and Mondelēz [MDLZ]. Most recently, he was on the board of fellow consumer goods giant Procter & Gamble (P&G) [PG].

His appointment in March 2018 followed a months-long proxy battle, which he ended up losing narrowly. During that period, Trian Partners released a letter to P&G shareholders to encourage them to vote in favour of Peltz’s appointment.

“P&G has tried to spin and deflect and mislead you, because they do not want shareholders to focus on the company’s decade-long history of underperformance. It is critical that you cut through the noise,” the company stated, according to an SEC filing.

Peltz left the board last year, but the P&G share price has risen 90% since his appointment. His involvement clearly played a part in helping to turn the stock around and he’ll be hoping he can do the same for Unilever.

Earlier this year, Unilever’s proposed £50bn takeover of GSK’s [GSK.L] consumer healthcare arm collapsed. Fitch Ratings had warned that the purchase could open “the possibility of a multi-notch downgrade” and would push net debt to 4.5–5x earnings.

In a letter to shareholders, one of Unilever’s top shareholders, Fundsmith, described the failed acquisition as a “near death experience” that would have killed the value of its investment had it been gone through.

Peltz will bring a sense of urgency

According to Bernstein analyst Bruno Monteyne, the extent of Peltz’s involvement will be what can be described as “back to basics” actions. These will include investing in innovation and improving incentive schemes, as well as accelerating the pace of acquisitions and disposals.

Monteyne wrote in a research note seen by Reuters that the most “Trian-unique element of the P&G plan was his proposal to split P&G into independent operating units. Taking this approach with Unilever would “make a lot more sense”.

Flossbach von Storc, Unilever’s eight largest shareholder, believes Peltz’s appointment will come with “a sense of urgency”. They believe his involvement will be “less about a big structural change like a large-scale acquisition” and more focused on “constant improvements of brand equity and execution”.

James Edwardes Jones and Emma Lethere at RBC Capital Markets are optimistic about the appointment on the basis that it should “drive changes to corporate culture [and] structure”, reported Morningstar. If it doesn’t then, at the very least, “the presence of an activist investor can drive collaboration amongst Unilever's other shareholders and raise Unilever's profile in the media to increase accountability of ongoing changes”.

Jones and Lethere reiterated a ‘sector perform’ rating for the stock, according to MarketBeat data. The target of 3,400p for the Unilever share price implies a downside of 8% from the 1 June closing price.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy