Key Takeaways

- Tariffs protecting US industry have the potential to strengthen domestic manufacturing and fuel reshoring initiatives;

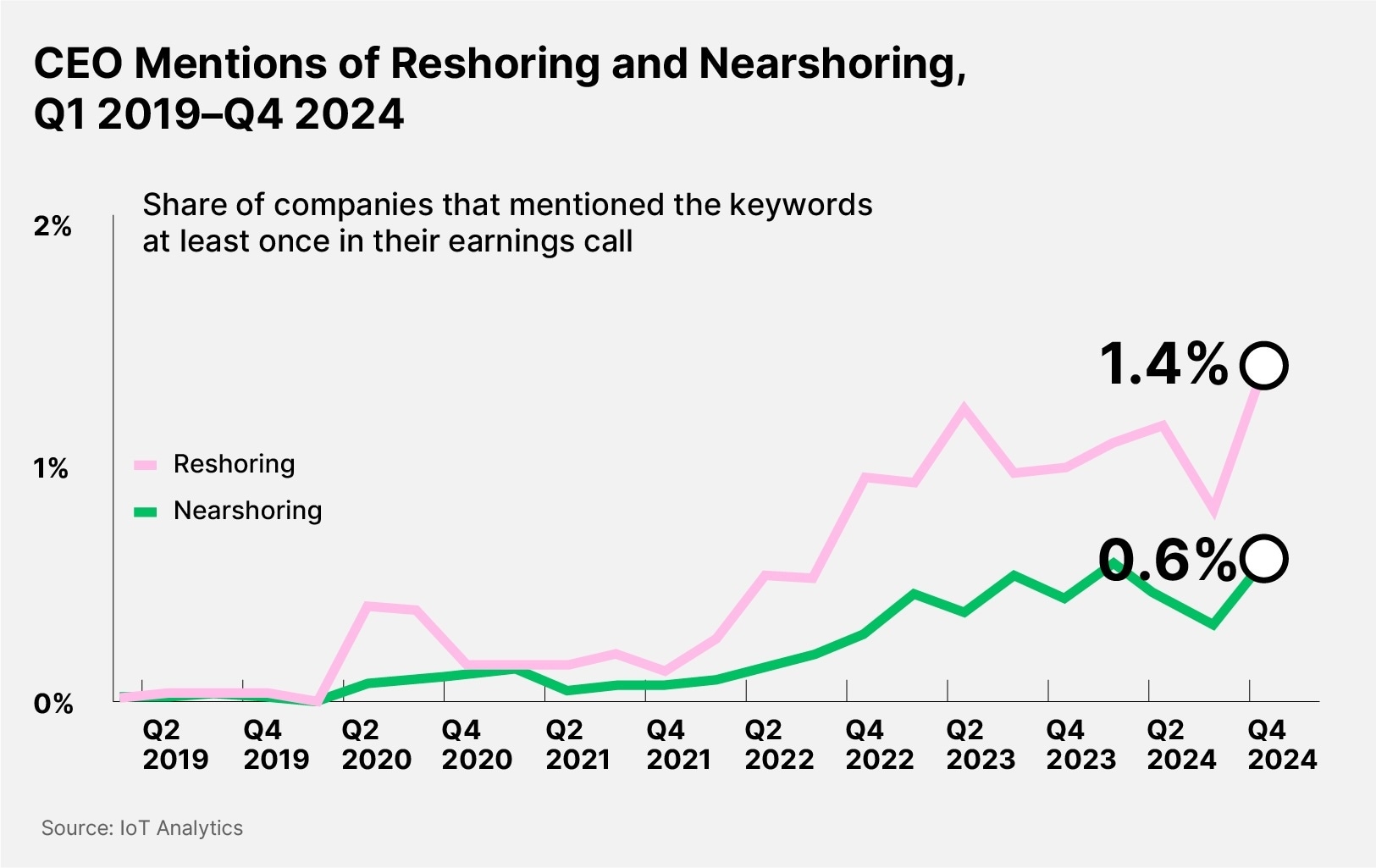

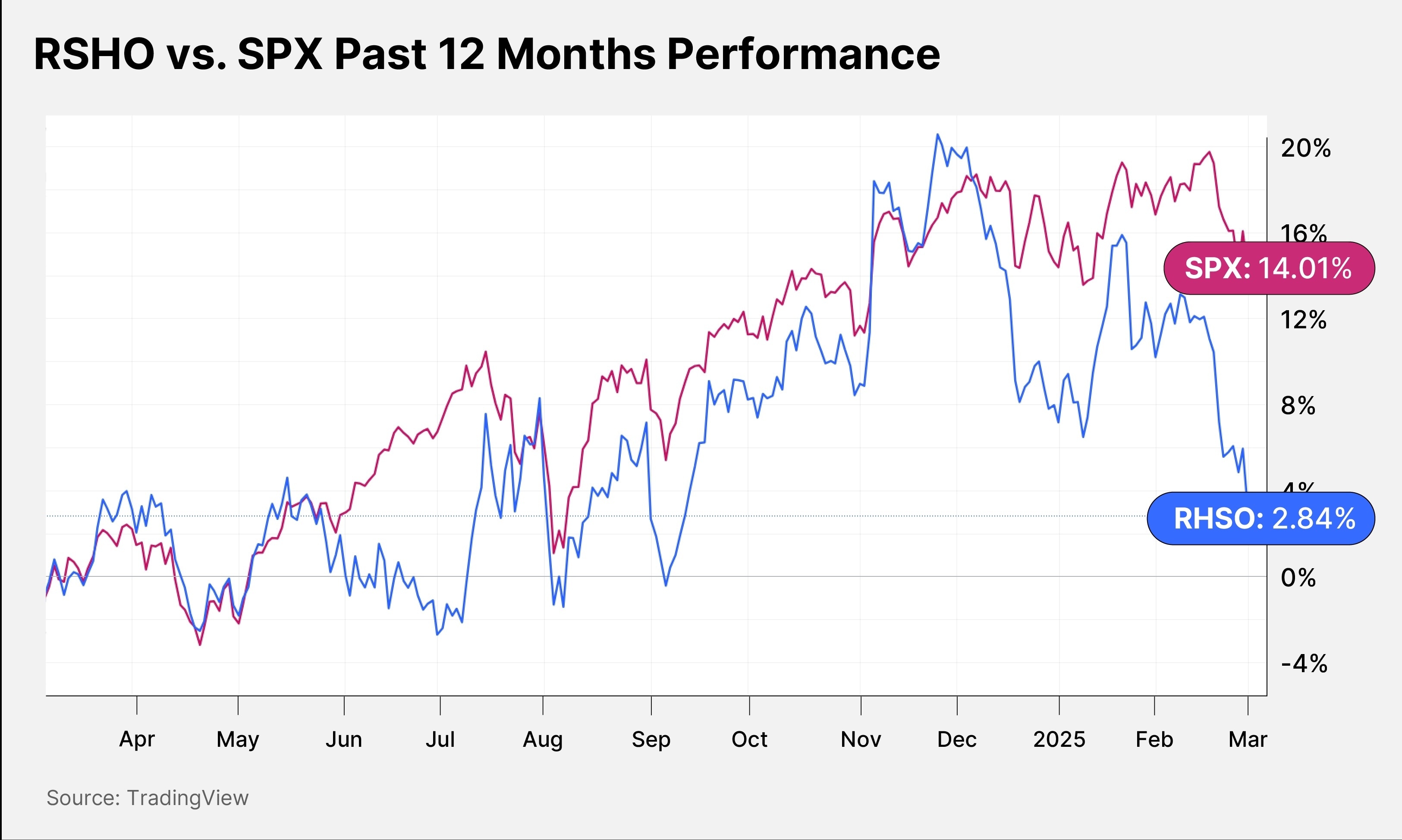

- Donald Trump’s US election win saw reshoring-related financial instruments rally, and many companies pivot to a focus on domestic manufacturing;

- Inflationary pressures and macroeconomic uncertainty could serve as key headwinds, even for firms prepared to deal with tariffs.

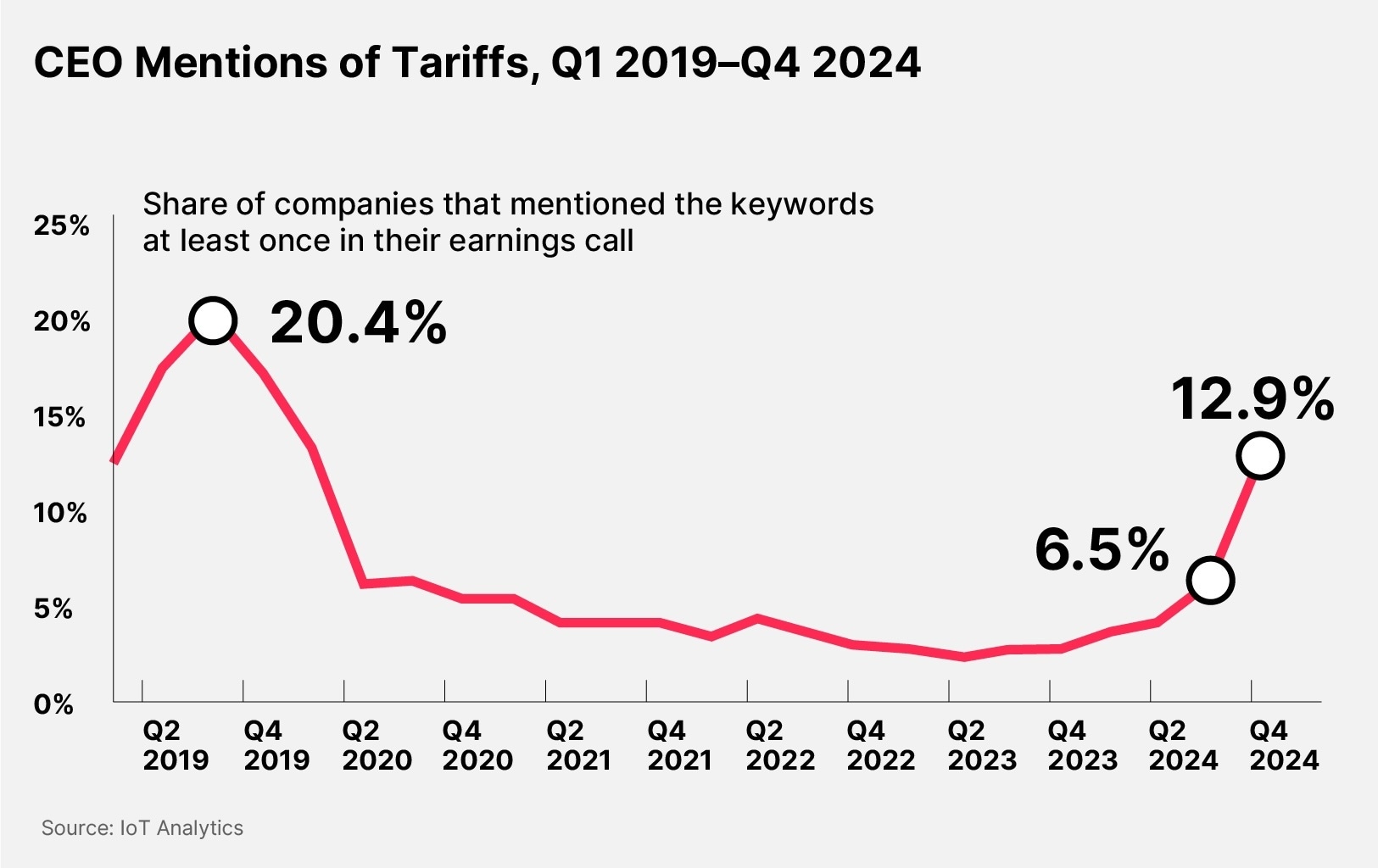

It did not take long for US President Donald Trump to start wielding his presidential power. Within days of his inauguration, he declared tariffs of 25% on goods imported from Canada and Mexico, and 10% on imports from China.

The tariffs on the US’ neighbors were quickly paused for 30 days after they both agreed to tighten migration and drug controls; however, they were reintroduced on March 4, alongside an additional 10% tariff on all goods from China. Trump described the tariffs on China as the “opening salvo” and warning that there is potential for them to become “very, very substantial” if Beijing and Washington cannot come to an agreement.

Beijing has retaliated by imposing a raft of tariffs on American materials and products, including 10% on crude oil and agricultural machinery, 15% on food products and 15% on coal and liquefied natural gas.

Trump has also threatened further tariffs targeting chipmakers, drugmakers and metal producers. He followed through on the last of these three with a flat 25% tariff on all imports of aluminum and steel scheduled to go into effect on March 12. He also said he is introducing new industry standards that will demand aluminum be “smelted and cast” and steel be “melted and poured” in North America.

These tariffs and standards are designed to protect the US’ national interests and domestic industries.

Research by the bipartisan Coalition for A Prosperous America argued last year that the tariffs introduced by Trump during his first presidency “strengthened the US economy”, while also leading to “significant reshoring” efforts, a boon for domestic manufacturing.

Following the 25% tariffs imposed on Mexico, the Atlantic Council released research that concluded that there is a high probability Trump’s tariffs “would create new incentives for US consumers to buy US-made products”.

So, what does Trump’s tariff policy mean for investors?

“Geopolitical uncertainty, especially in the form of protectionism, is redrawing geographic lines that investors have become accustomed to,” Chris Semenuk, Portfolio Manager for the Tema American Reshoring ETF [RSHO], tells OPTO Foresight.

Investors could consider the reshoring theme, which is focused on US industrial companies that are bringing production to the US and reducing their reliance on other countries for their manufacturing and materials.

“The fundamental business case to reshore is getting stronger due to sustained geopolitical and trade uncertainty,” says Semenuk, adding that reshoring stocks are “likely to be more insulated from this risk than other companies and should do better over time”.

Reshoring Theme vs. the Broader Market

The Tema American Reshoring ETF [RSHO] reached a record high in the weeks following Trump’s election win. However, the fund has pulled back since Trump’s first tariff announcement, falling 4.75% since the start of 2025 through March 3, versus a marginal 0.54% drop for the S&P 500. The fund is up 43.27% since its launch in May 2023.

In this article, we look at seven reshoring stocks and highlight their recent company performance, as well as how they expect to manage the impact of tariffs. Each stock is either a holding in RSHO or was named by Morgan Stanley as a beneficiary of reshoring activities following Trump’s election win.

Seven Reshoring Stocks

All share prices and metrics up-to-date as of March 3

Applied Industrial Technologies [AIT]

Year-to-date: 0.52%

Past 12 months: 25.78%

Market Cap | P/S Ratio | Forward P/S Ratio | P/E Ratio | Forward P/E Ratio | PEG Ratio |

$9.22bn | 2.07 | 1.92 | 24.32 | 23.29 | 2.94 |

Applied Industrial Technologies is an Ohio-based distributor of a range of industrial solutions that help optimize machinery and make production more efficient.

Outside of the US, AIT has facilities in several countries, including Canada and Mexico. CEO Neil Schrimsher said on the Q2 2025 earnings call on January 25 that tariffs are unlikely to have a significant impact.

AIT is “low direct import”, Schrimsher added. Production in countries including Mexico is “highly contained”, meaning that much of what is produced in those countries is sold to customers there.

However, he did caution that, if tariffs were to have an inflationary impact, then this may need to be passed on to end users in the form of price increases.

Mizuho Securities reiterated a ‘buy’ rating on AIT stock following the Q2 earnings, reaffirming the firm’s $285 price target, which indicates an upside of 18.60% from the most recent closing price of $240.30.

Caterpillar [CAT]

Year-to-date: -8.13%

Past 12 months: 0.10%

Market Cap | P/S Ratio | Forward P/S Ratio | P/E Ratio | Forward P/E Ratio | PEG Ratio |

$158.69bn | 2.49 | 2.48 | 15.06 | 16.39 | 2.07 |

Caterpillar is an industrial giant that manufactures equipment for construction and mining.

Revenue for its Q4 fell 5% year-over-year, while operating profit slipped 7%. The company also issued a soft outlook for Q1 2025.

“We are a global manufacturer, but our largest manufacturing presence is in the US, and we are a net exporter outside of the US and that positions us pretty well versus many other companies out there,” said CEO Jim Umpleby on the Q4 earnings call in January.

Though the company aims to sell in the same region it manufactures, Umpleby pointed out that some products do have to be moved around, which obviously exposes it to tariff risks.

“We’ve been around [for] 100 years, and we’ve seen many different administrations with different attitudes on these issues, and we’ll deal with it,” he added.

Evercore ISI upgraded CAT stock from ‘underperform’ to ‘in line’ in light of the earnings report. The firm’s price target of $365 indicates an upside of 9.93% from the most recent closing price of $332.04.

Eaton Corp [ETN]

Year-to-date: -16.09%

Past 12 months: -4.02%

Market Cap | P/S Ratio | Forward P/S Ratio | P/E Ratio | Forward P/E Ratio | PEG Ratio |

$109.41bn | 4.45 | 4.06 | 29.31 | 23.12 | 2.56 |

Eaton is a supplier of electrical equipment and power management solutions based in Ohio but headquartered in Dublin, Ireland.

As well as supplying parts and systems to the aerospace industry, Eaton has exposure to several themes, including electrification, infrastructure and the energy transition. It also plays an important role in helping data centers to meet the power demand for generative artificial intelligence (AI).

Along with other US industrial stocks with AI exposure, Eaton’s share price fell in reaction to news of DeepSeek’s purportedly more efficient AI models at the end of last month.

As for tariffs, COO and President Paulo Ruiz was defiant when asked about the impact they could have. “We are ready… Depending on what’s announced, we know exactly what to trigger,” he said on the Q4 earnings call in January.

Some production has been moved close to the consumption side to mitigate the impact tariffs could have, Ruiz added

Melius Research downgraded ETN stock from ‘buy’ to ‘hold’ ahead of the Q4 earnings. The firm believes the emergence of DeepSeek could impact AI capex and the multiples that investors will be willing to pay for stocks with AI exposure. Its price target of $373 indicates an upside of 33.95% from the most recent closing price of $278.46.

Fastenal [FAST]

Year-to-date: 4.03%

Past 12 months: 4.42%

Market Cap | P/S Ratio | Forward P/S Ratio | P/E Ratio | Forward P/E Ratio | PEG Ratio |

$42.65bn | 5.65 | 5.19 | 37.19 | 34.53 | 3.73 |

Fastenal is a Minnesota-based distributor of construction, industrial and safety supplies.

In a January sales update released on February 6, Fastenal said sales in the US were up 1.7% from December and accounted for 83% of total sales, while sales in Canada and Mexico accounted for 14.1% of sales and were up 5.9%.

While Fastenal is not over-reliant on Canada and Mexico for revenue, it is prepared for the tariffs, although it did not go into too much detail on the Q4 2024 earnings call in January.

When quizzed by analysts, CEO Dan Florness explained how the company had navigated the port strike that briefly impacted the US east coast last October. He said that the company had spent a bit more money bringing 35 to 40 containers to the west coast and transporting them across to the east coast to reduce the risk to its customers’ businesses, because “that’s what a great supply chain partner does”.

Fastenal is “well poised to communicate and react to whatever happens” under the Trump administration, Florness added.

CFO Holden Lewis pointed out that the company had “accelerated some inventory scheduled for future delivery into current periods ahead of potential new tariffs.”

Stifel maintained a ‘hold’ rating on FAST stock in January, though it cut the firm’s price target from $86 to $82, which indicates an upside of 9.26% from the most recent closing price of $74.38.

Hubbell [HUBB]

Year-to-date: -14.96%

Past 12 months: -6.57%

Market Cap | P/S Ratio | Forward P/S Ratio | P/E Ratio | Forward P/E Ratio | PEG Ratio |

$19.05bn | 3.39 | 3.17 | 24.70 | 20.12 | 2.01 |

Hubbell is a Connecticut-based manufacturer and distributor of electrical systems and products for industrial, utility and telecoms companies, as well as solutions for data centers.

Revenue for Q4 declined marginally, but this was offset by margin growth, particularly the 20% margin achieved by its electrical segment. This was thanks to strength in high-margin areas like data centers and renewables.

As happened with ETN stock, Hubbell’s share price dropped in late January amid concerns that DeepSeek could impact spending on data center capacity on home soil.

Asked on the Q4 earnings call about the risk tariffs posed, CFO William Sperry said that its China exposure “has decreased significantly due to divestitures and reshoring efforts”. However, he cautioned that “the situation is fluid” for Canada and Mexico, “but we are preparing to manage any impacts through pricing and productivity measures”.

Wells Fargo maintained an ‘equal weight’ rating on HUBB stock following the earnings report. The firm reduced its price target from $455 to $450, which indicates an upside of 26.78% from the most recent closing price of $354.95.

Rockwell Automation [ROK]

Year-to-date: -2.07%

Past 12 months: -1.80%

Market Cap | P/S Ratio | Forward P/S Ratio | P/E Ratio | Forward P/E Ratio | PEG Ratio |

$31.51bn | 3.91 | 3.81 | 34.68 | 28.45 | 4.28 |

Milwaukee-based Rockwell Automation is an industrial automation company. Its business offerings include a lifecycle services unit, which offers machinery asset management and condition monitoring.

The company beat Q1 2025 profit estimates, it announced on February 10, driven by demand for its lifecycle services unit.

CEO Blake Moret warned that the current macroeconomic climate, along with policy uncertainty under the Trump administration, meant some customers were being cautious with their capex spending.

In prepared remarks released with the earnings report, Moret expressed confidence that Rockwell is in a strong position to minimize the impact of the tariffs. The company had been modelling various scenarios before the election.

“Undoubtedly, there will be near-term disruptions and volatility in the global supply chain, both for us and our customers, but we continue to believe Rockwell is a net beneficiary of policies that increase US manufacturing,” said Moret.

Oppenheimer raised its price target for ROK stock from $300 to $320 following the earnings report, indicating an upside of 14.85% from the most recent closing price of $278.63.

Trane Technologies [TT]

Year-to-date: -7.38%

Past 12 months: 21.69%

Market Cap | P/S Ratio | Forward P/S Ratio | P/E Ratio | Forward P/E Ratio | PEG Ratio |

$77.66bn | 3.95 | 3.54 | 30.80 | 26.98 | 2.15 |

Trane is an American-Irish manufacturer of heating, ventilation, air conditioning and refrigeration systems.

In Q4 2024, Asia-Pacific accounted for 8% of revenue, half of that from China. The region’s bookings and revenue were up 8% and 1% sequentially, while bookings in China grew by low single digits and revenue saw a low-teen decline.

Despite this low exposure to China, the company has manufacturing facilities in the country, as well as Mexico. Tariffs have the potential to disrupt its supply chains, and any increase in raw material prices may have to be passed on to customers.

On the Q4 2024 earnings call on January 31, the day before Trump’s tariffs were officially announced, Trane acknowledged that “potential tariff impacts could affect cost structures and profitability”.

However, CEO David Regnery told analysts on the call that “for decades now we’ve had a manufacturing strategy of ‘in region for region’”, meaning that products made in a region are sold there.

RBC Capital maintained a ‘sector perform’ rating on TT stock following the earnings report, encouraged by growth in Asia offsetting softness in China. The firm raised its price target from $395 to $400, indicating an upside of 15.53% from the most recent closing price of $346.24.

Conclusion

Trump’s tariffs are designed to bring manufacturing and supply chains back to the US and promote US-made goods. Moving production and labor closer to home can help companies to manage risks associated not only with geopolitical tensions, but also with natural disasters and future pandemics.

However, as these seven stocks show, even companies with low exposure to offshore supply chains — namely in Canada, China and Mexico — could still be impacted by Trump’s tariff policies.

Investing in stocks in the reshoring theme could nevertheless offer a safe haven if the global trade war were to intensify further.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy