Every day, we handpick the 5 Top Stories stock market investors need to know. In 5 minutes, you’ll learn the stocks, CEOs, and money managers moving markets.

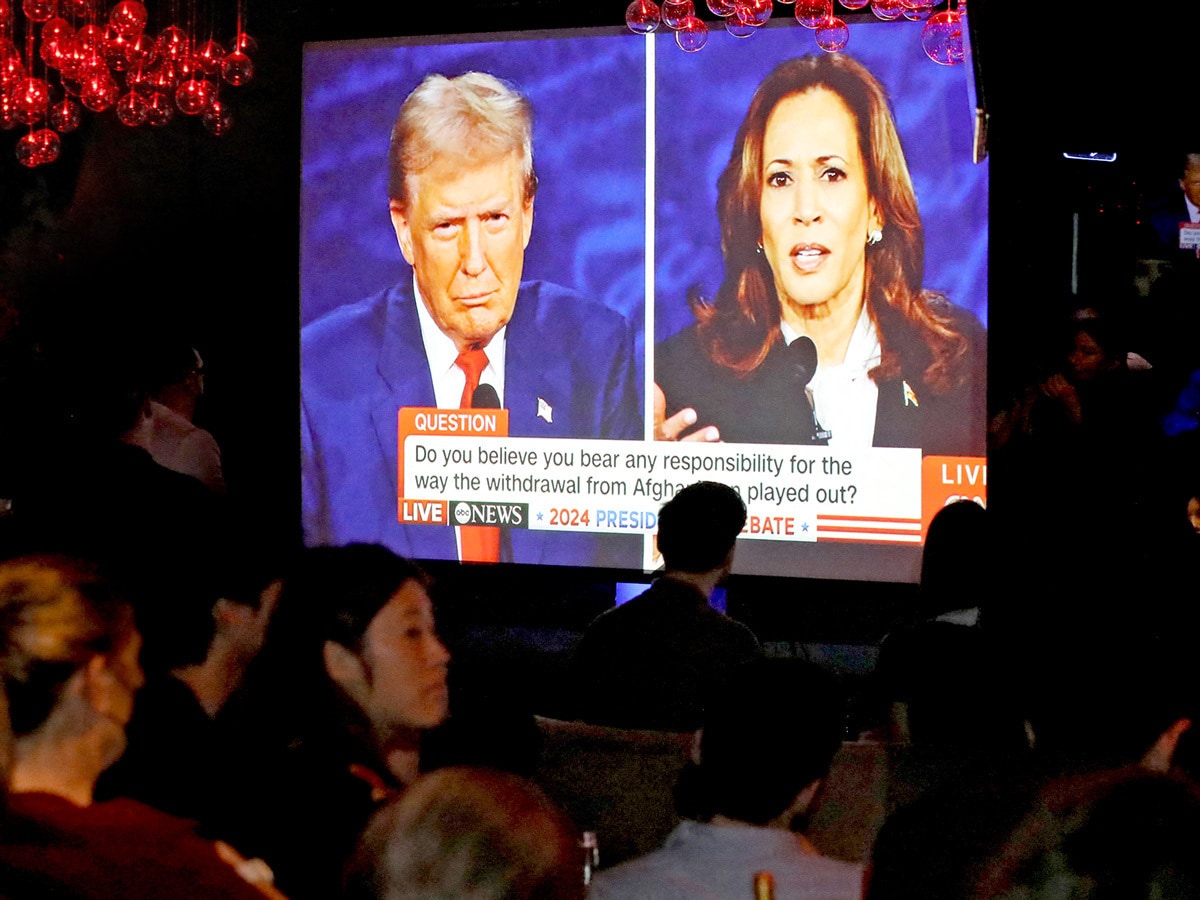

Who Would Be Better for the Economy?

In the wake of the debate, commentators have piled in with opinions and analysis. ING predicted that a Trump win would lead to a treasuries selloff: “Of the two candidates, a Trump win would be most inflationary, and thus worse for USTs in our view,” ING economists wrote in a note seen by Seeking Alpha. Meanwhile, Bloomberg detailed which sectors stood to benefit in the case of a Harris win: they include electric vehicles, solar and clean energy generally, homebuilders, and cannabis. If Trump wins, traditional energy and defense stocks would likely see a boost.

AWS Expands in UK

Amazon [AMZN] plans to invest £8bn over five years to expand its UK cloud business, boosting data centers and supporting up to 14,000 jobs. The investment is part of a broader expansion by Amazon Web Services (AWS), which has committed billions globally, including in Germany, Mexico, and Saudi Arabia. This move gives the UK’s new Chancellor of the Exchequer Rachel Reeves a boost ahead of the country’s upcoming international investment summit on October 14.

What’s Next for Microsoft and AI?

“I think OpenAI, by any objective measure, has been one of the most consequential partners Microsoft has ever had, and Microsoft has had some really good partners,” said Microsoft’s [MSFT] Chief Technology Officer Kevin Scott during an interview at the Goldman Sachs Communacopia and Technology Conference on Tuesday. Scott also hinted at a new artificial intelligence (AI) model or product to be released before the end of the year: “Let me just say, the work has not stopped at GPT-4.”

Google Cloud CEO on How to Monetize AI

Also at the Communacopia and Technology Conference, Google [GOOGL] Cloud CEO Thomas Kurian discussed the company’s AI monetization strategies. He noted a tenfold increase in usage of their clusters year-over-year, with 60% of AI start-ups utilizing their infrastructure. Google has adopted a consumption-based pricing model and a token-based platform. Their data centers utilize both proprietary processors and Nvidia [NVDA] chips, similar to AWS, which also incorporates Advanced Micro Devices [AMD] chips.

More Momentum for India’s Chip Drive

Tech-to-construction giant Larsen & Toubro [LTOUF] is set to invest over $300m over three years to establish a fabless chip company in the country, focusing on semiconductor design while outsourcing production. The company plans to develop 15 chip designs by year-end and launch sales by 2027. This initiative aligns with India’s push to build local semiconductor capabilities, as tensions between the US and China drive manufacturers to diversify beyond traditional hubs like China and Taiwan, Bloomberg reported.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy