Novel gene editing techniques, including companion diagnostics, offer increasingly precise avenues for cancer diagnosis and treatment. Arelis Agosto, Senior Healthcare Analyst at Global X ETFs, sheds light on the potential of genomic sequencing approaches to improve healthcare, particularly oncology.

1. The Taxonomy of Gene Therapies

Cell and gene therapies are a transformative element in the healthcare industry.

The theme comprises a set of novel treatments that, in the words of Arelis Agosto, Senior Healthcare Analyst at Global X ETFs, could comprise “anything from gene editing technologies, to actually editing the DNA in order to cure an illness, to cell or gene therapy.”

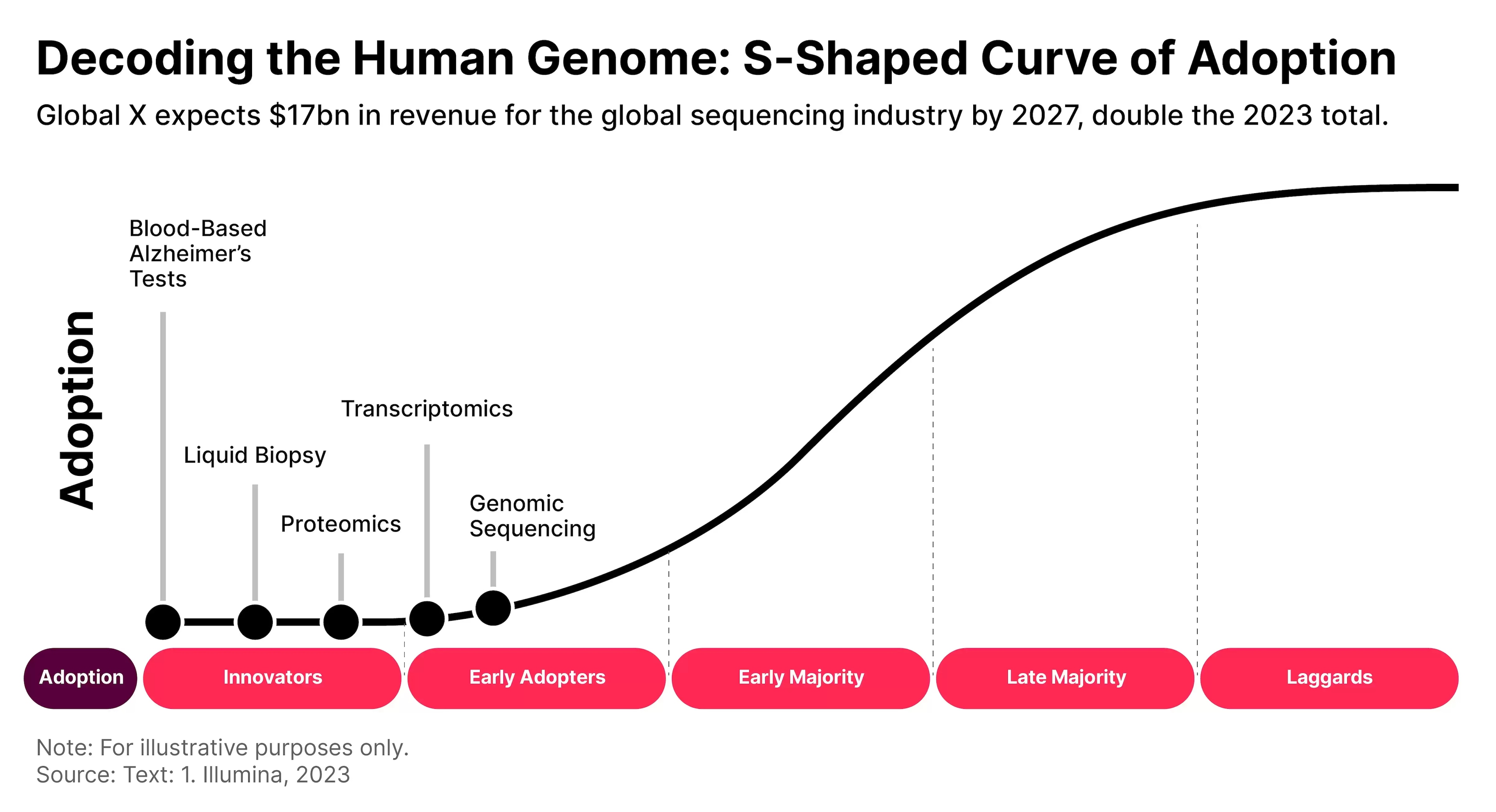

One important aspect of genomic treatments is that they are in a very early stage of their S-curve. By far, genomic sequencing is the most mature part of the space, and that is only in the early adoption phase.

TYPES OF CELL AND GENE THERAPY

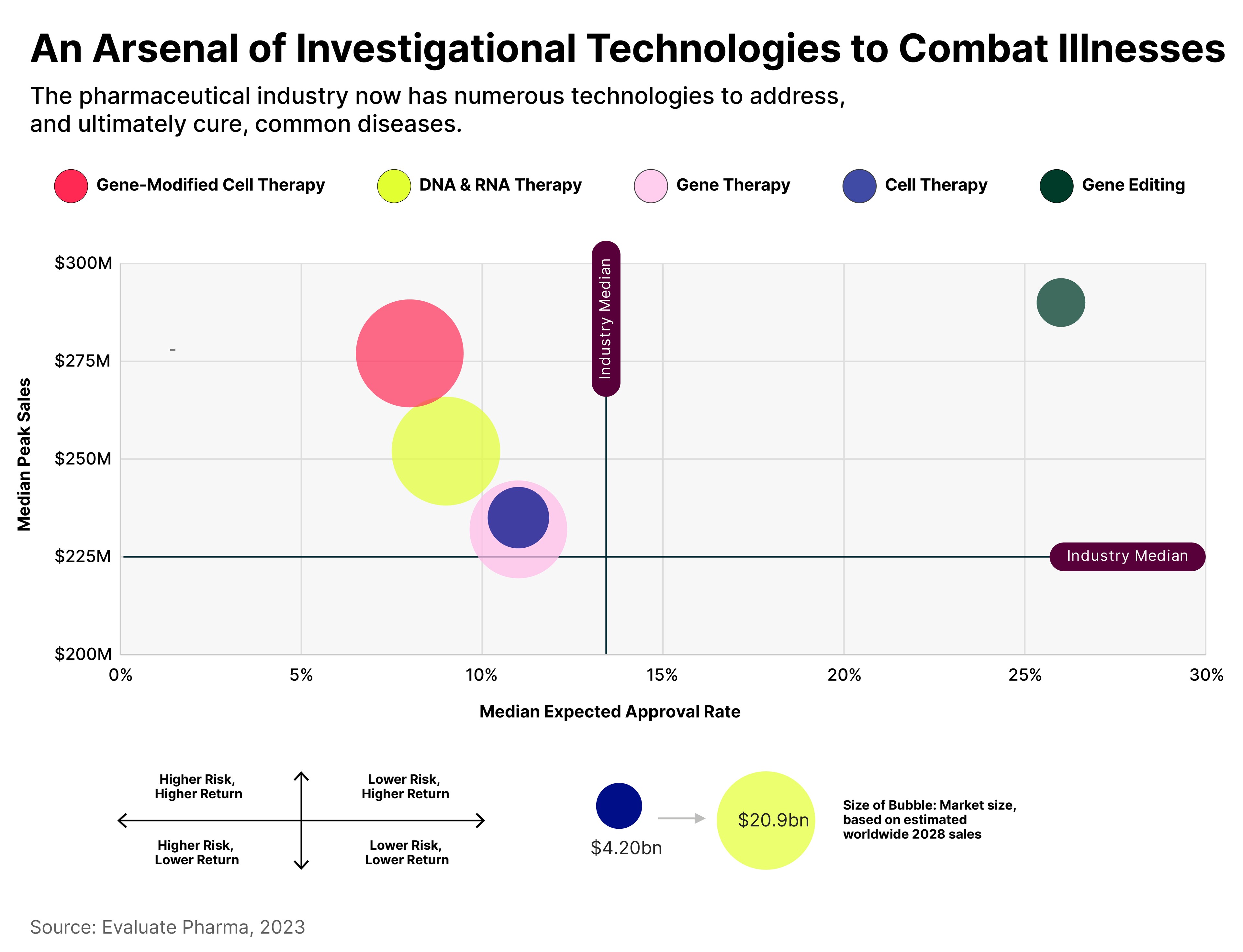

According to Global X’s December report, ‘Charting Disruption: Outlook for 2024 and Beyond’, there are five key technologies that underpin this market:

- Gene editing: removing, adding or altering sections of DNA.

- Cell therapy: repairing or replacing damaged tissues and/or cells by transplanting healthy human cells.

- Gene therapy: replacing defective or missing genes within patient cells with healthy versions of specific genes.

- DNA and RNA therapy: manipulating the body’s RNA in order to provide instructions to create specific proteins, or to turn particular genes on or off.

- Gene-modified cell therapy: fighting disease by transplanting genetically modified cells.

Each of these has a specific investment profile.

On one hand, there is risk associated with the uncertainty of approvals for some treatments. On the other hand, given the estimated addressable markets, there are significant potential rewards.

By both these metrics, gene editing has the best risk/reward profile. But, given it is a new field within genomics, it is unlikely to have grown to as large a size as the other fields by 2028.

2. Knowledge is Power

Compared to traditional treatment methods, cell and gene therapies may offer improved patient outcomes and cost savings, and treat a wider range of conditions.

There are significant, far-reaching economic implications of these benefits.

For instance, healthcare providers, particularly in the US, will have more effective treatment options available for their patients.

Agosto references better insurance coverage as another possible benefit but emphasises that the value of the technology is driven by its impact on patients’ quality of life.

“We're talking about illnesses that are highly cumbersome, that require patients to go out and have transfusions or infusions multiple times a week. It has not only significant value for the patient but in terms of their overall lifestyle, it can be quite meaningful,” says Agosto.

GENOMIC SEQUENCING

Genomic sequencing is one of the fundamental components of this technology.

“Genomic sequencing is exactly as it sounds. It’s essentially sequencing a patient's DNA to understand where potential mutations might lie.”

Having this information, says Agosto, means that patients can be given treatments tailored to their predispositions to certain conditions.

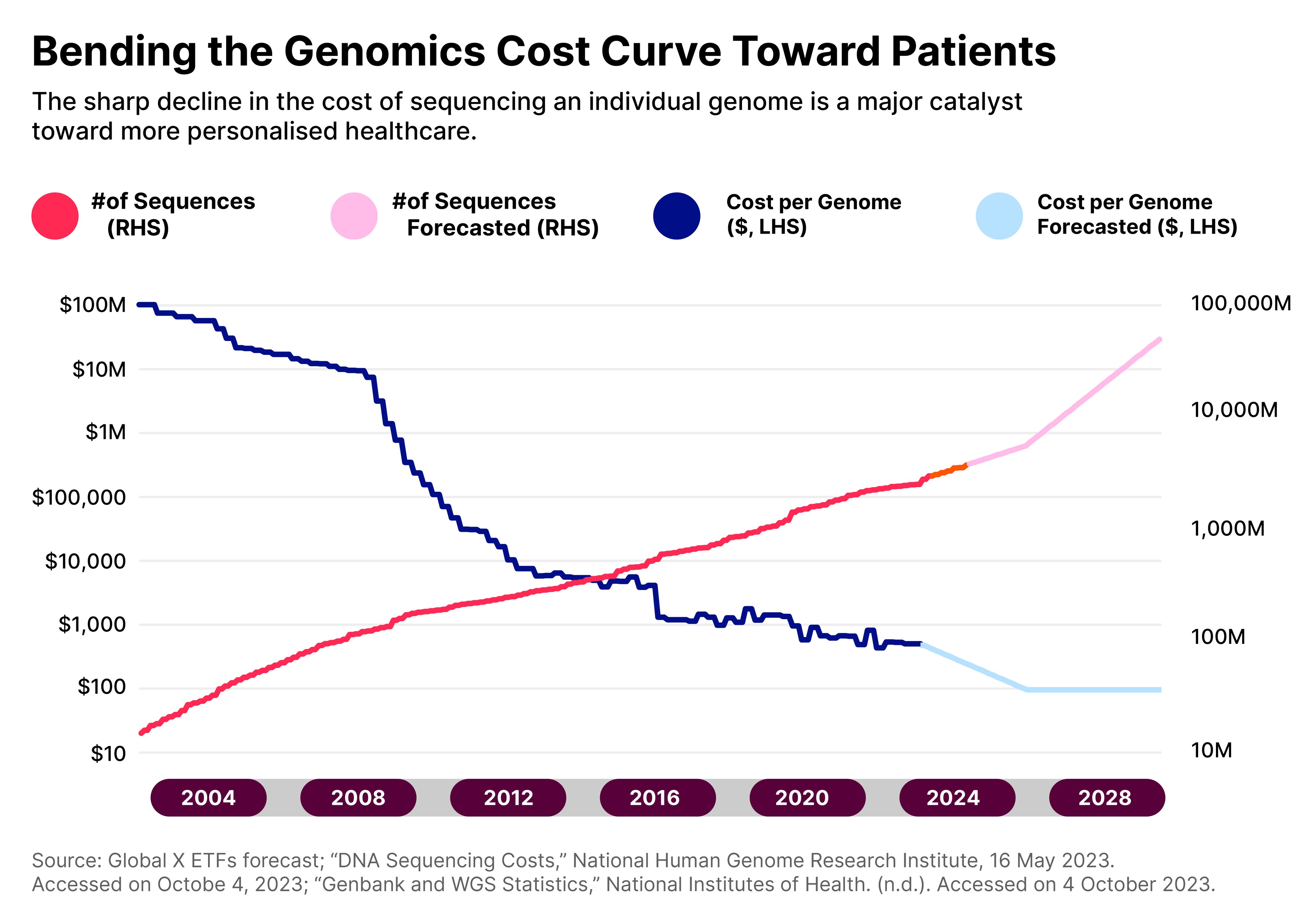

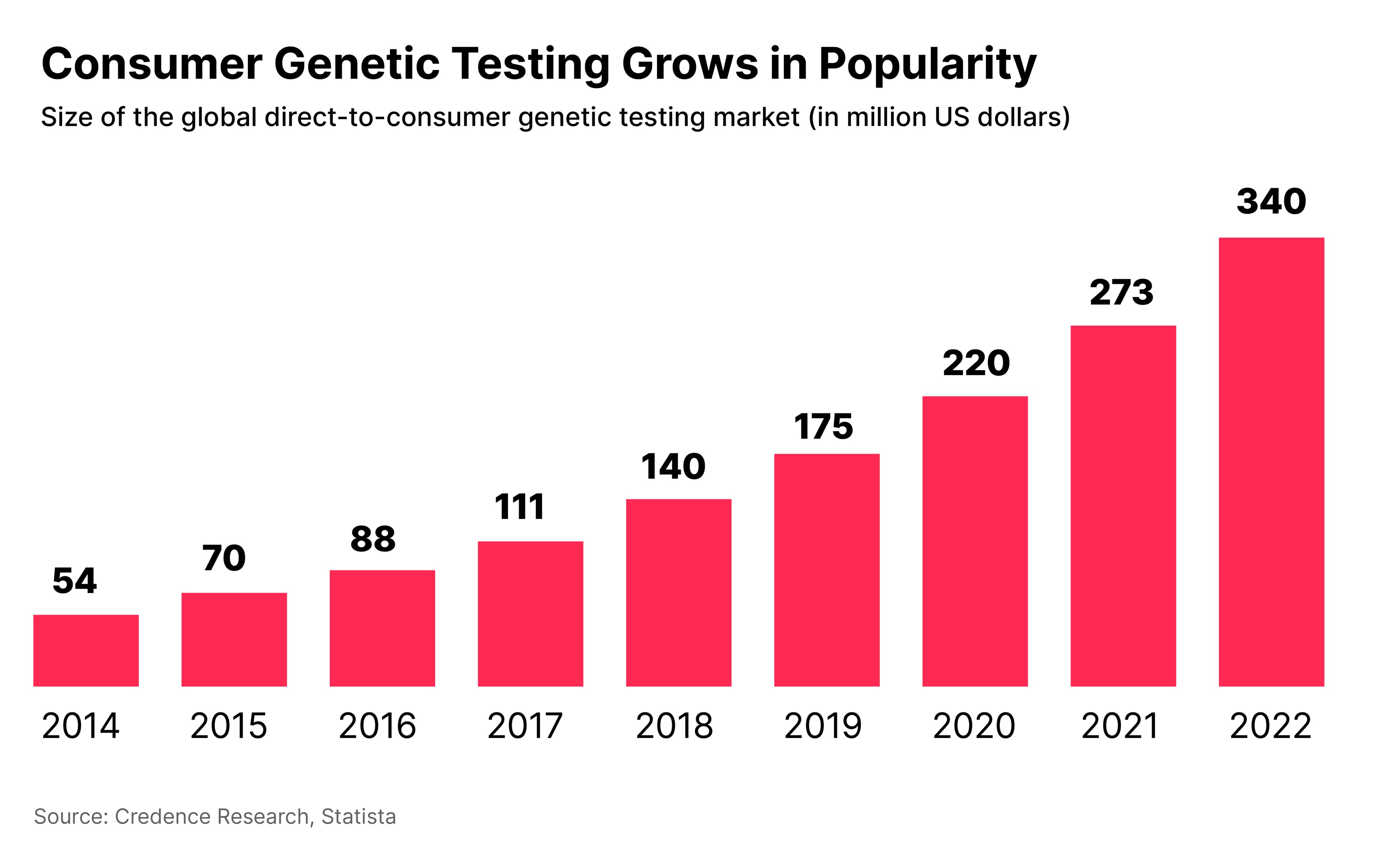

Despite this, the high price point — currently at around $400–500 for a single human genome — means that only 0.07% of the world’s population has had their genome sequenced. However, as costs continue to fall, adoption is expected to increase.

“The industry has agreed that the $100 mark will allow for an inflection point for greater adoption,” says Agosto.

3. Combating Cancer

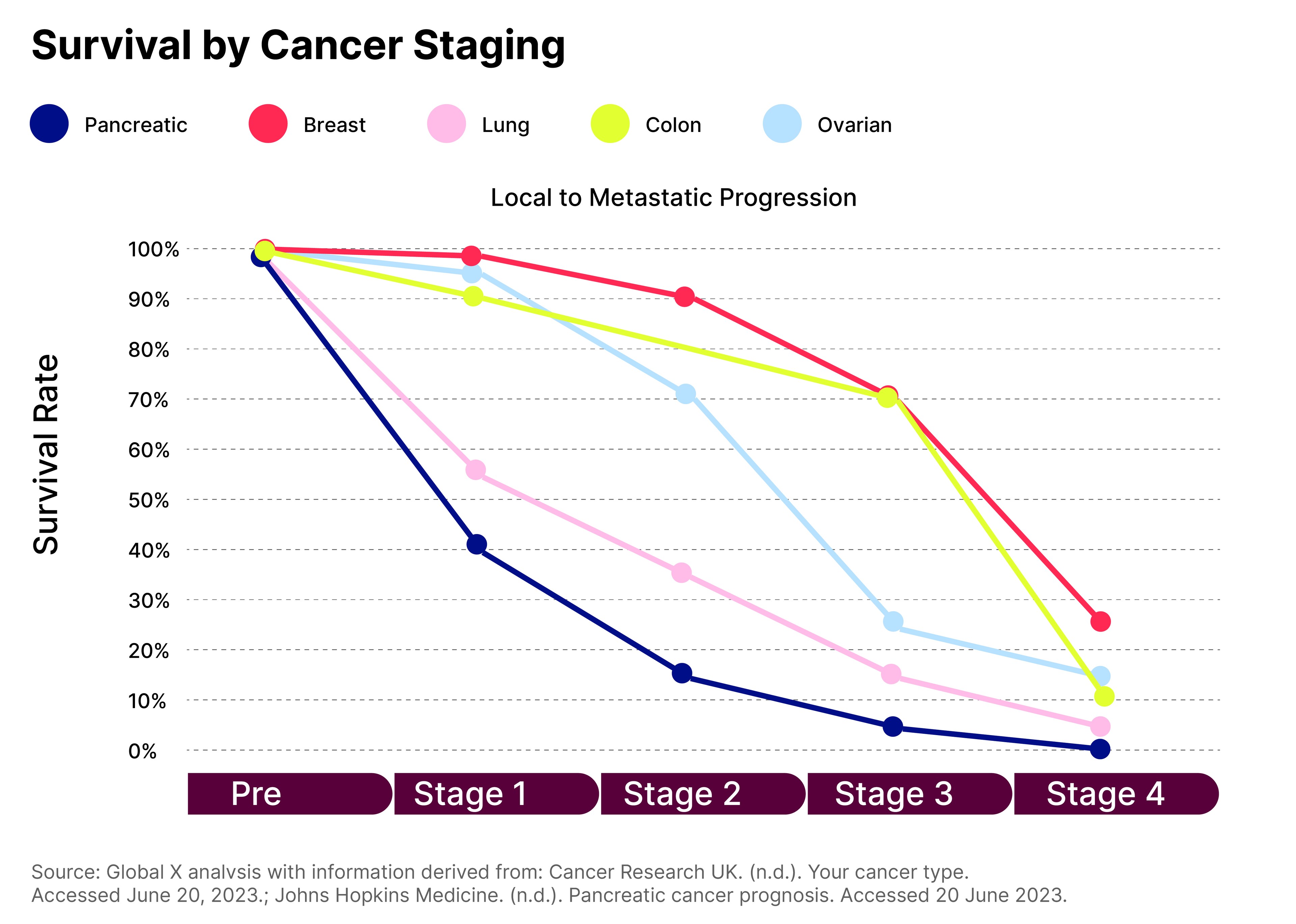

While genomic sequencing has far-reaching implications, one specific and highly relevant use case is in oncology.

When it comes to cancer diagnosis, “there are a few different ways that genomic sequencing can be utilised”, says Agosto.

One of these is screening.

Because of the varying availability of particular screening methods, Agosto says that “only 25% of cancers are actually detected via screening methods”, as opposed to when the cancer has developed to the point of displaying symptoms.

Cancer survival rates are correlated with early detection, so improved screening results could have a significant impact on patient outcomes.

Genomic sequencing allows the detection of cancerous biomarkers in liquid biopsies.

Agosto outlines her hope that this type of screening will soon be a standard part of annual health check-ups.

Another use case is confirmatory diagnostics. Screening (including using genomic biomarkers, as above) often highlights an elevated risk of cancer, but further testing is required in order to confirm a diagnosis.

“Instead of, for example, doing a lung biopsy, which is as you can imagine quite invasive and costly, we can instead perform a liquid biopsy.”

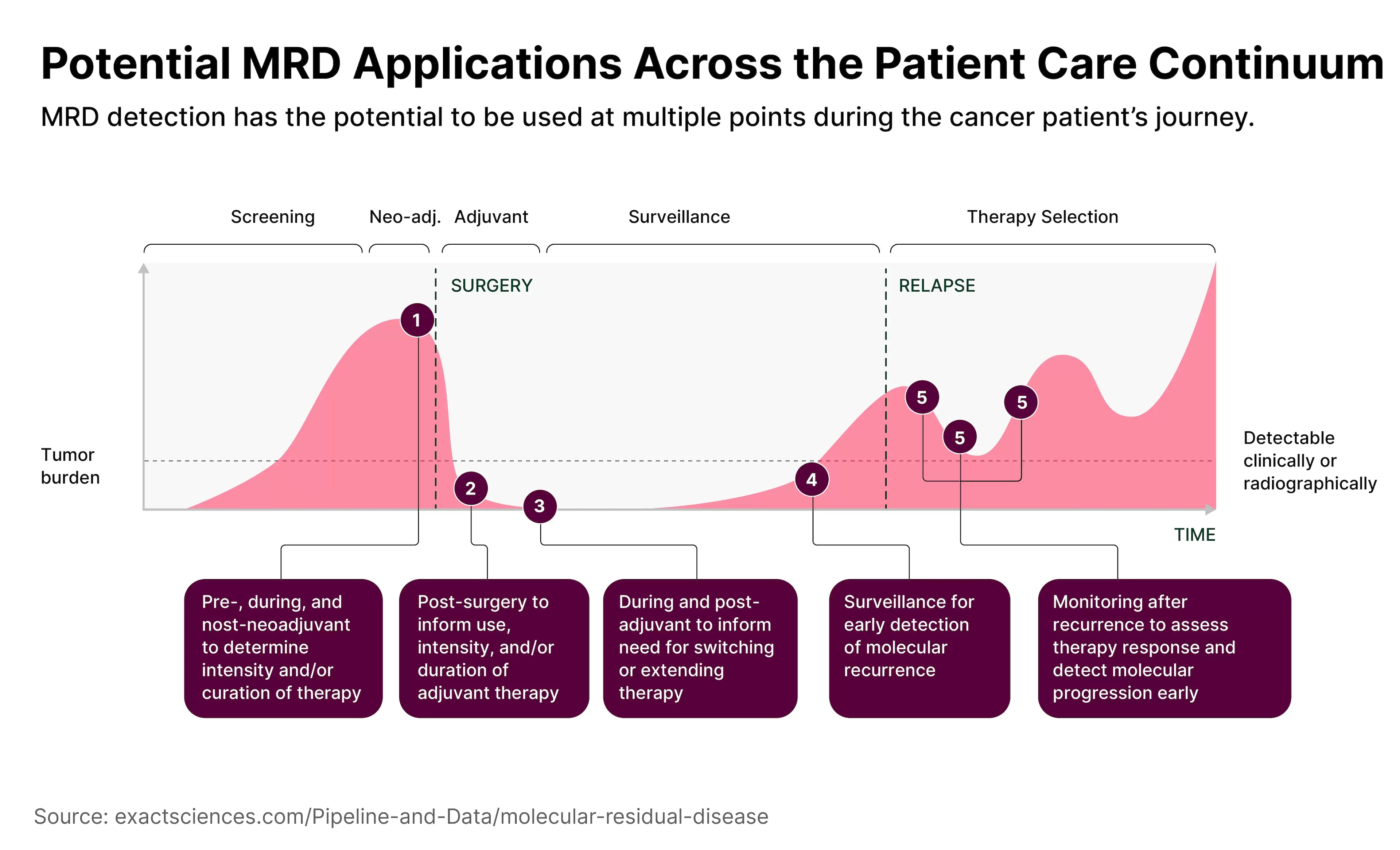

Third, genomic sequencing can be used in recurrent monitoring.

“Unfortunately, about 85% of relapses are caught too late,” says Agosto, emphasising the advantages of “a non-invasive, cost-effective way to see if a patient that had gone into remission is starting to have a potential relapse, and catching it as early as humanly possible”.

4. Companion Diagnostics

A highly significant use case is companion diagnostics, which involves matching patients to specific treatments based on the factors driving an illness.

Historically, says Agosto, cancer treatments had a one-size-fits-all approach. Then, oncologists started to tailor treatments depending on where in the body (lung, prostate, etc.) the cancer occurred.

Now, however, “we’re starting to understand the underlying causes as to why cancer is spreading in the body.” Depending on the type of mutation and where it occurs anatomically, “if we target that specifically, it has a very beneficial impact on the patient outcome.”

The specificity of these treatments is increasing all the time. “Now we’re starting to see oncology treatments be approved for a KRAS G12C mutation. That’s very, very specific as to what it’s targeting.”

Of course, when the treatment is this precise, it is vital to have an equally precise diagnosis.

“How do we know if a patient actually has that mutation versus something else? Through a campaign diagnostic. And through genomic sequencing, we’re starting to understand specifically what is leading to the growth of cancer in the body, and thus what treatment we can actually take.”

For example, Natera [NTRA] applied to the US Food and Drug Administration for approval of its Signatera treatment in October. Signatera uses a personalised and tumour-informed molecular residual disease (MRD) test as a companion diagnostic assay for patients with muscle-invasive bladder cancer, according to its website.

MRD tests could completely alter approaches to treating cancer, says Agosto. “Instead of throwing darts at a dartboard and seeing what works, we have a very clear path of what treatments we can actually utilise.”

5. Testing and Treatments

HEREDITARY TESTING

While identifying cancers earlier, and providing more targeted treatments, has the potential to increase survival rates and improve the quality of life for patients undergoing treatment, there is a much wider range of possible applications for genomic-based diagnostic approaches.

One such example is hereditary testing, which offers the potential to use genomic sequencing to screen patients for susceptibility to a much wider range of health conditions.

“When a person is interested in their overall health, they can take a hereditary testing screener”, which might, for example, indicate a predisposition for Alzheimer's disease, or ovarian cancer.

Using genomic technology to hone this type of testing also offers the potential for greater precision in diagnoses.

“60–70% of dementia patients are told that they have Alzheimer’s, even though they have completely different presentations, completely different timelines… We need to really understand the underlying cause for each individual patient.

“We think that there’s a lot of potential for better treatments, better diagnostic capabilities and overall better care for patients.”

M&A AND PARTNERSHIPS

Because companion diagnostics bridges the gap between testing and treatment, it opens up the potential for corporate consolidation between the makers of diagnostics and treatments. This, according to Agosto, could prompt an uptick in M&A activity within the space.

“There's a clear winner in this case, at least in our view, leading the way for the conversion between diagnostics and treatments, and that's Roche [ROG:SW].

“Having a lot of this under their own umbrella — the companion diagnostics and the actual treatment — is really impressive.”

This unique position within the market is creating partnership opportunities for Roche.

For example, Eli Lilly [LLY] is expected to gain approval for an Alzheimer's drug this year and has a partnership with Roche. This, says Agosto, demonstrates “the importance of Alzheimer’s diagnosis as a way to unlock the potential revenue from an Alzheimer’s treatment”.

6. The Genomic Sequencing Opportunity

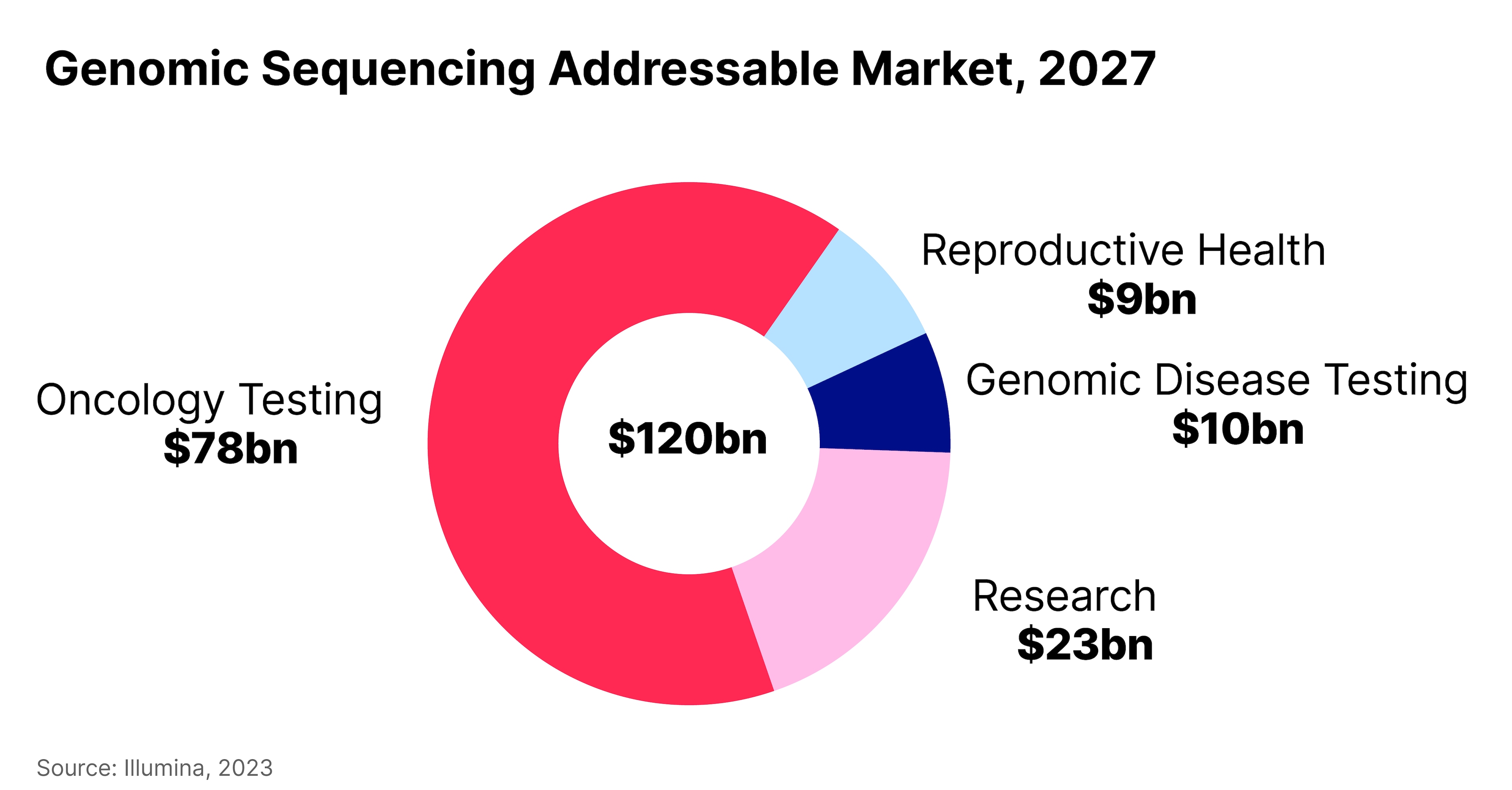

Global X estimates the total genomic sequencing market to be worth $120bn by 2027.

The ETF provider sees oncology testing as the most mature segment of this market, capturing 65% of the total, or $78bn, by 2027.

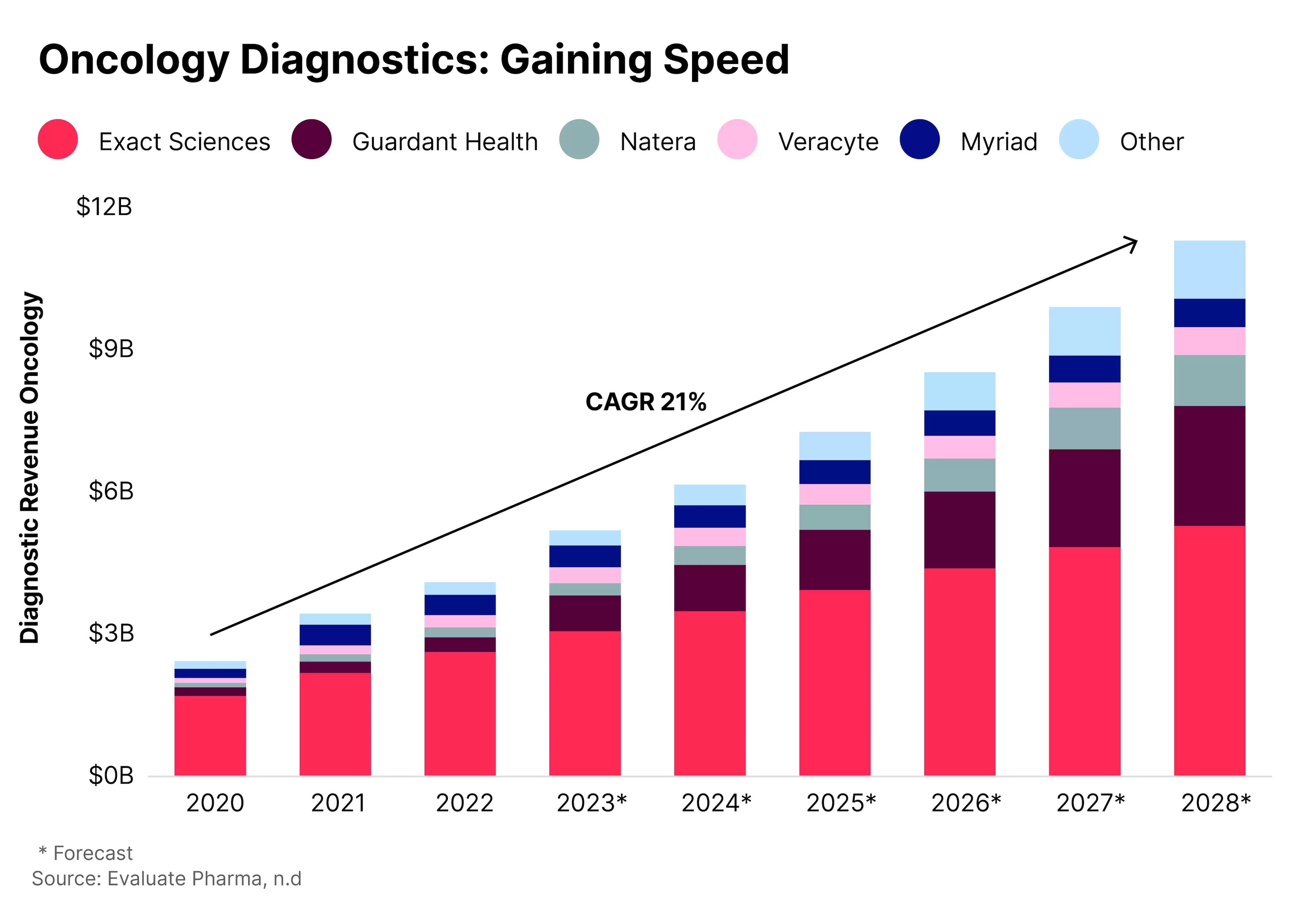

KEY PLAYERS

Some of the key players in the market for oncology diagnostics, according to Global X, are Exact Sciences [EXAS], Guardant Health [GH], Natera, Veracyte [VCYT] and Myriad Genetics [MYGN]. Of these, Exact Sciences has the largest current and projected share of the market, followed by Guardant Health.

Natera, Myriad and Veracyte are all held by the Global X Genomics & Biotechnology ETF [GNOM] as of 5 March; Natera is the fund’s top holding, with a 6.6% weighting. The fund also holds BioMarin with a 3.2% weighting.

GNOM has fallen 7.3%% in the 12 months to 4 March but is up 3.3% year-to-date.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy