In part one of this two part series, Lily Bernicker at Collaborative Fund explores the climate investment landscape, looking at where it’s come from and where it’s going.

Climate technology has not been an obvious fit for venture capital. These businesses have rarely found a way to grow large enough, quickly enough.

That said, climate clearly satisfies the venture requirement for massive markets. And as the climate crisis is caused by and affects every part of our global economy, decarbonisation is the biggest investment opportunity for impact and value creation over the next decade.

Given this potential, the question of whether or not venture dollars can be responsibly invested into climate businesses is not if, but when?

2006 seemed like the right moment. An Inconvenient Truth just came out, oil crossed $75 per barrel, and VCs doubled their investments in clean energy in just a year. Investors then went on to put more than $25bn in the sector from 2006-2011 giving rise to the infamous clean tech boom.

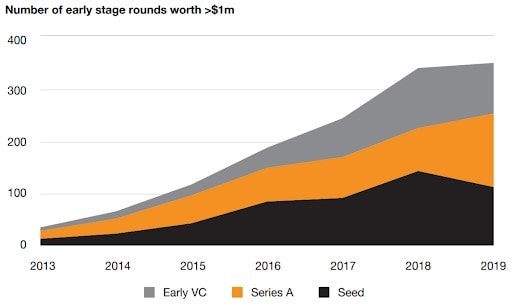

But the rush was short lived, and mainstream interest in the sector quickly contracted after the financial crisis and a few high-profile shutdowns, driving early-stage investing down to just 35 deals in 2013.

PWC Analysis of Early-Stage Climate Tech Investments (2013-2019)

At Collaborative Fund, we’ve gradually ramped up deployment from our first major climate investment in Beyond Meat [BYND] in 2015. At the time, plant-based meat alternatives weren’t a radical innovation. They’d been around and geared towards vegans for years.

However, we recognised that demand for healthier substitutes and affinity for brands that align with how consumers see themselves couldn’t be satisfied with existing products, and would only grow. Beyond Meat was the first to make mass market consumers feel good about a healthy and more sustainable choice that doesn’t ask them to compromise on taste, nutrition, or value. This vision convinced us that they could become one of the biggest food companies in the United States.

Since then, we’ve been compelled to do more in the category, encouraged by trends like: increased spend on sustainable products, newly cost-competitive low-carbon technologies, and a wave of experienced founders entering the field.

These shifts have created new opportunities to invest in businesses where mitigating or adapting to climate change is a driver of performance rather than a limitation.

We’ve also been active through some of the industry’s big setbacks. Our first clean energy investment was Dandelion Energy’s seed round in 2017: the same month that the US announced its intent to leave the Paris Agreement and shortly after Solar City dodged a shutdown through their merger with Tesla [TSLA].

While the path to decarbonisation will never be a straight line, there have been irreversible advancements in technology and market pressures that make this generation of climate tech fundamentally different from the last.

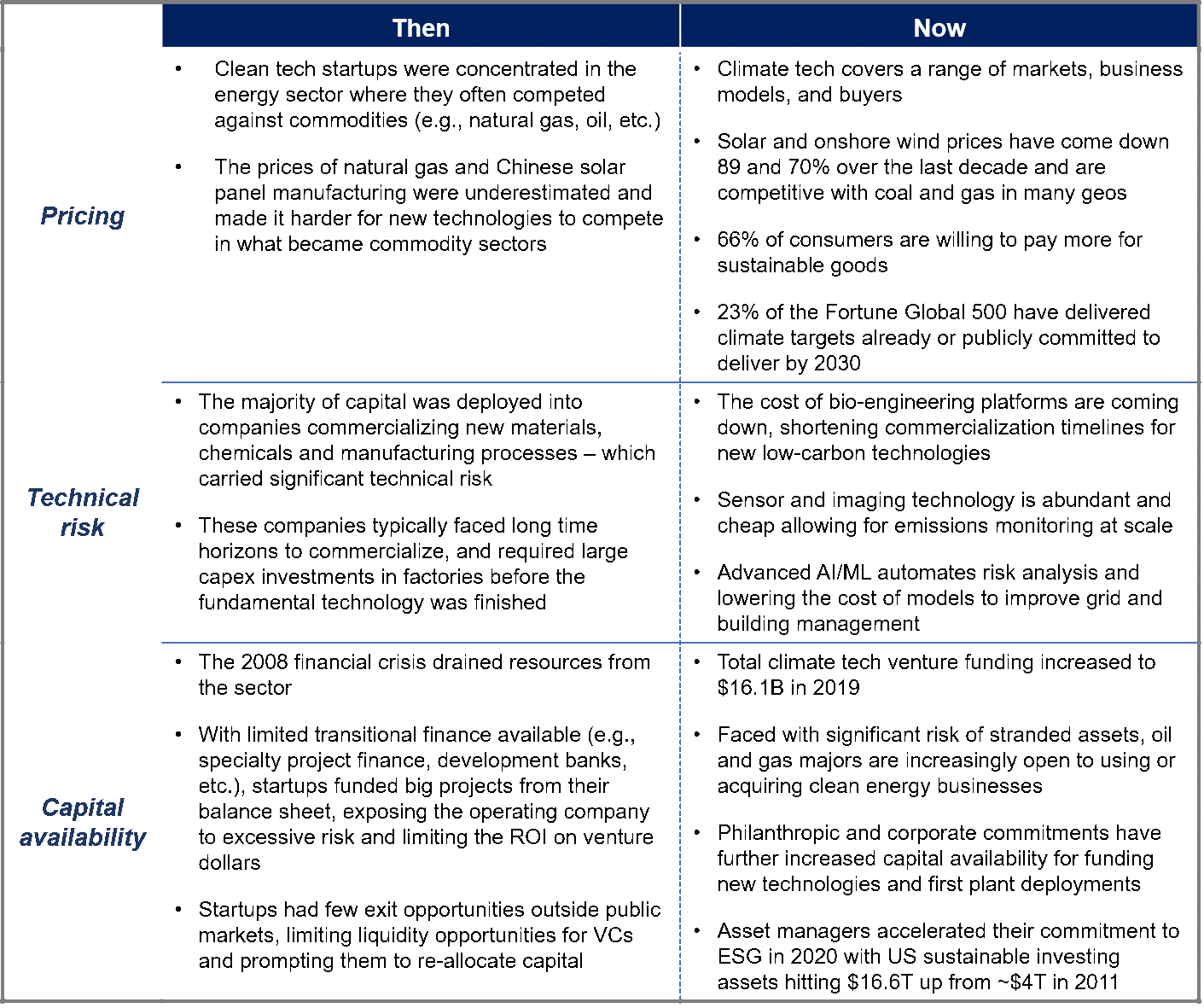

As we’ve expanded our climate practice over the last five years, it’s helped us to consistently track how and to what extent the market has changed. Luckily there has been some great research on the first cleantech boom. And there is increasing consensus on why it failed to deliver the returns VCs require, namely: cheap competition, technical challenges, and lack of capital availability.

At Collaborative Fund, we use these challenges as a model to explore how the market has shifted over time.

In the short term, even climate businesses built on mature technology will continue to face financing risk. But as commercialisation timelines get shorter and venture-backed climate businesses start to break out across every industry (not just energy), we anticipate a wave of traditional funding will enter the field.

Businesses that scale by preventing or mitigating the impact of the climate crisis fit squarely within the Collaborative Fund thesis. Markets value companies that are the best at satisfying demand at scale. Markets don’t care (yet) how urgent the climate crisis is or how little time we have to deploy solutions to keep warming below 1.5°C.

Therefore, we don’t either. We’re technology and business model agnostic. We invest in deep tech, software, and everything in between. But we don’t invest in companies that require users to compromise on performance or cost in exchange for climate impact.

This article was originally published by Collaborative Fund on 16 December 2020. In Part II, they share the framework that they use to evaluate climate opportunities and what they’re most excited for going forward.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy