Every day, we handpick the 5 Top Stories stock market investors need to know. In 5 minutes, you’ll learn the stocks, CEOs, and money managers moving markets.

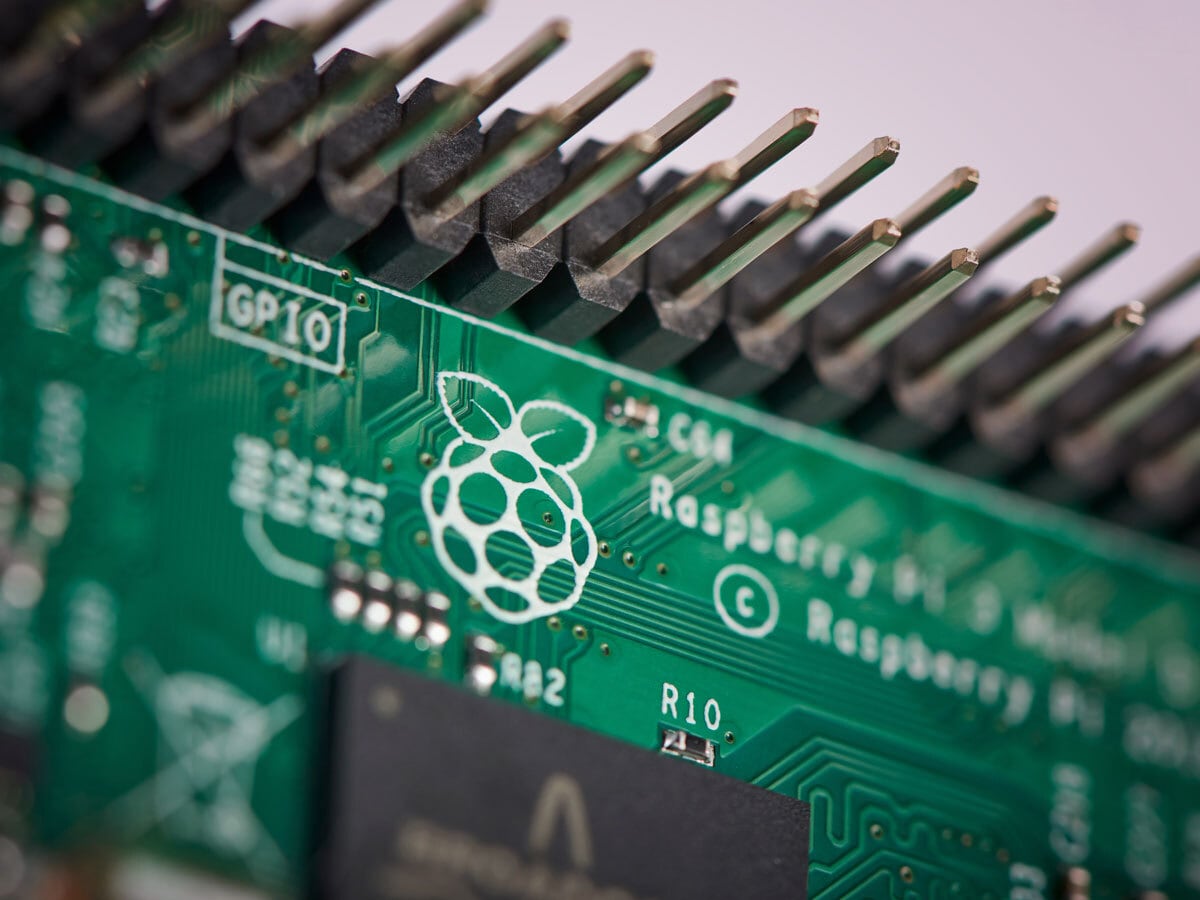

Will Raspberry Pi Revive London IPOs?

Good news for the City: British personal computer maker Raspberry Pi is considering a UK listing, in what would be the first substantial London IPO since February. The company, which produces low-cost computers, is seeking a valuation of about £500m, Bloomberg reported. It is currently controlled by a charitable foundation. London has accounted for just over 2% of the $12bn raised in IPOs in Europe this year, the lowest proportion for some decades.

Robotaxis: Latest News

Cruise, General Motors’ [GM] autonomous car unit, has reached a settlement worth up to $12m with a pedestrian who was dragged by one of its units in San Francisco last year, according to Bloomberg. Elsewhere, Baidu [BIDU] announced on Wednesday that it expects Apollo Go, its robotaxi arm, to turn a profit next year. Lastly, Honda Motor [HMC] and IBM [IBM] have signed a memorandum of understanding to collaborate on R&D for computing technologies such as chips for software-defined vehicles.

Google Showcases AI Pivot

Project Astra is the name of Alphabet’s [GOOGL] new “multimodal” artificial intelligence (AI) agent. Powered by an upgraded version of the Gemini model, Project Astra can answer video, audio and text queries in real time. This announcement was one of a series at Alphabet’s annual developer conference on Tuesday designed to showcase Google’s pivot to AI. Another new model is LearnLM, designed to help students with their homework.

Hydrogen Producer Spikes on Loan

The Plug Power [PLUG] share price climbed as much as 70% in New York on Tuesday — its biggest intraday jump in seven years — after the Biden administration made a conditional commitment to provide the firm with $1.7bn in loans to build up to six facilities. “The loan guarantee will prove instrumental to grow and scale not only Plug’s green hydrogen plant network, but the clean hydrogen industry in the US,” CEO Andy Marsh said in a statement.

Solar Firms Pop on ‘Meme Stock’ Revival

Shares in US-listed solar firms have jumped this week amid a resurgence in retail investor interest in heavily shorted stocks. Sunpower [SPWR], for example, was up as much as 63% on Tuesday, only to lose 25% in premarket trading Wednesday. The firm’s market cap of $788m is a fraction of the $9.2bn it hit in January 2021, MarketWatch reported. Another factor has been the Biden administration’s announcement of new tariffs on Chinese solar equipment.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy