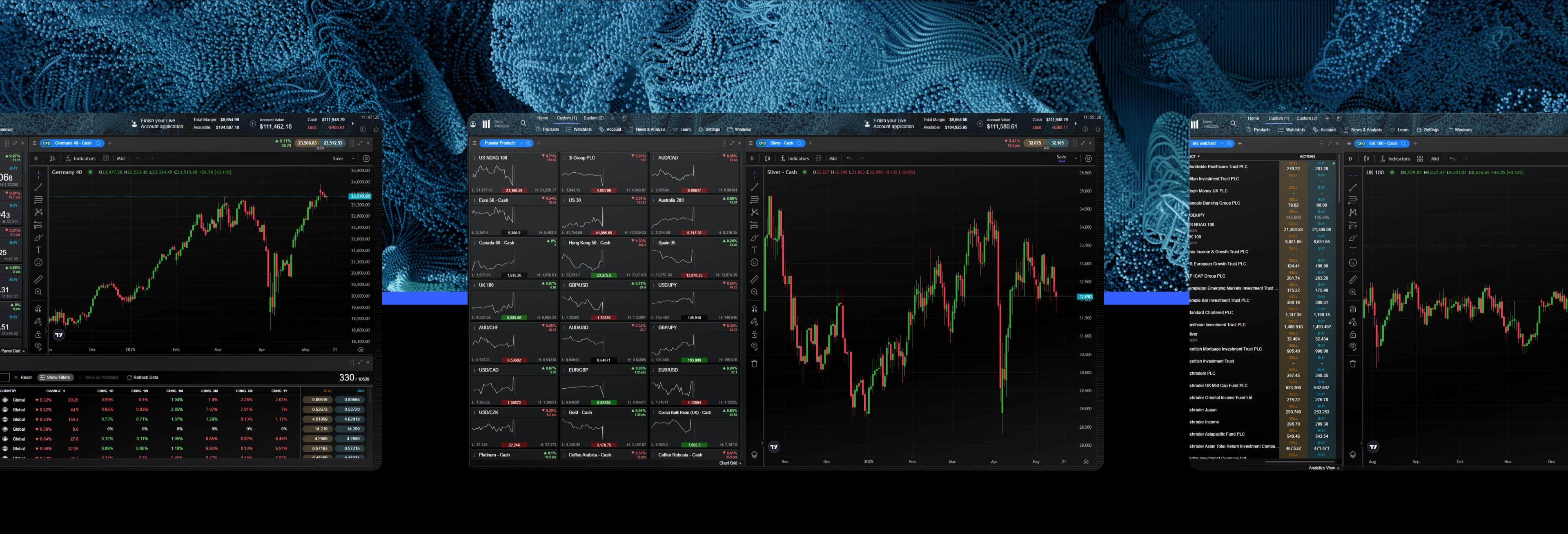

Trade with Our FX Active Account

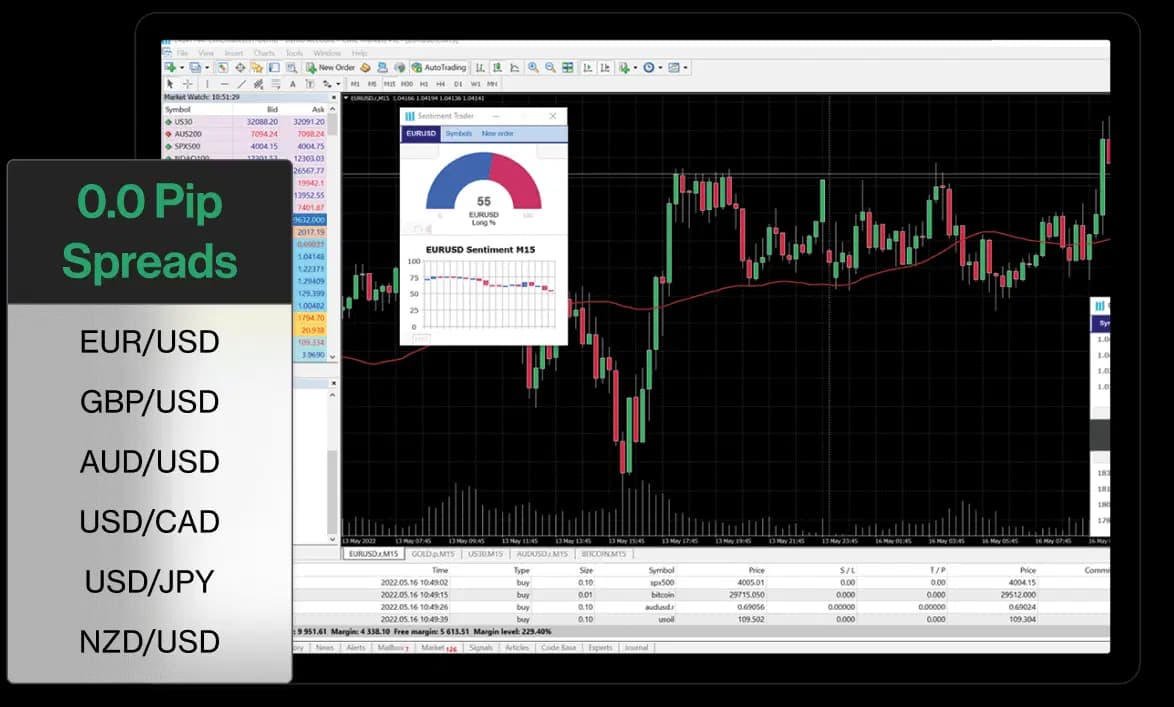

Trade on pure price action coupled with fully transparent execution, and enjoy spreads from 0.0 pips on six major FX pairs, with fixed low commission. Get a 25% spread discount on 300+ other FX pairs, versus our standard CFD account.

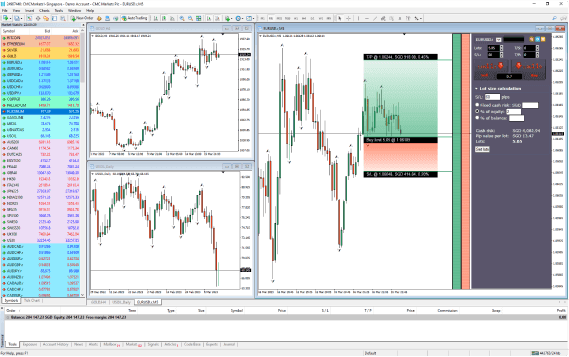

FX Active is available on the CMC platform and MT4.

ForexBrokers.com Awards

Good Money Guide Awards

ADVFN International Financial Awards

The FX Active advantage

Trade on EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CAD, and USD/JPY, with spreads from 0.0 pips, plus enjoy a 25% spread discount on all our other forex pairs.

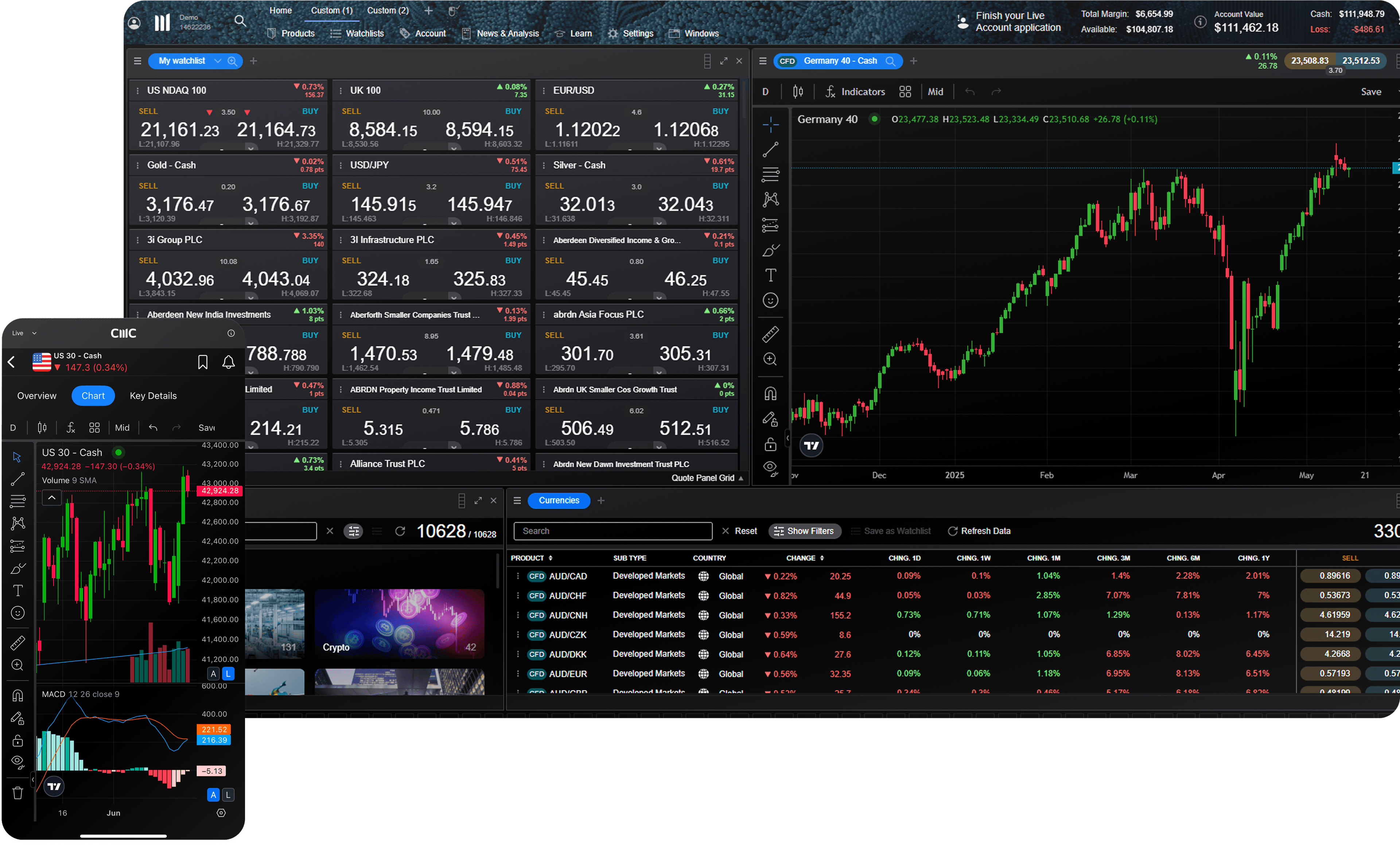

With an FX Active account, you can trade all the instruments available on the CMC platform and MT4, just like with a standard account.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade sizes in the relevant product. The spread will widen for larger trade sizes, see our platform for more information.

*Commission applies to the FX Active account only.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

What you will get as an FX Active trader?

See bid and ask prices, premiums, and more up front, helping you to understand your costs before you place a trade.

Access ultra-tight spreads from 0.0 pips on six major FX pairs, and save with a 25% spread discount on all our other FX pairs.

Factor in your cost per trade, with fixed low commission at just $2.50 per $100,000 notional value.

With a combination of feeds from tier-one banks, you'll always receive our most accurate price.

Deposit and withdraw funds easily to and from your FX Active account.

Explore other platforms

ForexBrokers.com Awards

CMC platform

Trade CFDs on MT4

MT4 (MetaTrader4)

Trade on the world's most popular platform with our suite of free premium MT4 indicators and Expert Advisors.

Ready to get started?

FAQs

FX Active is an account designed for high-volume traders, who want to get even more from their forex trading. It features tighter spreads and fixed commissions, enabling pure price transparency. In addition to 300+ FX pairs on our CMC platform, or over 175+ pairs through the MT4 platform, all other non-FX instruments are also available to trade in the same way as with a standard account.

Trade a wide range of forex instruments, including over 300 FX pairs on our CMC platform and 170+ on MT4.

With an FX Active account, you can trade on all the markets and instruments available on our CMC platform including forex, indices, commodities, shares, ETFs, plus rates and bonds. On MT4, you can trade on FX, indices, commodities and popular Canadian shares. Note that only certain FX instruments have spreads from 0.0 pips.

FX Active has fully transparent commissions across all forex pairs at 0.0025% per transaction, as well as minimum spreads from 0.0 pips on six major FX pairs, and a 25% spread reduction compared with our standard CFD account on all the other currency pairs we offer.

Commission is charged at a fixed rate of 0.0025% per transaction. This works out as $2.50 per $100,000 worth of currency trade. At this notional volume, it would cost $5 to open and close a trade. MT4 commissions are charged upfront for opening and closing trades.

Yes, there is an FX Active demo account.

An FX Active demo account allows you to experience the platform's wide range of innovative features and tools in a risk-free environment. You can practice trading on your favourite instruments and try out trading strategies and techniques with $10,000 of virtual currency.

Our CMC platform demo account remains open once created. MT4 platform demo accounts remain active provided that you log in to the platform at least once every 30 days. If you don't log in within that timeframe, your demo account will automatically be closed. You can set up a new account again at any time in the future.

As a CMC client, your money is held separately from CMC Markets’ own money and is held on trust in segregated bank accounts with a Canadian bank. This account is opened and maintained in the name of CMC Markets Canada Inc. We do not use client money to hedge our positions or to meet the trading obligations of other customers. This offers you financial security and you can rest assured that your money with us is protected.

Yes, CMC Markets Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO). CFDs are distributed in Canada by CMC Markets Canada Inc. acting as principal.

There's no cost when opening a live trading account with us. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you'll need to deposit funds in your account to place a trade.

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

Ready to get started?

Start trading with a live account today or try a demo with $10,000 of virtual funds.

Do you have any questions?

Our client services team is here whenever the markets are open.

Email us at clientmanagement@cmcmarkets.ca or call us on 1-866-884-2608.

20.009 seconds CFD median trade execution time on CMC Markets' web and mobile platforms, 1 April 2024-31 March 2025.