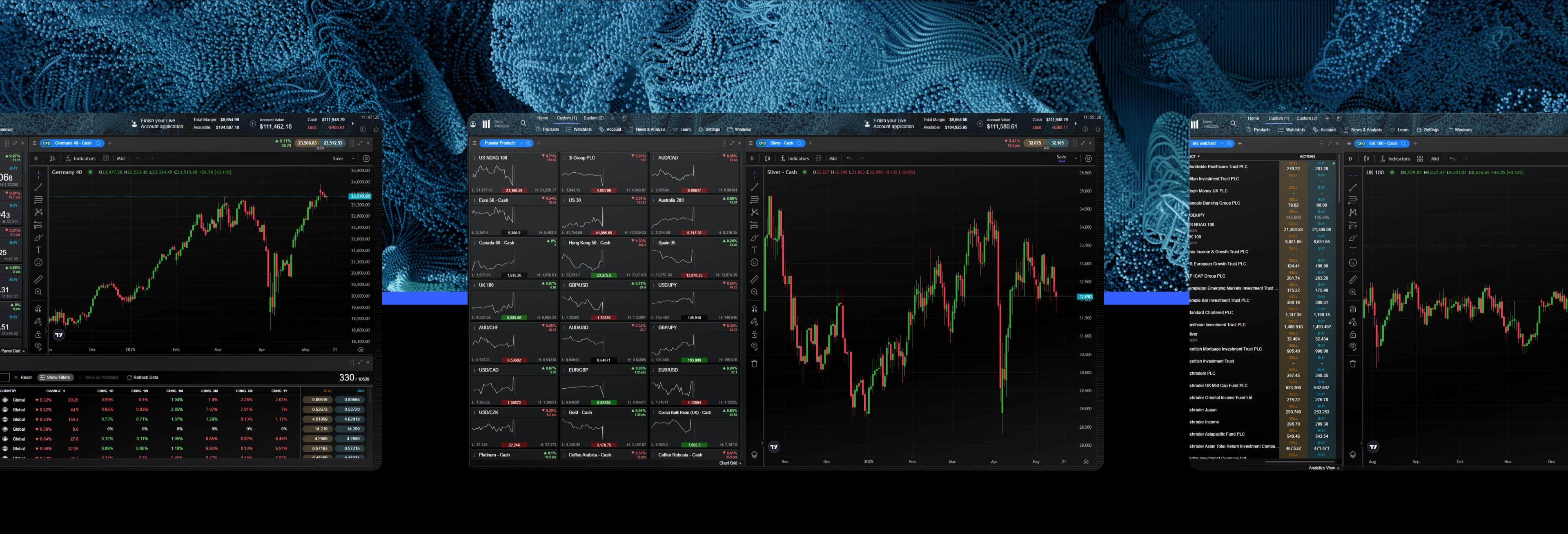

Explore Over 10.000 Financial Instruments

Trade CFDs on a huge range of global financial markets, including forex, indices, commodities, and shares. Enjoy competitive spreads on our innovative, award-winning web and mobile trading platforms¹, plus experienced customer service by your side.

ForexBrokers.com Awards

Good Money Guide Awards

ADVFN International Financial Awards

Get access to the global markets

Trade on the strength of one currency versus another, in the world's largest and most liquid market.

Speculate on the performance of a huge range of global stocks, from Apple to Zoom. Enjoy $0 commission on US and CAD shares.

Choose from over 1,000 ETFs to trade, including popular themes from the US and Canada.

Speculate on the prices of the most popular global commodities, including gold, silver, oil and natural gas.

Take a view on interest rates, gilts and treasury notes to get exposure to a specific region's economy.

Enjoy tight spreads and no hidden fees

What are other traders saying about CMC Markets?

Choose your account

Experience competitive pricing for 11,000+ instruments, with tight spreads and no hidden fees.

Standard

Available on the CMC platform and MT4, a traditional FX/CFD account with spread-based pricing across FX, shares, indices, treasuries, and commodities.

FX Active

Available on CMC platform and MT4, an account designed for active FX traders seeking the tightest spreads on FX pairs and a commission-based pricing model.

FAQs

Financial markets is a very broad term and can vary from world to virtual currencies, commodities to stock indices, shares to ETFs plus rates and bonds, where traders can invest in or trade on a huge range of securities and derivatives.

One of the advantages of trading CFDs is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it's important to manage your risk.

Indices are a measure of a section of shares in the stock market, created by combining the value of several stocks to create one aggregate value. Major financial indices include the Dow Jones Industrial Average, FTSE 100, and S&P 500. The Dow Jones index, for example, represents 30 large publicly-listed companies traded on the New York Stock Exchange. More on indices trading

FX trading, also known as foreign exchange trading, or forex trading, is the exchange of different currencies on a decentralized global market. It's one of the largest and most liquid financial markets in the world. Forex trading involves the simultaneous buying and selling of the world's currencies on this market.

A commodity is a physical good that can be bought or sold on the commodity market. Commodities can be categorized into either hard or soft varieties. Hard commodities are natural resources like oil, gold and rubber and are often mined or extracted. Soft commodities are agricultural products such as coffee, wheat or corn. More on commodities

Share trading in the underlying market involves buying and selling company shares, with the aim of making a profit. Shares represent a portion of ownership of a public company. With us, you can trade CFDs on shares, without actually owning the underlying share. Learn more about share trading.

A bond is a fixed-income instrument, or debt security, and represents a long-term lending agreement between a borrower and lender – effectively an 'IOU'. The bond issuer is often a corporation or a government, and the funds are used to finance a project or operation. Learn how to trade bonds.

As a CMC client, your money is held separately from CMC Markets’ own money and is held on trust in segregated bank accounts with a Canadian bank. This account is opened and maintained in the name of CMC Markets Canada Inc. We do not use client money to hedge our positions or to meet the trading obligations of other customers. This offers you financial security and you can rest assured that your money with us is protected.

Yes, CMC Markets Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO). CFDs are distributed in Canada by CMC Markets Canada Inc. acting as principal.

There's no cost when opening a live trading account with us. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you'll need to deposit funds in your account to place a trade.

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

Ready to get started?

Start trading with a live account today or try a demo with $10,000 of virtual funds.

Do you have any questions?

Our client services team is here whenever the markets are open.

Email us at clientmanagement@cmcmarkets.ca or call us on 1-866-884-2608.